Embed presentation

Download to read offline

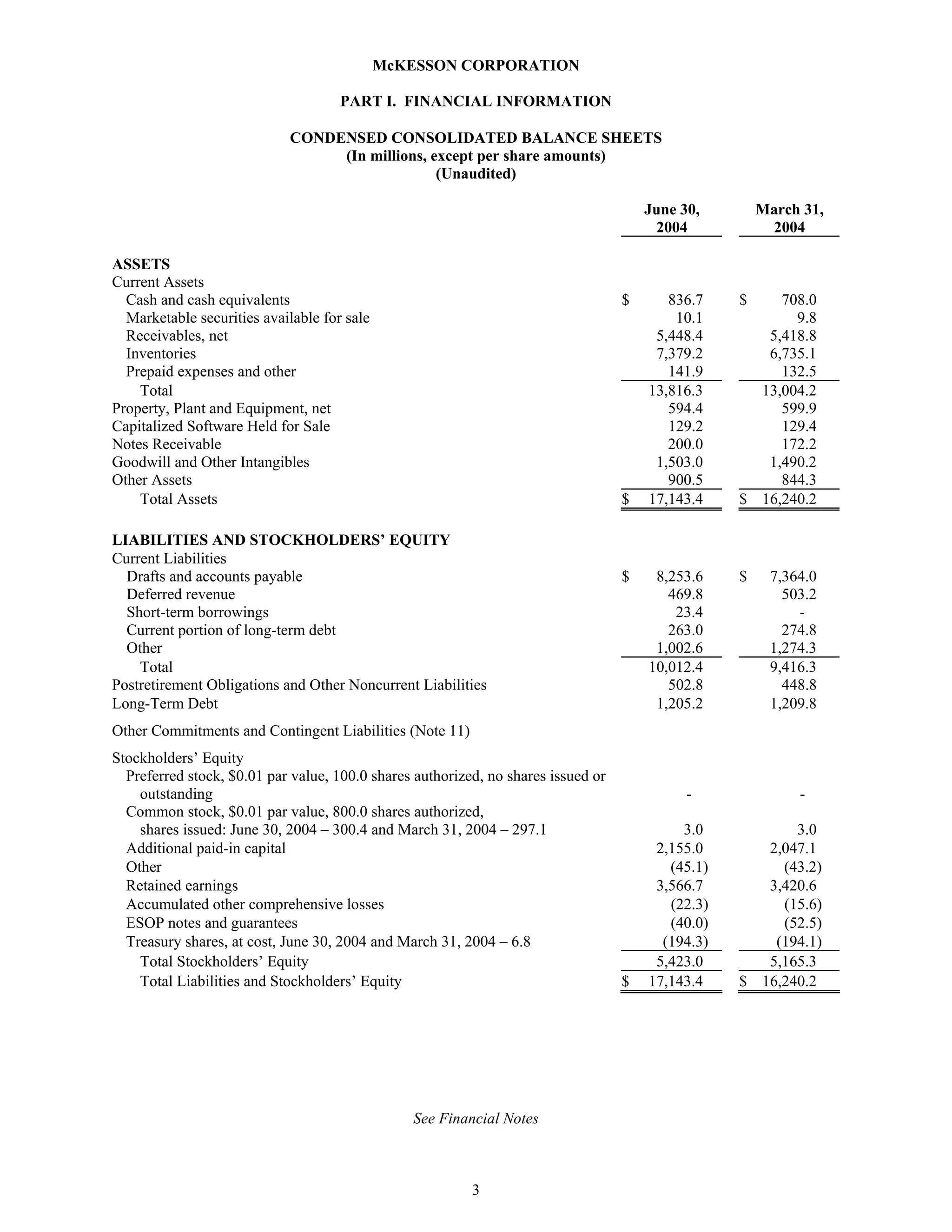

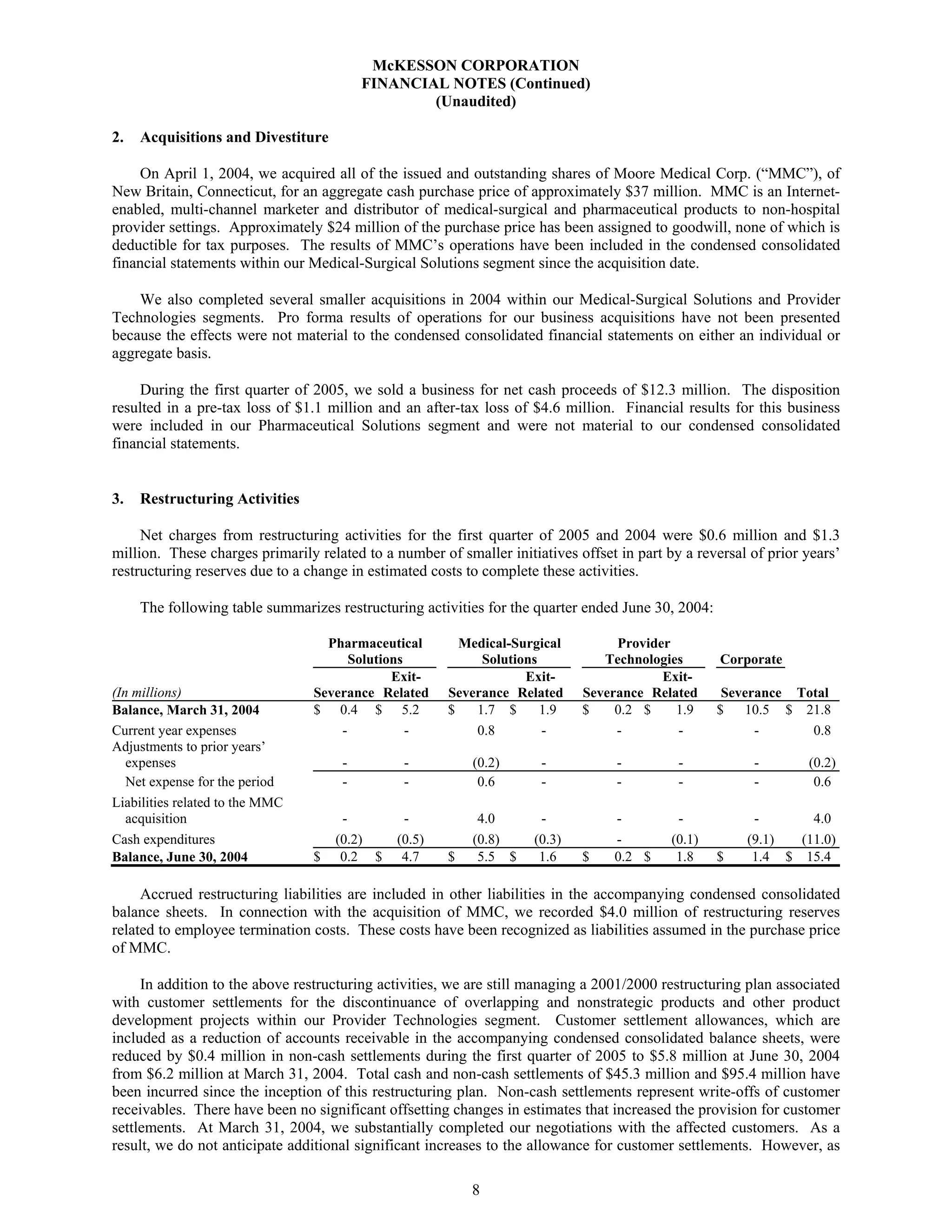

