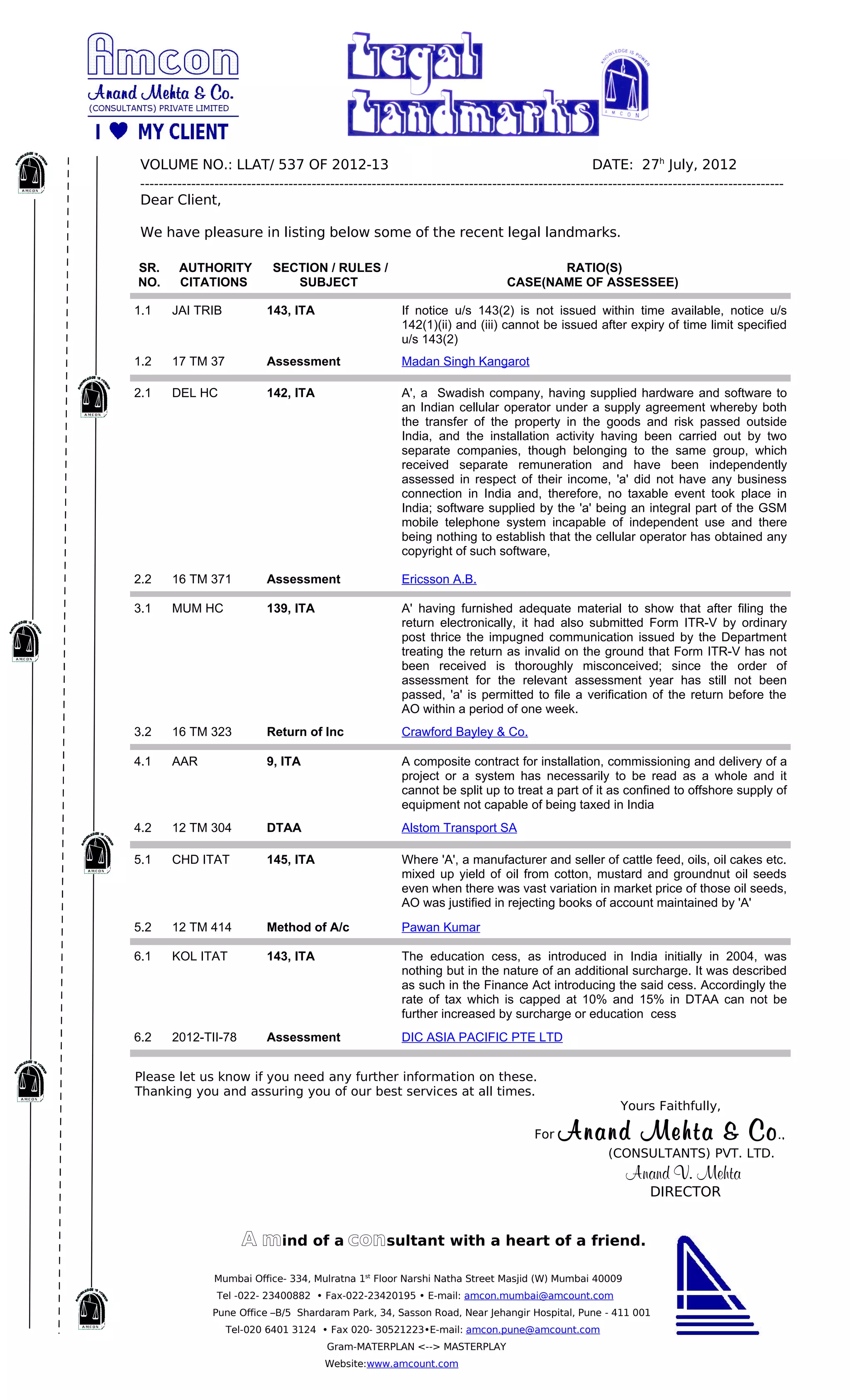

This document provides a summary of recent legal landmarks and rulings on taxation issues in India. It lists 6 key cases or rulings (numbered 1 through 6) from various authorities such as the Delhi High Court, Mumbai High Court, Authority for Advance Rulings, and Income Tax Appellate Tribunals. Each key ruling includes the section or rule of law, a brief summary of the ratio or legal principle, and a reference to the case name. The document was sent by Anand Mehta & Co. consultants to inform the client of these recent taxation rulings and offer additional information if required.