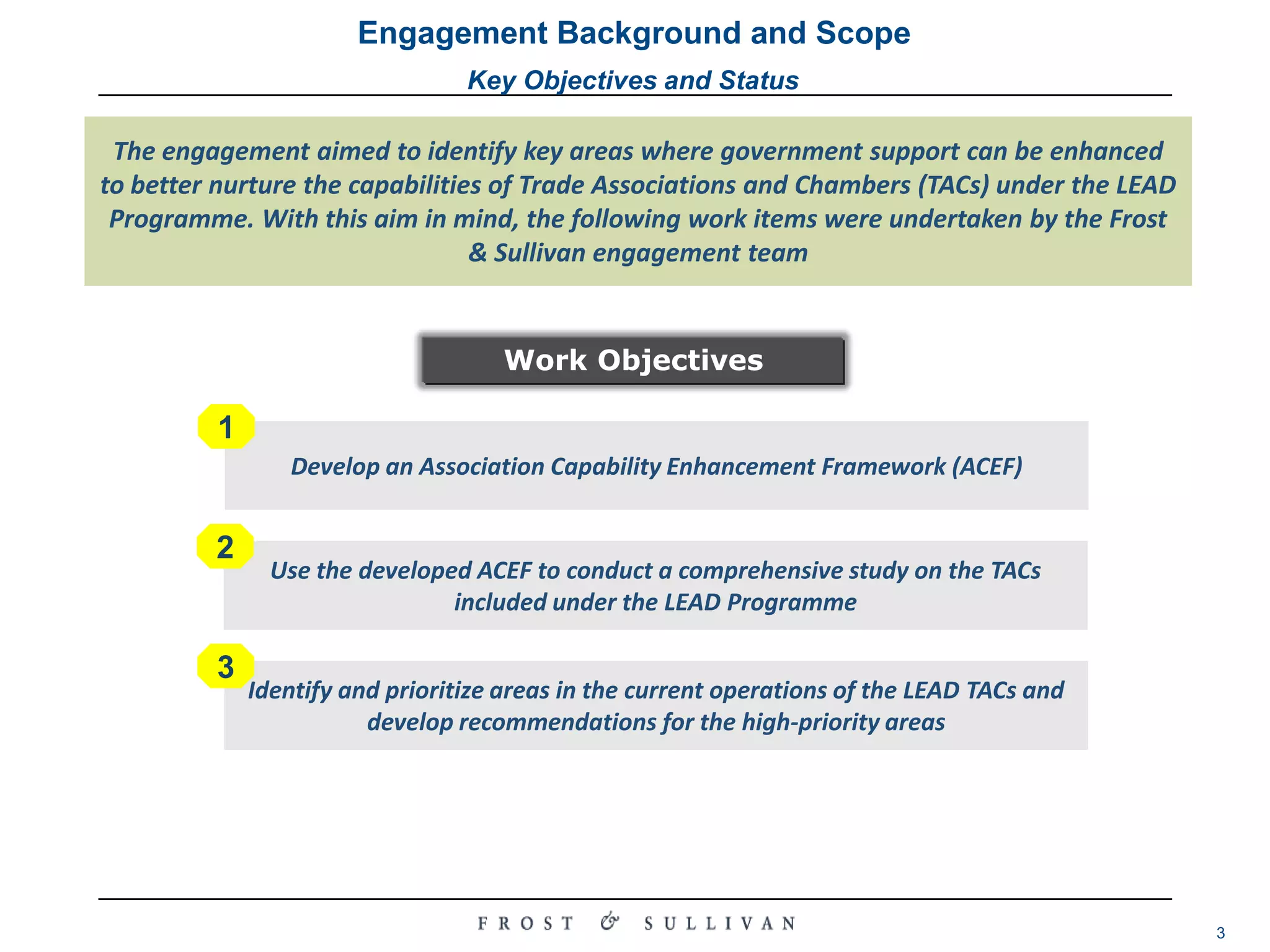

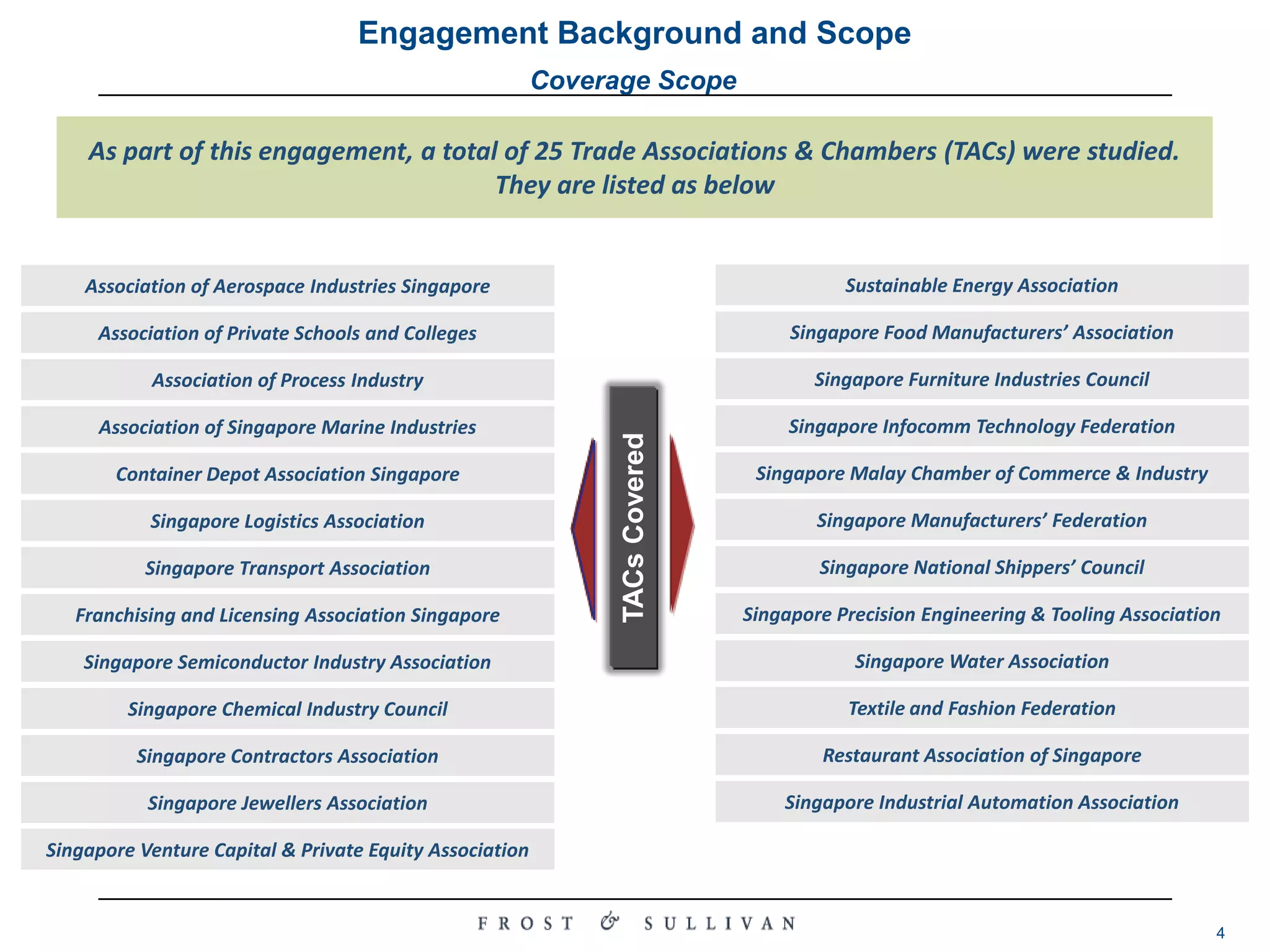

