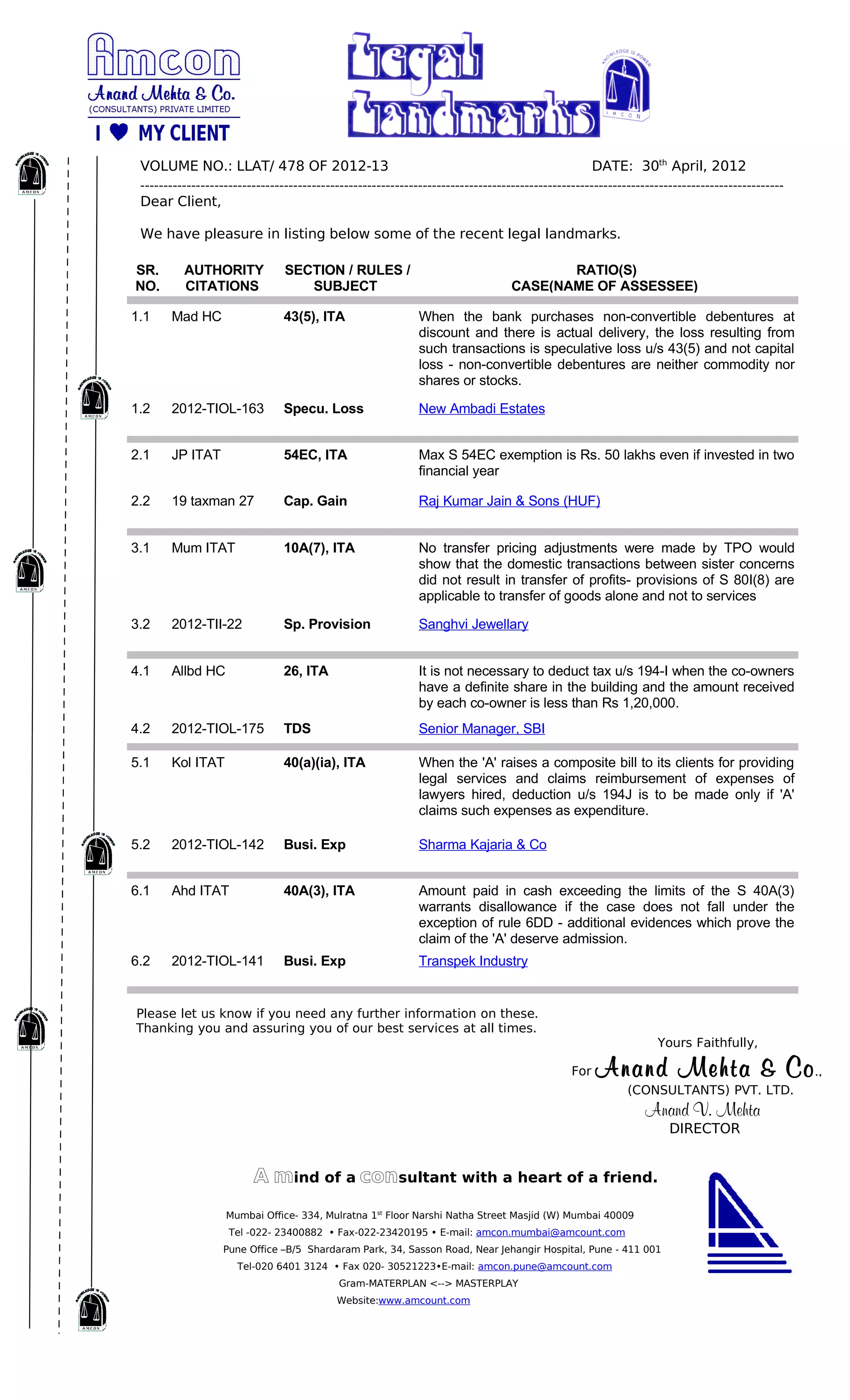

This document provides a summary of recent legal landmarks and rulings across various sections of the Indian Income Tax Act. It lists 6 key rulings related to topics such as capital gains tax, tax deductions, transfer pricing adjustments, and disallowance of business expenses. For each ruling, it provides the section/rules of the ITA, ratios from relevant case names, and citation details. The document was sent by Anand Mehta & Co. consultants to inform a client about recent changes and clarifications in tax law.