Liquidation.pdf

•

0 likes•20 views

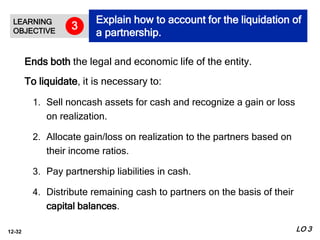

The document describes the steps to liquidate a partnership: 1. Sell non-cash assets for cash and recognize any gains or losses. 2. Allocate any gains or losses to partners based on their income ratios. 3. Pay partnership liabilities in cash. 4. Distribute any remaining cash to partners based on their capital balances.

Report

Share

Report

Share

Download to read offline

Recommended

app_f Accounting for Partnerships.pptx

This document discusses accounting for partnerships. It begins by defining a partnership and identifying key characteristics such as unlimited liability, mutual agency between partners, and co-ownership of assets. It then explains the accounting entries to record the formation of a partnership by contributing assets. The document also covers dividing net income or losses according to partner agreements, preparing partnership financial statements, and accounting for the liquidation of a partnership including distributing cash and handling capital account deficiencies. Learning objectives are provided for each major topic.

1 Revaluation of Partnership Assets.pptx

The document discusses revaluation of partnership assets when certain events occur, such as a new partner joining or an existing partner leaving. It provides definitions and examples of how to account for revaluation of assets and goodwill.

When assets are revalued, any gains or losses must be allocated to partners' capital accounts based on their profit/loss sharing ratios. A revaluation account is used to record increases and decreases in asset values. If total asset value increases, partners' capital accounts are credited; if it decreases, partners' capital accounts are debited. Goodwill is also allocated to partners and any changes due to revaluations or change in profit ratios are adjusted in their capital accounts.

LESSON-4.-PARTNERSHIP-LIQUIDATION.-PPT.pdf

The document discusses the liquidation process for partnerships. It begins by defining liquidation as winding up a partnership's activities by selling assets, paying liabilities, and distributing any remaining cash to partners. It then covers dividing losses and gains, distributing cash/assets, payments to partners, and various case scenarios that may occur during liquidation. It also discusses installment payments to partners and developing a cash distribution program to facilitate payments.

Pengantar Akuntansi 2 - Ch12 Investment

The document discusses accounting for investments. It explains that corporations invest in debt and equity securities for cash management, investment income, or strategic reasons. The accounting depends on the level of ownership and influence over the investee. For debt investments, companies record the purchase cost and interest revenue/expense. For equity investments under 20% ownership, companies use the cost method and record dividends. Between 20-50% ownership, companies use the equity method to record their share of earnings and dividends. Over 50% ownership indicates control, so consolidated financial statements are prepared. Investments are classified and reported differently depending on intent and changes in fair value.

profit and loss.pdf

- Partnerships divide net income or loss according to the partnership agreement. Common methods include fixed ratios, capital account ratios, salaries plus fixed ratio of remaining income, and salaries plus interest on capital plus fixed ratio.

- Salaries paid to partners are an expense to the partnership, but interest on partners' capital balances is considered a distribution of income, not an expense.

- The partnership income statement closes revenue and expense accounts to the income summary account. Then the income summary closes to each partner's capital account based on their share of the net income or loss according to the partnership agreement.

Financial_Accounting_chapter_12.ppt

Corporations generally invest in debt or share securities for three main reasons: (1) to manage excess cash, (2) generate investment income, and (3) for strategic reasons. The accounting for investments depends on the type and ownership level. For debt investments and share investments where ownership is less than 20%, companies record investments at cost and recognize gains/losses upon sale. For share investments where ownership is 20-50%, companies use the equity method to adjust the investment balance for the investor's share of earnings and dividends. For share investments over 50% ownership, consolidated financial statements are prepared to combine the parent and subsidiary.

Chp17 advanced accounting beams 11e

- The document discusses partnership liquidation, including definitions, procedures, and accounting treatments.

- A simple partnership liquidation involves one cash distribution where partners receive amounts equal to their pre-distribution capital account balances.

- Priority rankings for distributing assets in liquidation are: 1) amounts owed to non-partner creditors and partners other than for capital and profits, and 2) amounts due to partners based on remaining assets after liabilities are paid.

Ch02[38042]![Ch02[38042]](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![Ch02[38042]](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

Here are the steps to analyze and post a journal entry:

1. Analyze the journal entry to determine the accounts involved and whether each account increased or decreased.

2. Determine if each account is an asset, liability, equity, revenue or expense account based on the general ledger chart of accounts.

3. Translate increases in asset and expense accounts and decreases in liability, equity and revenue accounts into debits, and increases in liability, equity and revenue accounts and decreases in asset and expense accounts into credits.

4. Record the debits and credits in the appropriate general ledger accounts.

Posting

Question

LO 6

Recommended

app_f Accounting for Partnerships.pptx

This document discusses accounting for partnerships. It begins by defining a partnership and identifying key characteristics such as unlimited liability, mutual agency between partners, and co-ownership of assets. It then explains the accounting entries to record the formation of a partnership by contributing assets. The document also covers dividing net income or losses according to partner agreements, preparing partnership financial statements, and accounting for the liquidation of a partnership including distributing cash and handling capital account deficiencies. Learning objectives are provided for each major topic.

1 Revaluation of Partnership Assets.pptx

The document discusses revaluation of partnership assets when certain events occur, such as a new partner joining or an existing partner leaving. It provides definitions and examples of how to account for revaluation of assets and goodwill.