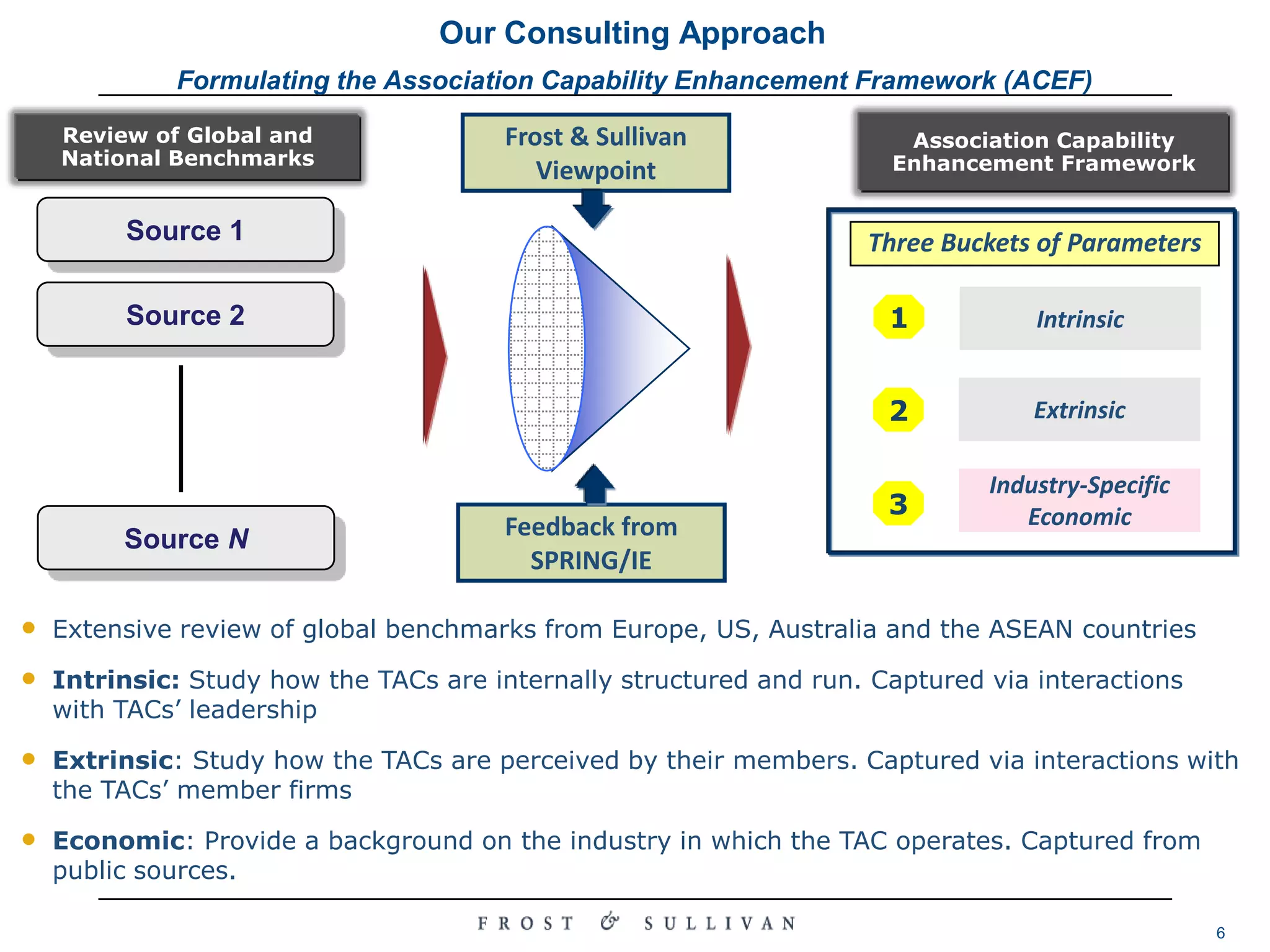

