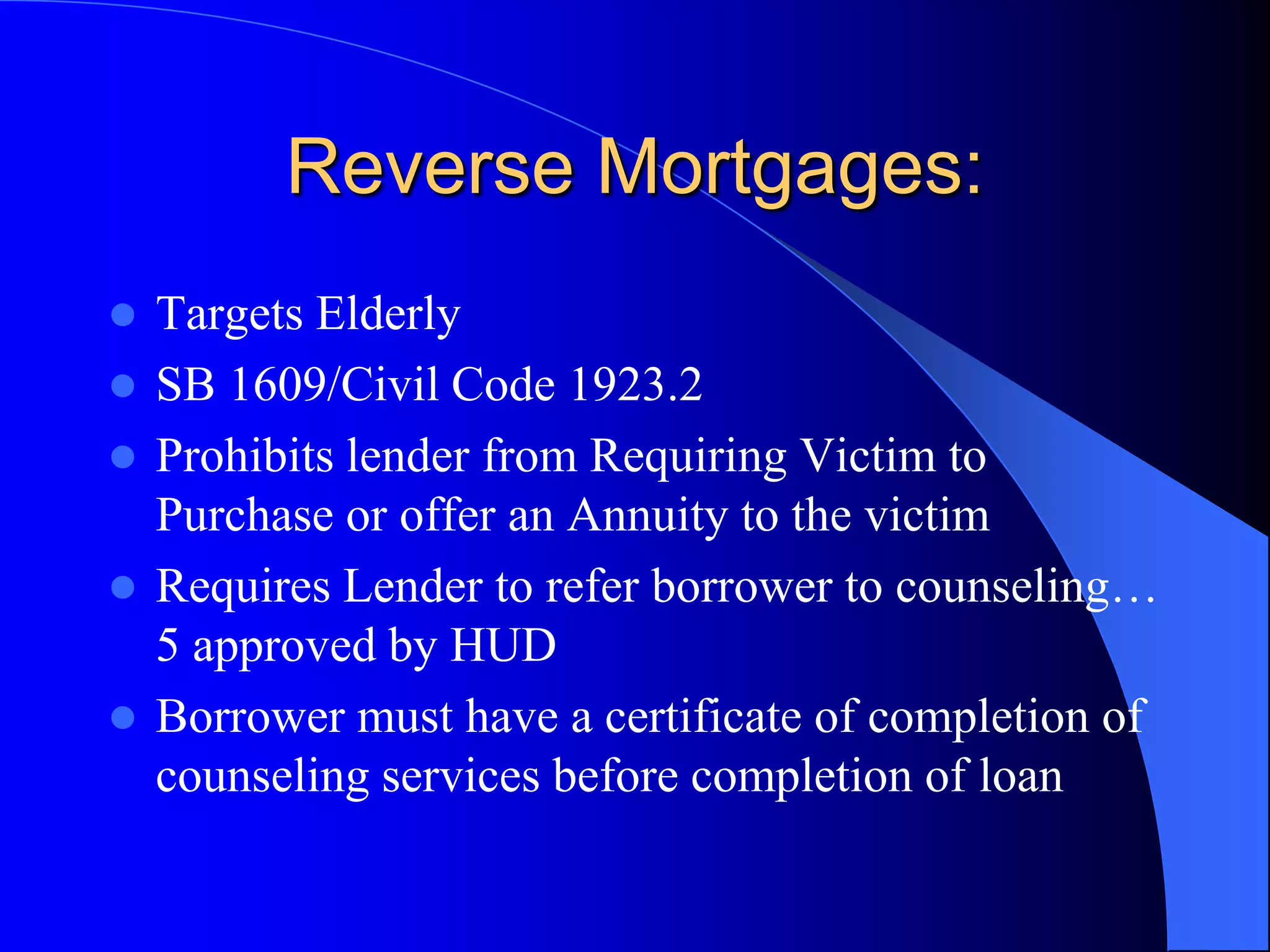

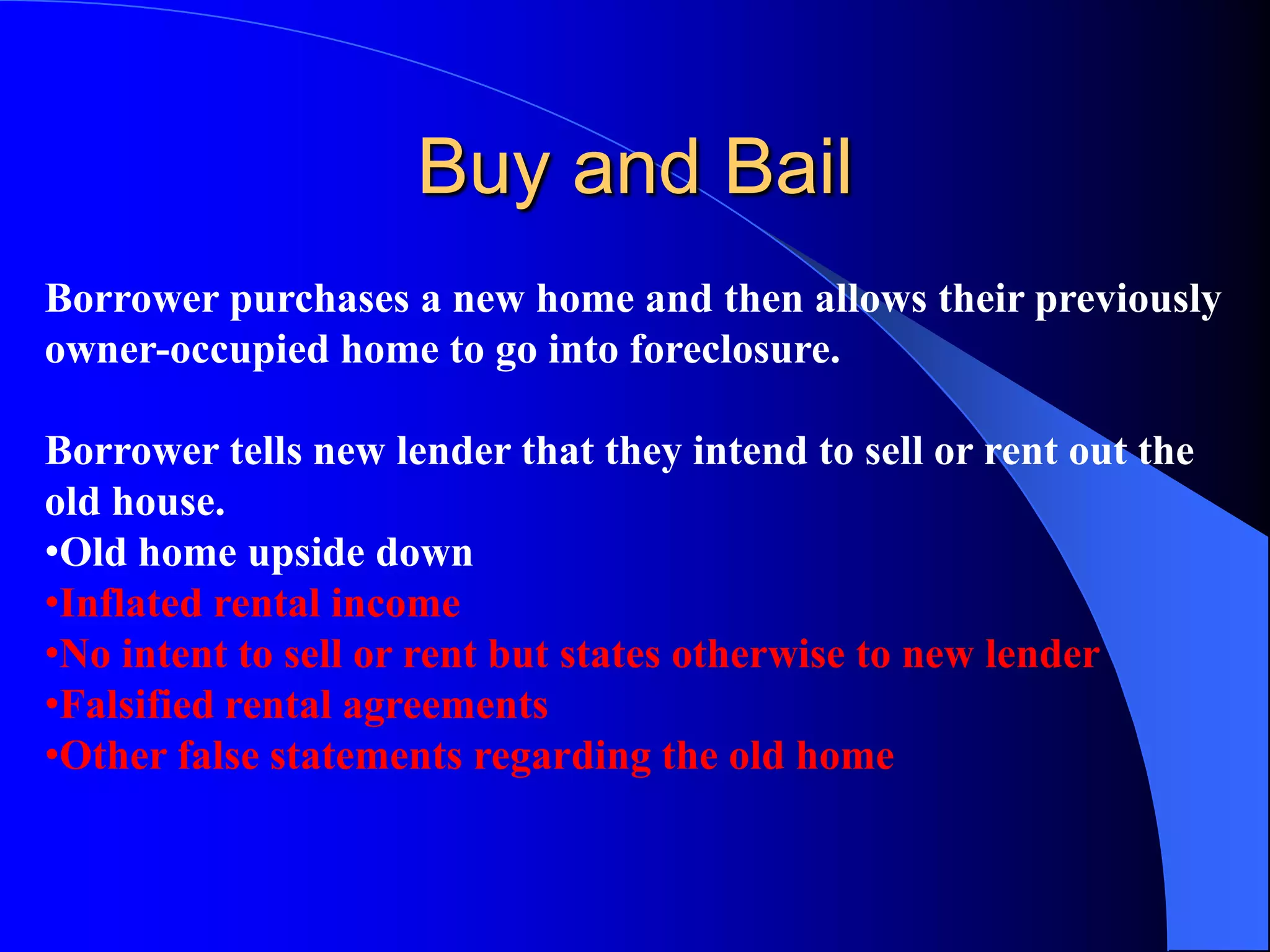

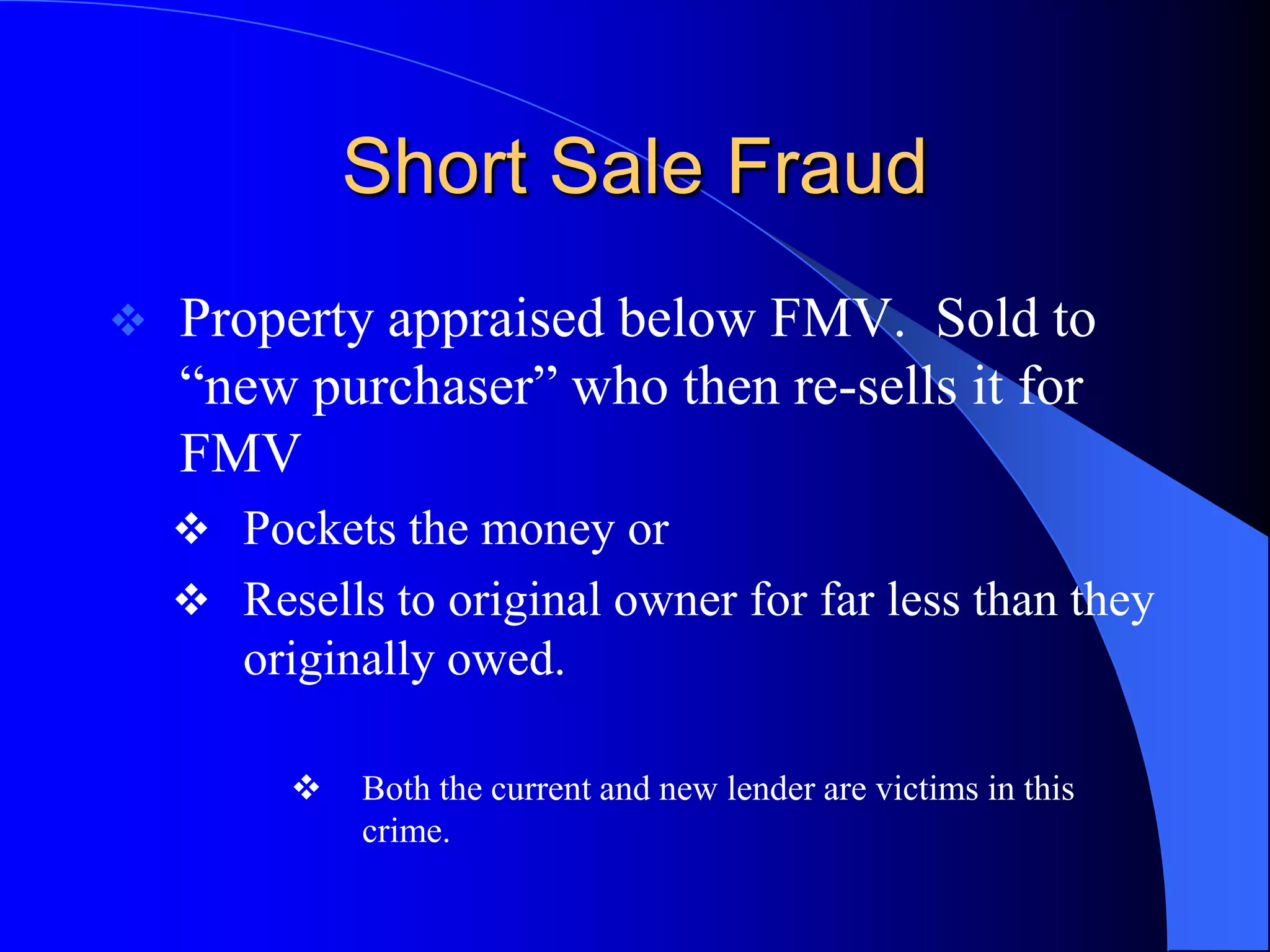

