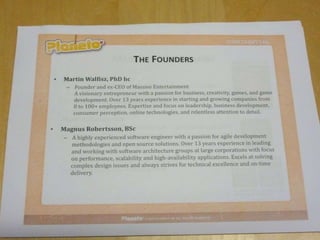

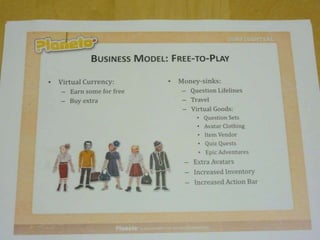

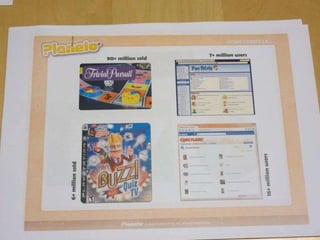

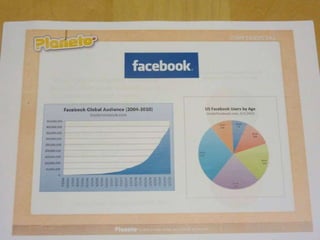

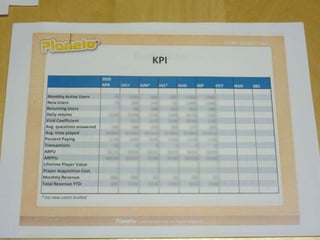

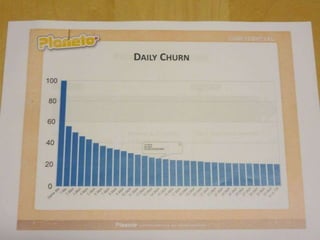

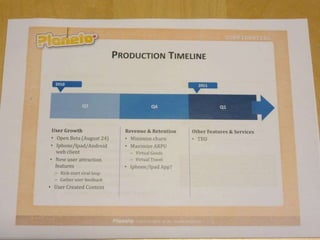

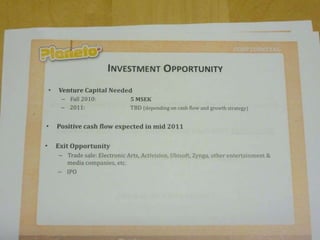

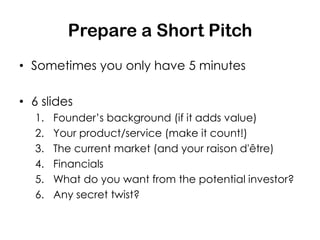

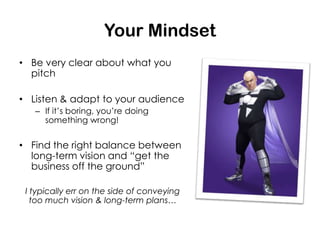

The document discusses a case study on Planeto, a quiz platform, emphasizing the importance of preparing an effective pitch for potential investors. It outlines key elements such as the founder's background, product, market, financials, and investment requests while advising on pitch delivery, networking, and understanding venture capital terminology. Final tips include maintaining passion for the business idea, being in control of company valuation, and the emotional challenges of raising funds.

![Your [IRL] Network

• Meet people!

– Someone always knows

someone, that knows

someone, that knows

someone with money…

• Grab two lunches and

five coffee-breaks every

day](https://image.slidesharecdn.com/chasingvc-120412094642-phpapp01/85/Chasing-venture-capital-46-320.jpg)