When assets are revalued, any gains or losses must be allocated to partners' capital accounts based on their profit/loss sharing ratios. A revaluation account is used to record increases and decreases in asset values. If total asset value increases, partners' capital accounts are credited; if it decreases, partners' capital accounts are debited. Goodwill is also allocated to partners and any changes due to revaluations or change in profit ratios are adjusted in their capital accounts.

LESSON-4.-PARTNERSHIP-LIQUIDATION.-PPT.pdf

The document discusses the liquidation process for partnerships. It begins by defining liquidation as winding up a partnership's activities by selling assets, paying liabilities, and distributing any remaining cash to partners. It then covers dividing losses and gains, distributing cash/assets, payments to partners, and various case scenarios that may occur during liquidation. It also discusses installment payments to partners and developing a cash distribution program to facilitate payments.

Pengantar Akuntansi 2 - Ch12 Investment

The document discusses accounting for investments. It explains that corporations invest in debt and equity securities for cash management, investment income, or strategic reasons. The accounting depends on the level of ownership and influence over the investee. For debt investments, companies record the purchase cost and interest revenue/expense. For equity investments under 20% ownership, companies use the cost method and record dividends. Between 20-50% ownership, companies use the equity method to record their share of earnings and dividends. Over 50% ownership indicates control, so consolidated financial statements are prepared. Investments are classified and reported differently depending on intent and changes in fair value.

profit and loss.pdf

- Partnerships divide net income or loss according to the partnership agreement. Common methods include fixed ratios, capital account ratios, salaries plus fixed ratio of remaining income, and salaries plus interest on capital plus fixed ratio.

- Salaries paid to partners are an expense to the partnership, but interest on partners' capital balances is considered a distribution of income, not an expense.

- The partnership income statement closes revenue and expense accounts to the income summary account. Then the income summary closes to each partner's capital account based on their share of the net income or loss according to the partnership agreement.

Financial_Accounting_chapter_12.ppt

Corporations generally invest in debt or share securities for three main reasons: (1) to manage excess cash, (2) generate investment income, and (3) for strategic reasons. The accounting for investments depends on the type and ownership level. For debt investments and share investments where ownership is less than 20%, companies record investments at cost and recognize gains/losses upon sale. For share investments where ownership is 20-50%, companies use the equity method to adjust the investment balance for the investor's share of earnings and dividends. For share investments over 50% ownership, consolidated financial statements are prepared to combine the parent and subsidiary.

Chp17 advanced accounting beams 11e

- The document discusses partnership liquidation, including definitions, procedures, and accounting treatments.

- A simple partnership liquidation involves one cash distribution where partners receive amounts equal to their pre-distribution capital account balances.

- Priority rankings for distributing assets in liquidation are: 1) amounts owed to non-partner creditors and partners other than for capital and profits, and 2) amounts due to partners based on remaining assets after liabilities are paid.

Ch02[38042]![Ch02[38042]](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![Ch02[38042]](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

Here are the steps to analyze and post a journal entry:

1. Analyze the journal entry to determine the accounts involved and whether each account increased or decreased.

2. Determine if each account is an asset, liability, equity, revenue or expense account based on the general ledger chart of accounts.

3. Translate increases in asset and expense accounts and decreases in liability, equity and revenue accounts into debits, and increases in liability, equity and revenue accounts and decreases in asset and expense accounts into credits.

4. Record the debits and credits in the appropriate general ledger accounts.

Posting

Question

LO 6

Stockholders’ Equity 1 Corporate Capital Illustration Experience Tradition/tu...

FOR MORE CLASSES VISIT

www.tutorialoutlet.com

Stockholders’ Equity 1 Corporate Capital

Illustration: Bad Corporation issued 300 shares of $10 par value common stock for $4,500. Prepare the journal entry to record the

issuance of the shares.

Act Intermediate Accounting (15th Ed)(gnv64) chapter 03

The document discusses the accounting information system and key concepts in the accounting cycle. It provides learning objectives for understanding basic accounting terminology, explaining double-entry rules, identifying steps in the accounting cycle, and recording transactions in journals and ledgers. Key terms are defined, such as assets, liabilities, equity, revenues, expenses, and debits and credits. Examples demonstrate double-entry accounting, the accounting equation, and the steps of the accounting cycle including journalizing, posting, preparing a trial balance, and making adjusting entries.

Ca2 chapter 12

This document describes accounting for partnerships and limited liability companies. It discusses the basic characteristics of proprietorships, partnerships, and LLCs. It also describes how to record the formation of a partnership by contributing assets, how to divide partnership net income and losses, how to account for admitting or withdrawing a partner, and how to liquidate a partnership. The objectives are to describe these topics and illustrate them with journal entries.

Ch 8 - Accounting for Receivables.ppt

This document provides an overview of accounting for receivables. It defines different types of receivables like accounts receivable and notes receivable. It explains how companies recognize, value, and dispose of both accounts receivable and notes receivable. Specific topics covered include recognizing revenue on credit sales, estimating and recording allowance for doubtful accounts, accounting for uncollectible accounts, determining maturity dates and interest on notes, and presenting receivables on financial statements. The document aims to help students understand the key accounting concepts and entries related to receivables.

FA II chapt 1- part III.pptx

This document discusses accounting for intangible assets. It covers characteristics of intangible assets, how purchased and internally created intangibles are recorded, amortization of limited-life and indefinite-life intangibles, types of intangible assets including goodwill, and impairment of intangible assets. The document contains examples and illustrations to demonstrate accounting entries and calculations related to intangible assets.

