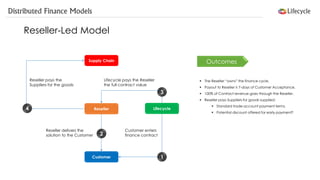

The document outlines the benefits of financing solutions for both customers and resellers, emphasizing solution affordability, cash flow optimization, and tax relief. It details the finance process, reseller motivations, operational benefits, and how to sell finance solutions effectively. Lifecycle positions itself as a partner offering comprehensive financing for various solutions, facilitating quicker payment and strengthening vendor relationships.

![BUSINESS PARTNER

A virtual extension of your business overnight, without carrying the associated overhead

Understanding your business in depth and developing solutions to support your strategy

Focused on helping you proactively grow your business, not just servicing ad hoc demand

Exceptional customer-service [pre-qualifications, pre-sales consultancy, fast-track underwriting]

TOTAL SOLUTION FUNDER

Financing entire solutions –not just product

Hardware + Software + Services + Maintenance & Support + Cloud

Support for funding reseller products and services as part of a “unified solution”

Optional payment deferral to support NFR programs and ROI sales [subject to status]

MULTIPLE UN-BIASED CREDIT LINES

Not limited to a single credit-line [as is the case with typical vendor brands –Dell, HP, Cisco, etc.]

No minimum requirement for vendor-specific hardware percentage

Negligible knock-back rate i.e. can fund customers across credit-status spectrum

Single point of access to global project funding resources

LIFECYCLE ALLIANCE PROGRAM

Essential tools for building a successful business

Virtual white-labelled Finance Operations Team [Telephone, Email, Video]

White-labelled marketing and business development collateral [pdf brochures, videos, etc.]

Marketing and campaigning assistance

Lifecycle don’t just ‘Provide’,… we ‘Partner’](https://image.slidesharecdn.com/lifecycle-systemsintegratorfinanceprograms-141007091749-conversion-gate01/85/Lifecycle-Systems-Integrator-Finance-Programs-21-320.jpg)