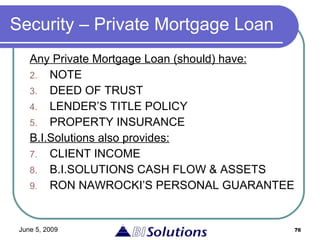

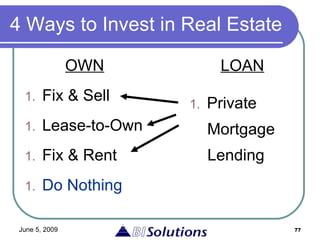

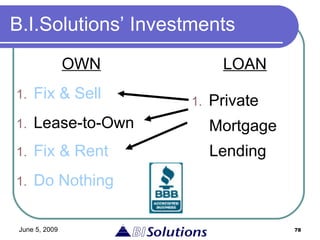

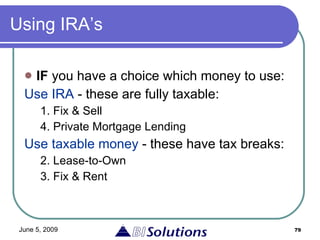

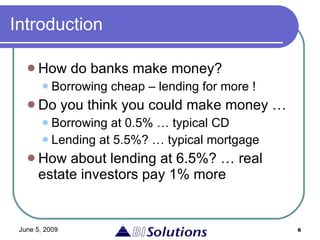

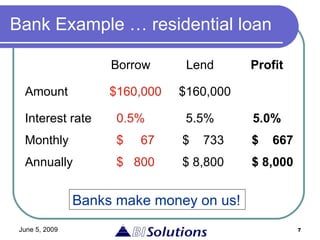

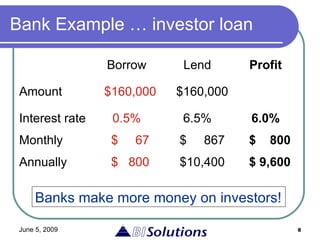

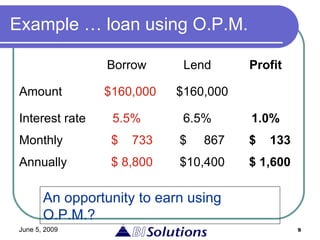

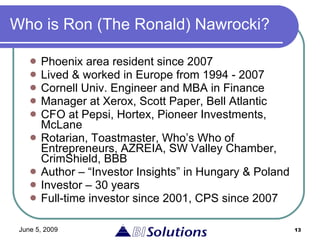

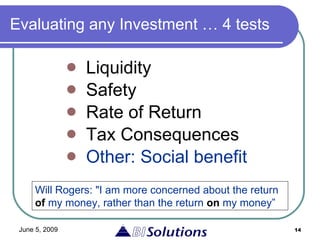

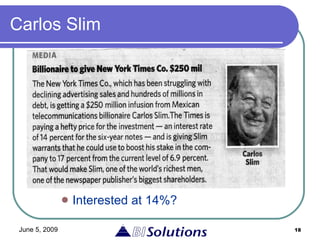

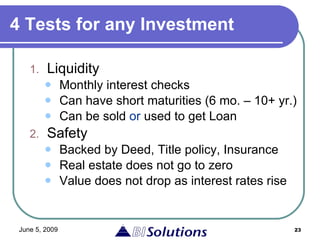

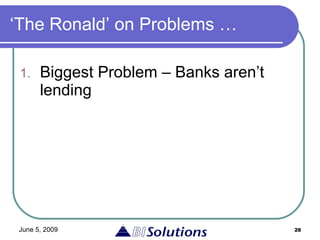

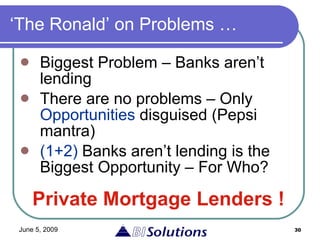

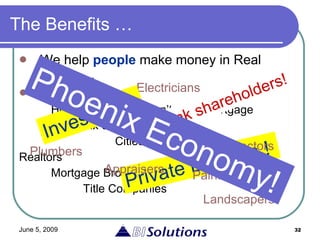

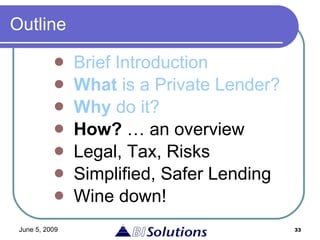

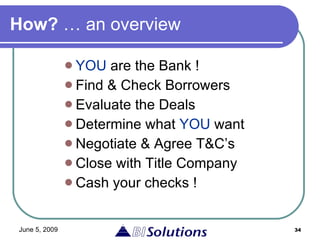

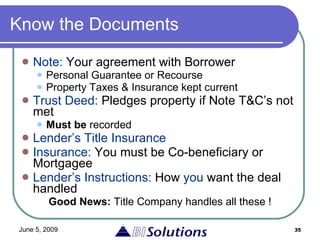

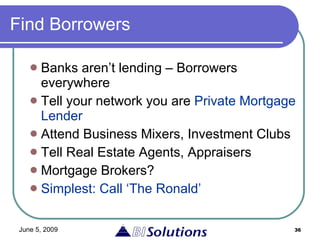

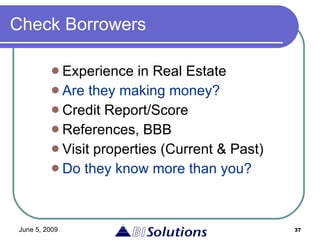

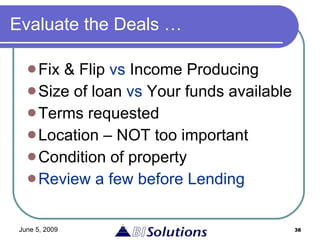

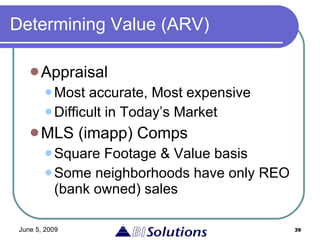

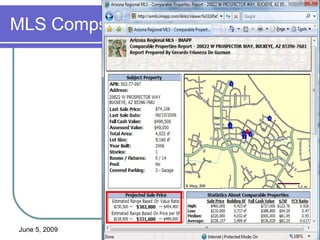

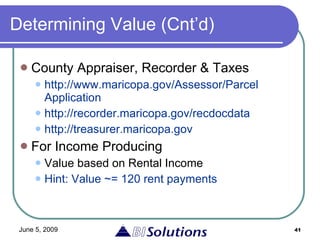

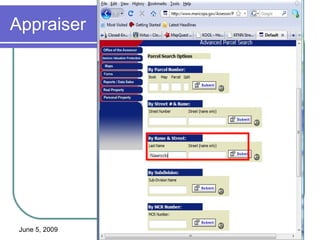

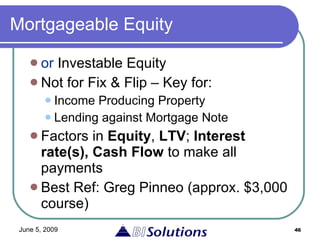

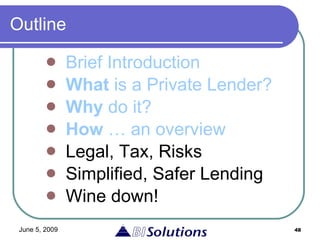

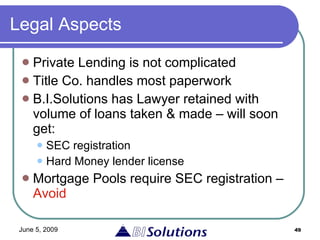