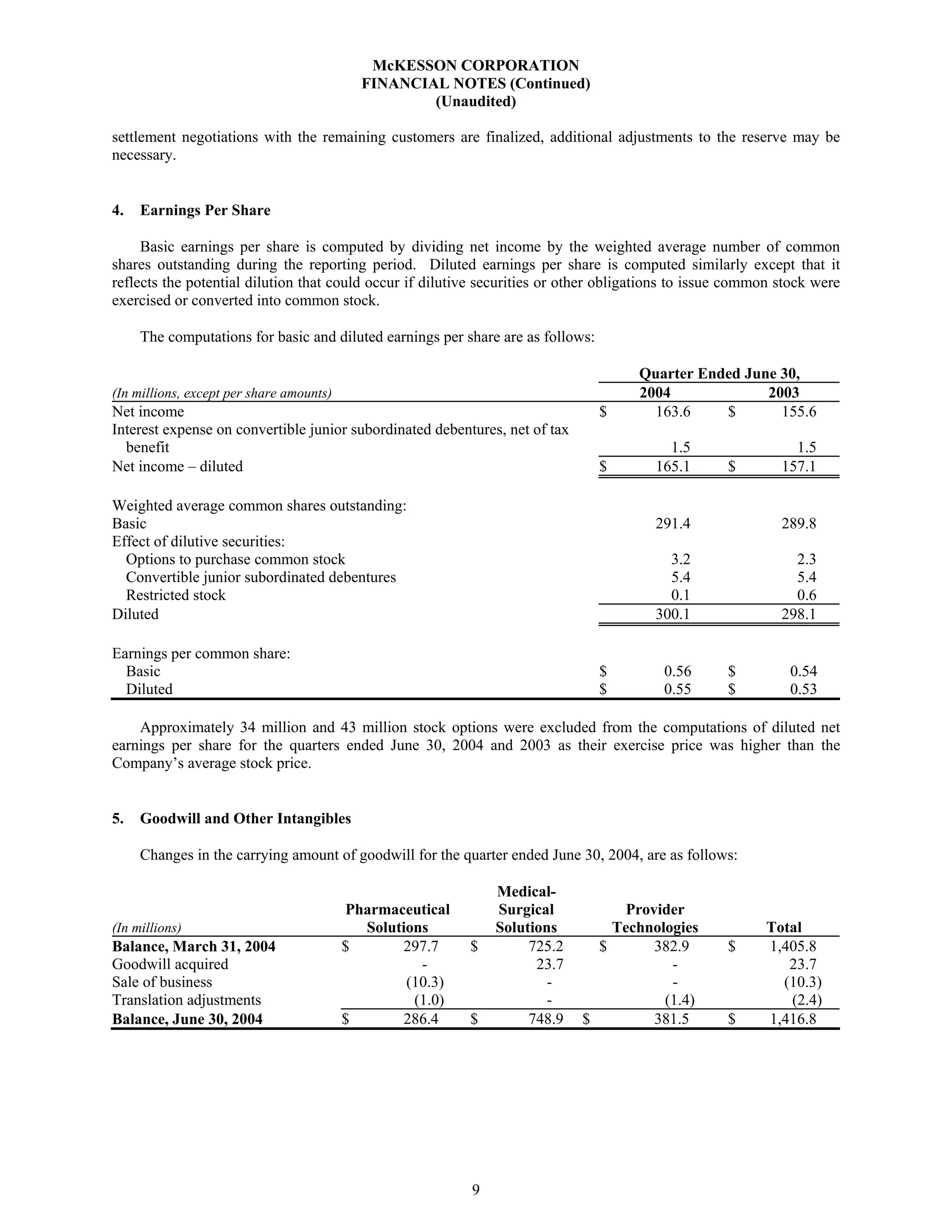

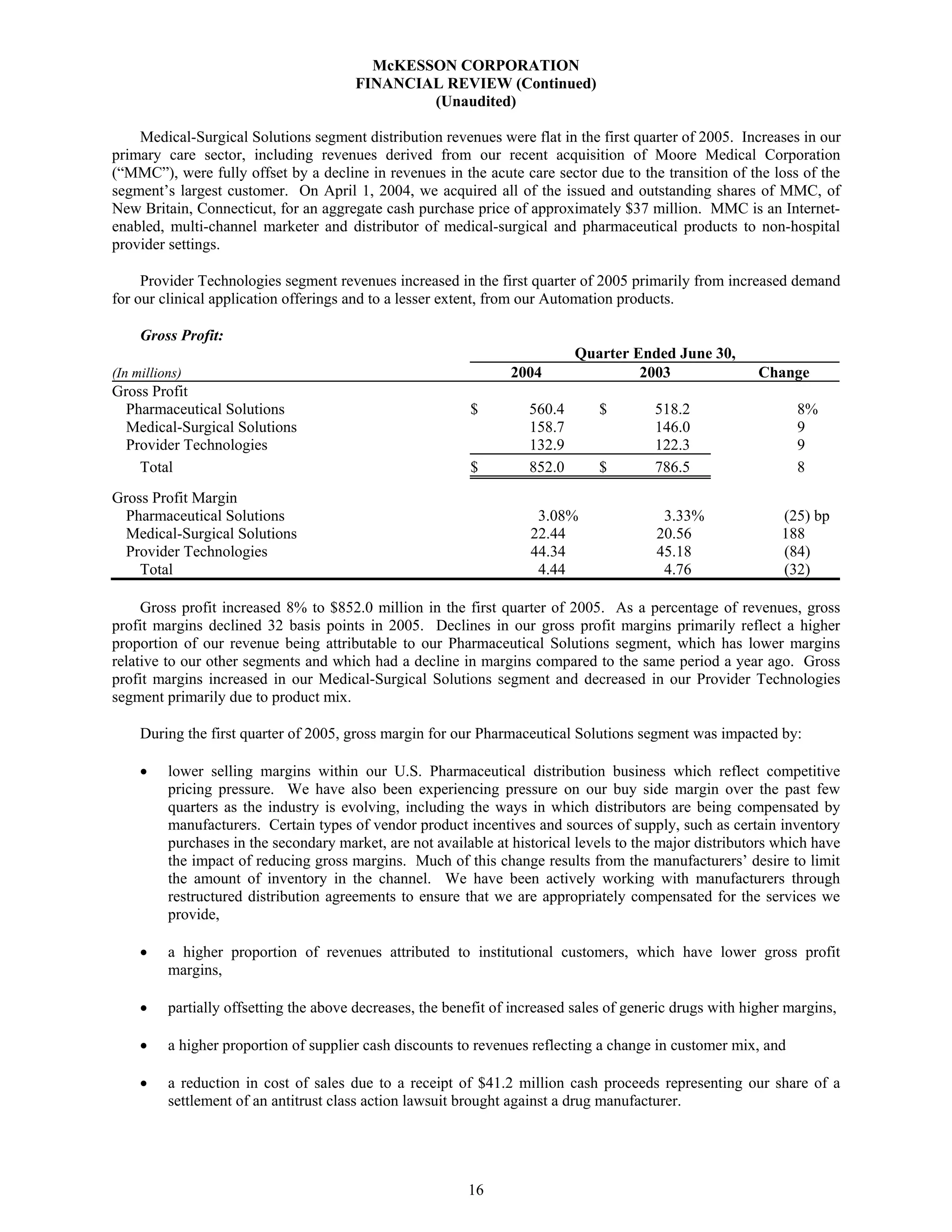

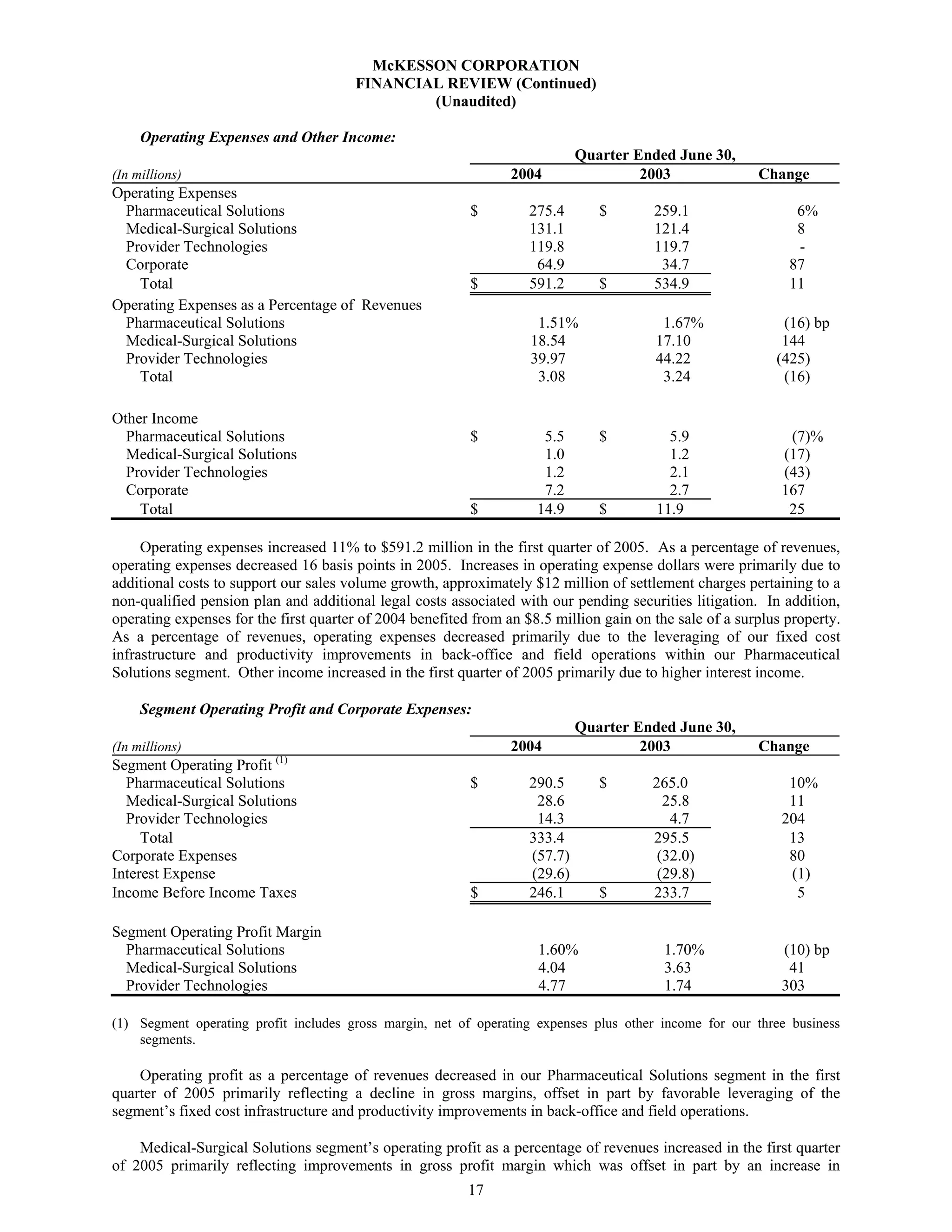

