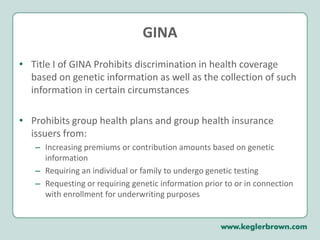

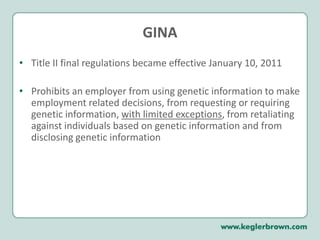

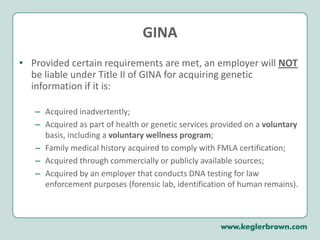

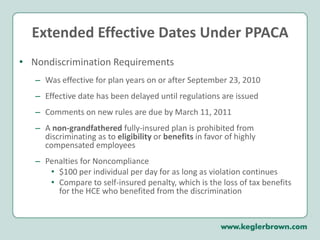

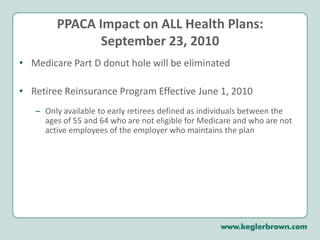

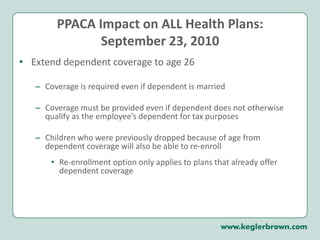

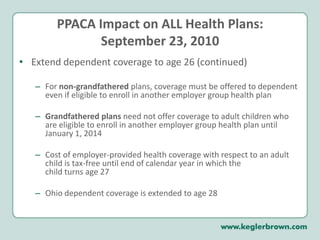

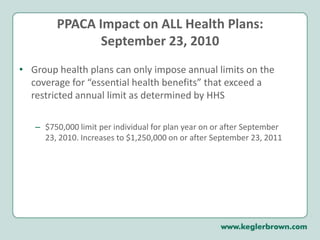

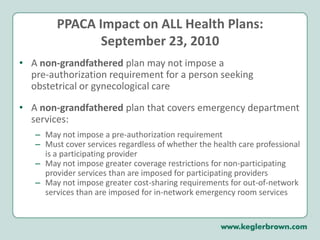

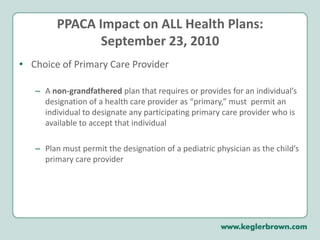

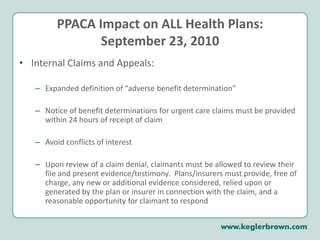

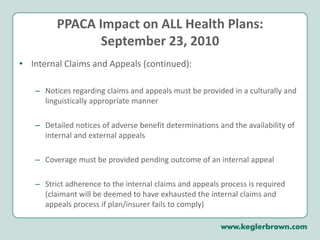

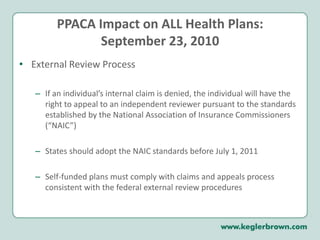

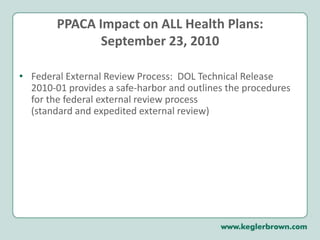

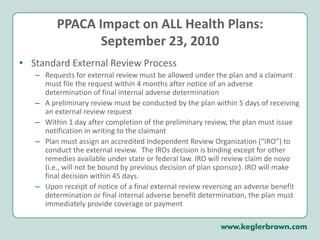

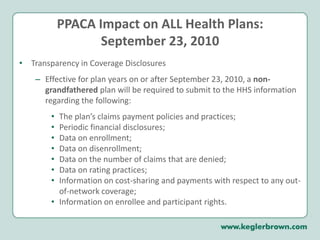

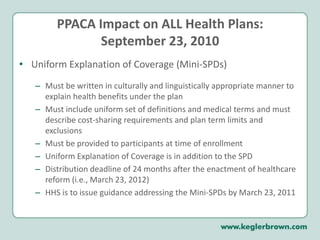

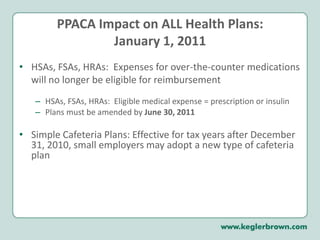

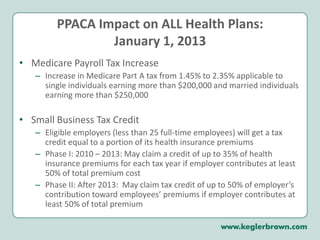