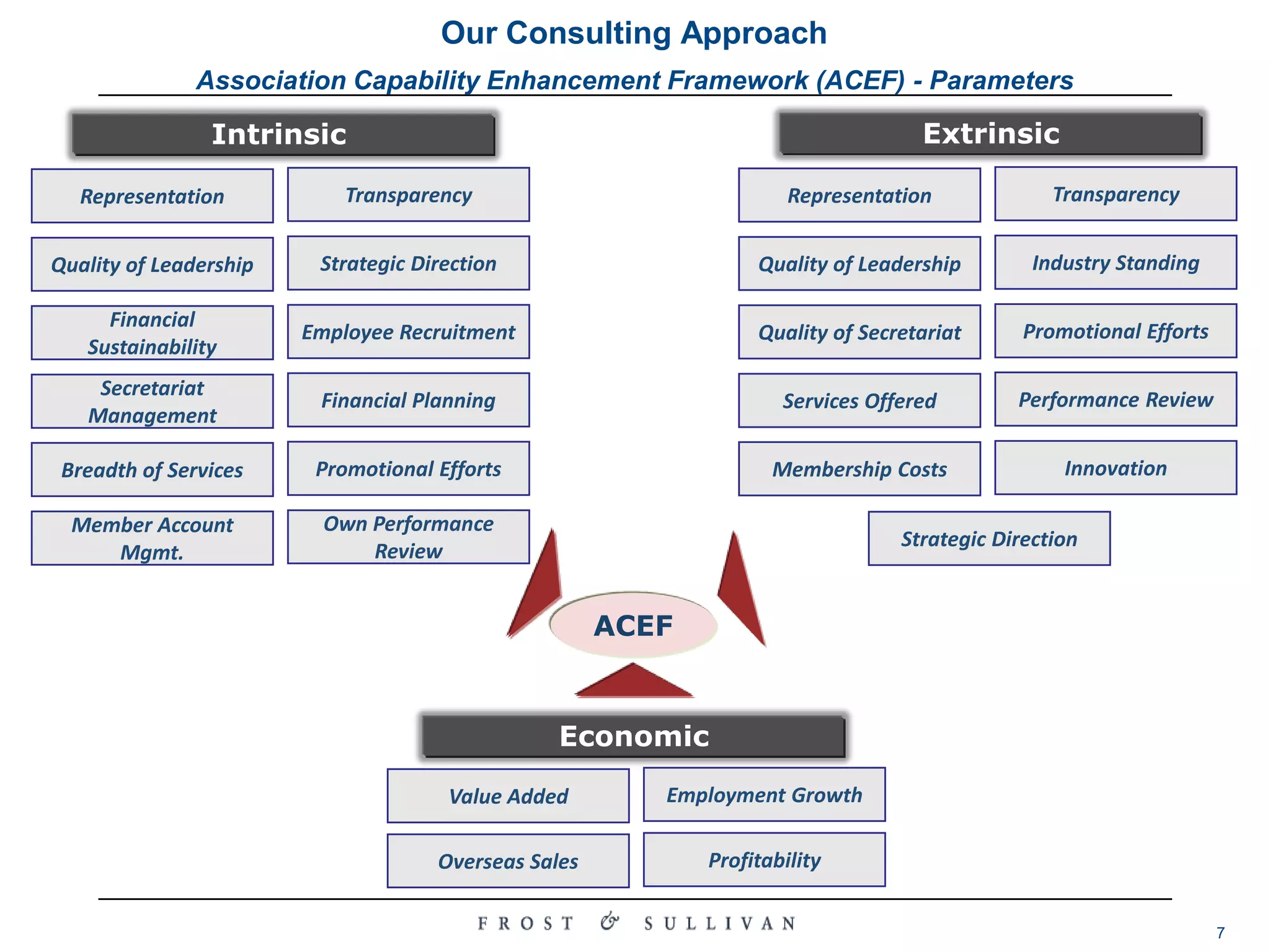

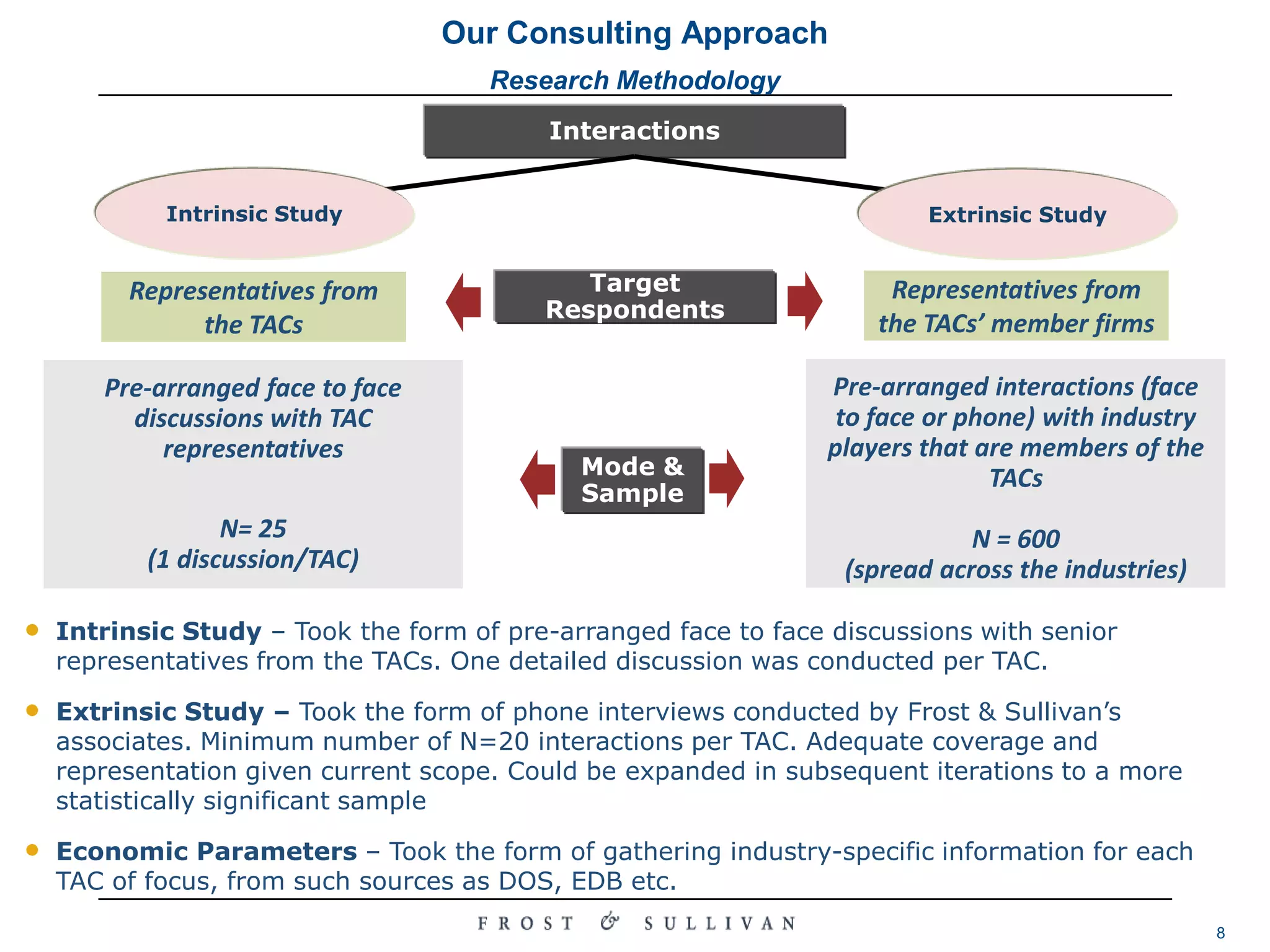

