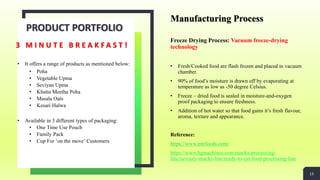

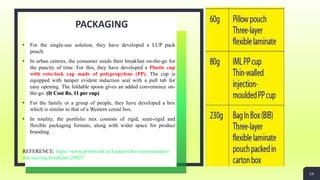

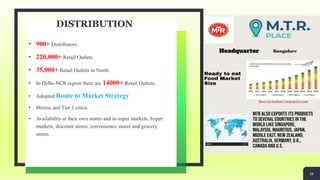

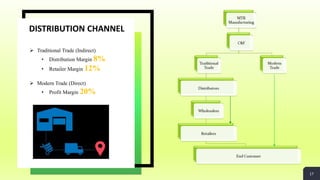

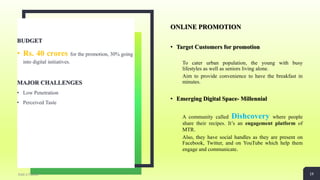

MTR is an Indian food company established in 1924 that produces a variety of packaged foods and beverages. In 2017, it launched a new line of ready-to-eat breakfast products called "3 Minute Breakfast" that can be prepared by adding hot water. The products are sold in individual pouches, cups, and family-sized boxes. MTR uses freeze drying technology to preserve the food's taste and nutrients. The "3 Minute Breakfast" line has helped boost MTR's revenue from ready-to-cook meals. MTR distributes its products through a network of distributors and retailers across India and also exports to other countries.