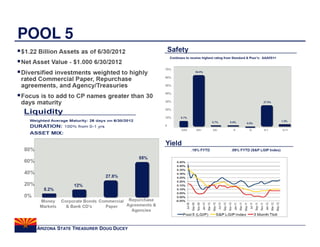

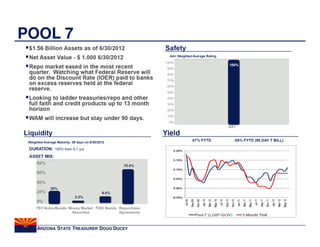

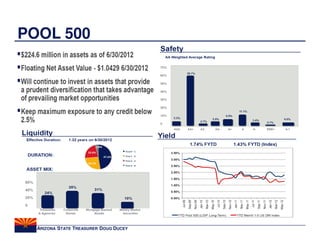

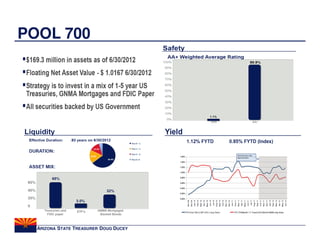

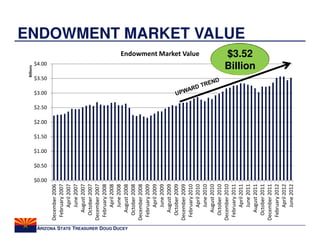

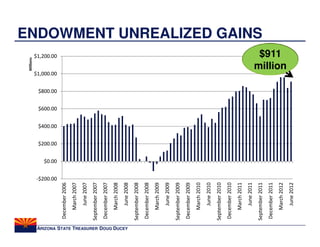

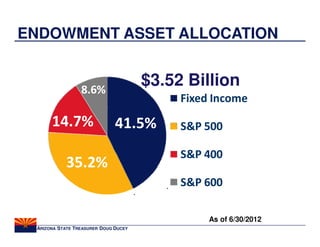

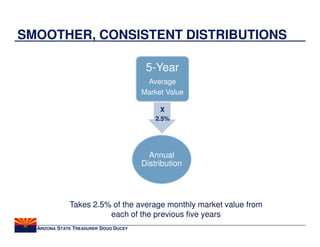

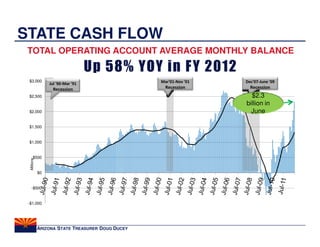

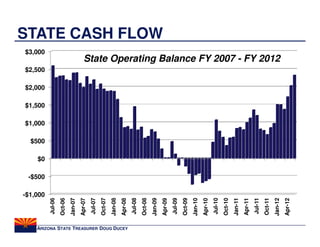

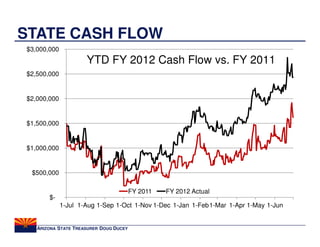

The quarterly meeting agenda included discussing the performance of the LGIP, endowments, and state cash flow. The treasurer's investment philosophy prioritizes safety, liquidity, then yield. LGIP pools performed well in Q4 2012. The endowment market value was $3.52 billion as of June 2012 with unrealized gains of $911 million. A new distribution formula based on a 5-year average was proposed. State cash flow and balances were up significantly year-over-year. Jim Palmer then presented on current market conditions, Fed policy, strategies around the yield curve and duration, and attractive sectors.