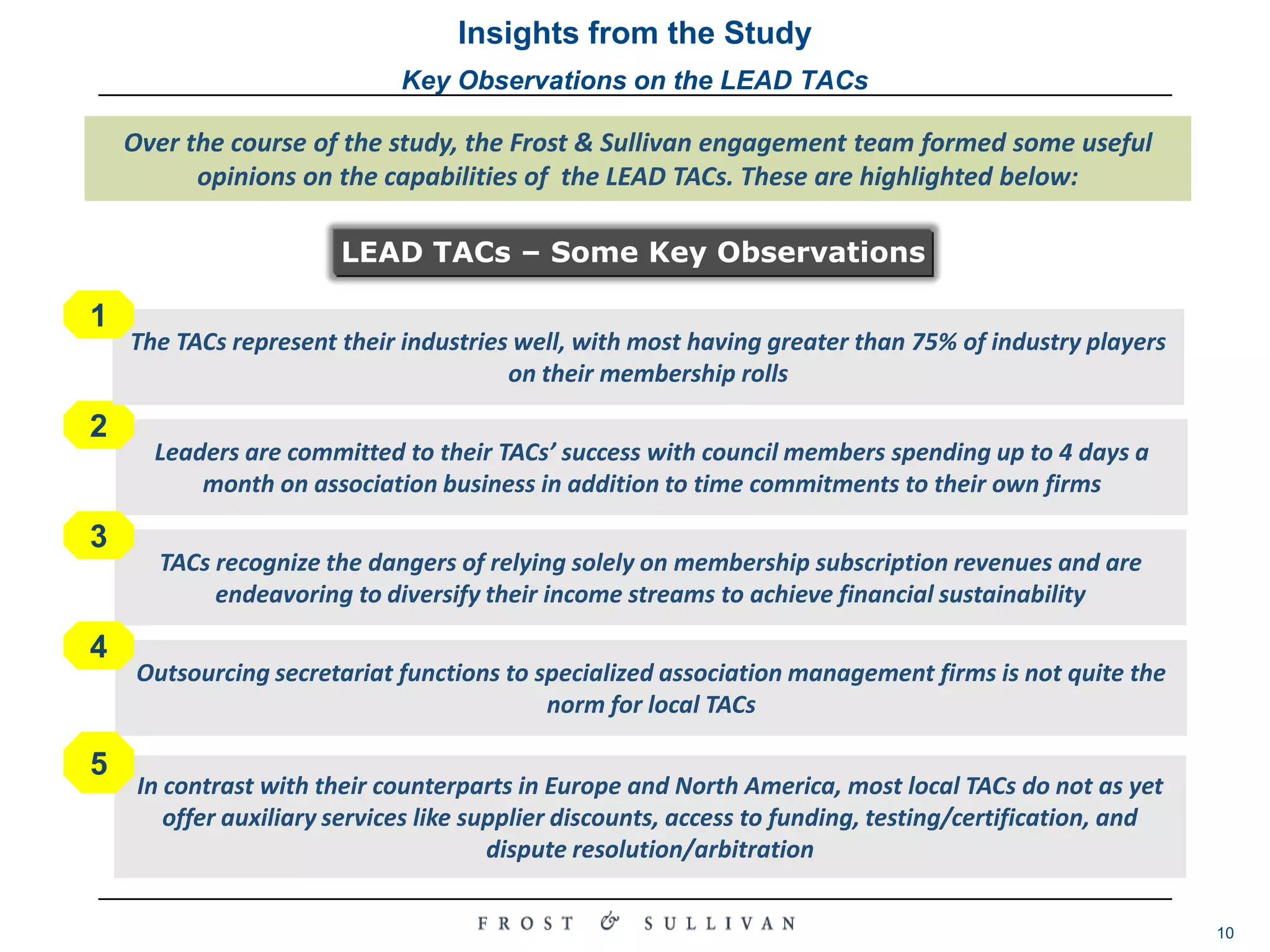