Partnership 20 accounts-goodwill_202

The document discusses the dissolution of a partnership between X, Y and Z who share profits in a 3:2:1 ratio. Upon dissolution:

- Inventory is sold to Nelson for $4,000 and non-current assets are sold for $8,000 except items worth $5,000 purchased by X for $7,000.

- Debtors excluding the insolvent Smithson pay their balances. Expenses total $1,300 and Z cannot cover his share.

- The realization account is used to record asset sales and distributions to partners' capital accounts, with X receiving $12,675, Y $2,625 and Z $3,050.

Lamar Van Dusen - Allocating profit or loss in a partnership

The document discusses allocating profit and loss in a partnership. It defines a partnership and partnership agreement. Key points include:

- Profits and losses are allocated to partner capital accounts based on the partnership agreement. If not specified, profits are split evenly.

- Partners receive salary allowances before remaining profits are allocated.

- Losses are absorbed equally by partners after salary allowances.

- Journal entries are made to allocate total profit/loss to each partner's capital account.

accounting.ppt

This document provides an overview of Chapter 14 which covers corporations, dividends, retained earnings, and income reporting. The chapter objectives are to prepare entries for cash and stock dividends, identify items in a retained earnings statement, prepare and analyze the stockholders' equity section, describe corporation income statements, and compute earnings per share. Key topics covered include types of dividends, entries for cash and stock dividends, retained earnings statement presentation and analysis, stockholders' equity presentation and analysis, and income statement presentation and analysis.

Chapter 2, Fundamentals of Accounting I (2).pptx

This document provides an overview of the accounting cycle for service businesses. It discusses key concepts like accounts, debits and credits, journals, ledgers, and the steps in the recording process. The recording process involves analyzing transactions, recording them in a journal, and then posting the journal entries to the appropriate accounts in the general ledger. Adjusting entries, preparing an adjusted trial balance, and closing entries are also part of the full accounting cycle.

Admission of partner

Here are the journal entries to record the admission of the new partner N:

1. Creditors A/c Dr. 2,000

To Provision for Discount on Creditors A/c 2,000

(To create 10% provision for discount on creditors)

2. Debtors A/c Dr. 2,000

Provision for Doubtful Debts A/c Dr. 1,000

To Bad Debts A/c 3,000

(To write off bad debts of Rs. 2,000 and create 5% provision for doubtful debts)

3. Stock A/c Dr. 5,000

To Revaluation A/c 5,000

(To revalue stock at

chapter 15 akl.pptx

Here is the solution for part b:

Group Exercise 1: Solution for part b

Income Summary 57,000

Capital, Alex 32,400

Capital, James 24,600

chapter_02.ppt

The document discusses key concepts related to analyzing business transactions and their impact on a company's balance sheet. It introduces the balance sheet framework of assets equaling liabilities plus stockholders' equity. Several examples are provided of journal entries for common business transactions and their posting to T-accounts to illustrate how the accounting equation remains balanced. The objectives are to understand how specific business activities affect balance sheet accounts and how companies track changes through journal entries and T-accounts.

Chapter02.ppt

The document discusses key concepts related to analyzing business transactions and their impact on a company's balance sheet. It introduces the balance sheet framework of assets equaling liabilities plus stockholders' equity. Several examples are provided of journal entries for common business transactions and their posting to T-accounts to illustrate how the accounting equation remains balanced. The objectives are to understand how specific business activities affect balance sheet accounts and how companies track changes through the use of journals and T-accounts.

Retirment.pdf

The withdrawal of a partner, whether voluntary or involuntary, legally dissolves the partnership. When a partner withdraws, the remaining partners may buy out the withdrawing partner's equity by paying them from their personal assets or from partnership assets. The partnership may pay a bonus to the withdrawing or remaining partners depending on factors like the value of partnership assets.

ch03.pptx

The Accounting Information System

LEARNING OBJECTIVES

After studying this chapter, you should be able to:

Describe the basic accounting information system.

Record and summarize basic transactions.

Identify and prepare adjusting entries.

Prepare financial statements from the adjusted trial balance and prepare closing entries.

Prepare financial statements for a merchandising company.

ch03_Acct process.pptx

The document describes the accounting cycle and basic accounting concepts. It begins by outlining the learning objectives of describing the basic accounting information system, recording transactions, preparing adjusting entries, and preparing financial statements. It then provides details on the accounting information system, journal entries, T-accounts, debits and credits, the accounting equation, the trial balance, and adjusting entries. It includes examples of adjusting entries for supplies, insurance, depreciation, and unearned revenue. The overall purpose is to explain the fundamentals of the accounting process.

7 accounting for_equity

This document discusses equity accounting. It covers the key components of equity like ordinary shares, preference shares, retained earnings, and treasury shares. It discusses accounting for issuing shares including par value shares and no-par shares. It also covers accounting for treasury shares, preference shares, and dividends. The learning objectives cover characteristics of corporations, components of equity, procedures for issuing shares, accounting for treasury shares, preference shares, dividend policy, and presentation and analysis of equity.

Accounting information system

The document provides an overview of the key concepts and steps covered in Chapter 3 of Intermediate Accounting. It discusses the accounting information system and its objectives. The key steps in the accounting cycle are identified as journalizing transactions, posting to ledger accounts, preparing an initial trial balance, adjusting entries, and final financial statements. Basic accounting terminology is defined, including accounts, debits/credits, the accounting equation, and the different types of accounts. Examples are provided to illustrate double-entry accounting and the posting process.

