Embed presentation

Downloaded 57 times

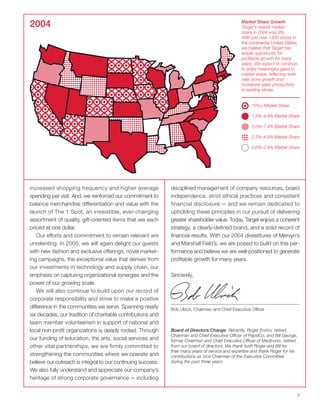

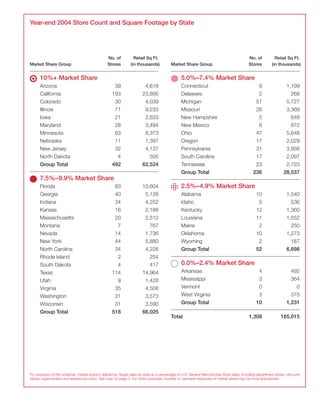

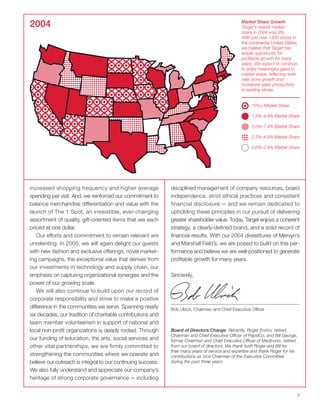

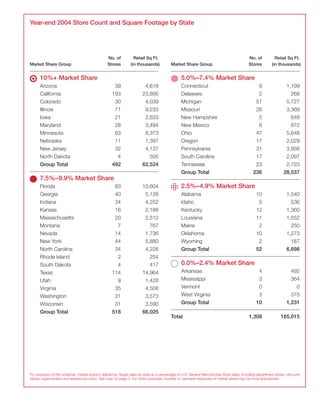

Target Corporation's annual report for 2004 highlights the company's financial performance and strategic initiatives. Revenues grew 17% over the past 5 years to $46.8 billion in 2004. Earnings before interest and taxes grew 165% to $3.6 billion in the same period. The company sold its Mervyn's and Marshall Field's business units for $4.9 billion in pretax cash proceeds. Target also authorized a $3 billion share repurchase program. The report discusses Target's strategy of delivering quality, trend-right merchandise at compelling prices under its "Expect More. Pay Less." brand promise through product design, exclusive brands, store experience, and marketing campaigns. Target expects to operate about 2,000 stores by