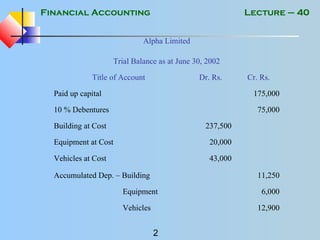

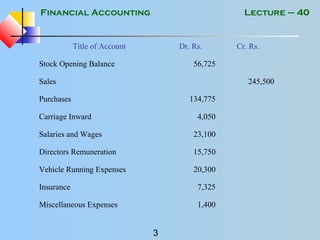

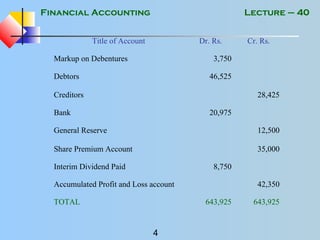

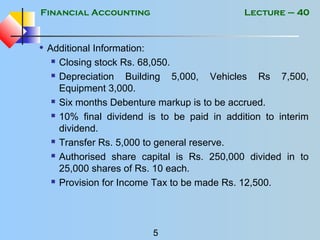

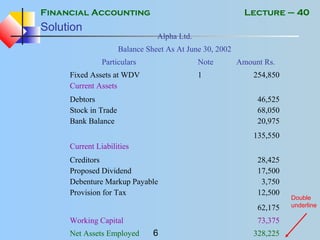

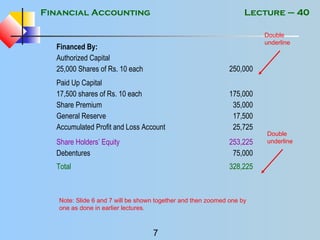

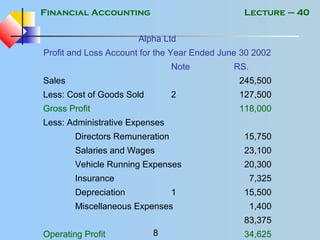

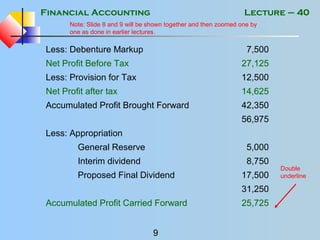

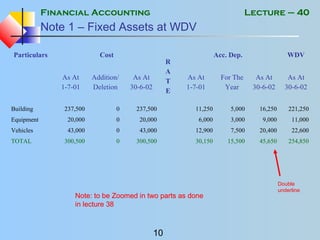

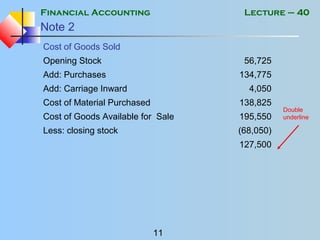

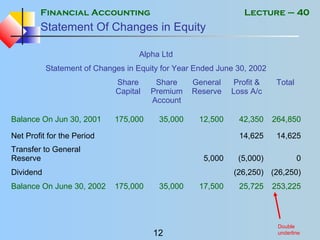

The document outlines the financial accounting details of Alpha Ltd as of June 30, 2002, including a trial balance, profit and loss account, and balance sheet. Key highlights include sales, expenses, net profit, and depreciation for fixed assets, along with additional information such as dividend provisions and tax calculations. It also presents a statement of changes in equity, demonstrating the company's financial status over the year.