Ch03

The document provides an overview of the key learning objectives and content covered in Chapter 3 of Intermediate Accounting (IFRS 2nd Edition) by Kieso, Weygandt, and Warfield. The chapter introduces fundamental accounting concepts including the accounting equation, double-entry system, accounting cycle, basic terminology, adjusting entries, and preparation of financial statements. It also discusses how the accounting information system collects and processes transaction data to disseminate financial information to stakeholders.

Call 8867766396 Satta Matka Dpboss Matka Guessing Satta batta Matka 420 Satta...

CALL 8867766396 SATTA MATKA | DPBOSS | KALYAN MAIN BAZAR | FAST MATKA | DPBOSS GUESSING | TARA MATKA | KALYAN CHART | MATKA BOSS

Industrial Tech SW: Category Renewal and Creation

Every industrial revolution has created a new set of categories and a new set of players.

Multiple new technologies have emerged, but Samsara and C3.ai are only two companies which have gone public so far.

Manufacturing startups constitute the largest pipeline share of unicorns and IPO candidates in the SF Bay Area, and software startups dominate in Germany.

More Related Content

Similar to Liquidation.pdf

Stockholders’ Equity 1 Corporate Capital Illustration Experience Tradition/tu...

FOR MORE CLASSES VISIT

www.tutorialoutlet.com

Stockholders’ Equity 1 Corporate Capital

Illustration: Bad Corporation issued 300 shares of $10 par value common stock for $4,500. Prepare the journal entry to record the

issuance of the shares.

Act Intermediate Accounting (15th Ed)(gnv64) chapter 03

The document discusses the accounting information system and key concepts in the accounting cycle. It provides learning objectives for understanding basic accounting terminology, explaining double-entry rules, identifying steps in the accounting cycle, and recording transactions in journals and ledgers. Key terms are defined, such as assets, liabilities, equity, revenues, expenses, and debits and credits. Examples demonstrate double-entry accounting, the accounting equation, and the steps of the accounting cycle including journalizing, posting, preparing a trial balance, and making adjusting entries.

Ca2 chapter 12

This document describes accounting for partnerships and limited liability companies. It discusses the basic characteristics of proprietorships, partnerships, and LLCs. It also describes how to record the formation of a partnership by contributing assets, how to divide partnership net income and losses, how to account for admitting or withdrawing a partner, and how to liquidate a partnership. The objectives are to describe these topics and illustrate them with journal entries.

Ch 8 - Accounting for Receivables.ppt

This document provides an overview of accounting for receivables. It defines different types of receivables like accounts receivable and notes receivable. It explains how companies recognize, value, and dispose of both accounts receivable and notes receivable. Specific topics covered include recognizing revenue on credit sales, estimating and recording allowance for doubtful accounts, accounting for uncollectible accounts, determining maturity dates and interest on notes, and presenting receivables on financial statements. The document aims to help students understand the key accounting concepts and entries related to receivables.

FA II chapt 1- part III.pptx

This document discusses accounting for intangible assets. It covers characteristics of intangible assets, how purchased and internally created intangibles are recorded, amortization of limited-life and indefinite-life intangibles, types of intangible assets including goodwill, and impairment of intangible assets. The document contains examples and illustrations to demonstrate accounting entries and calculations related to intangible assets.

Partnership 20 accounts-goodwill_202

The document discusses the dissolution of a partnership between X, Y and Z who share profits in a 3:2:1 ratio. Upon dissolution:

- Inventory is sold to Nelson for $4,000 and non-current assets are sold for $8,000 except items worth $5,000 purchased by X for $7,000.

- Debtors excluding the insolvent Smithson pay their balances. Expenses total $1,300 and Z cannot cover his share.

- The realization account is used to record asset sales and distributions to partners' capital accounts, with X receiving $12,675, Y $2,625 and Z $3,050.

Lamar Van Dusen - Allocating profit or loss in a partnership

The document discusses allocating profit and loss in a partnership. It defines a partnership and partnership agreement. Key points include:

- Profits and losses are allocated to partner capital accounts based on the partnership agreement. If not specified, profits are split evenly.

- Partners receive salary allowances before remaining profits are allocated.

- Losses are absorbed equally by partners after salary allowances.

- Journal entries are made to allocate total profit/loss to each partner's capital account.

accounting.ppt

This document provides an overview of Chapter 14 which covers corporations, dividends, retained earnings, and income reporting. The chapter objectives are to prepare entries for cash and stock dividends, identify items in a retained earnings statement, prepare and analyze the stockholders' equity section, describe corporation income statements, and compute earnings per share. Key topics covered include types of dividends, entries for cash and stock dividends, retained earnings statement presentation and analysis, stockholders' equity presentation and analysis, and income statement presentation and analysis.

Chapter 2, Fundamentals of Accounting I (2).pptx

This document provides an overview of the accounting cycle for service businesses. It discusses key concepts like accounts, debits and credits, journals, ledgers, and the steps in the recording process. The recording process involves analyzing transactions, recording them in a journal, and then posting the journal entries to the appropriate accounts in the general ledger. Adjusting entries, preparing an adjusted trial balance, and closing entries are also part of the full accounting cycle.

