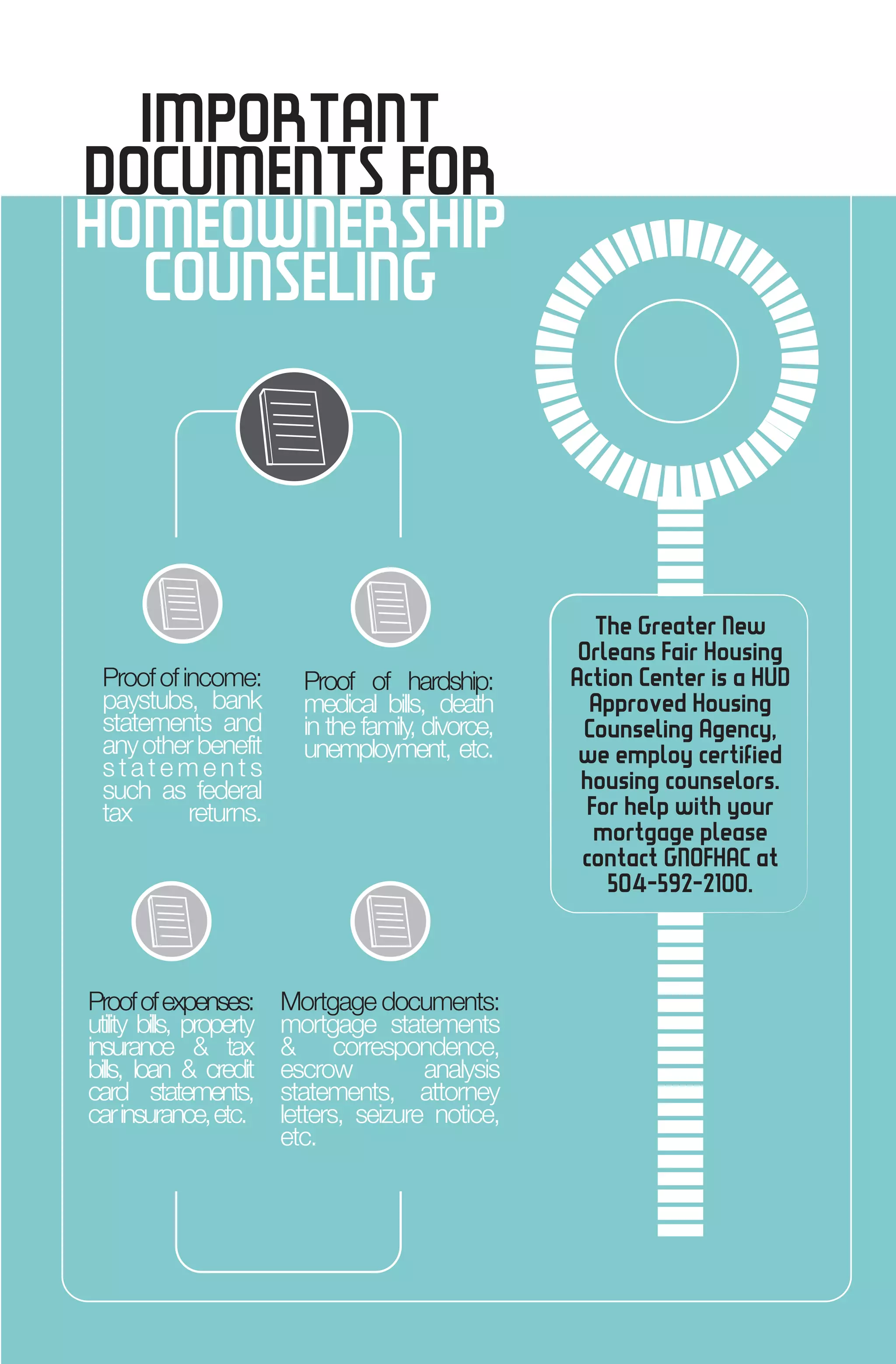

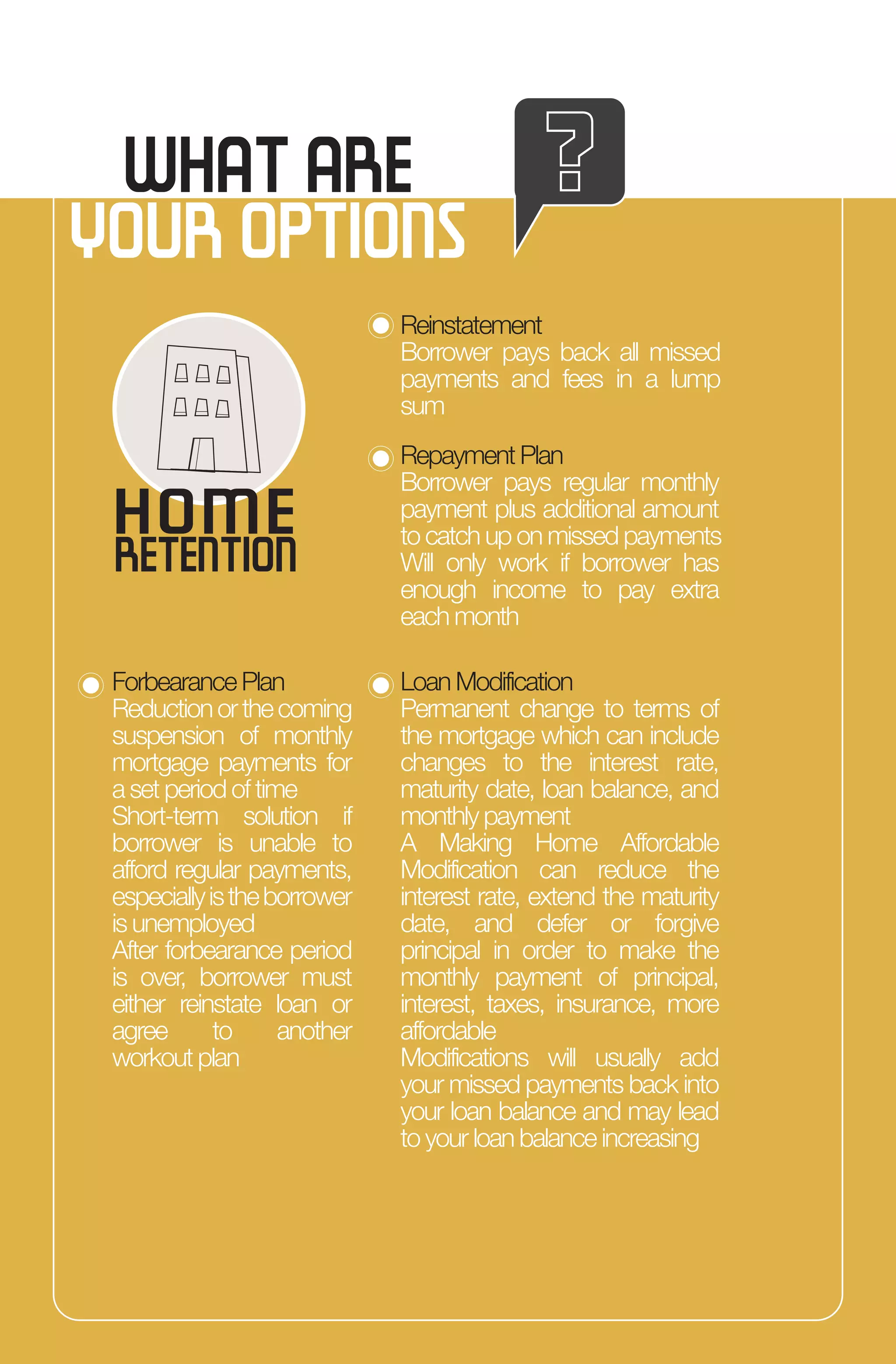

- The document provides information on foreclosure, foreclosure options, foreclosure scams, and how to avoid them. It explains what foreclosure is, the options homeowners have to avoid it like loan modifications or short sales, and common foreclosure scams involving fake counseling, illegal fees, or fraudulent legal services. It advises homeowners to only work with HUD-approved agencies and counselors and to never pay fees upfront to avoid being scammed.