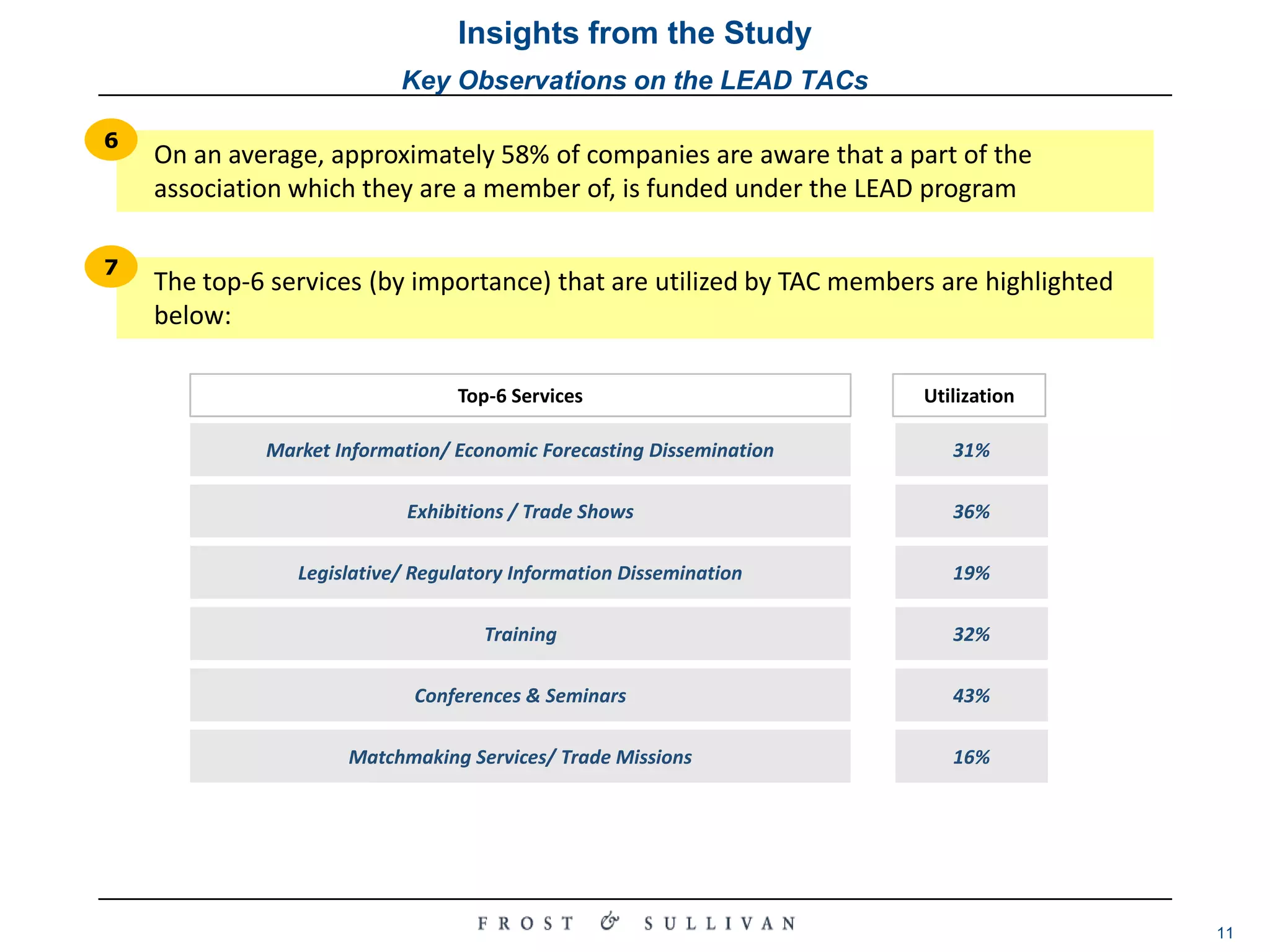

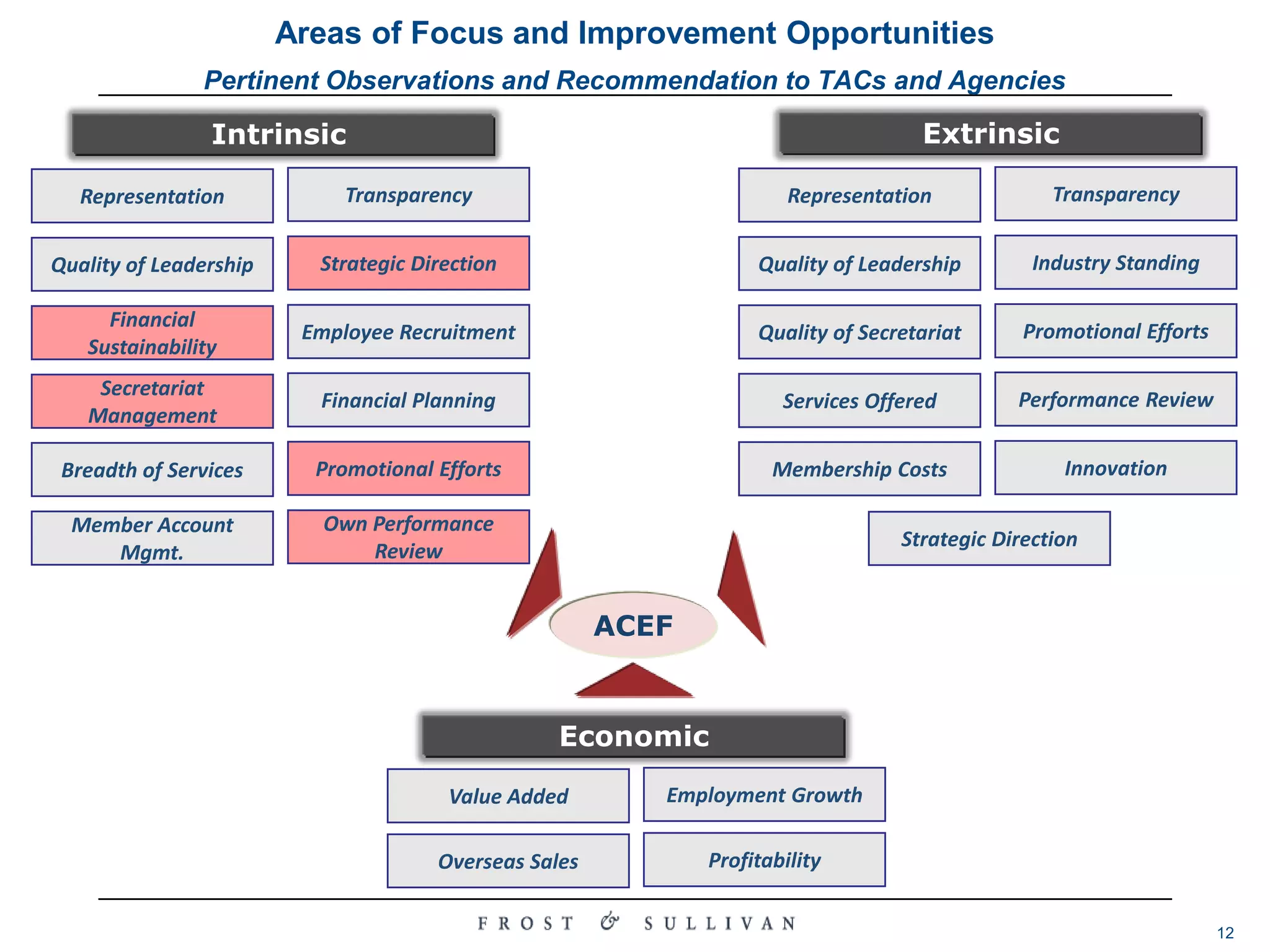