Admission of partner

Here are the journal entries to record the admission of the new partner N:

1. Creditors A/c Dr. 2,000

To Provision for Discount on Creditors A/c 2,000

(To create 10% provision for discount on creditors)

2. Debtors A/c Dr. 2,000

Provision for Doubtful Debts A/c Dr. 1,000

To Bad Debts A/c 3,000

(To write off bad debts of Rs. 2,000 and create 5% provision for doubtful debts)

3. Stock A/c Dr. 5,000

To Revaluation A/c 5,000

(To revalue stock at

chapter 15 akl.pptx

Here is the solution for part b:

Group Exercise 1: Solution for part b

Income Summary 57,000

Capital, Alex 32,400

Capital, James 24,600

chapter_02.ppt

The document discusses key concepts related to analyzing business transactions and their impact on a company's balance sheet. It introduces the balance sheet framework of assets equaling liabilities plus stockholders' equity. Several examples are provided of journal entries for common business transactions and their posting to T-accounts to illustrate how the accounting equation remains balanced. The objectives are to understand how specific business activities affect balance sheet accounts and how companies track changes through journal entries and T-accounts.

Chapter02.ppt

The document discusses key concepts related to analyzing business transactions and their impact on a company's balance sheet. It introduces the balance sheet framework of assets equaling liabilities plus stockholders' equity. Several examples are provided of journal entries for common business transactions and their posting to T-accounts to illustrate how the accounting equation remains balanced. The objectives are to understand how specific business activities affect balance sheet accounts and how companies track changes through the use of journals and T-accounts.

Retirment.pdf

The withdrawal of a partner, whether voluntary or involuntary, legally dissolves the partnership. When a partner withdraws, the remaining partners may buy out the withdrawing partner's equity by paying them from their personal assets or from partnership assets. The partnership may pay a bonus to the withdrawing or remaining partners depending on factors like the value of partnership assets.

ch03.pptx

The Accounting Information System

LEARNING OBJECTIVES

After studying this chapter, you should be able to:

Describe the basic accounting information system.

Record and summarize basic transactions.

Identify and prepare adjusting entries.

Prepare financial statements from the adjusted trial balance and prepare closing entries.

Prepare financial statements for a merchandising company.

ch03_Acct process.pptx

The document describes the accounting cycle and basic accounting concepts. It begins by outlining the learning objectives of describing the basic accounting information system, recording transactions, preparing adjusting entries, and preparing financial statements. It then provides details on the accounting information system, journal entries, T-accounts, debits and credits, the accounting equation, the trial balance, and adjusting entries. It includes examples of adjusting entries for supplies, insurance, depreciation, and unearned revenue. The overall purpose is to explain the fundamentals of the accounting process.

7 accounting for_equity

This document discusses equity accounting. It covers the key components of equity like ordinary shares, preference shares, retained earnings, and treasury shares. It discusses accounting for issuing shares including par value shares and no-par shares. It also covers accounting for treasury shares, preference shares, and dividends. The learning objectives cover characteristics of corporations, components of equity, procedures for issuing shares, accounting for treasury shares, preference shares, dividend policy, and presentation and analysis of equity.

Accounting information system

The document provides an overview of the key concepts and steps covered in Chapter 3 of Intermediate Accounting. It discusses the accounting information system and its objectives. The key steps in the accounting cycle are identified as journalizing transactions, posting to ledger accounts, preparing an initial trial balance, adjusting entries, and final financial statements. Basic accounting terminology is defined, including accounts, debits/credits, the accounting equation, and the different types of accounts. Examples are provided to illustrate double-entry accounting and the posting process.

Ch03

The document provides an overview of the key learning objectives and content covered in Chapter 3 of Intermediate Accounting (IFRS 2nd Edition) by Kieso, Weygandt, and Warfield. The chapter introduces fundamental accounting concepts including the accounting equation, double-entry system, accounting cycle, basic terminology, adjusting entries, and preparation of financial statements. It also discusses how the accounting information system collects and processes transaction data to disseminate financial information to stakeholders.

Similar to Liquidation.pdf (20)

Stockholders’ Equity 1 Corporate Capital Illustration Experience Tradition/tu...

Stockholders’ Equity 1 Corporate Capital Illustration Experience Tradition/tu...

Act Intermediate Accounting (15th Ed)(gnv64) chapter 03

Act Intermediate Accounting (15th Ed)(gnv64) chapter 03

Lamar Van Dusen - Allocating profit or loss in a partnership

Lamar Van Dusen - Allocating profit or loss in a partnership

Recently uploaded

Call 8867766396 Satta Matka Dpboss Matka Guessing Satta batta Matka 420 Satta...

CALL 8867766396 SATTA MATKA | DPBOSS | KALYAN MAIN BAZAR | FAST MATKA | DPBOSS GUESSING | TARA MATKA | KALYAN CHART | MATKA BOSS

Industrial Tech SW: Category Renewal and Creation

Every industrial revolution has created a new set of categories and a new set of players.

Multiple new technologies have emerged, but Samsara and C3.ai are only two companies which have gone public so far.

Manufacturing startups constitute the largest pipeline share of unicorns and IPO candidates in the SF Bay Area, and software startups dominate in Germany.

How to Implement a Real Estate CRM Software

To implement a CRM for real estate, set clear goals, choose a CRM with key real estate features, and customize it to your needs. Migrate your data, train your team, and use automation to save time. Monitor performance, ensure data security, and use the CRM to enhance marketing. Regularly check its effectiveness to improve your business.

Authentically Social by Corey Perlman - EO Puerto Rico

Authentically Social by Corey Perlman - EO Puerto RicoCorey Perlman, Social Media Speaker and Consultant

Social media for business Zodiac Signs and Food Preferences_ What Your Sign Says About Your Taste

Know what your zodiac sign says about your taste in food! Explore how the 12 zodiac signs influence your culinary preferences with insights from MyPandit. Dive into astrology and flavors!

