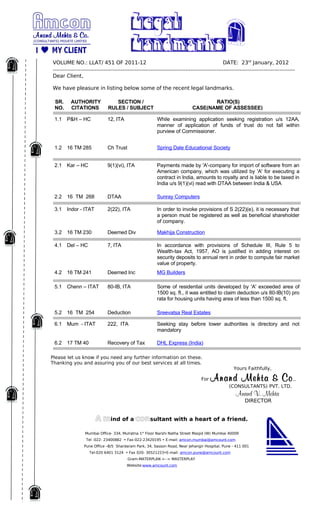

This document provides a summary of recent legal landmarks in India. It lists 6 legal cases with their section/rule references, case names, and key ratio decidendi. The cases cover topics like registration of trusts, tax treatment of software royalties, deemed dividends, deduction under section 80IB, and recovery of tax. The client is thanked for their business and assured of best services.