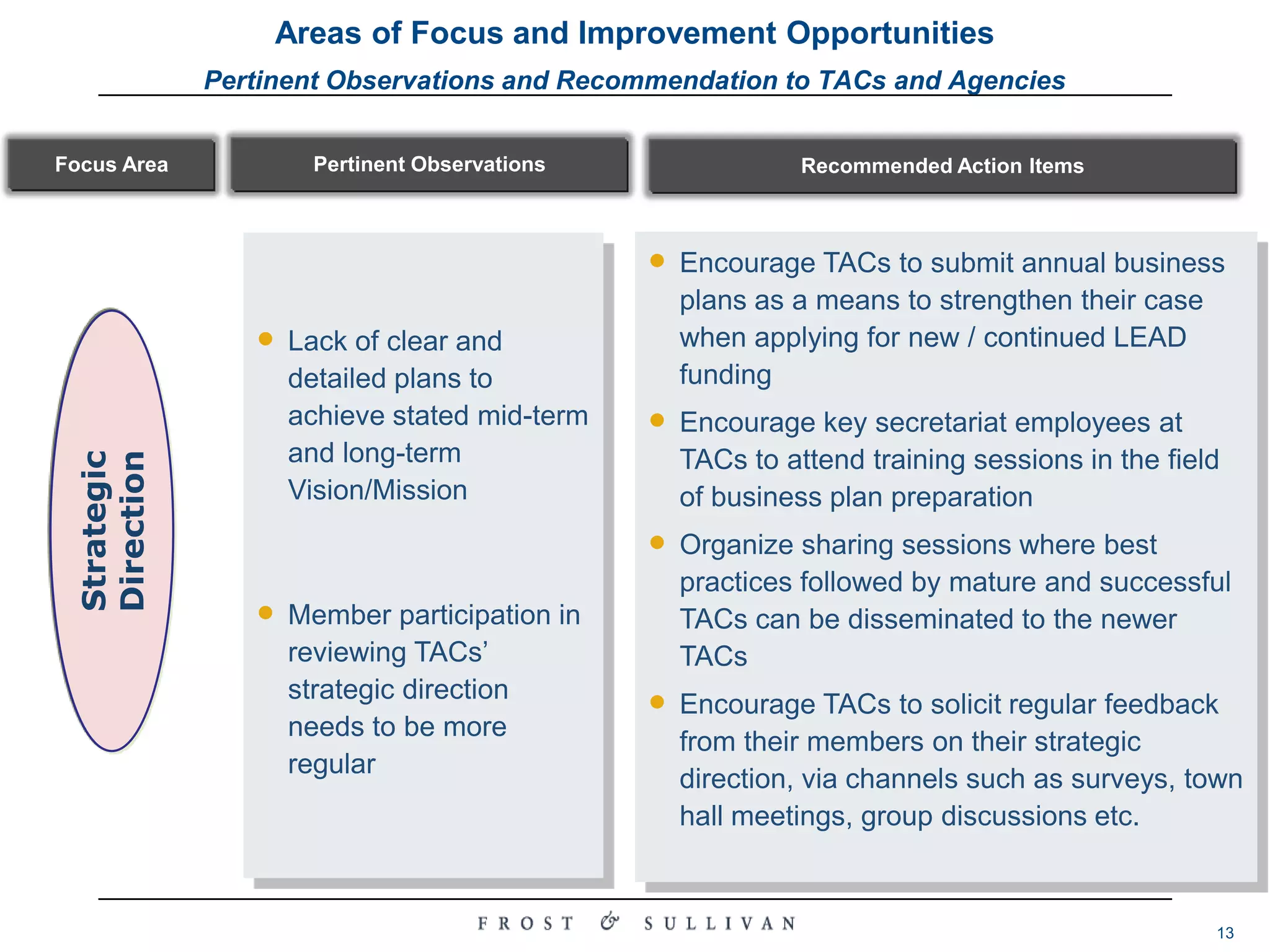