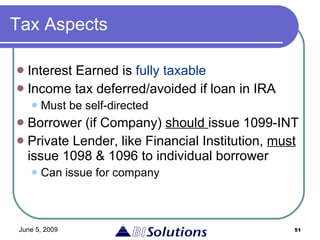

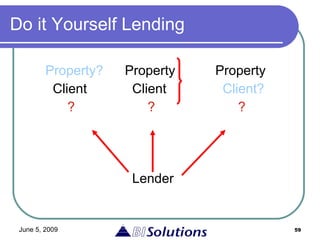

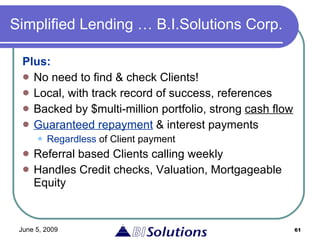

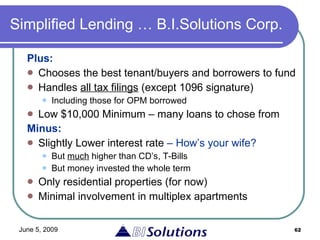

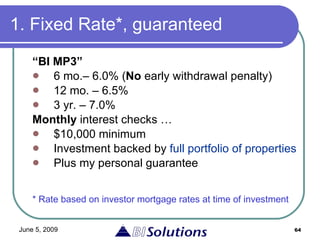

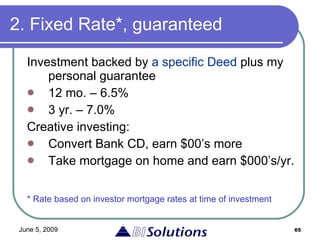

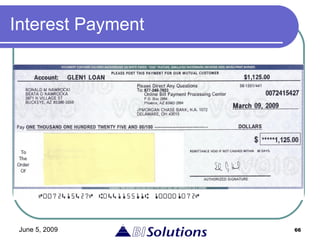

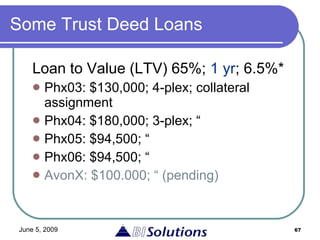

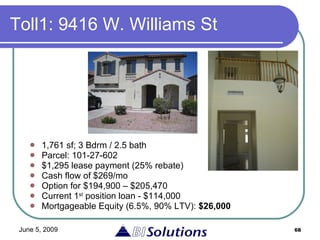

The document is an educational seminar presentation on private mortgage lending, outlining the opportunities and benefits for potential private lenders in the current economic landscape. It explains the definition of private lending, the potential returns compared to traditional banking, and emphasizes the importance of borrower evaluation and legal aspects. The presentation concludes with encouragement for participants to engage in private lending as a profitable investment strategy.

![Contact Ron Nawrocki (The Ronald) B.I.Solutions Corp. Verrado 1-623-249-4792 [email_address] www.TheRonald.us P roven, P rofitable, and P ositioned for Growth](https://image.slidesharecdn.com/bisolutionsprivlend101-124504130279-phpapp01/85/Bi-Solutions-Private-Lending-101-75-320.jpg)