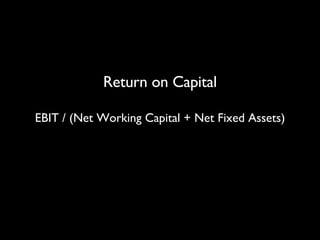

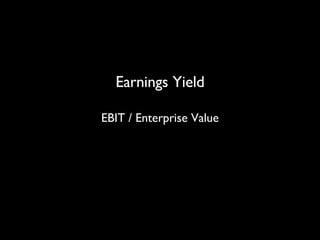

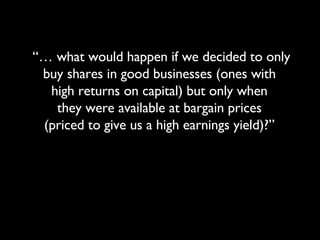

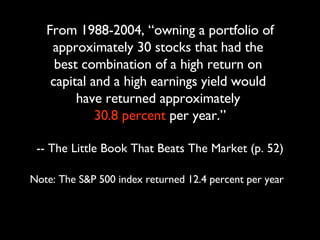

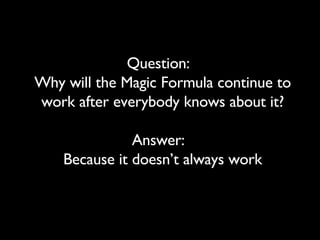

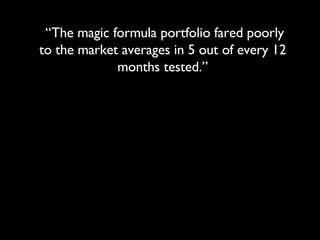

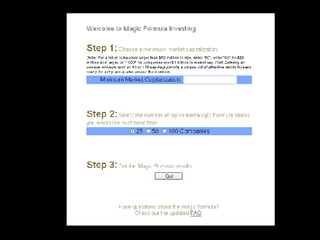

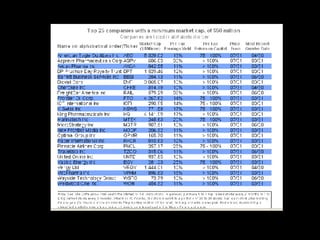

The document discusses the 'magic formula' investment strategy by Joel Greenblatt, emphasizing buying good companies at bargain prices based on key metrics like return on capital and earnings yield. It highlights that historically, this strategy yielded significant returns but has periods of underperformance compared to market averages. The document also provides a step-by-step guide for implementing the magic formula in personal investment portfolios.