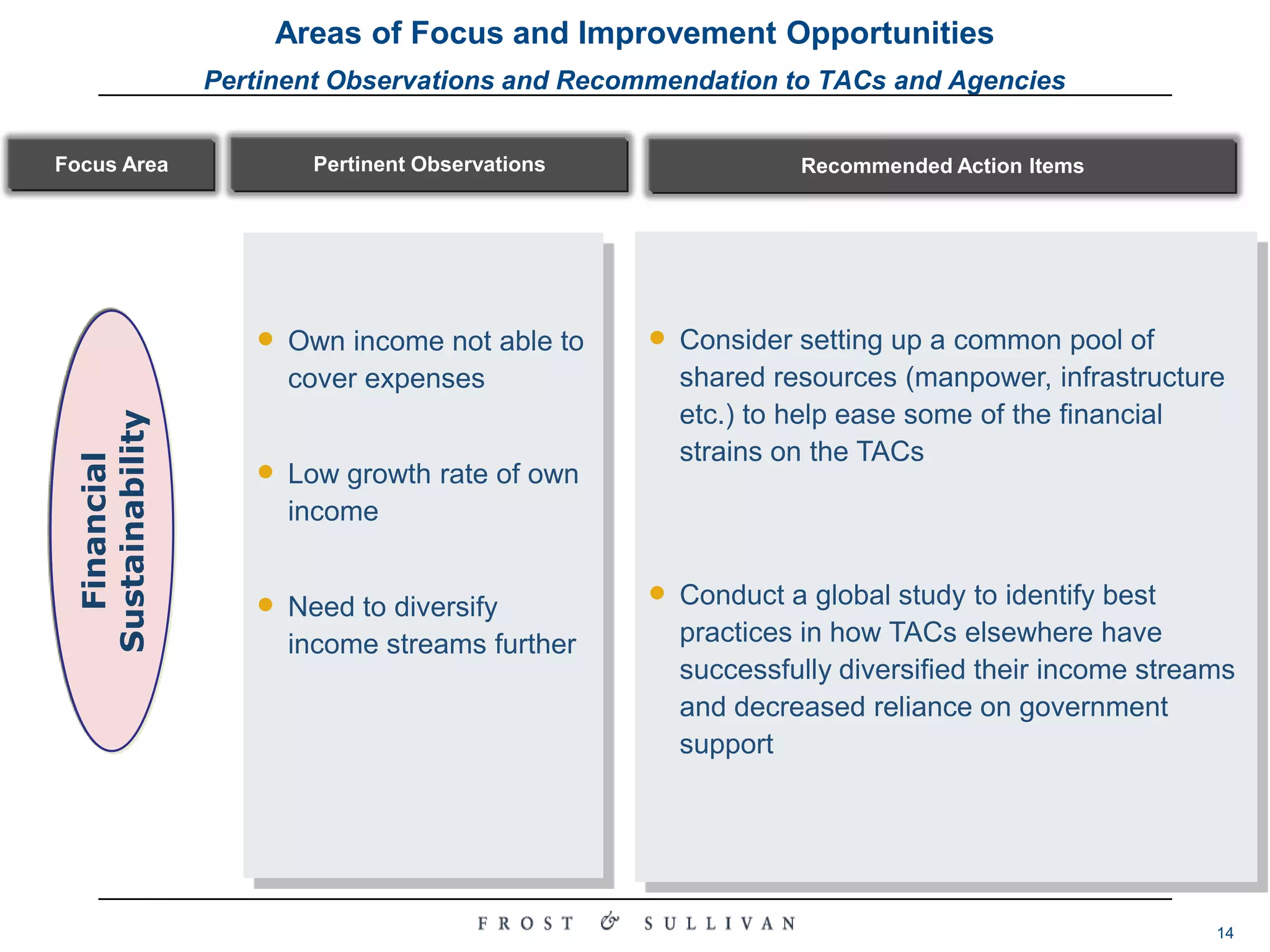

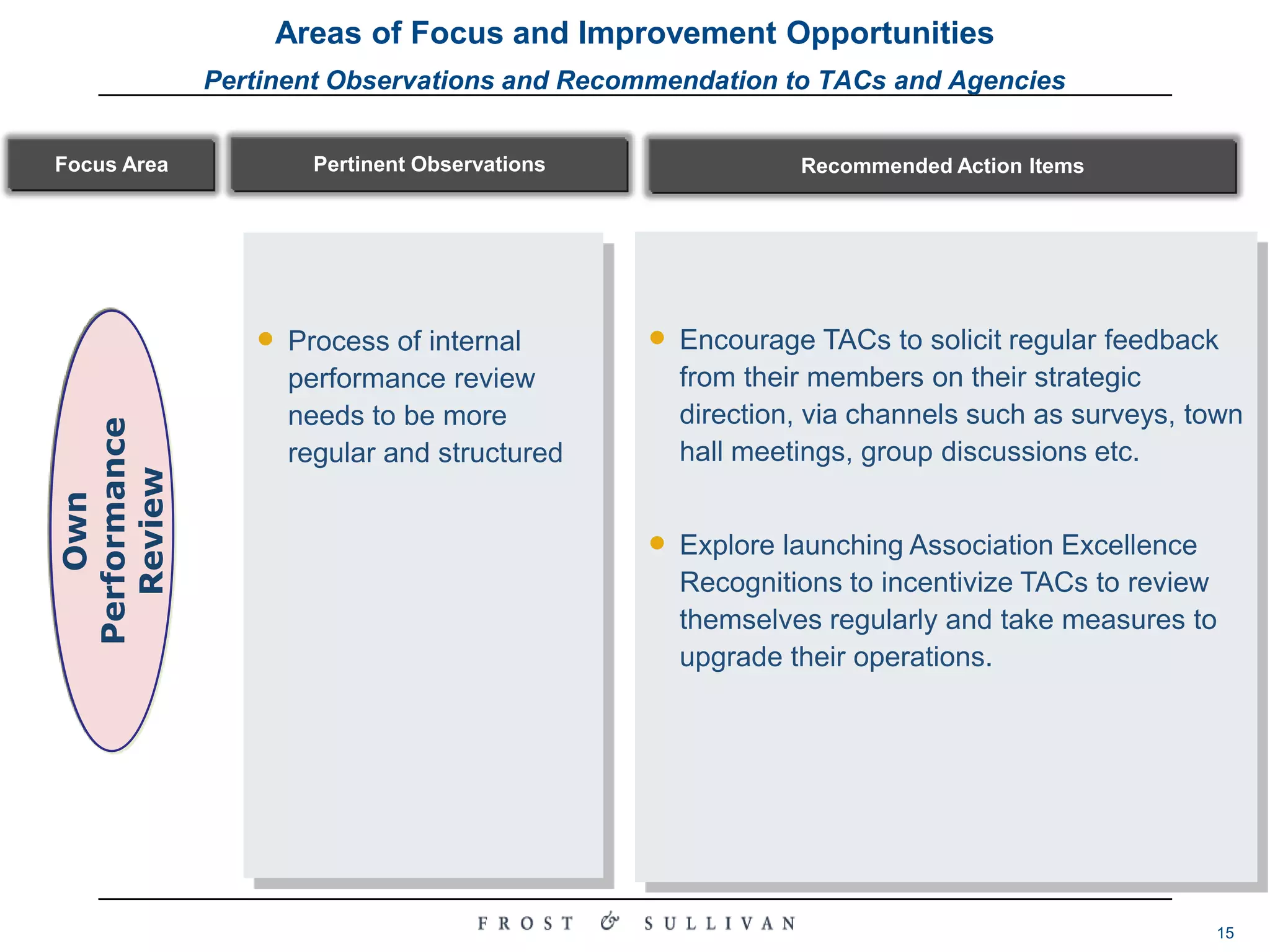

