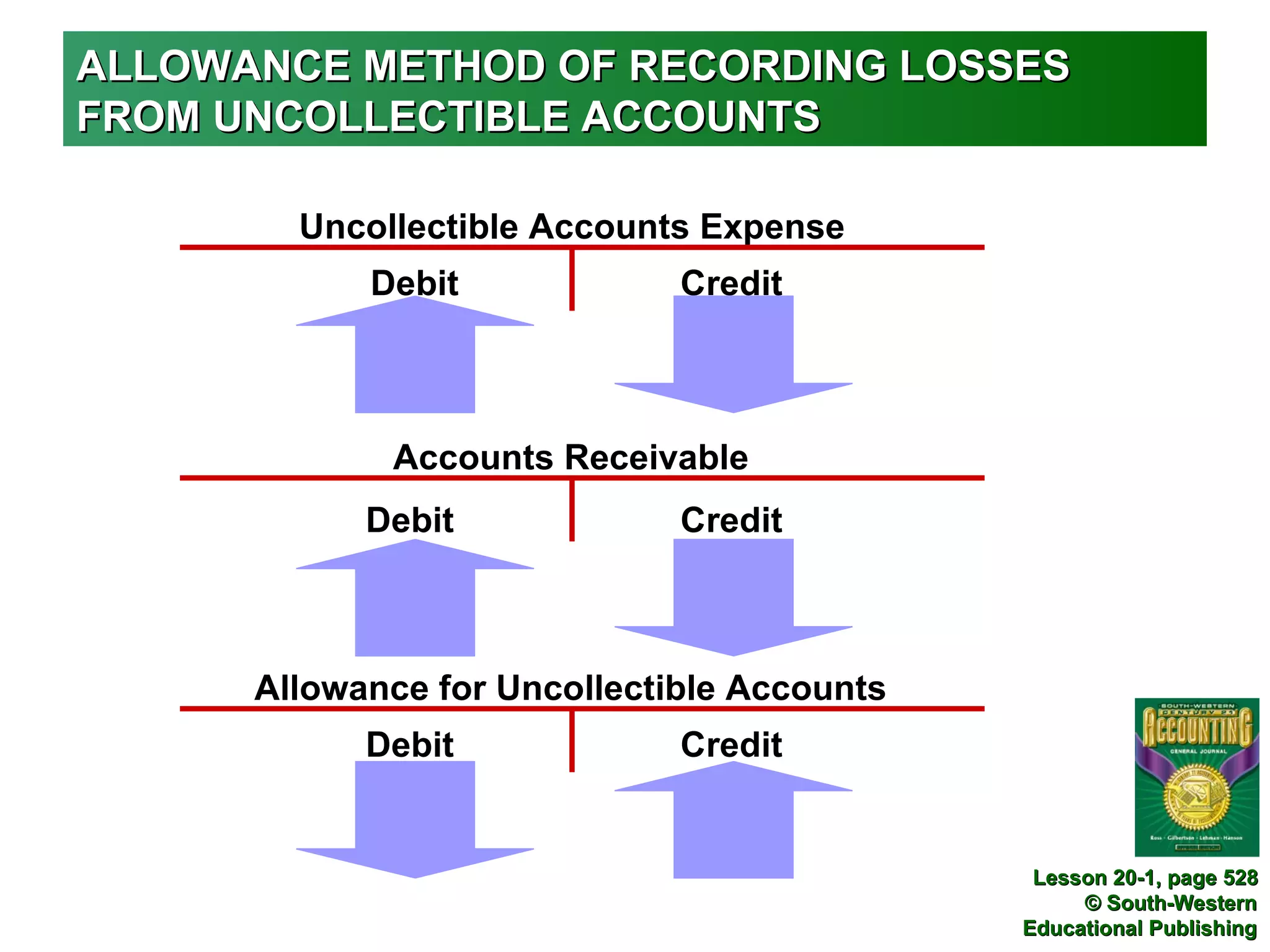

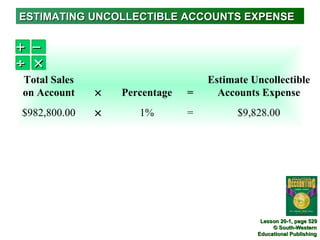

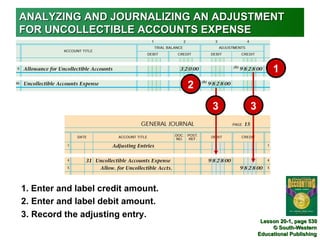

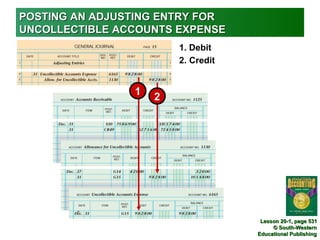

This document discusses the allowance method for recording uncollectible accounts. It explains how to estimate uncollectible accounts expense using a percentage of total sales. The document also shows how to analyze and journalize an adjusting entry to record estimated uncollectible accounts expense. Finally, it reviews key terms like uncollectible accounts, allowance method, book value, and book value of accounts receivable.