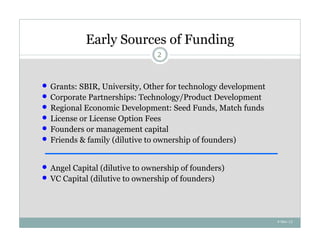

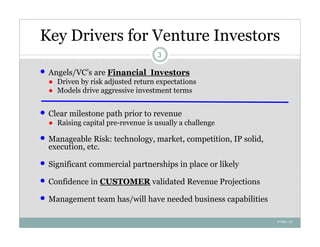

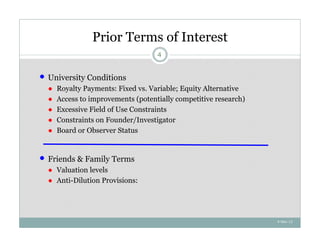

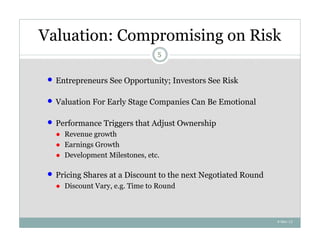

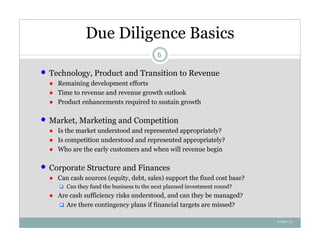

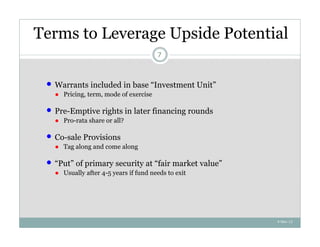

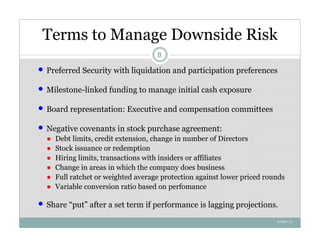

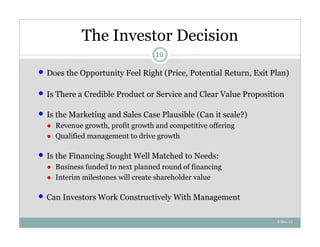

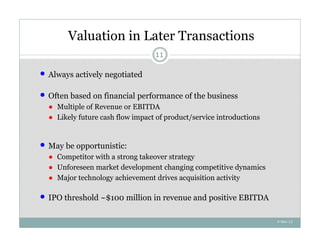

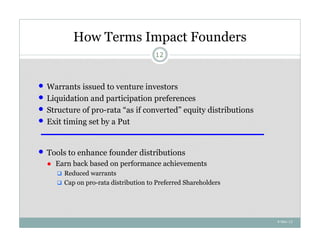

This document discusses key considerations for early-stage companies seeking funding from venture investors. It outlines various sources of early funding for technology development and provides an overview of the drivers and expectations of angel and venture capital investors. The document also discusses important due diligence factors for investors and terms that can be used to both manage risk and leverage upside potential in investments. Finally, it touches on building value post-investment and exit scenarios in later transactions.