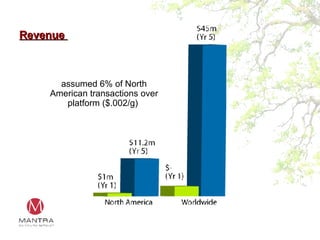

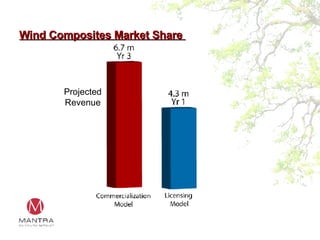

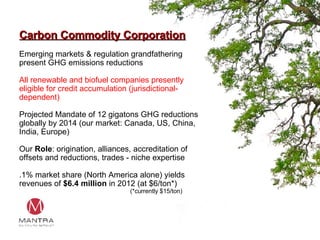

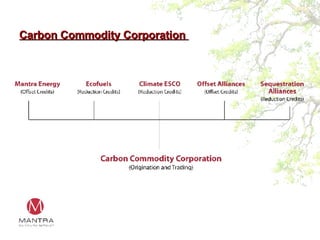

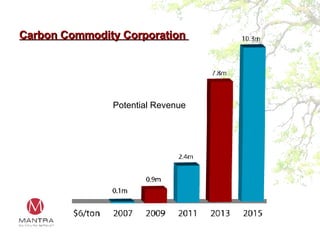

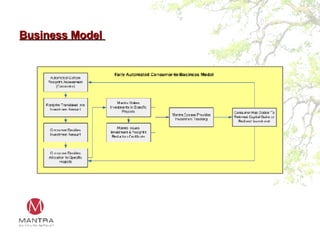

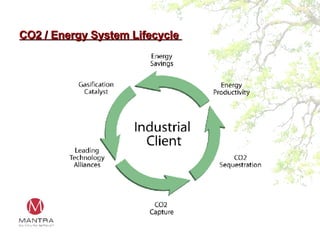

The document outlines a company's strategy to address climate change through developing and commercializing niche low-carbon energy technologies, originating and trading carbon credits globally, and providing integrated energy systems and services. The company aims to focus on renewable energy, low-carbon transportation, gasification, carbon capture and storage, and carbon commoditization technologies. It also describes several business lines and projects revenue projections for a biofuels trading platform, wind turbine composites, a carbon credit origination business, and an energy services company targeting industrial energy users.