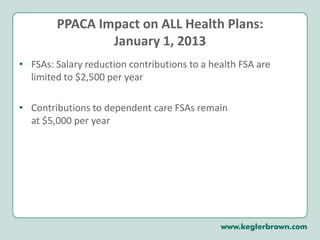

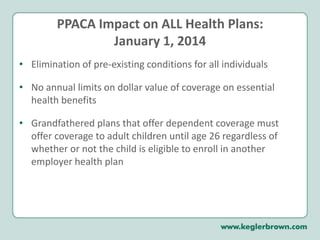

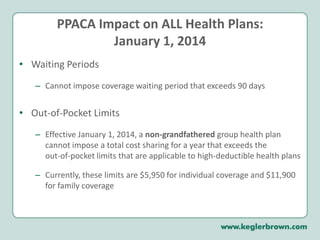

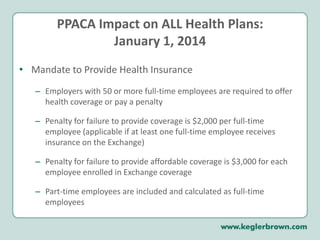

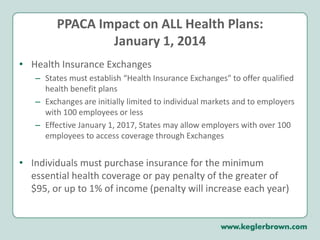

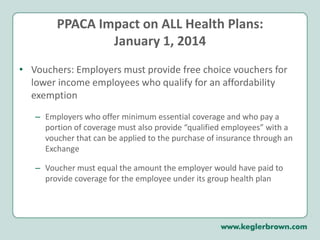

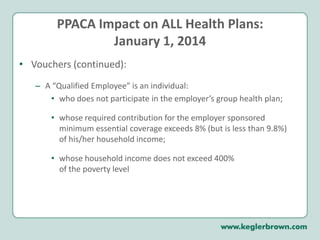

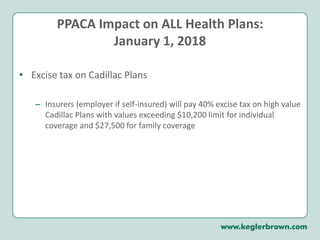

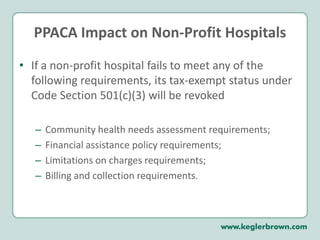

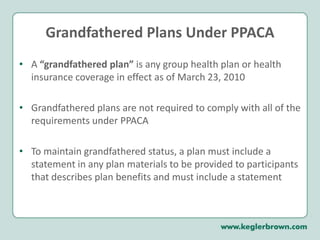

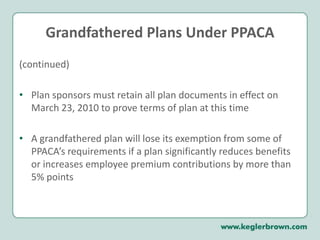

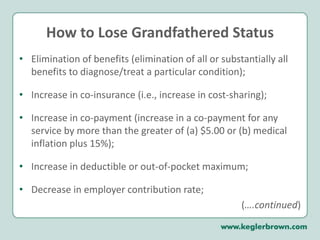

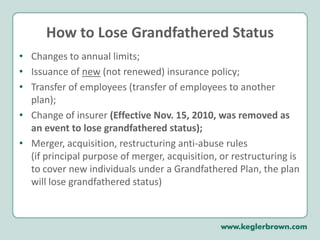

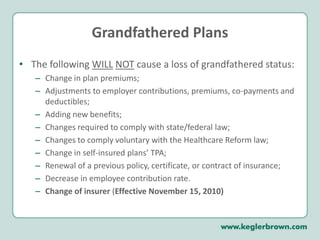

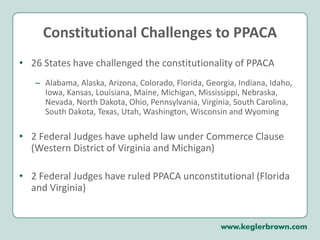

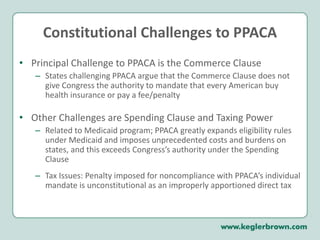

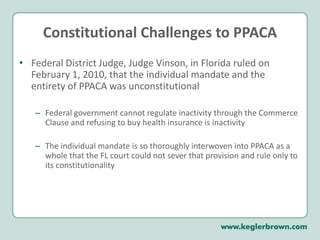

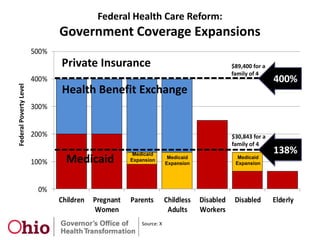

