Embed presentation

Download to read offline

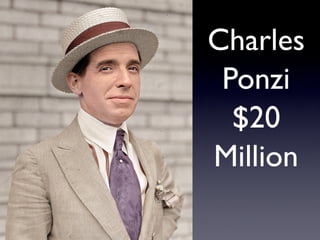

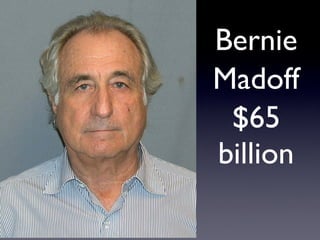

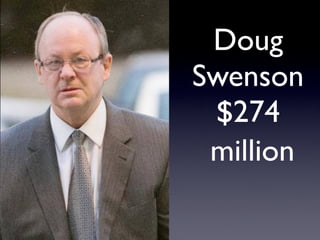

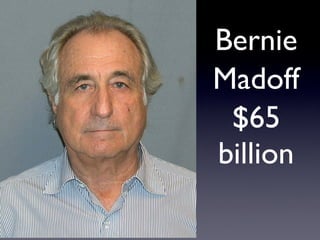

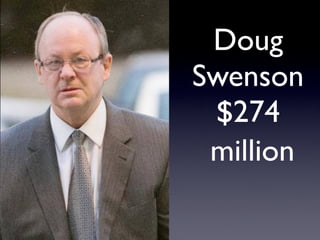

This document discusses various financial innovations and risks related to money, banking, and business. It covers topics like hedging credit, interest rate, liquidity, and currency risks. Specific innovations mentioned include collateralized debt obligations which package loans into securities to improve liquidity, and derivatives like CDOs and currency forwards which allow betting on or locking in future rates and defaults. Examples of famous financial scams and criminals are also listed. Overall the document seems to be covering different financial products and how risks are traded or hedged in innovative new ways.