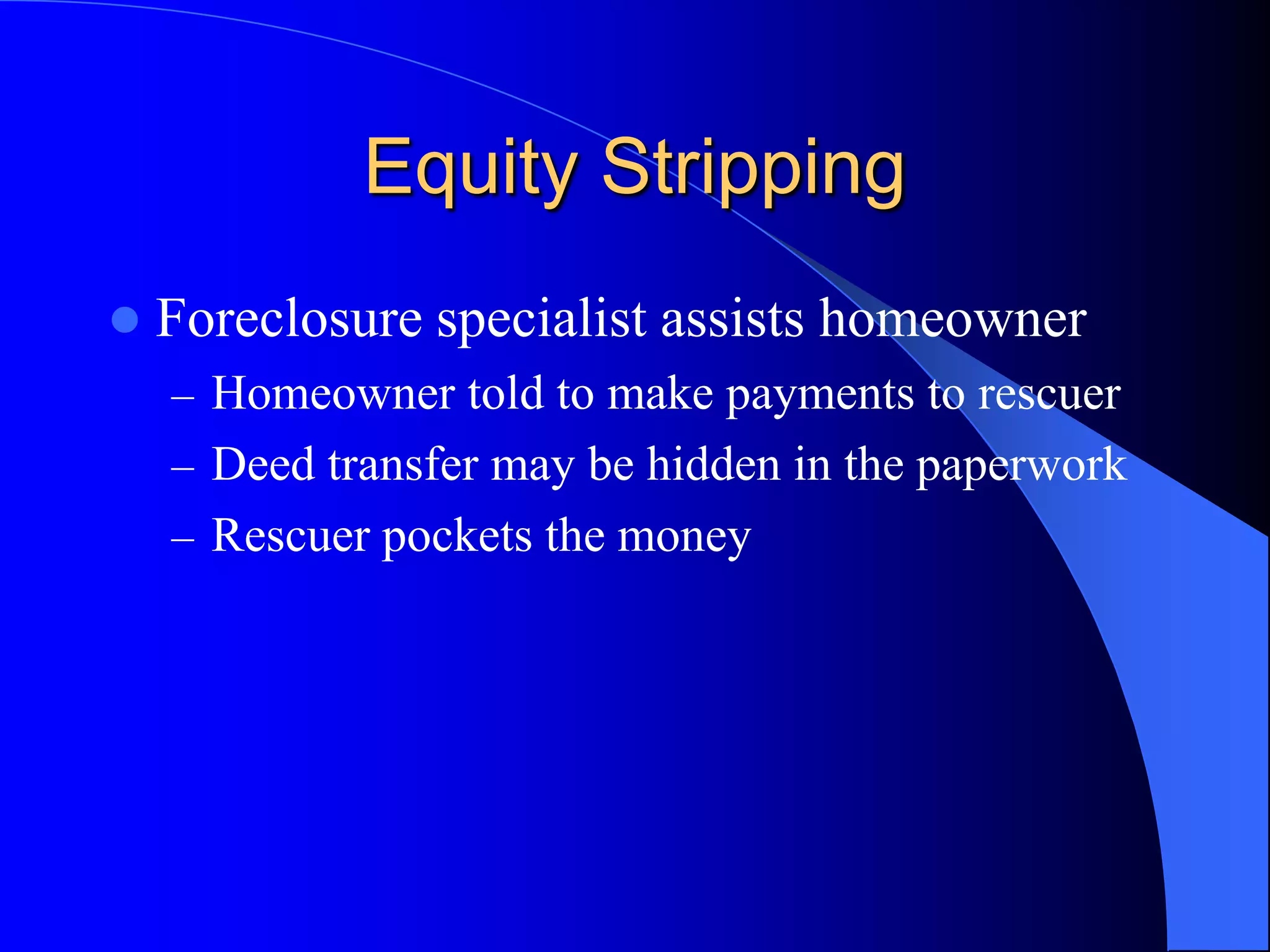

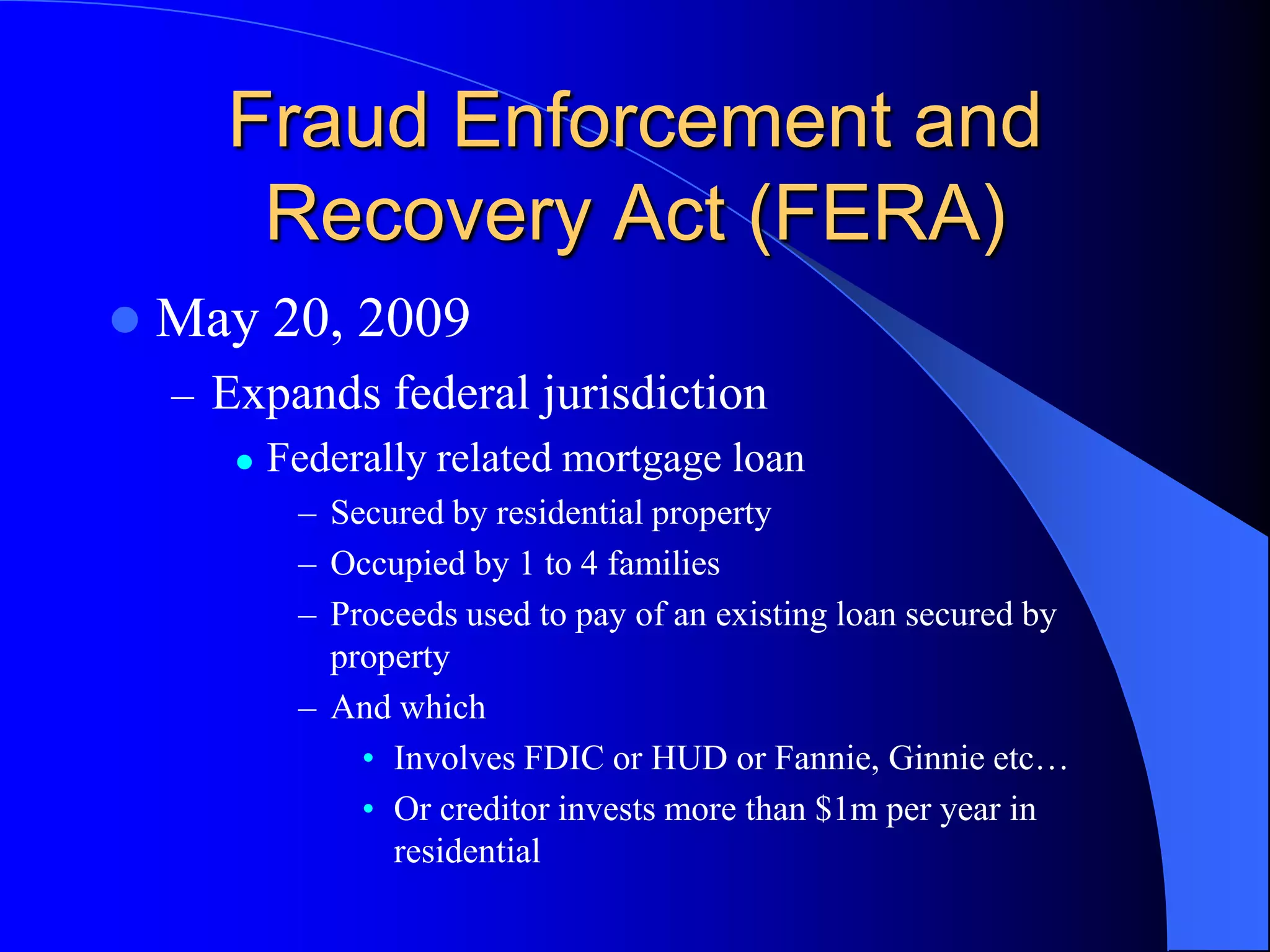

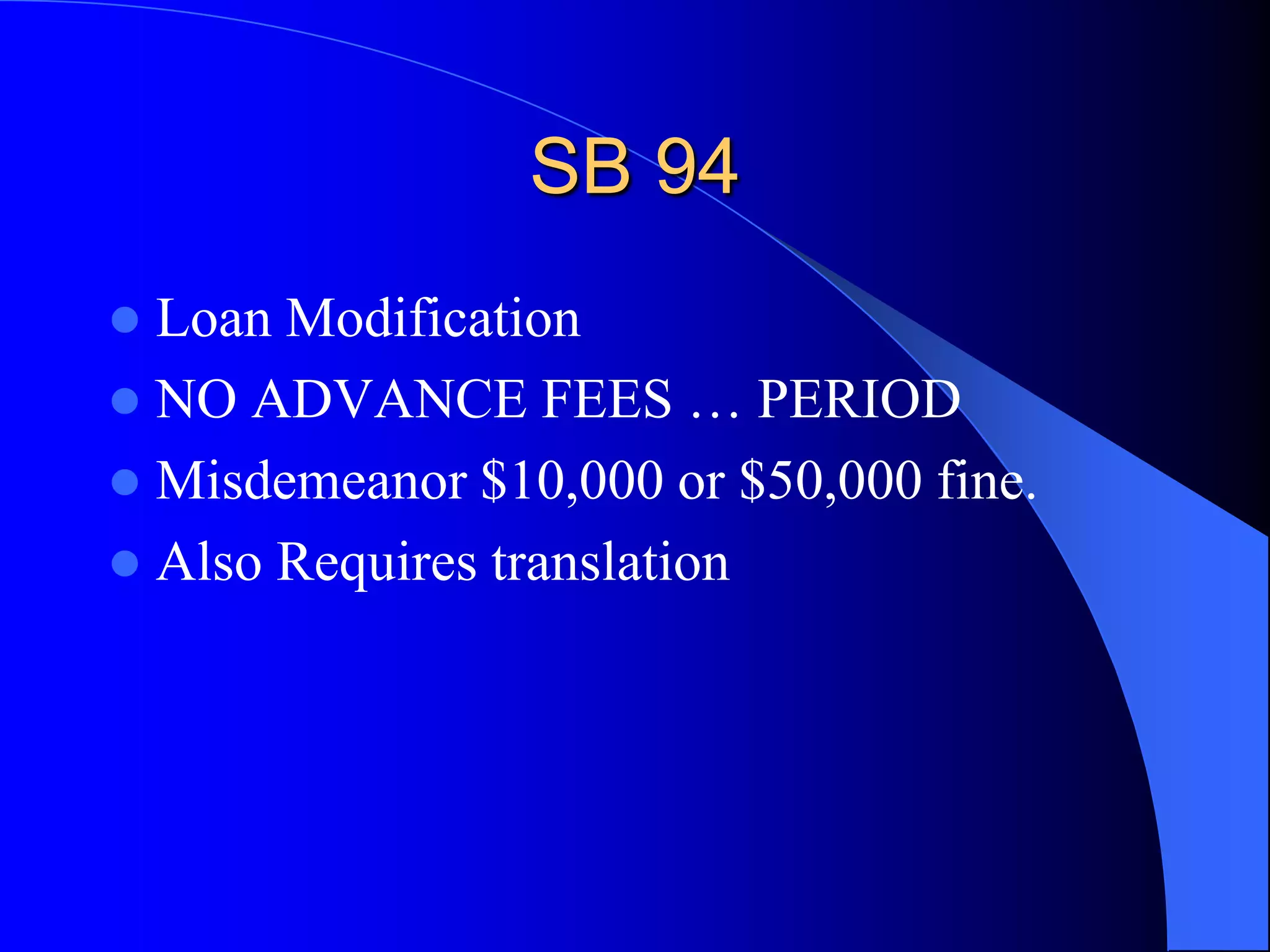

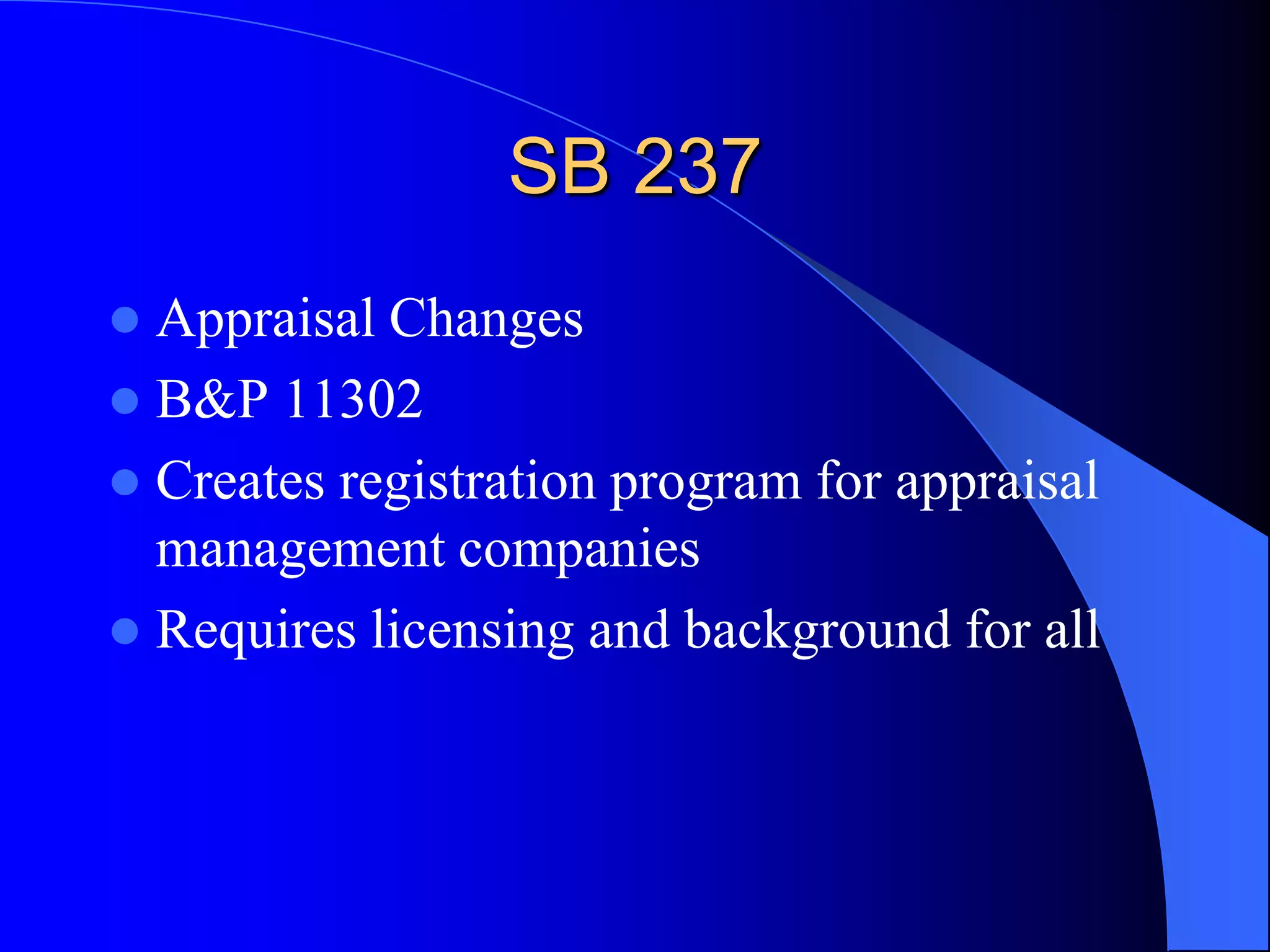

