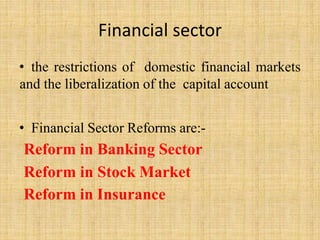

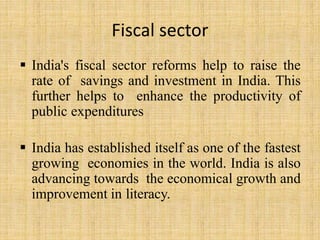

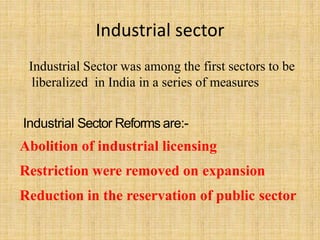

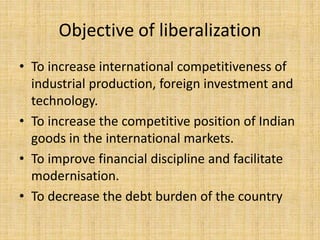

India undertook economic reforms in 1991 to liberalize its economy due to a balance of payments crisis and low foreign exchange reserves. Reforms were carried out across several sectors including financial, trade, fiscal and industrial sectors. Restrictions in these sectors were reduced and markets were opened up to enhance competition, increase investment and spur economic growth. The reforms helped increase India's GDP growth and led to benefits such as more foreign investment, rapid growth across all sectors, and an increase in exports, imports and stock market indices. The objective of liberalization was to make Indian industry and goods more competitive globally through increased trade, investment and technology.