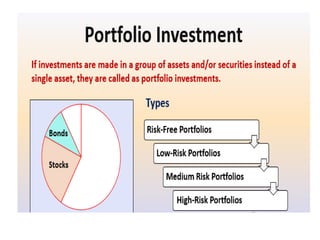

Portfolio management involves selecting investments for individuals to maximize returns while minimizing risks. A portfolio is a collection of various financial assets like stocks, bonds, cash, and real estate. Portfolio managers help clients choose the right mix of assets based on their goals, income, age, and risk tolerance. They provide both active and passive management, with active managers trying to earn higher returns by buying and selling assets while passive managers match a fixed portfolio to market conditions. The objectives of portfolio management include stable current income, marketable investments, tax planning, capital appreciation, liquidity, and safety of principal.