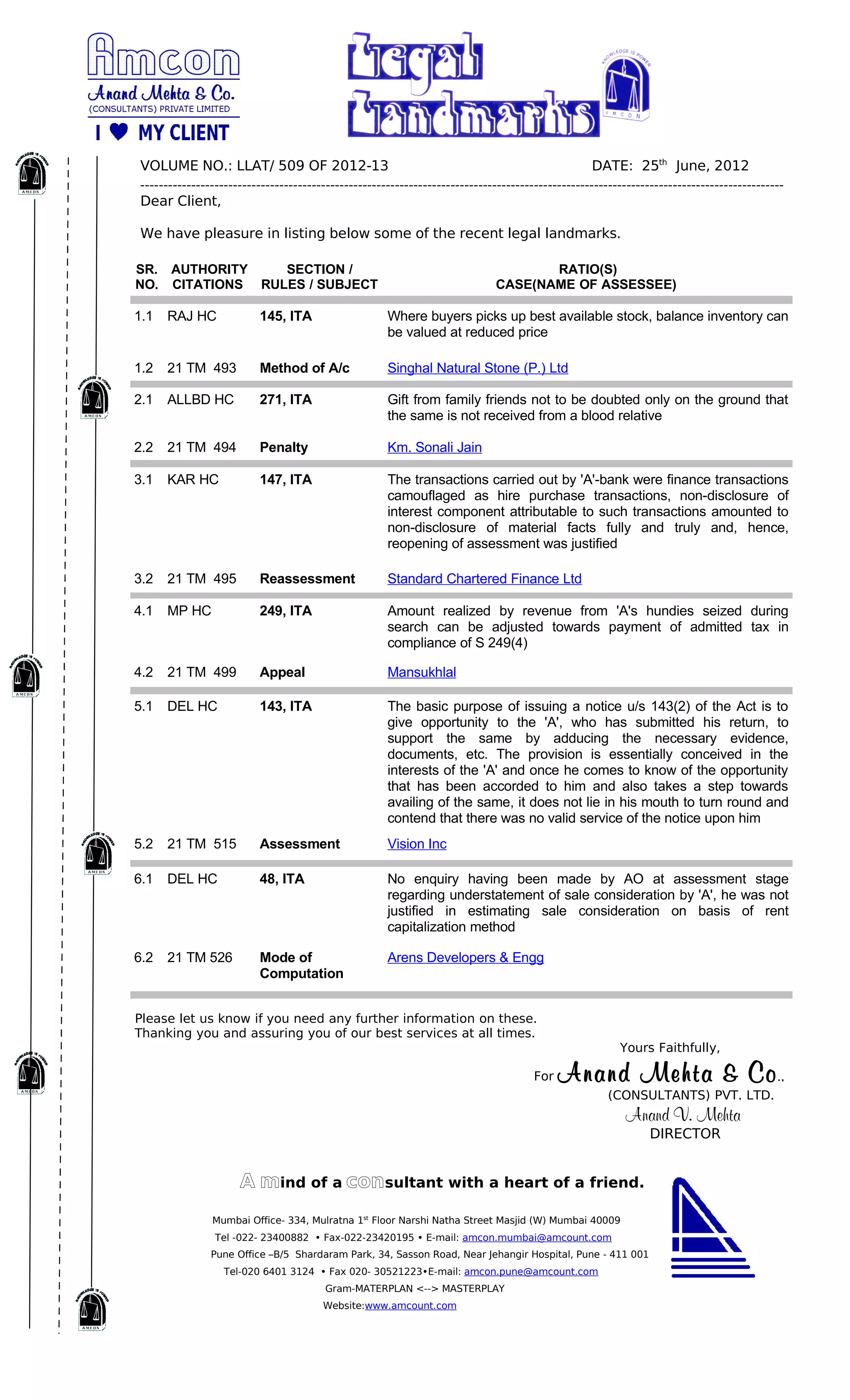

This document provides a summary of recent legal landmarks related to taxation. It lists 6 cases from various High Courts in India related to sections of the Income Tax Act of 1961. For each case, it provides the section/rules addressed, a brief summary of the ratio or legal principle of the case, and the name of the assessed party. The document was sent by Anand Mehta & Co. consultants to inform a client of these recent taxation rulings.