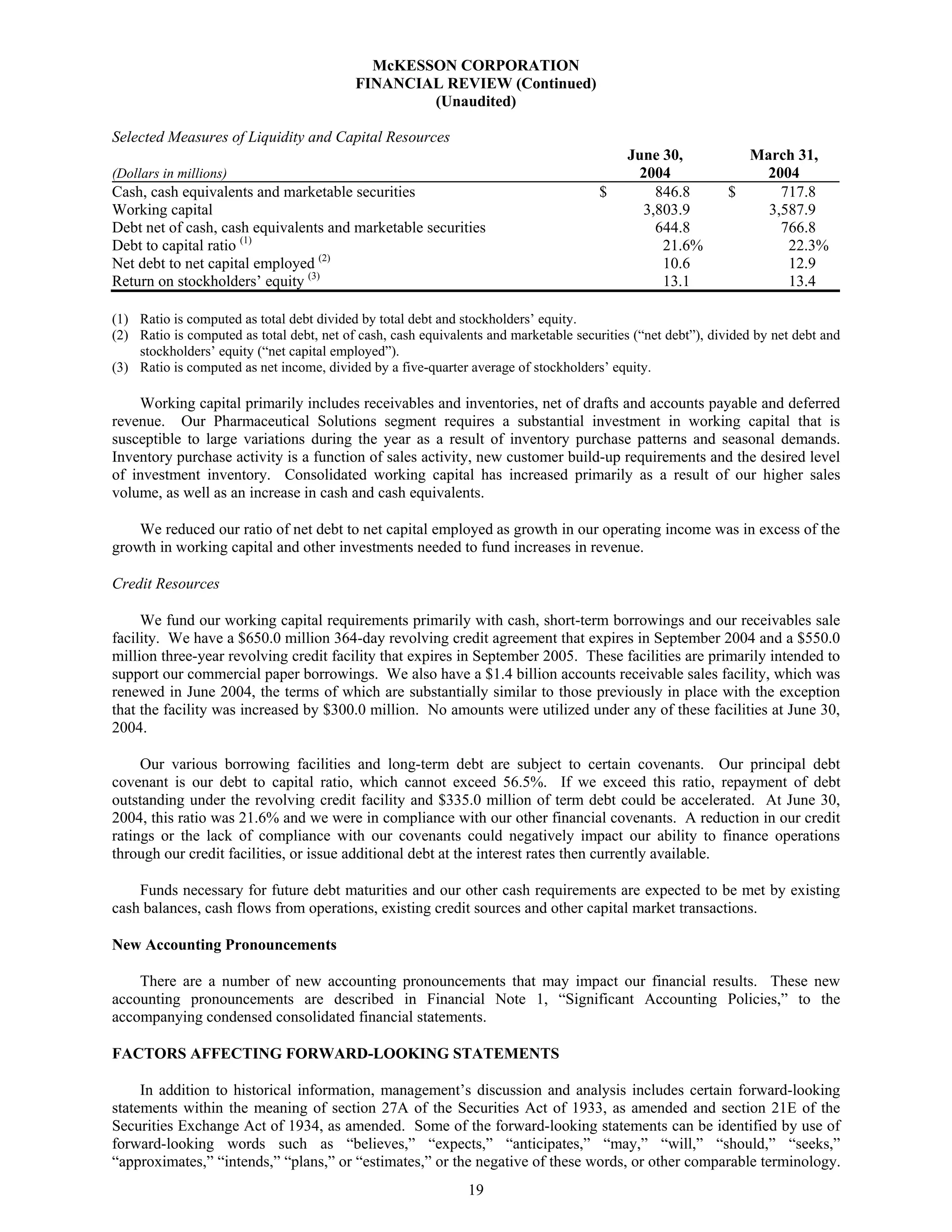

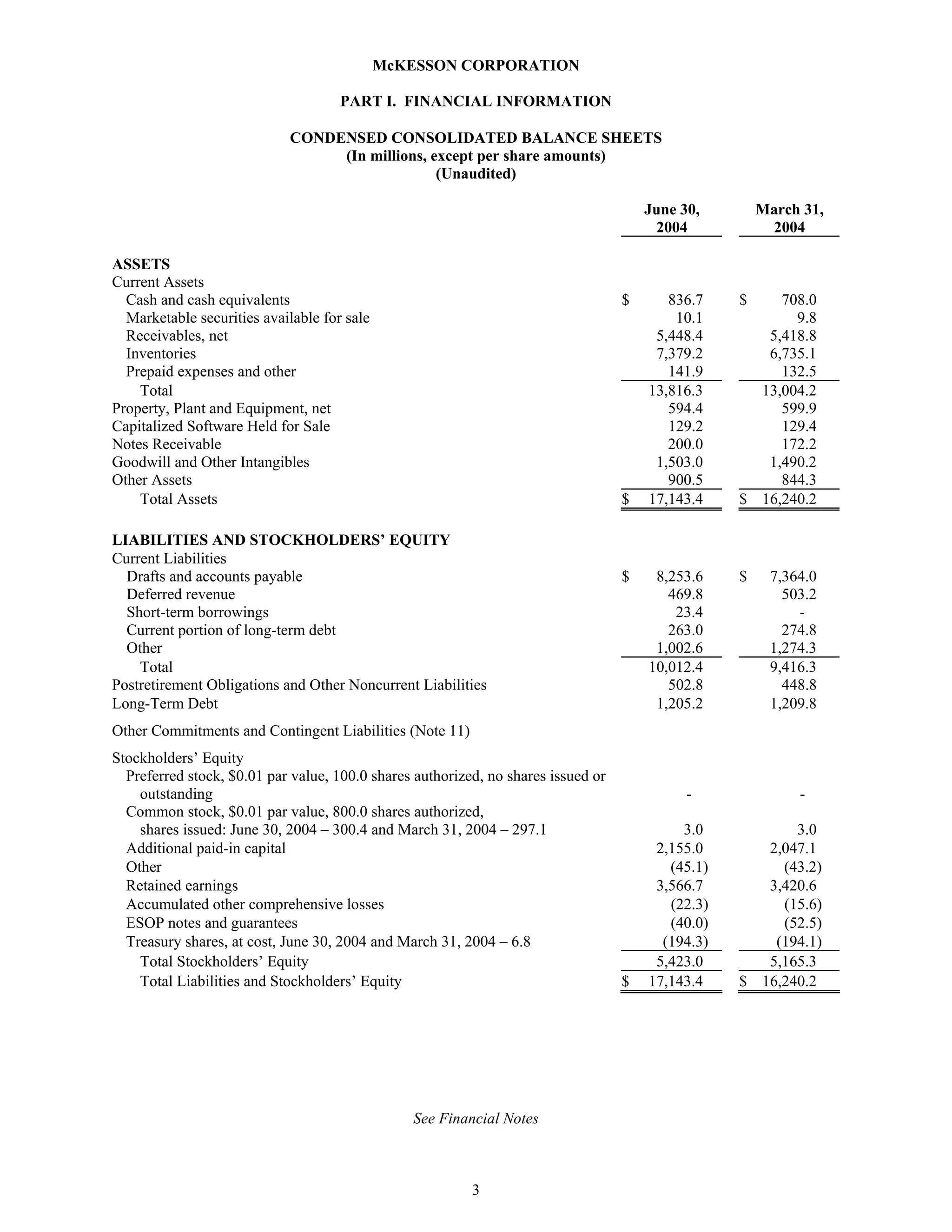

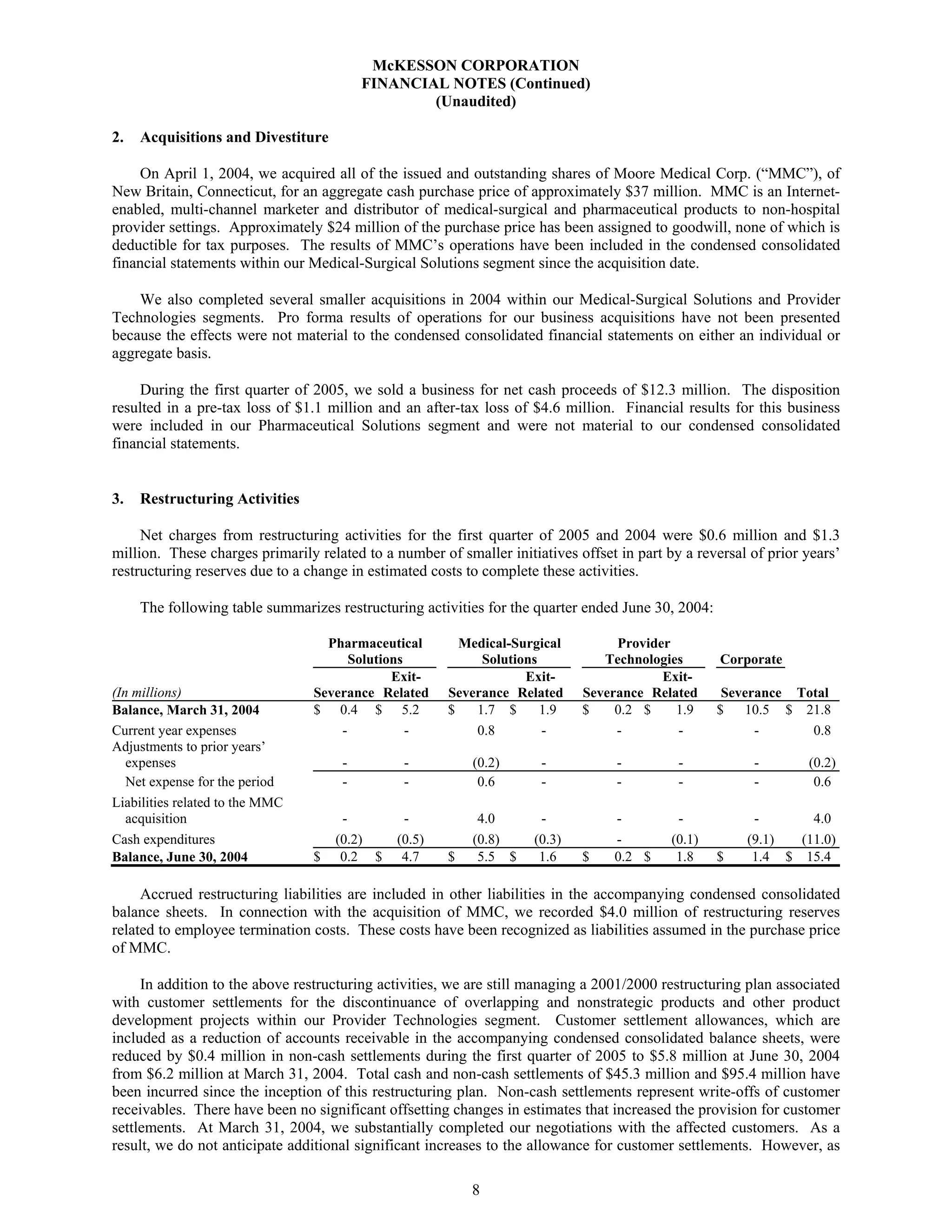