The Heart of Leadership_ How Emotional Intelligence Drives Business Success B...

Leaders who possess self-awareness deeply understand their emotions, strengths, and weaknesses.

The 10 Most Influential Leaders Guiding Corporate Evolution, 2024.pdf

In the recent edition, The 10 Most Influential Leaders Guiding Corporate Evolution, 2024, The Silicon Leaders magazine gladly features Dejan Štancer, President of the Global Chamber of Business Leaders (GCBL), along with other leaders.

Building Your Employer Brand with Social Media

Presented at The Global HR Summit, 6th June 2024

In this keynote, Luan Wise will provide invaluable insights to elevate your employer brand on social media platforms including LinkedIn, Facebook, Instagram, X (formerly Twitter) and TikTok. You'll learn how compelling content can authentically showcase your company culture, values, and employee experiences to support your talent acquisition and retention objectives. Additionally, you'll understand the power of employee advocacy to amplify reach and engagement – helping to position your organization as an employer of choice in today's competitive talent landscape.

2022 Vintage Roman Numerals Men Rings

Discover timeless style with the 2022 Vintage Roman Numerals Men's Ring. Crafted from premium stainless steel, this 6mm wide ring embodies elegance and durability. Perfect as a gift, it seamlessly blends classic Roman numeral detailing with modern sophistication, making it an ideal accessory for any occasion.

https://rb.gy/usj1a2

Understanding User Needs and Satisfying Them

https://www.productmanagementtoday.com/frs/26903918/understanding-user-needs-and-satisfying-them

We know we want to create products which our customers find to be valuable. Whether we label it as customer-centric or product-led depends on how long we've been doing product management. There are three challenges we face when doing this. The obvious challenge is figuring out what our users need; the non-obvious challenges are in creating a shared understanding of those needs and in sensing if what we're doing is meeting those needs.

In this webinar, we won't focus on the research methods for discovering user-needs. We will focus on synthesis of the needs we discover, communication and alignment tools, and how we operationalize addressing those needs.

Industry expert Scott Sehlhorst will:

• Introduce a taxonomy for user goals with real world examples

• Present the Onion Diagram, a tool for contextualizing task-level goals

• Illustrate how customer journey maps capture activity-level and task-level goals

• Demonstrate the best approach to selection and prioritization of user-goals to address

• Highlight the crucial benchmarks, observable changes, in ensuring fulfillment of customer needs

Company Valuation webinar series - Tuesday, 4 June 2024

This session provided an update as to the latest valuation data in the UK and then delved into a discussion on the upcoming election and the impacts on valuation. We finished, as always with a Q&A

Innovation Management Frameworks: Your Guide to Creativity & Innovation

Innovation Management Frameworks: Your Guide to Creativity & InnovationOperational Excellence Consulting

[To download this presentation, visit:

https://www.oeconsulting.com.sg/training-presentations]

This PowerPoint compilation offers a comprehensive overview of 20 leading innovation management frameworks and methodologies, selected for their broad applicability across various industries and organizational contexts. These frameworks are valuable resources for a wide range of users, including business professionals, educators, and consultants.

Each framework is presented with visually engaging diagrams and templates, ensuring the content is both informative and appealing. While this compilation is thorough, please note that the slides are intended as supplementary resources and may not be sufficient for standalone instructional purposes.

This compilation is ideal for anyone looking to enhance their understanding of innovation management and drive meaningful change within their organization. Whether you aim to improve product development processes, enhance customer experiences, or drive digital transformation, these frameworks offer valuable insights and tools to help you achieve your goals.

INCLUDED FRAMEWORKS/MODELS:

1. Stanford’s Design Thinking

2. IDEO’s Human-Centered Design

3. Strategyzer’s Business Model Innovation

4. Lean Startup Methodology

5. Agile Innovation Framework

6. Doblin’s Ten Types of Innovation

7. McKinsey’s Three Horizons of Growth

8. Customer Journey Map

9. Christensen’s Disruptive Innovation Theory

10. Blue Ocean Strategy

11. Strategyn’s Jobs-To-Be-Done (JTBD) Framework with Job Map

12. Design Sprint Framework

13. The Double Diamond

14. Lean Six Sigma DMAIC

15. TRIZ Problem-Solving Framework

16. Edward de Bono’s Six Thinking Hats

17. Stage-Gate Model

18. Toyota’s Six Steps of Kaizen

19. Microsoft’s Digital Transformation Framework

20. Design for Six Sigma (DFSS)

To download this presentation, visit:

https://www.oeconsulting.com.sg/training-presentationsHow to Implement a Strategy: Transform Your Strategy with BSC Designer's Comp...

The Strategy Implementation System offers a structured approach to translating stakeholder needs into actionable strategies using high-level and low-level scorecards. It involves stakeholder analysis, strategy decomposition, adoption of strategic frameworks like Balanced Scorecard or OKR, and alignment of goals, initiatives, and KPIs.

Key Components:

- Stakeholder Analysis

- Strategy Decomposition

- Adoption of Business Frameworks

- Goal Setting

- Initiatives and Action Plans

- KPIs and Performance Metrics

- Learning and Adaptation

- Alignment and Cascading of Scorecards

Benefits:

- Systematic strategy formulation and execution.

- Framework flexibility and automation.

- Enhanced alignment and strategic focus across the organization.

Business storytelling: key ingredients to a story

Storytelling is an incredibly valuable tool to share data and information. To get the most impact from stories there are a number of key ingredients. These are based on science and human nature. Using these elements in a story you can deliver information impactfully, ensure action and drive change.

