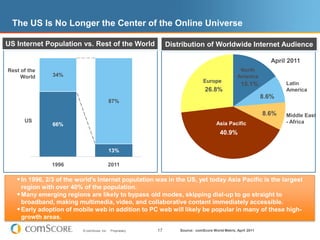

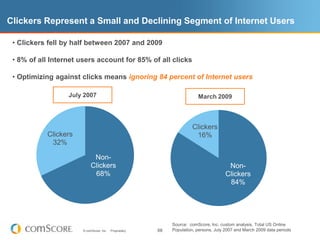

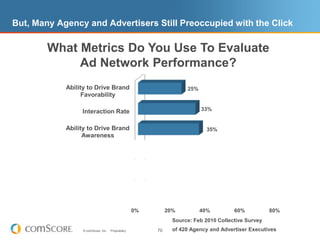

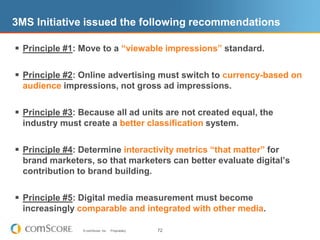

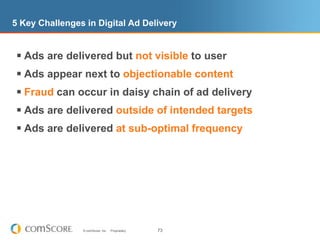

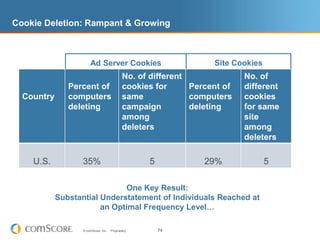

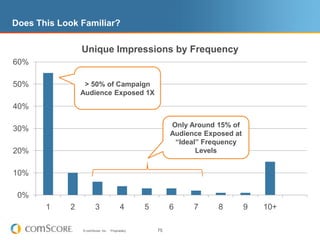

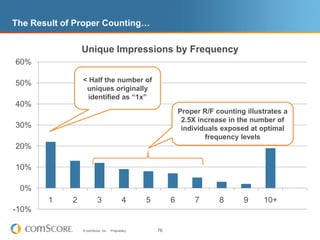

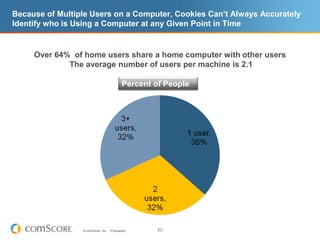

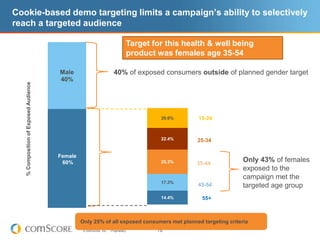

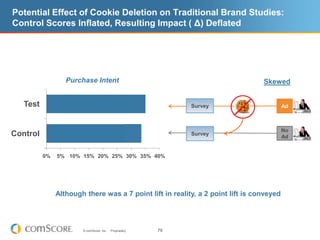

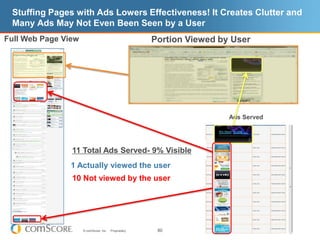

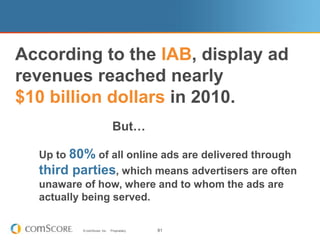

This document discusses challenges with digital media measurement and opportunities for improvement. It notes that cookies often provide an inaccurate view of audiences as they don't always reflect unique individuals and are frequently deleted. Additionally, clicks are an incomplete metric and optimization based solely on clicks ignores most users. The document recommends moving to a viewable impressions standard and currency based on audience size rather than gross impressions to address these issues.