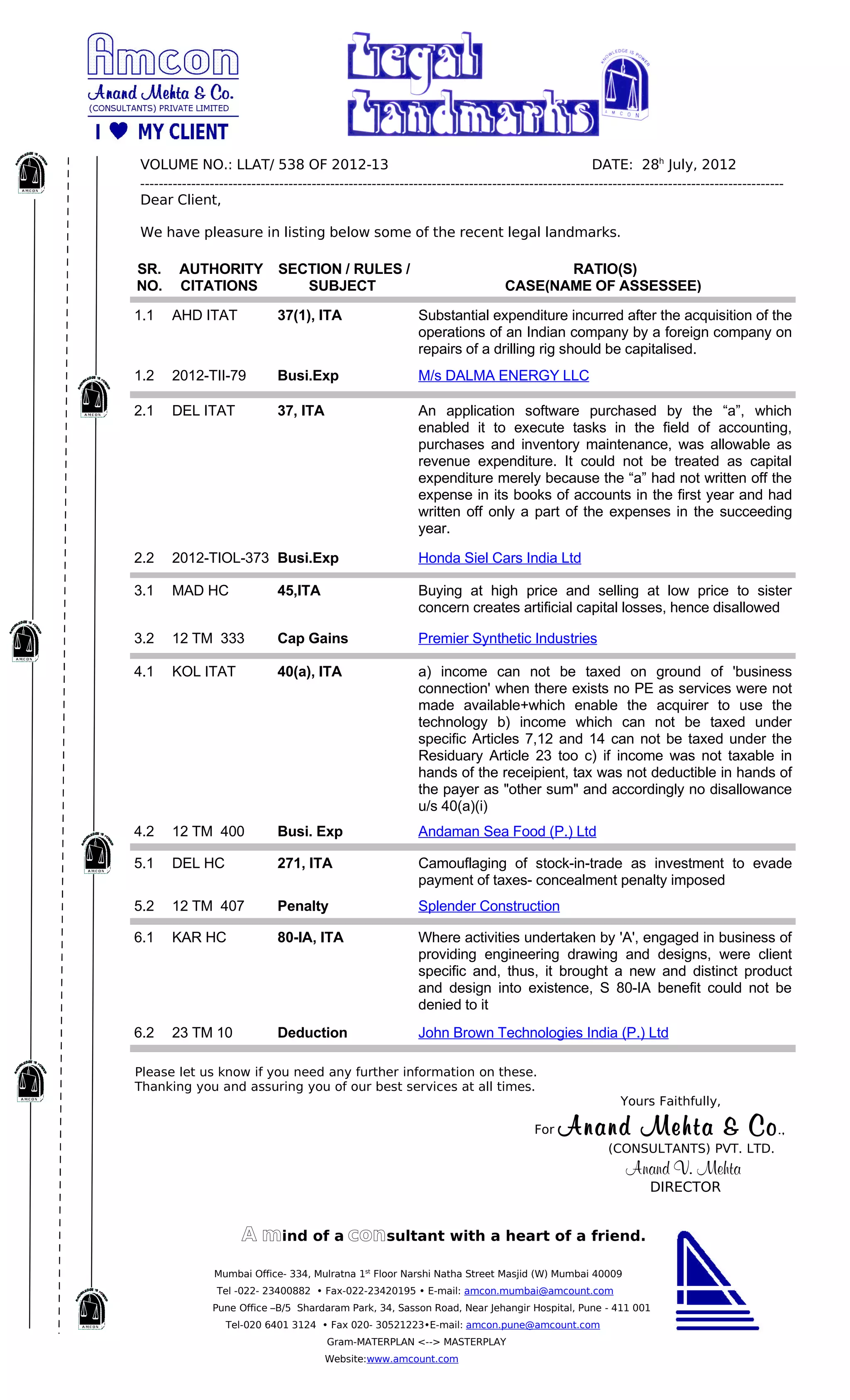

This document provides a summary of recent legal landmarks related to taxation. It lists 6 cases with details about the section/rules and key ratios involved. The cases cover topics such as capitalization of expenditures, allowability of software expenses, artificial capital losses between sister concerns, taxability of income without a permanent establishment, concealment penalties, and Section 80-IA benefits. The document was sent by Anand Mehta & Co. consultants to inform the client of these legal updates in taxation.