Digital Transformation Frameworks: Driving Digital Excellence

[To download this presentation, visit:

https://www.oeconsulting.com.sg/training-presentations]

This presentation is a curated compilation of PowerPoint diagrams and templates designed to illustrate 20 different digital transformation frameworks and models. These frameworks are based on recent industry trends and best practices, ensuring that the content remains relevant and up-to-date.

Key highlights include Microsoft's Digital Transformation Framework, which focuses on driving innovation and efficiency, and McKinsey's Ten Guiding Principles, which provide strategic insights for successful digital transformation. Additionally, Forrester's framework emphasizes enhancing customer experiences and modernizing IT infrastructure, while IDC's MaturityScape helps assess and develop organizational digital maturity. MIT's framework explores cutting-edge strategies for achieving digital success.

These materials are perfect for enhancing your business or classroom presentations, offering visual aids to supplement your insights. Please note that while comprehensive, these slides are intended as supplementary resources and may not be complete for standalone instructional purposes.

Frameworks/Models included:

Microsoft’s Digital Transformation Framework

McKinsey’s Ten Guiding Principles of Digital Transformation

Forrester’s Digital Transformation Framework

IDC’s Digital Transformation MaturityScape

MIT’s Digital Transformation Framework

Gartner’s Digital Transformation Framework

Accenture’s Digital Strategy & Enterprise Frameworks

Deloitte’s Digital Industrial Transformation Framework

Capgemini’s Digital Transformation Framework

PwC’s Digital Transformation Framework

Cisco’s Digital Transformation Framework

Cognizant’s Digital Transformation Framework

DXC Technology’s Digital Transformation Framework

The BCG Strategy Palette

McKinsey’s Digital Transformation Framework

Digital Transformation Compass

Four Levels of Digital Maturity

Design Thinking Framework

Business Model Canvas

Customer Journey Map

Event Report - SAP Sapphire 2024 Orlando - lots of innovation and old challenges

Holger Mueller of Constellation Research shares his key takeaways from SAP's Sapphire confernece, held in Orlando, June 3rd till 5th 2024, in the Orange Convention Center.

Brian Fitzsimmons on the Business Strategy and Content Flywheel of Barstool S...

On episode 272 of the Digital and Social Media Sports Podcast, Neil chatted with Brian Fitzsimmons, Director of Licensing and Business Development for Barstool Sports.

What follows is a collection of snippets from the podcast. To hear the full interview and more, check out the podcast on all podcast platforms and at www.dsmsports.net

Mastering B2B Payments Webinar from BlueSnap

B2B payments are rapidly changing. Find out the 5 key questions you need to be asking yourself to be sure you are mastering B2B payments today. Learn more at www.BlueSnap.com.

Unveiling the Dynamic Personalities, Key Dates, and Horoscope Insights: Gemin...

Explore the fascinating world of the Gemini Zodiac Sign. Discover the unique personality traits, key dates, and horoscope insights of Gemini individuals. Learn how their sociable, communicative nature and boundless curiosity make them the dynamic explorers of the zodiac. Dive into the duality of the Gemini sign and understand their intellectual and adventurous spirit.

Recently uploaded (20)

Call 8867766396 Satta Matka Dpboss Matka Guessing Satta batta Matka 420 Satta...

Call 8867766396 Satta Matka Dpboss Matka Guessing Satta batta Matka 420 Satta...

Authentically Social by Corey Perlman - EO Puerto Rico

Authentically Social by Corey Perlman - EO Puerto Rico

Zodiac Signs and Food Preferences_ What Your Sign Says About Your Taste

Zodiac Signs and Food Preferences_ What Your Sign Says About Your Taste

The Heart of Leadership_ How Emotional Intelligence Drives Business Success B...

The Heart of Leadership_ How Emotional Intelligence Drives Business Success B...

The 10 Most Influential Leaders Guiding Corporate Evolution, 2024.pdf

The 10 Most Influential Leaders Guiding Corporate Evolution, 2024.pdf

Company Valuation webinar series - Tuesday, 4 June 2024

Company Valuation webinar series - Tuesday, 4 June 2024

Innovation Management Frameworks: Your Guide to Creativity & Innovation

Innovation Management Frameworks: Your Guide to Creativity & Innovation

How to Implement a Strategy: Transform Your Strategy with BSC Designer's Comp...

How to Implement a Strategy: Transform Your Strategy with BSC Designer's Comp...

Digital Transformation Frameworks: Driving Digital Excellence

Digital Transformation Frameworks: Driving Digital Excellence

Event Report - SAP Sapphire 2024 Orlando - lots of innovation and old challenges

Event Report - SAP Sapphire 2024 Orlando - lots of innovation and old challenges

Brian Fitzsimmons on the Business Strategy and Content Flywheel of Barstool S...

Brian Fitzsimmons on the Business Strategy and Content Flywheel of Barstool S...

Unveiling the Dynamic Personalities, Key Dates, and Horoscope Insights: Gemin...

Unveiling the Dynamic Personalities, Key Dates, and Horoscope Insights: Gemin...

