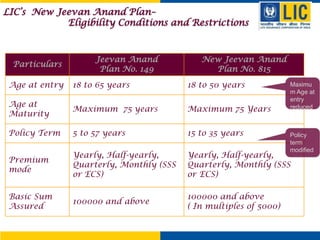

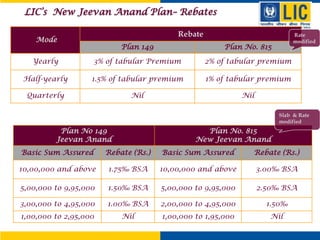

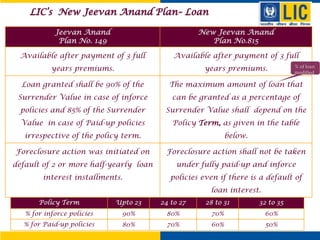

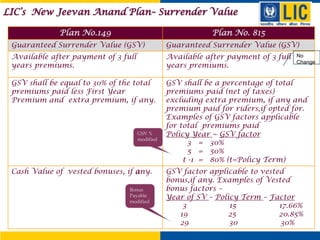

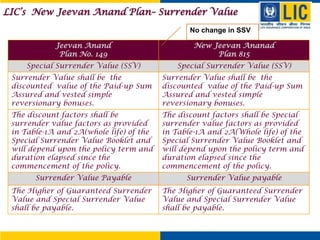

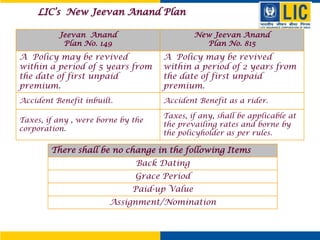

The document compares the benefits and features of LIC's existing Jeevan Anand plan and the new Jeevan Anand plan. Key differences in the new plan include a reduced maximum entry age of 50 years, modified policy terms of 15-35 years, increased death benefit of 125% of basic sum assured or 10 times annual premium, and changes to loan eligibility percentages and rebate slabs. The new plan also modifies guaranteed surrender value factors, removes accident benefit as inbuilt and makes taxes payable by the policyholder.

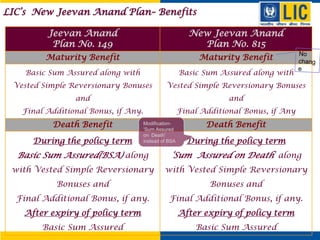

![LIC’s New Jeevan Anand Plan– Benefits

What is Sum Assured on Death?

Sum Assured on Death shall be Higher of ~

125% of Basic Sum Assured (1.25 x BSA)

OR

10 times Annual Premium.(10 x AP).

≈≈≈≈

The death benefit as defined above shall not be less than

105% of total premiums* paid as on the date of death .

[*excluding taxes, extra premiums and premiums for riders, if any]](https://image.slidesharecdn.com/newjeevananandtno815-140102213659-phpapp01/85/LIC-New-Jeevan-Anand-Plan-Table-No-815-3-320.jpg)