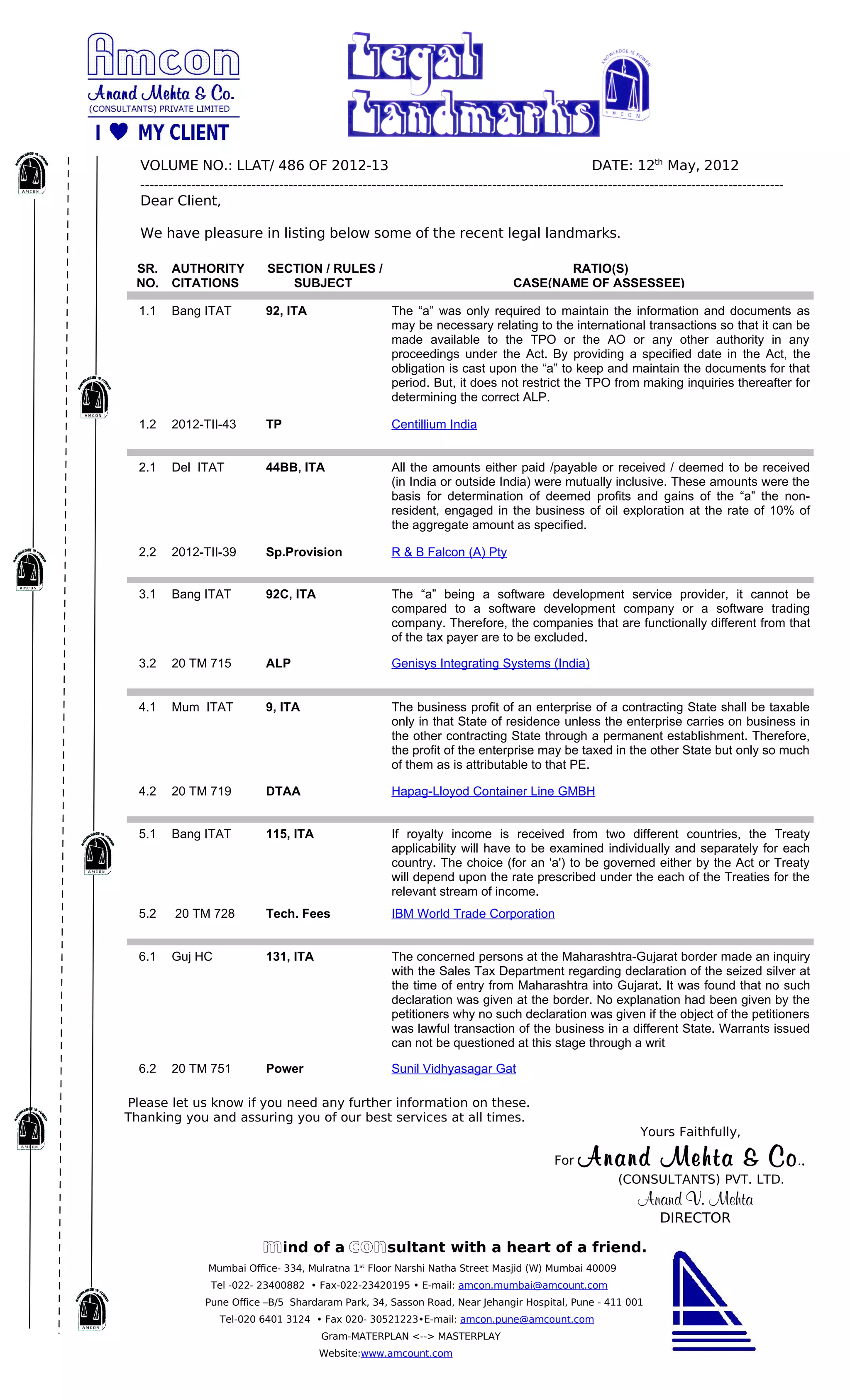

The document is a letter from Anand Mehta & Co. consulting firm providing a client with a summary of recent legal landmarks and rulings. It includes 6 cases with details of the section/rules and key ratio discussed. Case 1 discusses the obligation of a taxpayer to provide documentation for transfer pricing inquiries. Case 2 addresses amounts paid/received being included for special provisions for oil exploration. Case 3 excludes functionally different software companies from a taxpayer's transfer pricing comparables. Case 4 limits the taxation of a non-resident enterprise's profits to the contracting state and amounts attributable to a permanent establishment in another state. Case 5 states that treaty applicability must be examined separately for different countries of royalty receipt. Case 6 addresses the need for declaration