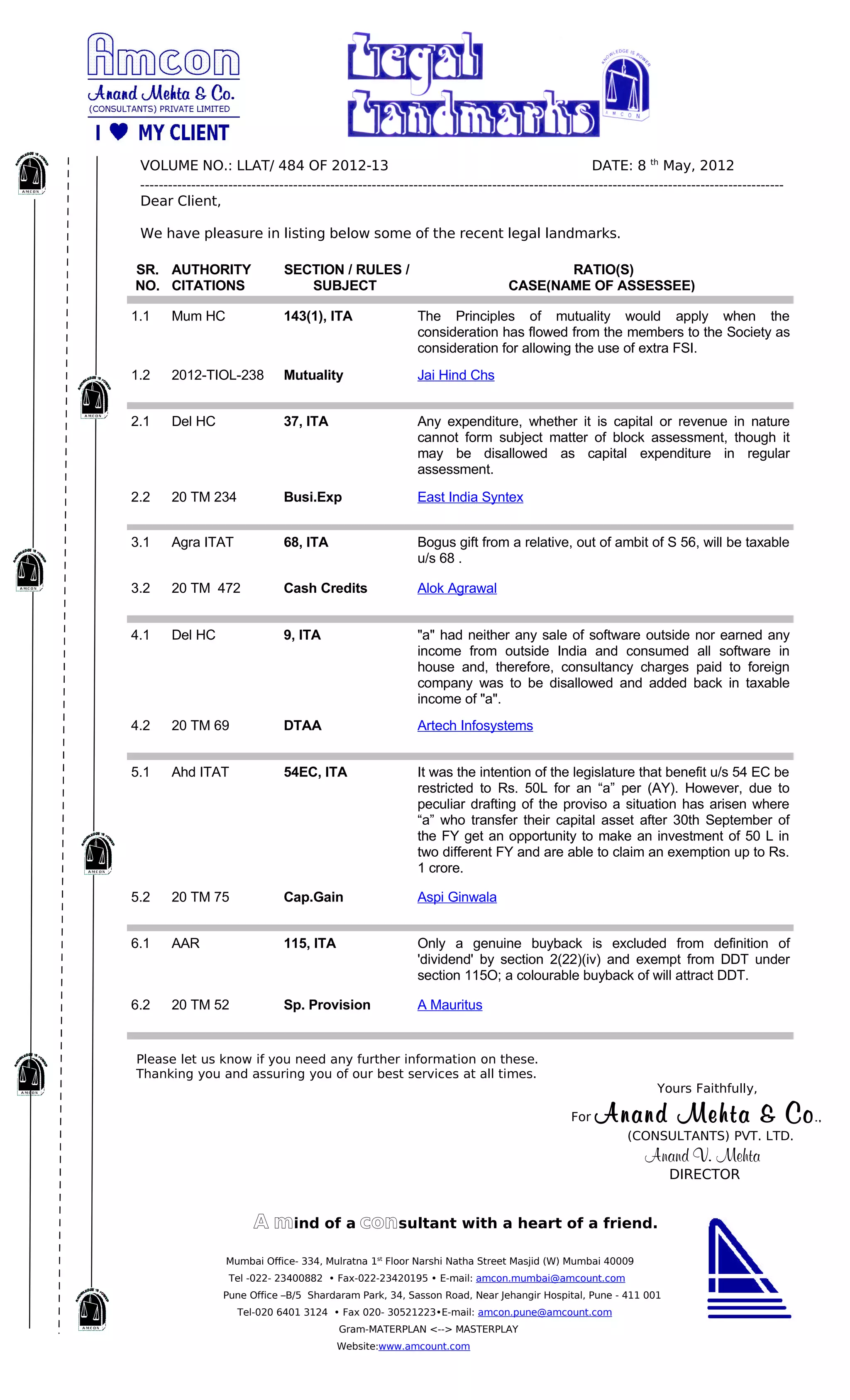

This document provides a summary of recent legal landmarks in India. It lists 6 key legal cases with details of the section/rules cited, key ratio decided, and case name. The cases cover topics around mutuality, business expenses, cash credits, transfer pricing, capital gains tax exemption limits, and dividend distribution tax. The document was sent by Anand Mehta & Co. consultants to inform a client about these important legal updates.