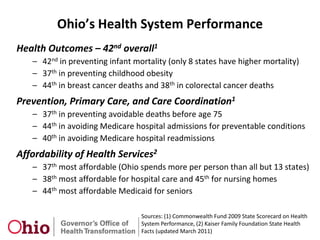

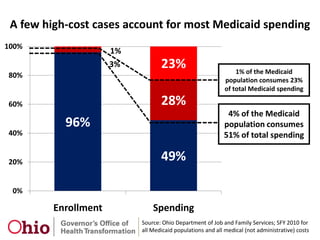

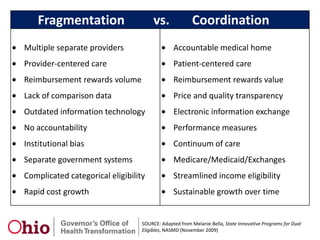

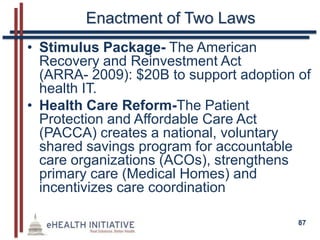

The document provides a comprehensive overview of health care reform, primarily focusing on the Genetic Information Nondiscrimination Act (GINA) and the Patient Protection and Affordable Care Act (PPACA). It outlines various provisions like prohibitions on discrimination based on genetic information, the extension of dependent coverage, the elimination of pre-existing conditions, and requirements for transparency in health plans. Additionally, it discusses penalties for noncompliance, the establishment of health insurance exchanges, and other significant changes affecting health care coverage and employer responsibilities.