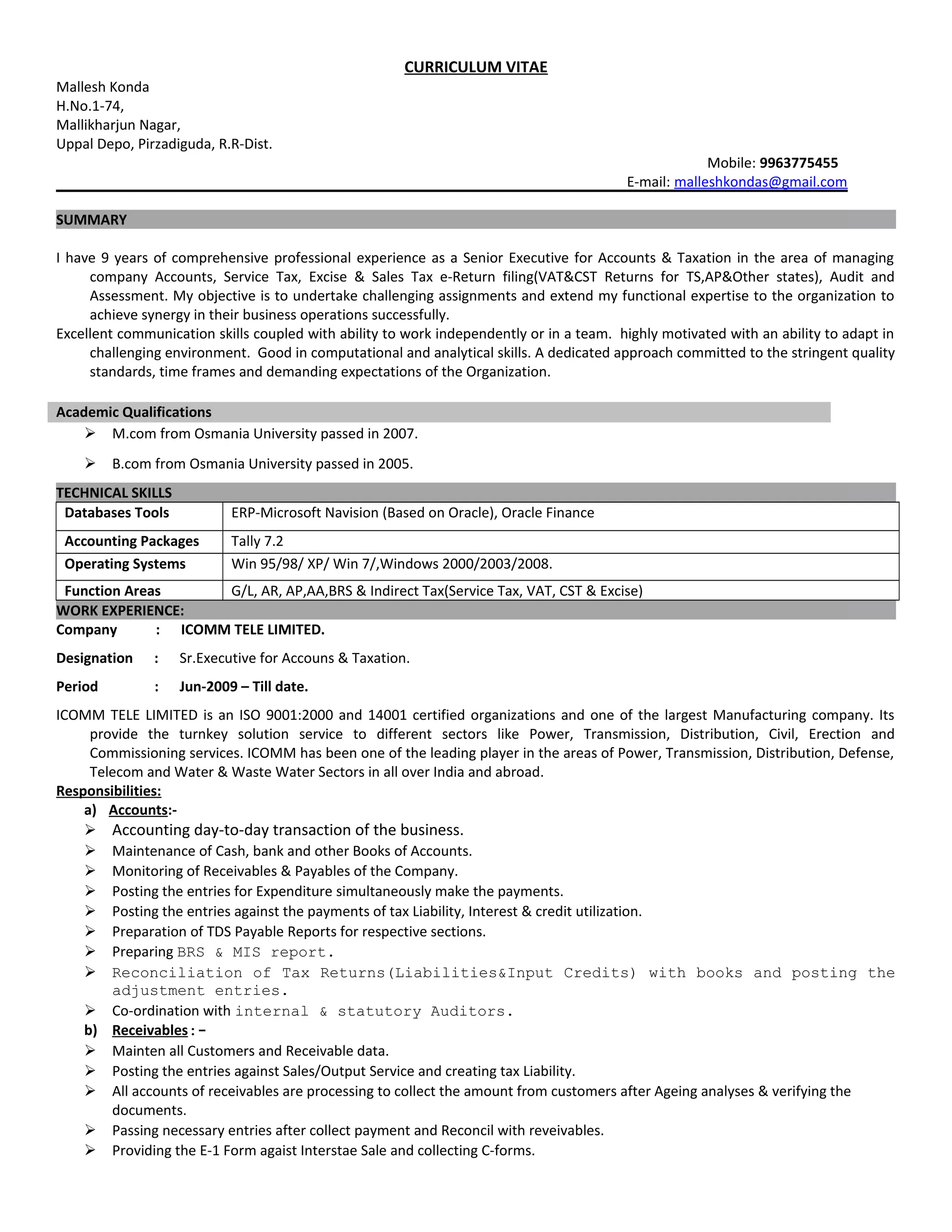

Mallesh Konda has 9 years of experience as a Senior Executive for Accounts & Taxation. He is currently working at ICOMM TELE LIMITED where he manages accounts, service tax, excise, and sales tax returns. Previously, he worked at GRANITE MART LTD as an Executive for Excise where he filed monthly excise returns and arranged for export documentation. He has an M.Com from Osmania University and is proficient with accounting packages like Tally and Navision as well as Microsoft Office applications.