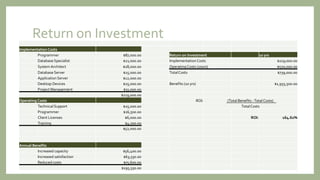

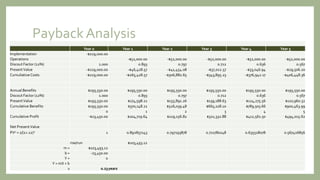

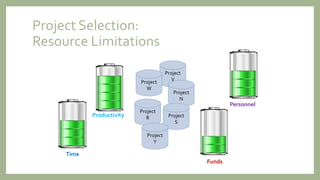

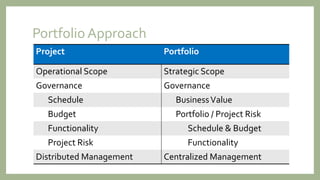

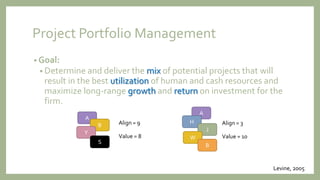

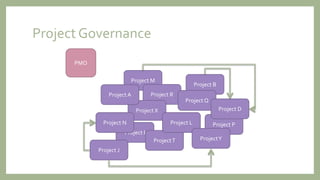

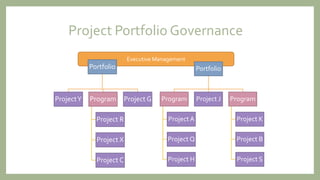

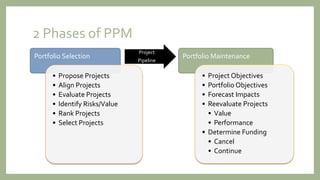

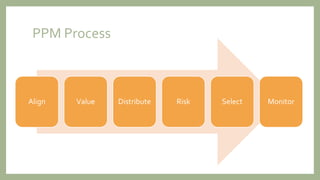

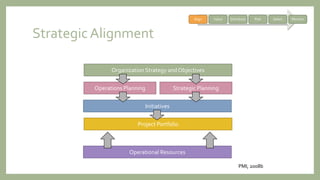

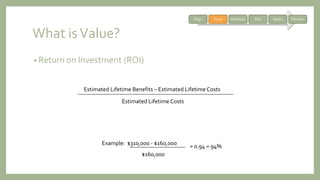

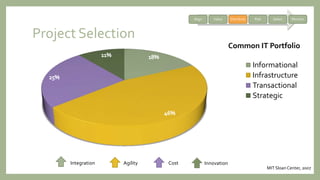

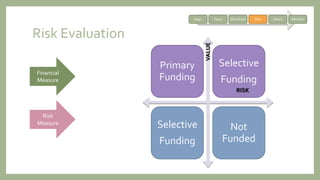

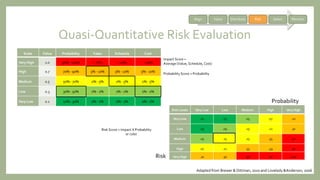

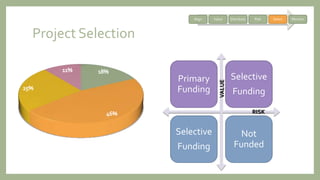

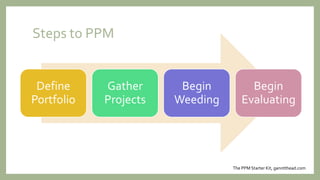

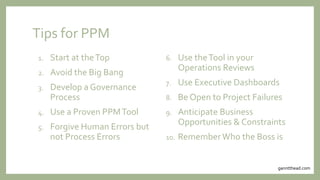

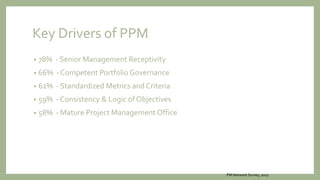

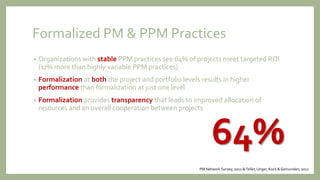

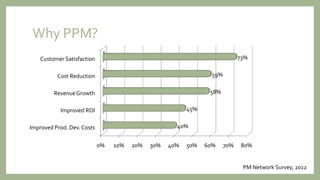

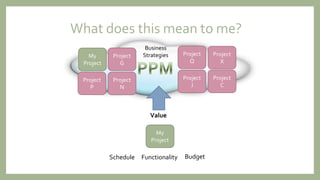

This document provides an overview of project portfolio management. It defines key concepts like projects, business value, and portfolio selection. It discusses techniques for evaluating business value, like ROI, NPV, and payback analysis. It also covers selecting projects using a portfolio approach to balance value, risk, and resources. The document outlines the process of project portfolio management including aligning projects to strategy, assessing value and risk, project selection, and ongoing portfolio monitoring. It provides tips for organizations migrating to a project portfolio management approach. The goal is to help project managers understand how to maximize the impact of their projects through a portfolio-level perspective.