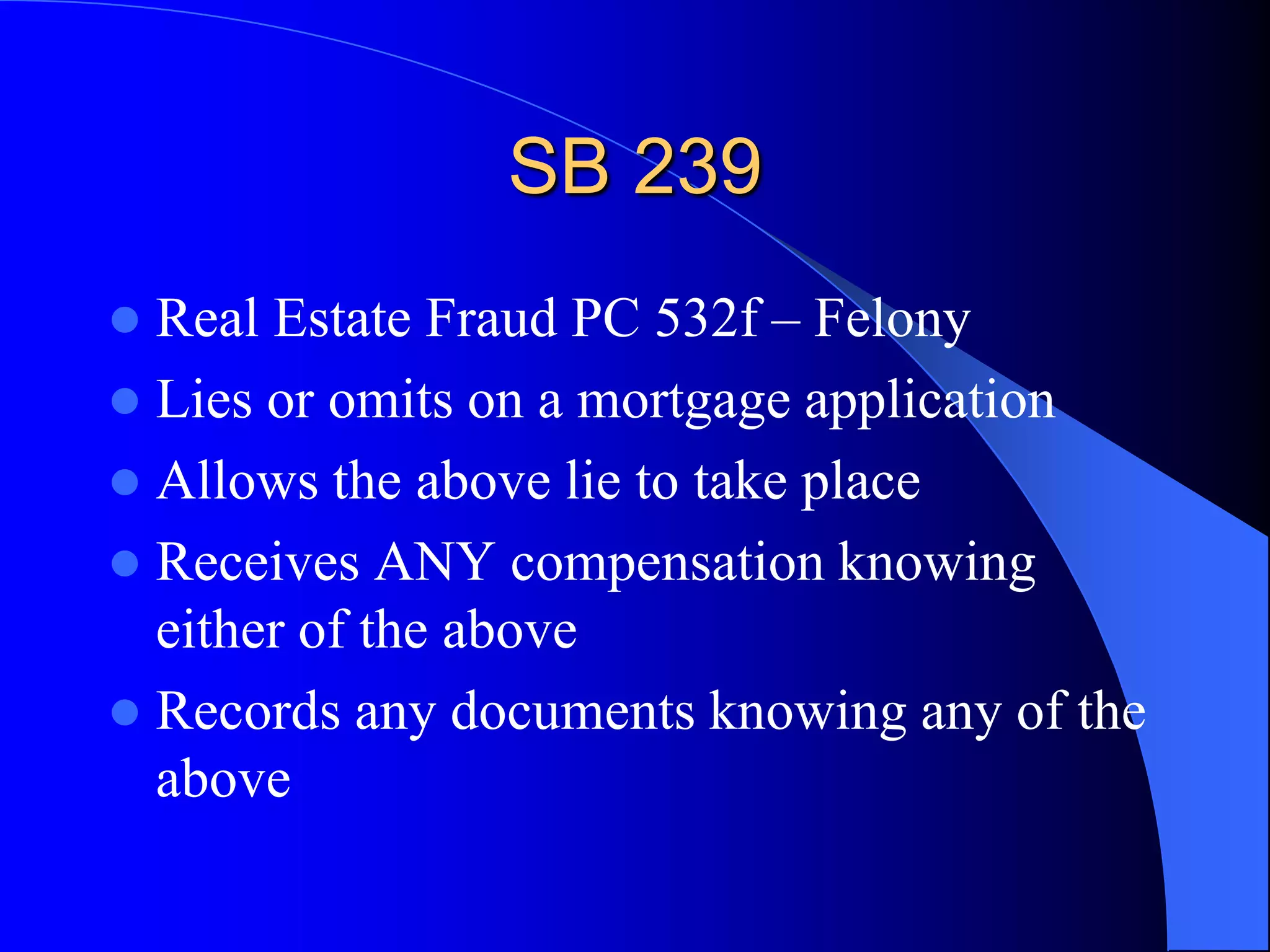

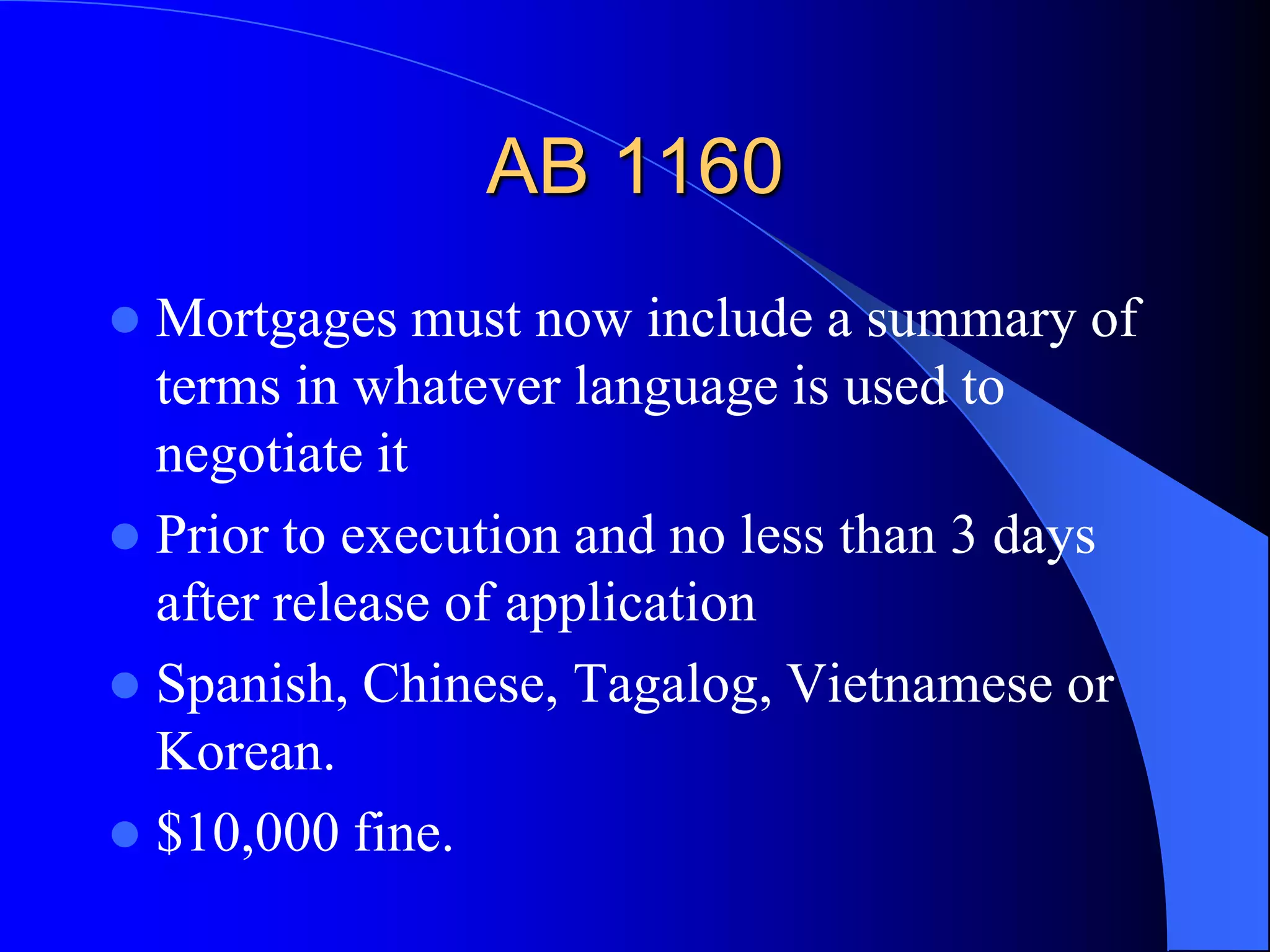

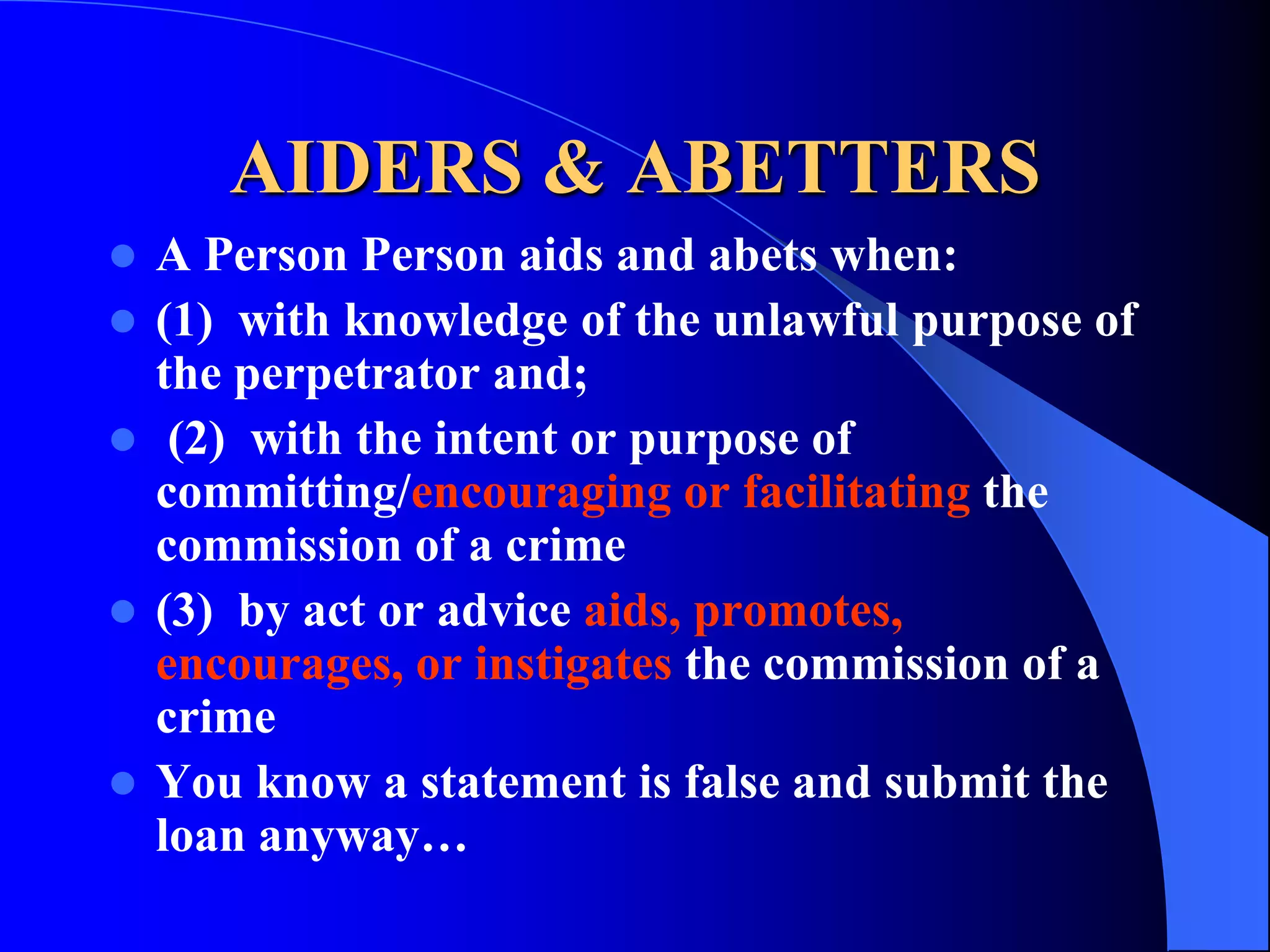

