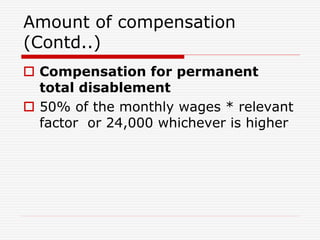

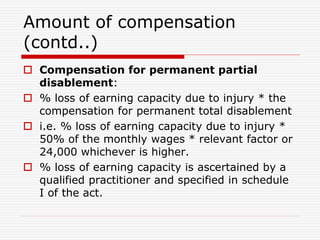

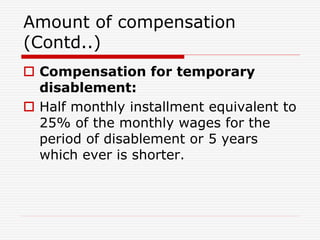

This document summarizes key Indian labor laws including the Workmen Compensation Act 1923, Minimum Wages Act 1948, and Payment of Bonus Act 1965. The Workmen Compensation Act provides relief for workers injured on the job through a system of compensation payments for temporary disablement, permanent disablement, and death. The Minimum Wages Act aims to ensure fair wages, especially for unorganized workers, by setting minimum wage rates. The Payment of Bonus Act entitles employees to receive an annual bonus based on company profits to promote harmony between labor and capital.

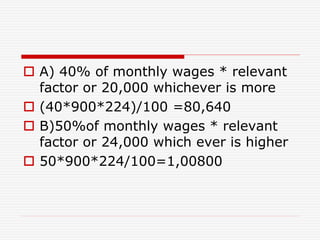

![ % loss of earning capacity due to the

injury * the compensation for

permanent total disablement

= (40/100)* [(50*800*224)/100]

=35840/-](https://image.slidesharecdn.com/legislativeframeworkwageandsalaryadministrationatmacrolevel-221225120529-635d76aa/85/Legislative-framework-wage-and-salary-administration-at-macro-Level-ppt-21-320.jpg)

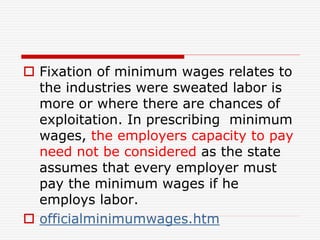

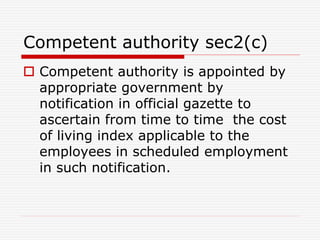

![Scheduled employment [sec 2(g)]and

cost of living index number [sec 2(d)]

Scheduled employment is the employment

specified in the schedule of the act.

Cost of living index number is the index

number ascertained and declared by the

competent authority by notification in official

gazette to be the cost of living index number

applicable to the employees in nay scheduled

employment in respect of which minimum

rates of wages have been fixed. The term ‘cost

of living index’ has been replaced by state

government as ‘consumer price index number’](https://image.slidesharecdn.com/legislativeframeworkwageandsalaryadministrationatmacrolevel-221225120529-635d76aa/85/Legislative-framework-wage-and-salary-administration-at-macro-Level-ppt-32-320.jpg)

![ Payment of minimum rate of

wages [sec12]

The employer shall pay to every

employee, minimum rates of wages

without any deduction of any kind. I a

workman does not turn out for work,

the employer may take disciplinary

action against the workman but cant

pay him anything less than the

minimum wages. That is illegal.](https://image.slidesharecdn.com/legislativeframeworkwageandsalaryadministrationatmacrolevel-221225120529-635d76aa/85/Legislative-framework-wage-and-salary-administration-at-macro-Level-ppt-36-320.jpg)

![ Fixing hours of work [sec13]

In regard to any scheduled

employment, the appropriate

government

1. Fix the number of hours which shall

constitute a normal working day.

2. Provide for a day of rest in every

period of 7 days

3. Provide for payment of work on a day

of rest at a rate not less than the

overtime rate.](https://image.slidesharecdn.com/legislativeframeworkwageandsalaryadministrationatmacrolevel-221225120529-635d76aa/85/Legislative-framework-wage-and-salary-administration-at-macro-Level-ppt-37-320.jpg)

![ Wages for overtime [sec14]

If an employee works for more than 9

hours in a day or more than 48 hours

in a week, he is entitled to get

overtime pay. He is entitled to one

and half times the ordinary rate of

wages in case of agriculture job and

double the ordinary rate of wages in

any other scheduled employment](https://image.slidesharecdn.com/legislativeframeworkwageandsalaryadministrationatmacrolevel-221225120529-635d76aa/85/Legislative-framework-wage-and-salary-administration-at-macro-Level-ppt-38-320.jpg)

![ Wages for less than the normal

working day [Sec 15]

An employee who works on any day

for a period less than the normal

working day, he is entitled to get the

full normal working day except in the

following case where

a) where his failure of work is caused

by his unwillingness to work and not

by omission of the employer to

provide him work.

b) any other circumstances as may

be prescribed](https://image.slidesharecdn.com/legislativeframeworkwageandsalaryadministrationatmacrolevel-221225120529-635d76aa/85/Legislative-framework-wage-and-salary-administration-at-macro-Level-ppt-39-320.jpg)

![Penalties on non payment of

minimum wages [sec22]

Imprisonment upto six months or fine

upto 500 or both

****](https://image.slidesharecdn.com/legislativeframeworkwageandsalaryadministrationatmacrolevel-221225120529-635d76aa/85/Legislative-framework-wage-and-salary-administration-at-macro-Level-ppt-40-320.jpg)