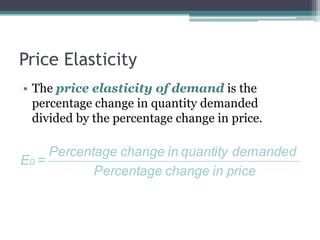

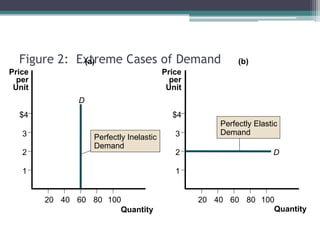

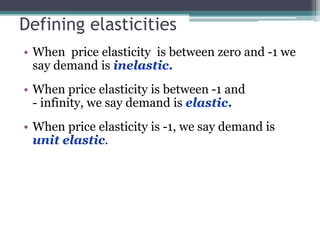

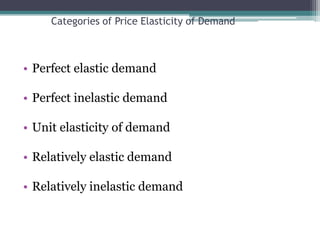

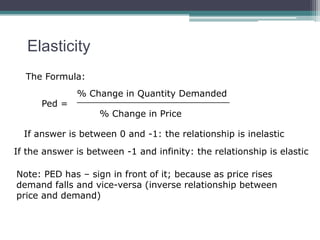

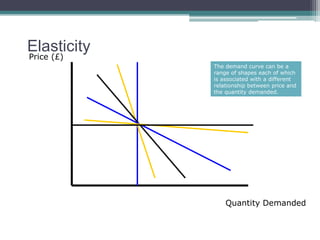

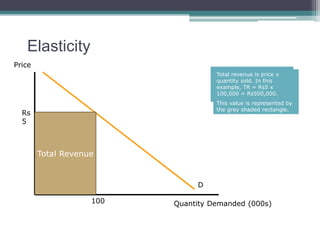

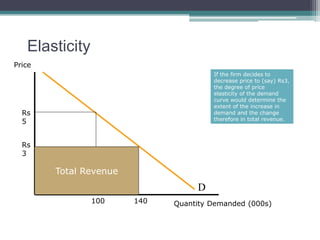

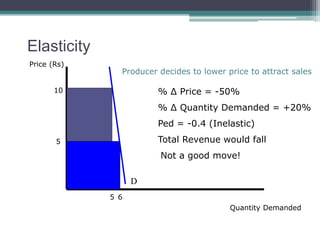

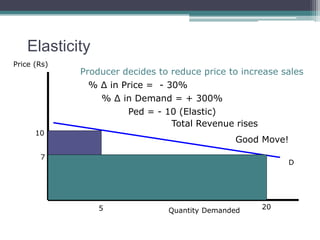

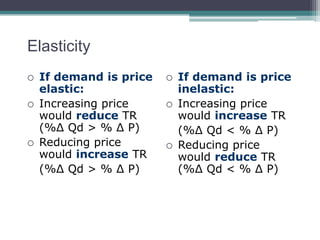

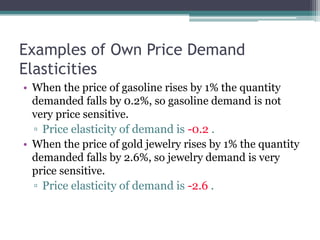

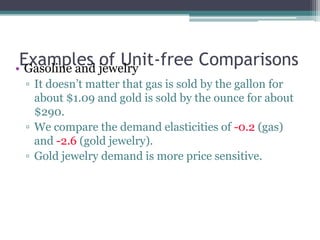

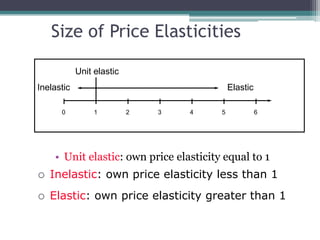

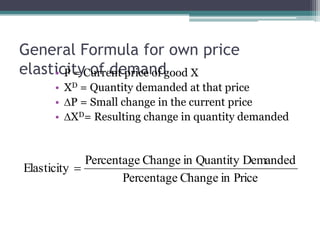

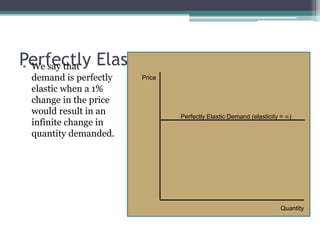

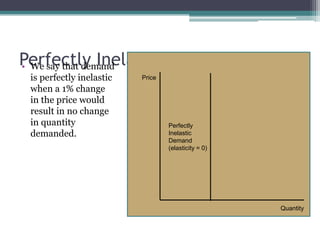

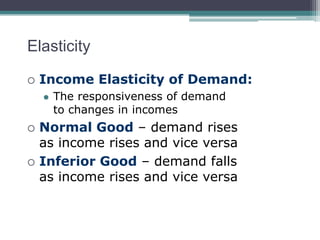

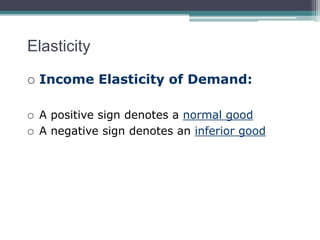

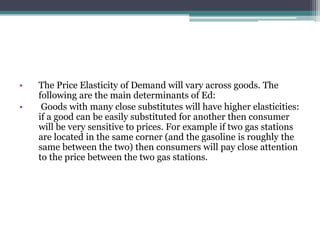

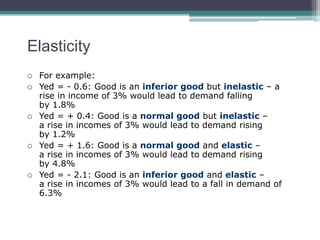

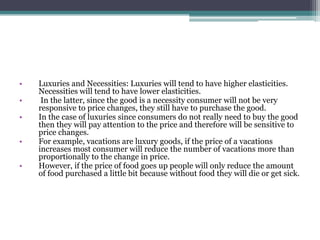

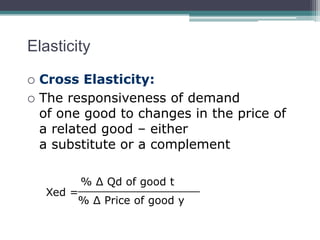

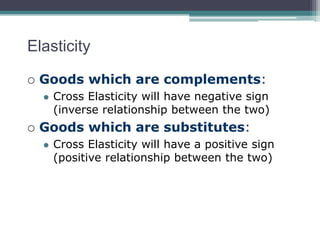

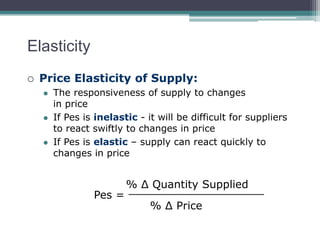

