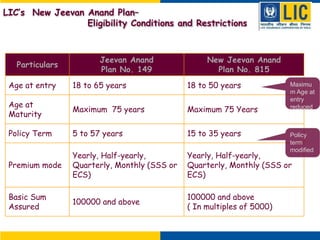

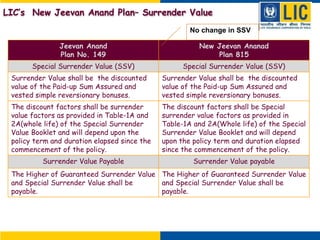

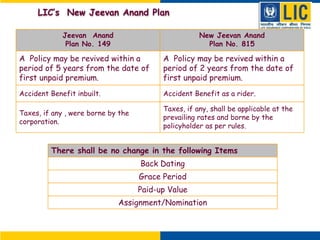

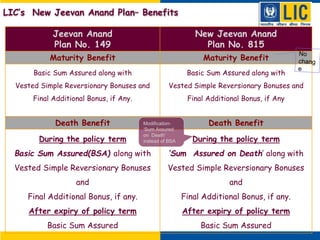

The document compares LIC's existing Jeevan Anand Plan No. 149 to the new Jeevan Anand Plan No. 815. Key differences include a reduced maximum entry age, shorter policy terms, modified death benefit definition, changes to loan and surrender value terms, and revival period reduced from 5 to 2 years. The accident benefit is now offered as a rider instead of being inbuilt. Taxes will now apply and be borne by the policyholder.

![What is Sum Assured on Death?

Sum Assured on Death shall be Higher of ~

125% of Basic Sum Assured (1.25 x BSA)

OR

10 times Annual Premium.(10 x AP).

≈≈≈≈

The death benefit as defined above shall not be less than 105% of

total premiums* paid as on the date of death .

[*excluding taxes, extra premiums and premiums for riders, if any]

LIC’s New Jeevan Anand Plan– Benefits](https://image.slidesharecdn.com/newjeevananand815-140813021724-phpapp02/85/New-jeevan-anand-815-3-320.jpg)