Liquidation.pdf

- 1. 12-32 Ends both the legal and economic life of the entity. To liquidate, it is necessary to: 1. Sell noncash assets for cash and recognize a gain or loss on realization. 2. Allocate gain/loss on realization to the partners based on their income ratios. 3. Pay partnership liabilities in cash. 4. Distribute remaining cash to partners on the basis of their capital balances. LEARNING OBJECTIVE Explain how to account for the liquidation of a partnership. 3 LO 3

- 2. 12-33 Illustration: Ace Company is liquidated when its ledger shows the following assets, liabilities, and owners’ equity accounts. Partnership Liquidation No Capital Deficiency Illustration 12-9 Account balances prior to liquidation LO 3

- 3. 12-34 Illustration: The partners of Ace Company agree to liquidate the partnership on the following terms: (1) The partnership will sell its noncash assets to Jackson Enterprises for $75,000 cash. (2) The partnership will pay its partnership liabilities. The income ratios of the partners are 3:2:1, respectively. No Capital Deficiency Partnership Liquidation LO 3

- 4. 12-35 Illustration: (1) Ace sells the noncash assets (accounts receivable, inventory, and equipment) for $75,000. The book value of these assets is $60,000 ($15,000 + $18,000 + $35,000 - $8,000). Prepare the entry to record the sale of the noncash assets. Accumulated Depreciation 8,000 Cash 75,000 Accounts Receivable 15,000 Equipment 35,000 Inventory 18,000 Gain on Realization 15,000 No Capital Deficiency Partnership Liquidation LO 3

- 5. 12-36 Illustration: (2) Prepare the entry to record the allocation of the gain on liquidation to the partners. R. Arnet, Capital ($15,000 x 3/6) 7,500 Gain on realization 15,000 P. Carey, Capital ($15,000 x 2/6) 5,000 W. Eaton, Capital ($15,000 x 1/6) 2,500 No Capital Deficiency Partnership Liquidation LO 3

- 6. 12-37 Illustration: (3) Prepare the entry to record the payment in full to the creditors. Accounts Payable 16,000 Notes Payable 15,000 Cash 31,000 No Capital Deficiency Partnership Liquidation LO 3

- 7. 12-38 Illustration: (4) Record the distribution of cash. R. Arnet, Capital 22,500 Cash 49,000 P. Carey, Capital 22,800 W. Eaton, Capital 3,700 No Capital Deficiency Partnership Liquidation Illustration 12-10 Ledger balances before distribution of cash LO 3

- 8. 12-39 Illustration 12-11 Schedule of cash payments, no capital deficiency SCHEDULE OF CASH PAYMENTS No Capital Deficiency Partnership Liquidation LO 3

- 9. 12-40 The first step in the liquidation of a partnership is to: a. allocate gain/loss on realization to the partners. b. distribute remaining cash to partners. c. pay partnership liabilities. d. sell noncash assets and recognize a gain or loss on realization. Question Partnership Liquidation LO 3

- 10. 12-41 If a partner with a capital deficiency is unable to pay the amount owed to the partnership, the deficiency is allocated to the partners with credit balances: a. equally. b. on the basis of their income ratios. c. on the basis of their capital balances. d. on the basis of their original investments. Question Partnership Liquidation LO 3

- 11. 12-42 The partners of Grafton Company have decided to liquidate their business. Noncash assets were sold for $115,000. The income ratios of the partners Kale D., Croix D., and Marais K. are 2:3:3, respectively. Complete the following schedule of cash payments for Grafton Company. DO IT! No Capital Deficiency 3 LO 3

- 12. 12-43 Illustration: Ace Company’s ledger shows the following assets, liabilities, and owners’ equity accounts. Partnership Liquidation Illustration 12-9 Account balances prior to liquidation LO 3 Capital Deficiency

- 13. 12-44 Illustration: Ace Company is on the brink of bankruptcy. They sell merchandise at substantial discounts, and sell the equipment at auction. Cash proceeds from these sales and collections from customers totals $42,000. (1) Prepare the entry for the realization of noncash assets. Accumulated Depreciation 8,000 Cash 42,000 Accounts Receivable 15,000 Equipment 35,000 Inventory 18,000 Loss on Realization 18,000 Capital Deficiency Partnership Liquidation LO 3

- 14. 12-45 Illustration: (2) Ace allocates the loss on realization to the partners on the basis of their income ratios. The entry is: R. Arnet, Capital ($18,000 x 3/6) 9,000 Loss on realization 18,000 P. Carey, Capital ($18,000 x 2/6) 6,000 W. Eaton, Capital ($18,000 x 1/6) 3,000 Capital Deficiency Partnership Liquidation LO 3

- 15. 12-46 Illustration: (3) Prepare the entry to record the payment in full to the creditors. Accounts Payable 16,000 Notes Payable 15,000 Cash 31,000 Capital Deficiency Partnership Liquidation LO 3

- 16. 12-47 R. Arnet P. Carey W. Eaton Cash Capital Capital Capital Balances before liquidation 16,000 $ (6,000) $ (11,800) $ 1,800 $ Eaton payment 1,800 (1,800) Balance 17,800 $ (6,000) $ (11,800) $ - $ W. Eaton, Capital 1,800 Cash 1,800 P. Carey, Capital 11,800 R. Arnet, Capital 6,000 Cash 17,800 Payment of Deficiency Capital Deficiency Partnership Liquidation LO 3

- 17. 12-48 R. Arnet P. Carey W. Eaton Cash Capital Capital Capital Balances before liquidation 16,000 $ (6,000) $ (11,800) $ 1,800 $ Allocation of deficiency 1,080 720 (1,800) Balance 16,000 $ (4,920) $ (11,080) $ - $ P. Carey, Capital 720 R. Arnet, Capital 1,080 P. Carey, Capital 11,080 R. Arnet, Capital 4,920 Cash 16,000 Farley, Capital 1,800 Nonpayment of Deficiency Capital Deficiency Partnership Liquidation LO 3