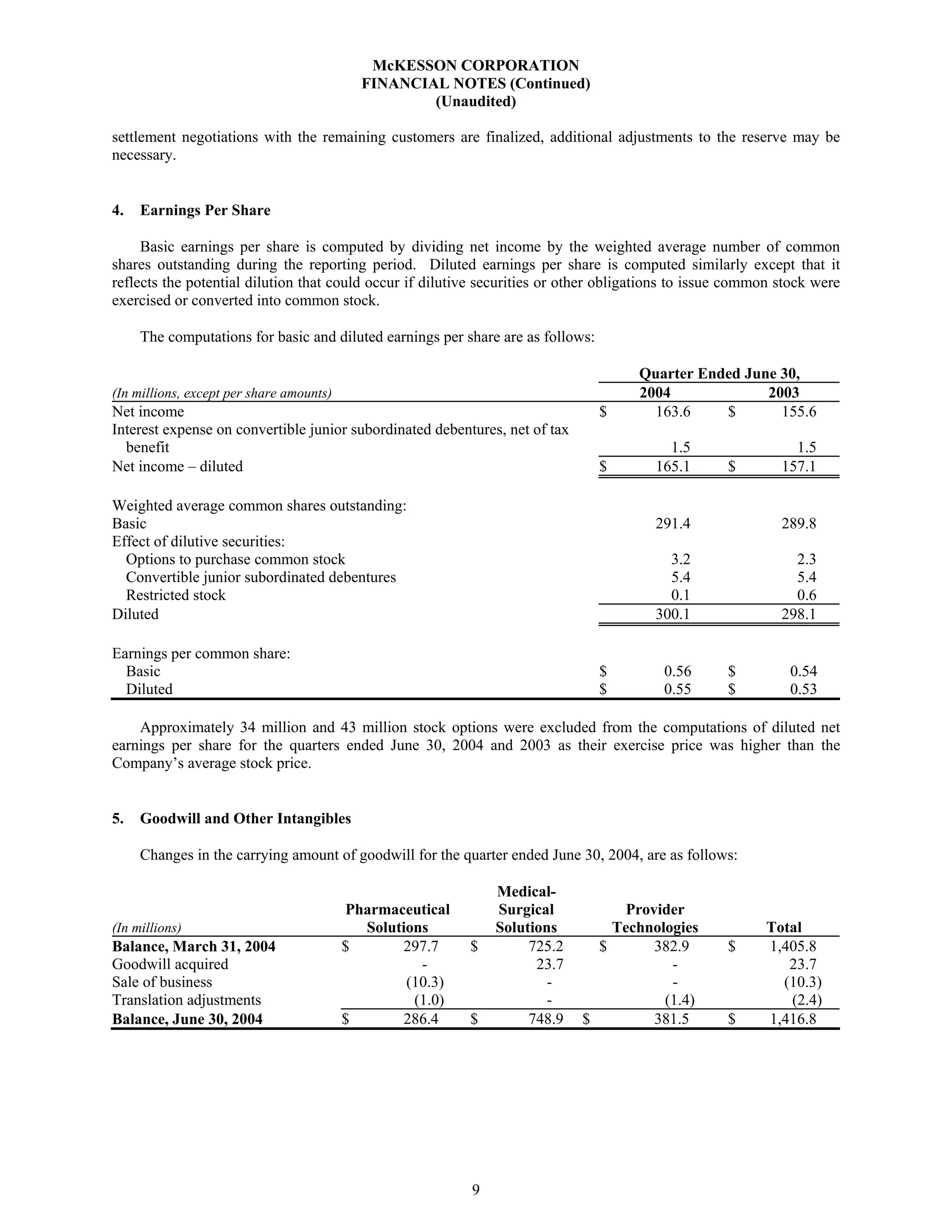

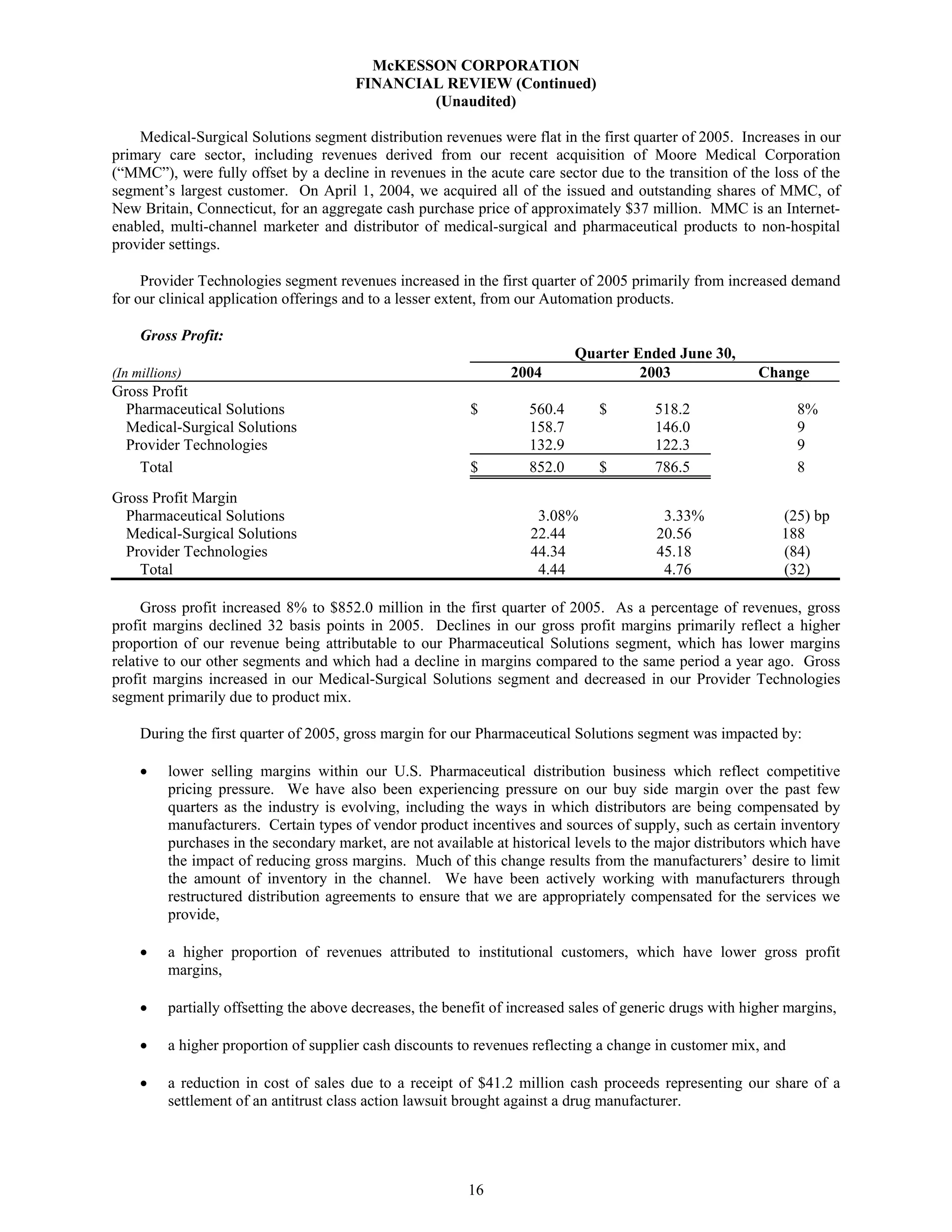

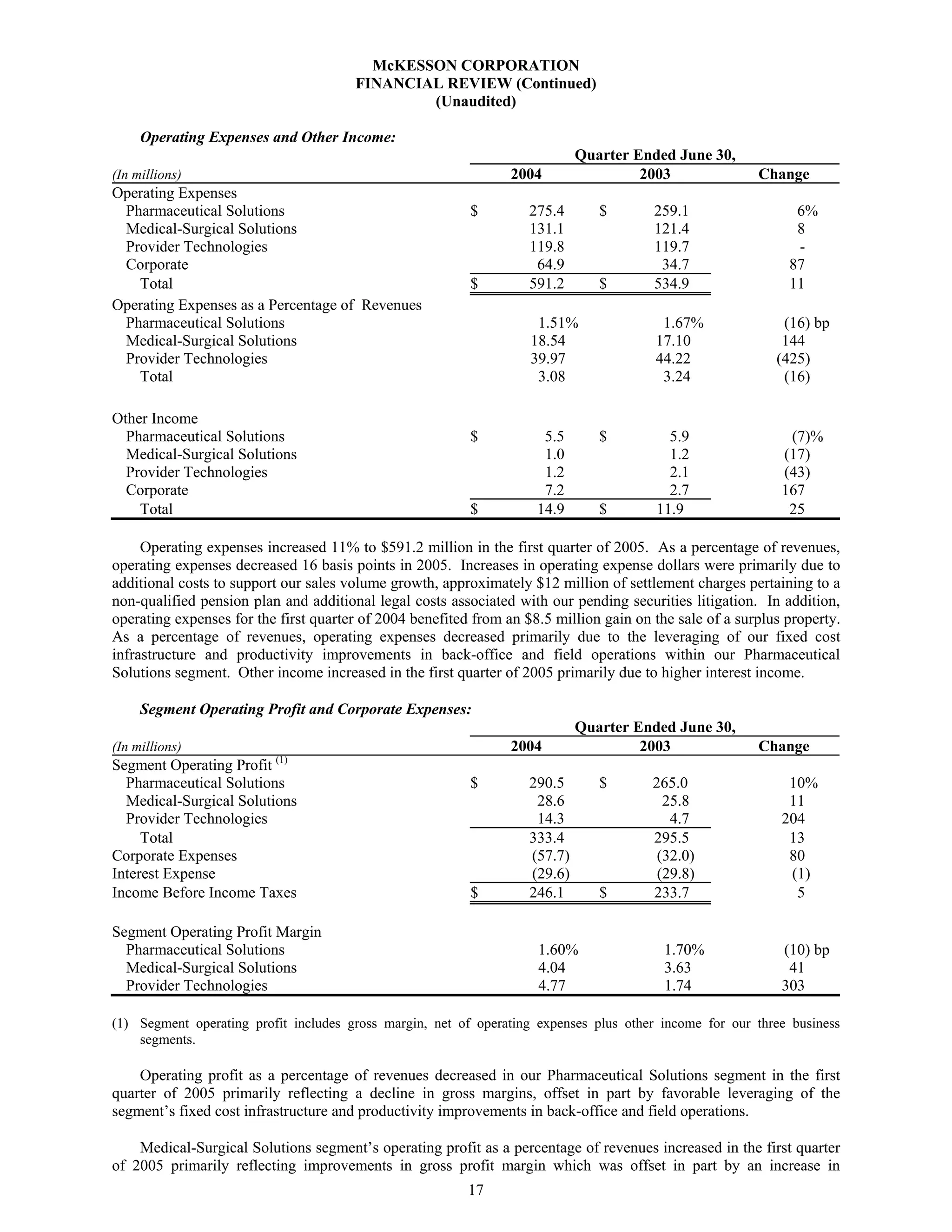

