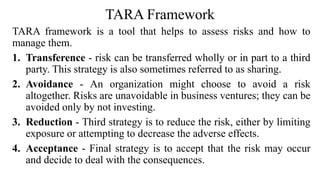

This document discusses risk management and control. It defines risk management as understanding and managing risks to achieve corporate objectives. It then describes the TARA framework for assessing and managing risks through transference, avoidance, reduction, and acceptance. The document also discusses business risks like strategic, product, commodity price, operational, and reputation risks. It covers the public interest accountants have and stakeholders they are accountable to. The document defines information systems and how they can be implemented as part of risk strategy with initial and running costs. It describes characteristics and benefits of big data like faster decision making and competitive advantage, as well as risks involving skills, security, and protection.