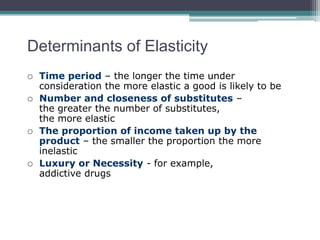

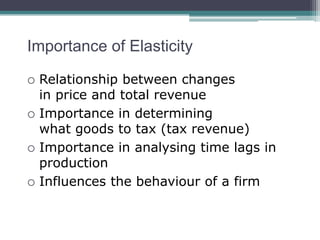

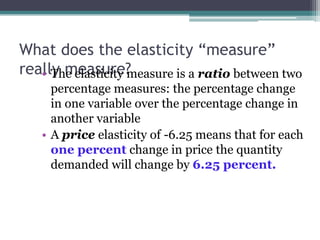

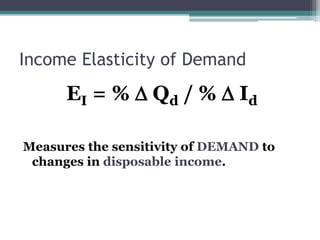

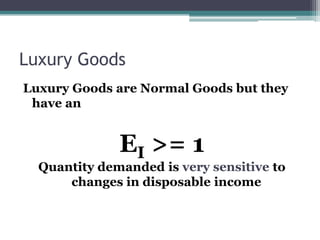

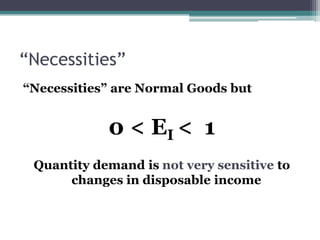

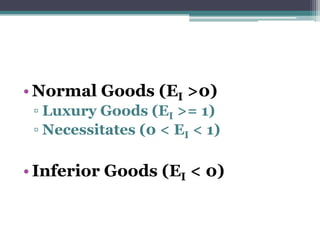

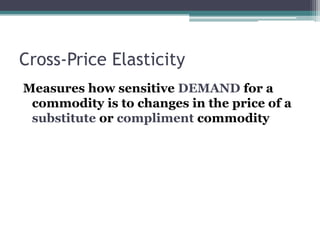

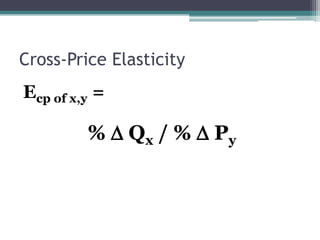

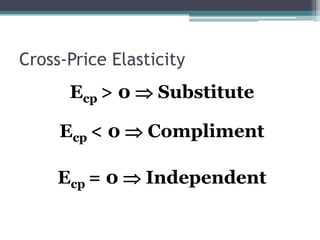

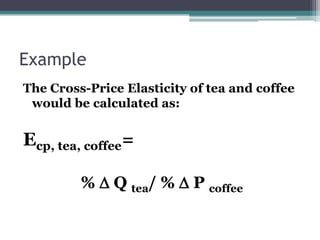

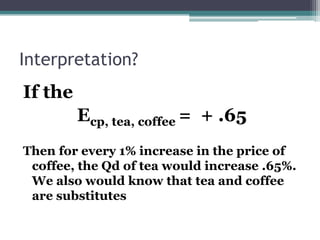

This document discusses different types of elasticity, including price elasticity, income elasticity, and cross elasticity. It defines elasticity as a measure of the responsiveness of one variable to changes in another. Price elasticity measures how much demand or supply changes with price changes. Income elasticity measures how demand changes with income changes. Cross elasticity measures how demand for one good changes with price changes in a related good. The document also discusses factors that determine elasticity and the importance of understanding elasticity concepts.