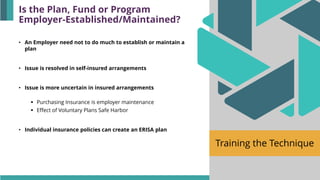

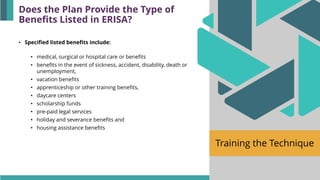

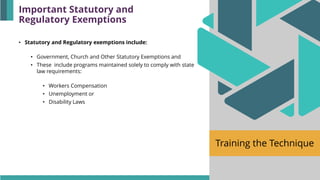

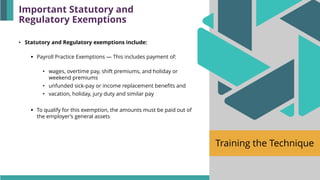

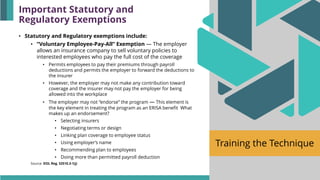

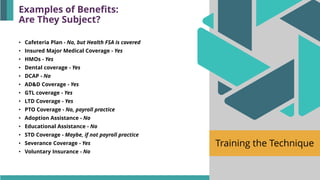

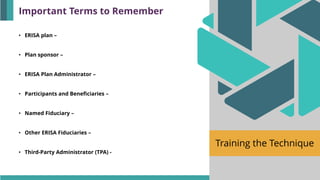

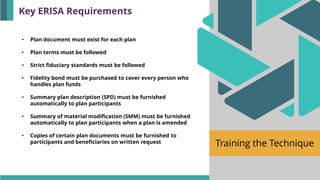

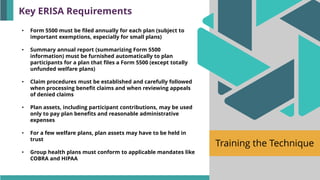

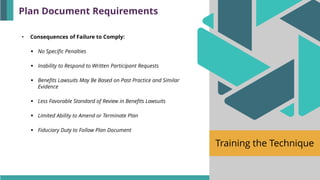

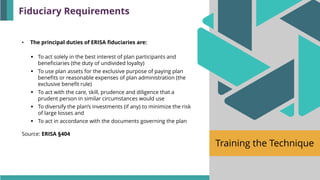

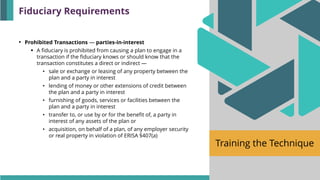

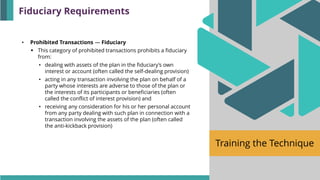

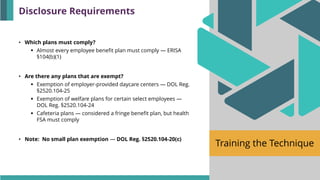

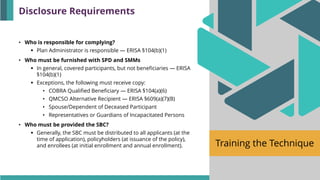

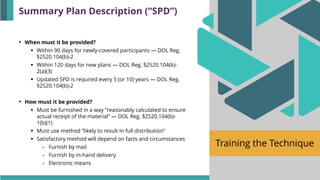

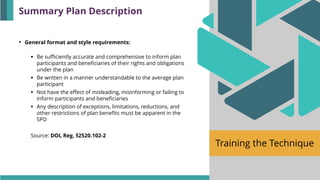

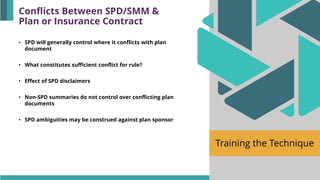

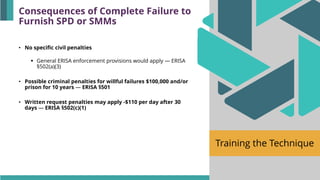

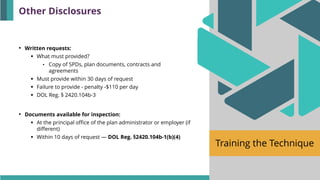

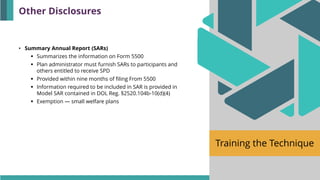

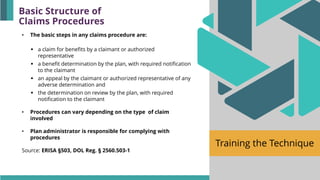

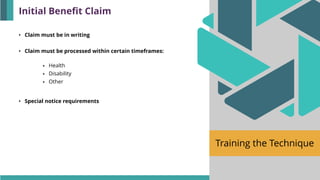

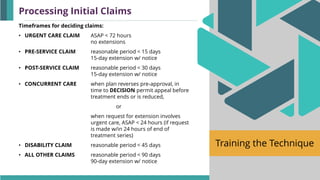

This document outlines the compliance requirements of the Employee Retirement Income Security Act (ERISA) for private-sector employers, detailing who must comply, the types of plans affected, and the basic elements of an ERISA welfare benefit plan. It discusses necessary documentation, fiduciary responsibilities, prohibited transactions, and disclosure requirements for employee benefit plans, emphasizing the importance of maintaining written plan documents and stringent fiduciary standards. Key exemptions and regulations surrounding benefits and administrative practices are also summarized.