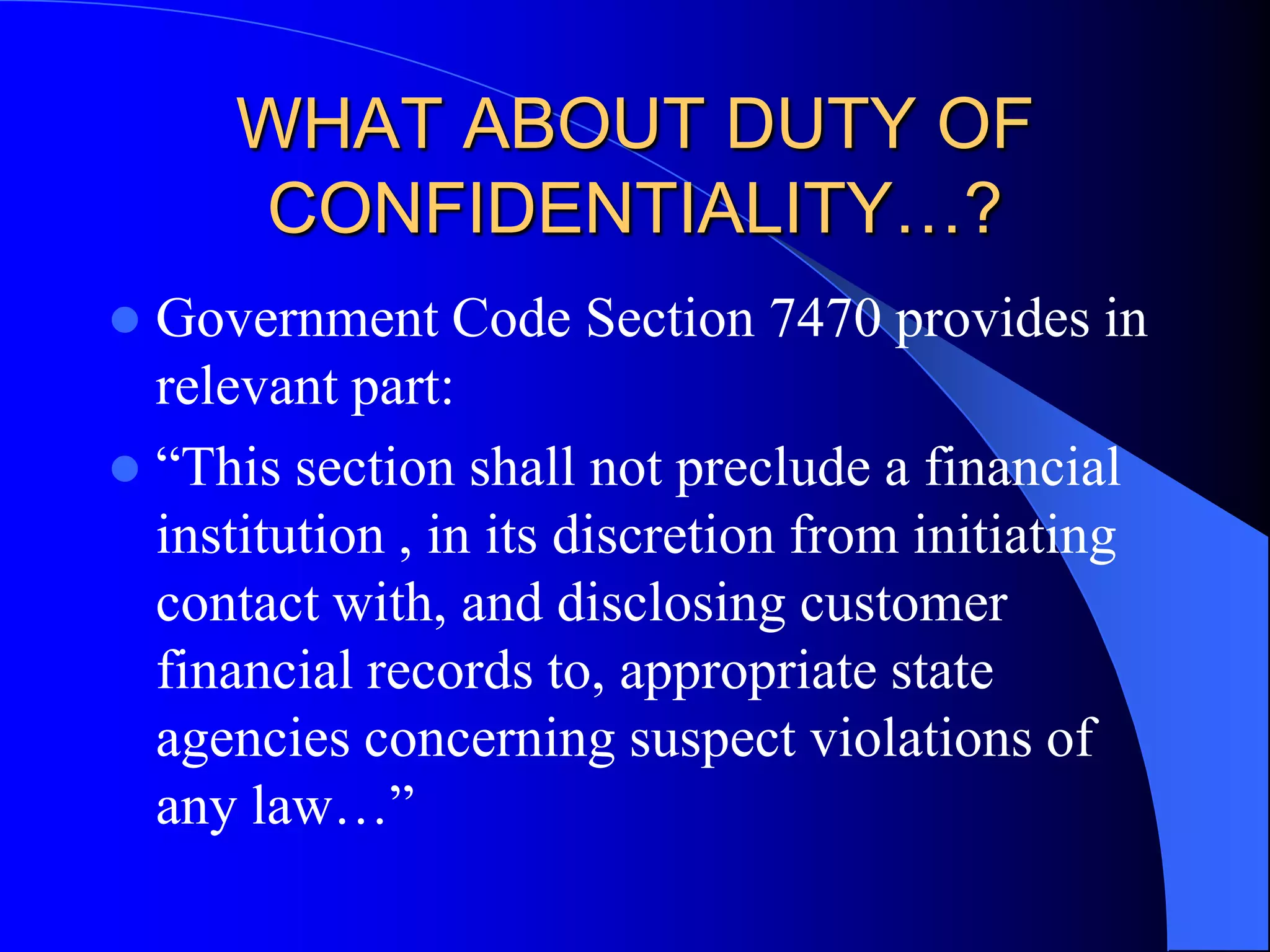

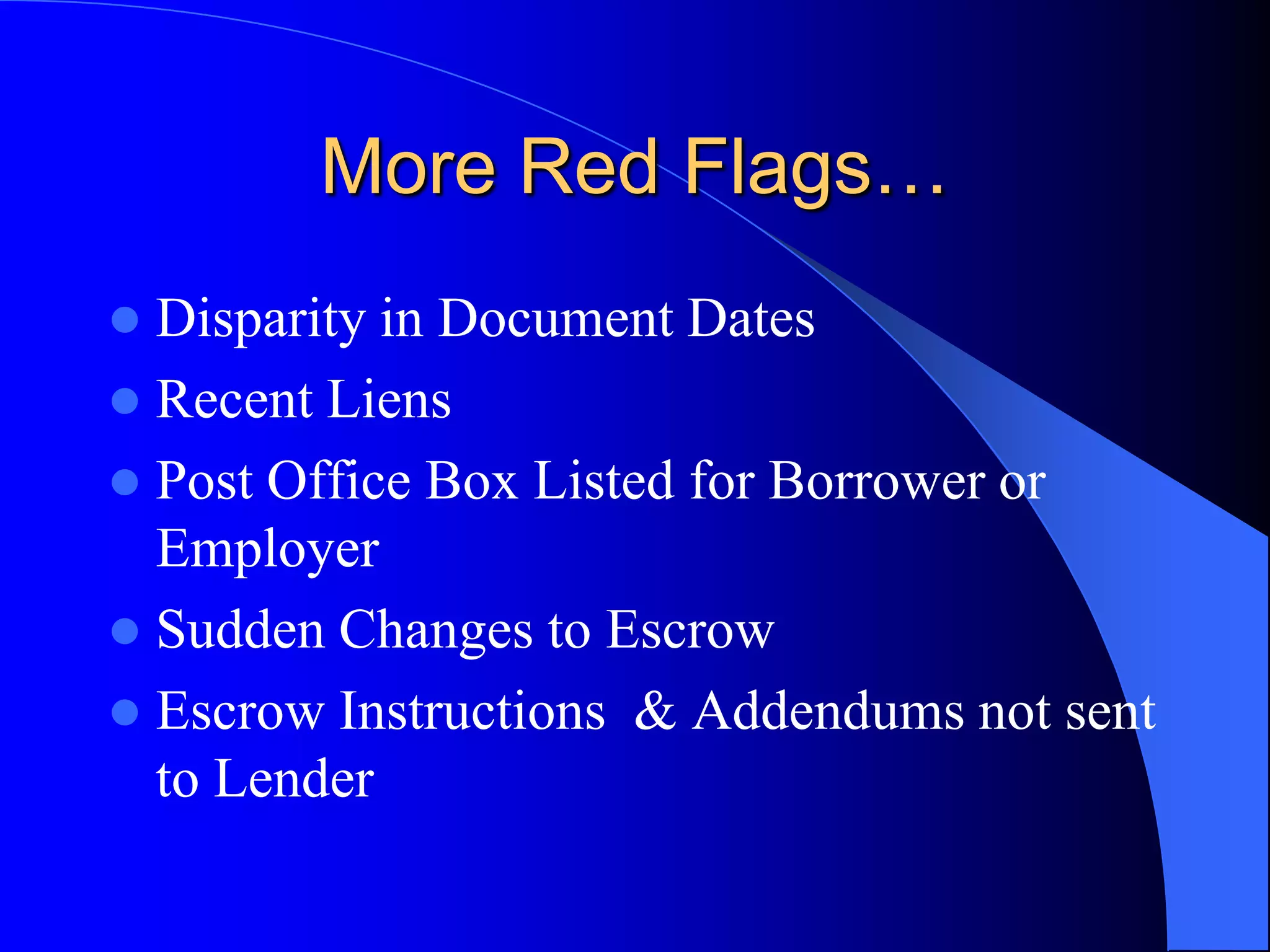

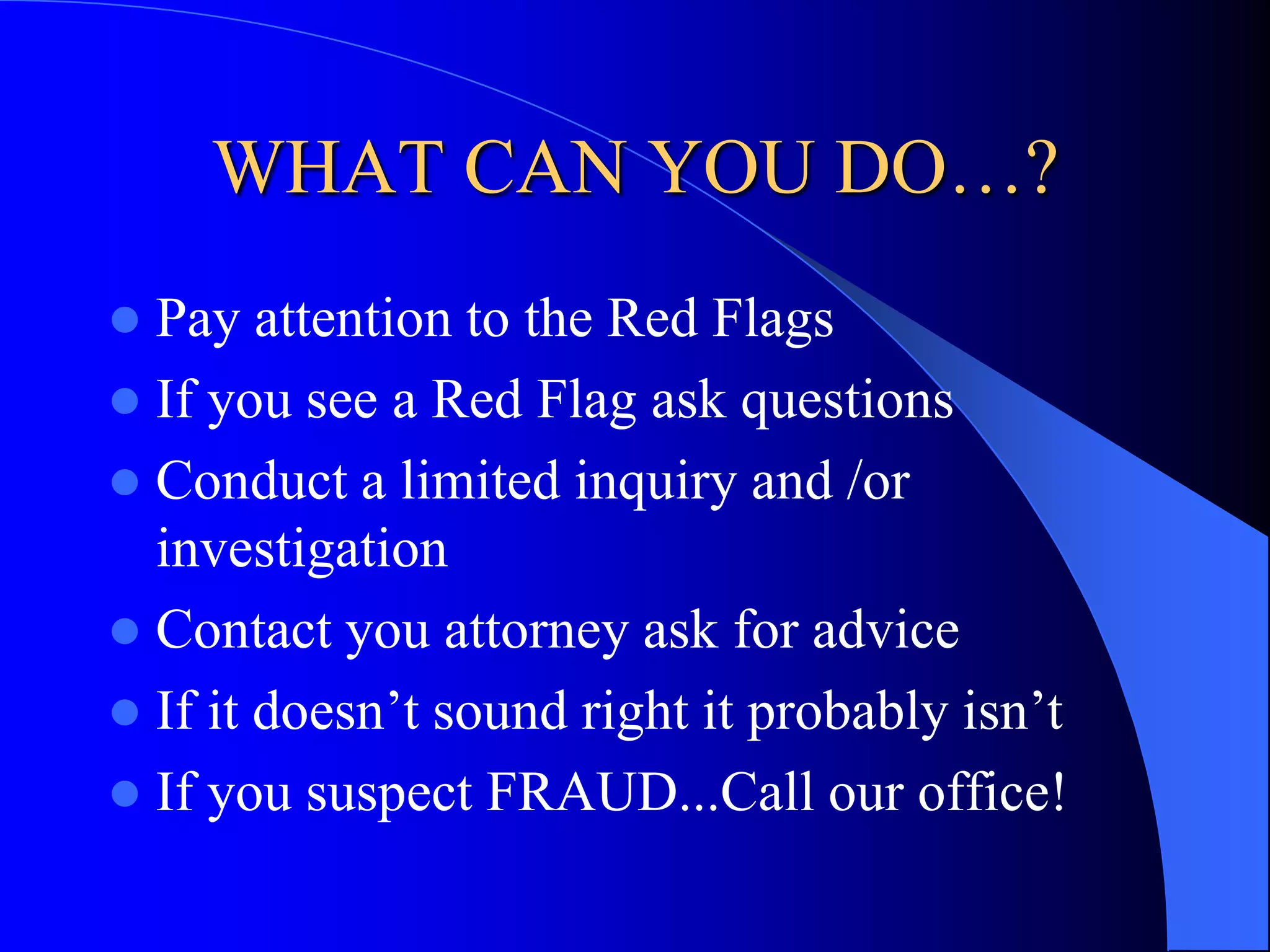

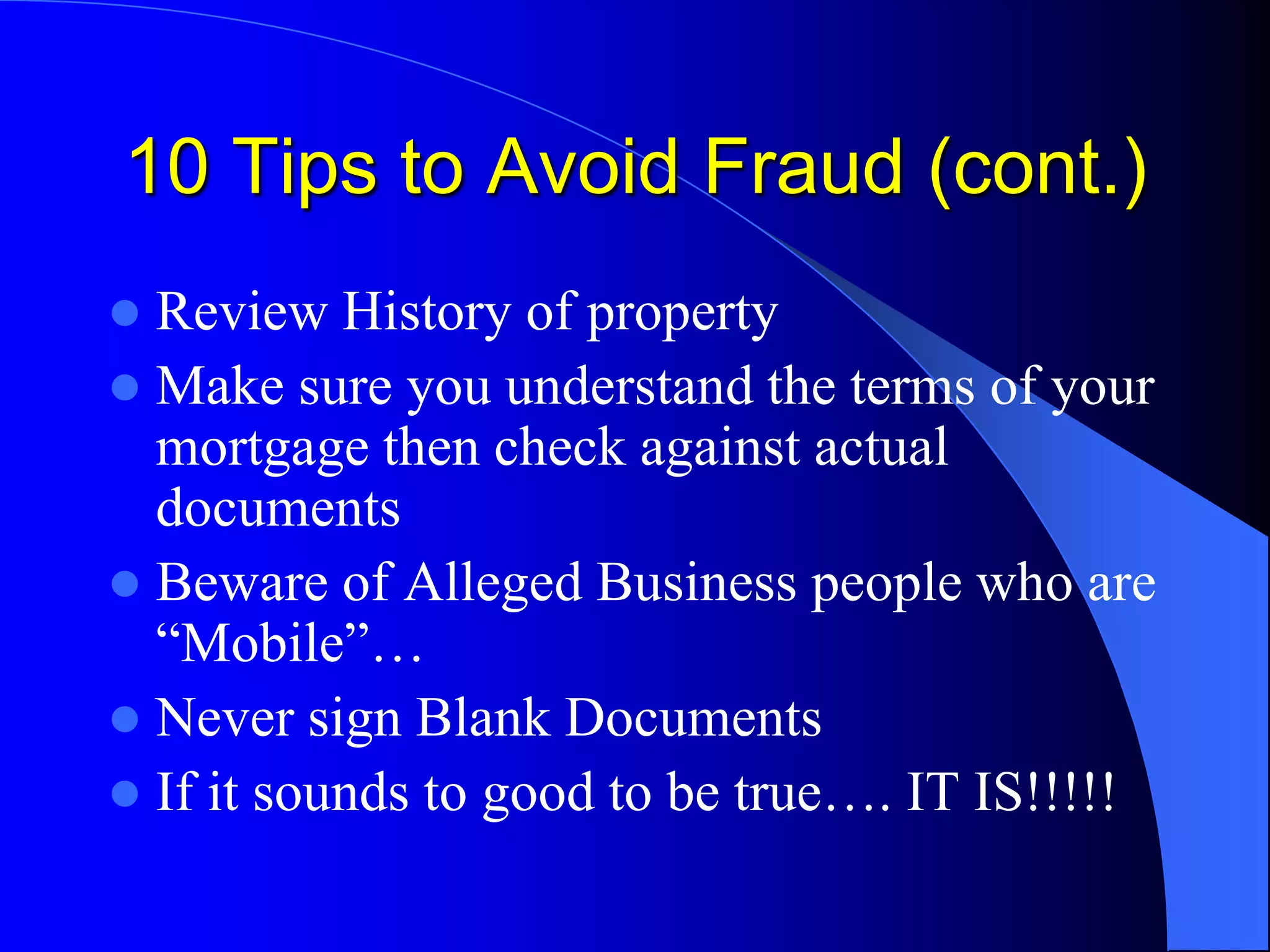

The document discusses real estate fraud in Stanislaus County, highlighting the roles of district attorneys and investigators in investigating and prosecuting fraudulent activities that exploit vulnerable victims, such as the elderly and those in foreclosure. Various types of fraud, including foreclosure fraud, mortgage fraud, and predatory lending practices, are outlined, along with the legal framework and recent laws aimed at combating these crimes. The document also provides tips for the public on how to recognize and avoid fraud in real estate transactions.