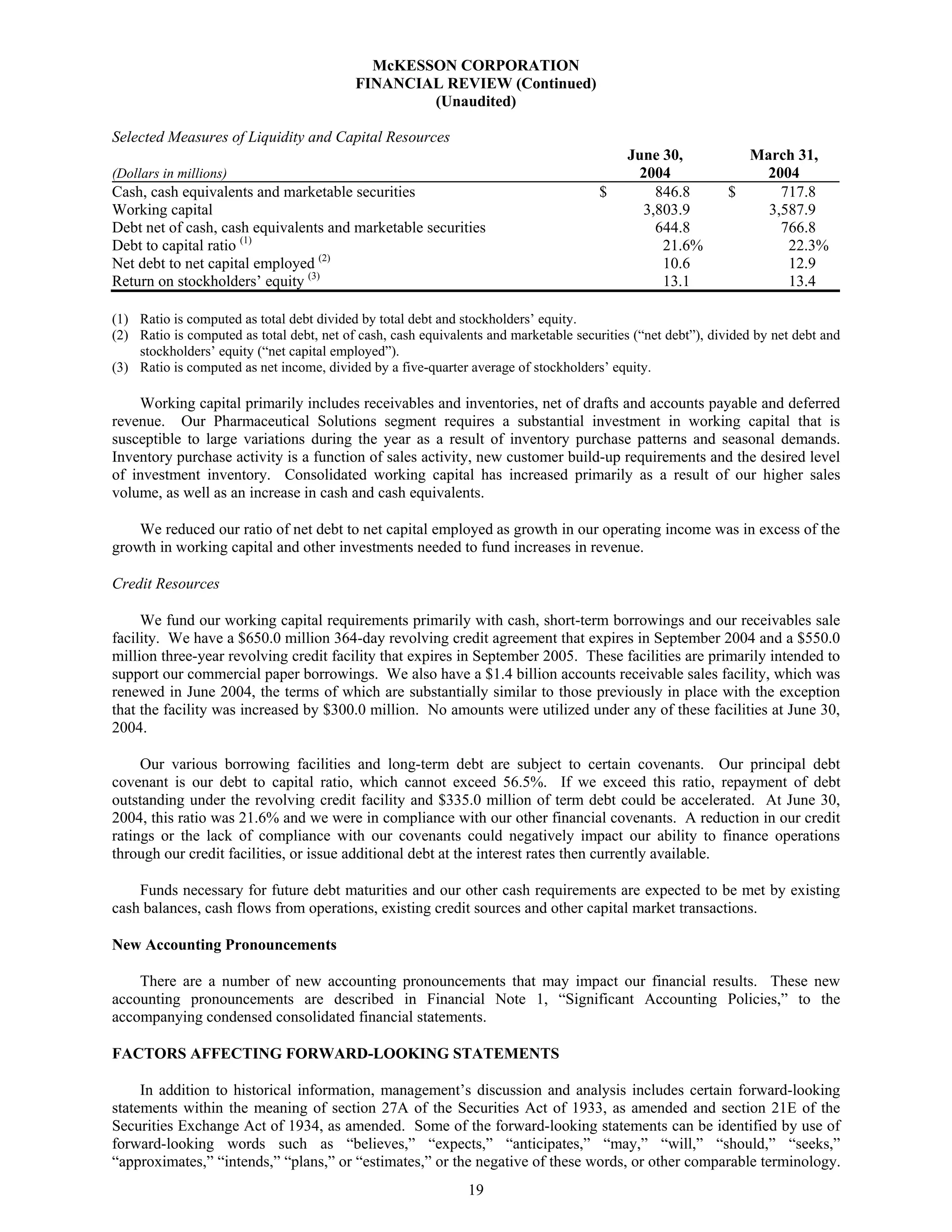

- McKesson Corporation filed a quarterly report with the SEC for the quarter ended June 30, 2004. - As of June 30, 2004 McKesson had total assets of $17.1 billion including $8.4 billion in current liabilities and $5.4 billion in stockholders' equity. - For the quarter ended June 30, 2004 McKesson reported revenues of $19.2 billion and net income of $146.1 million, an increase from revenues of $16.5 billion and net income of $131.6 million for the same quarter the previous year.