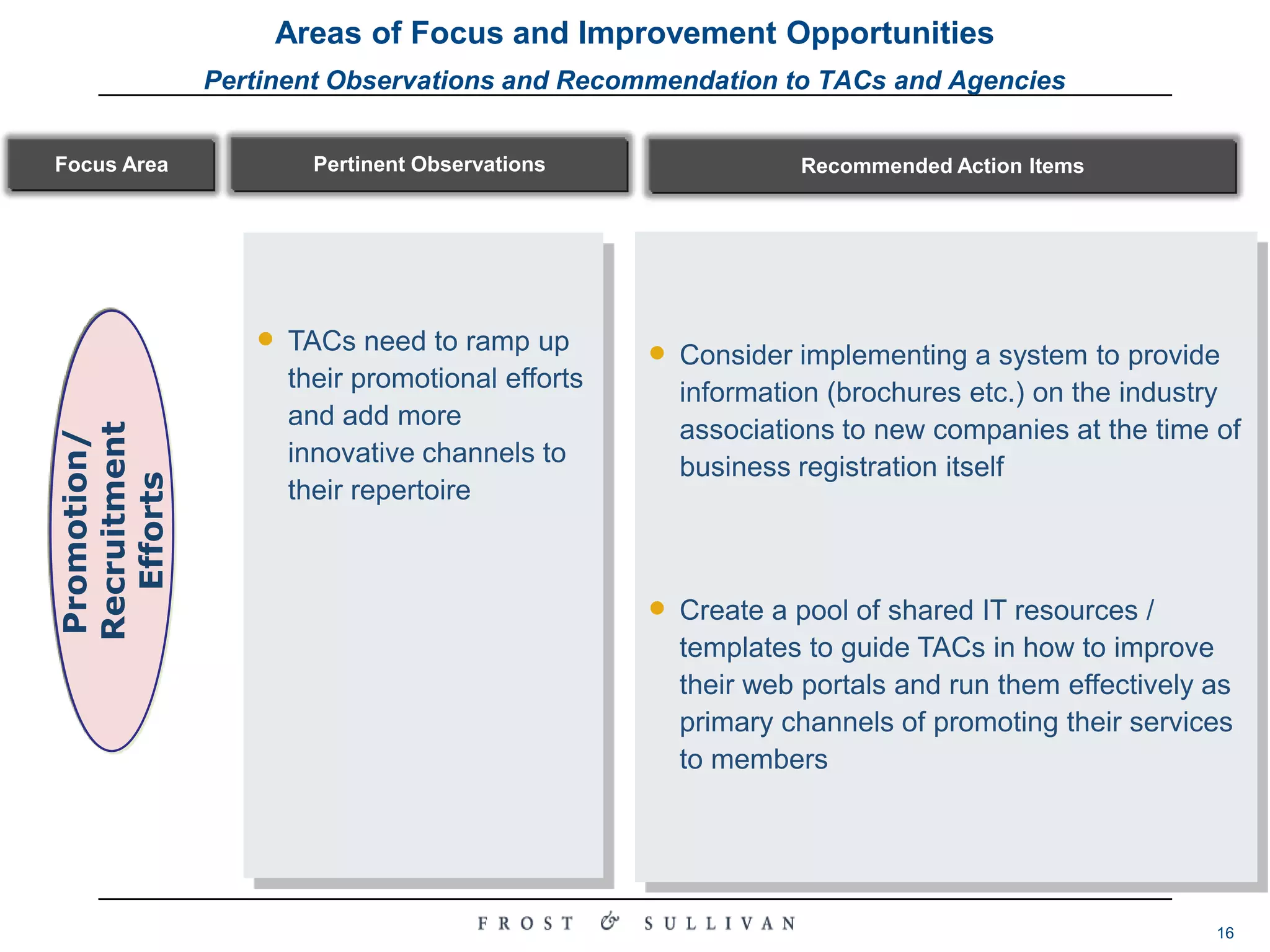

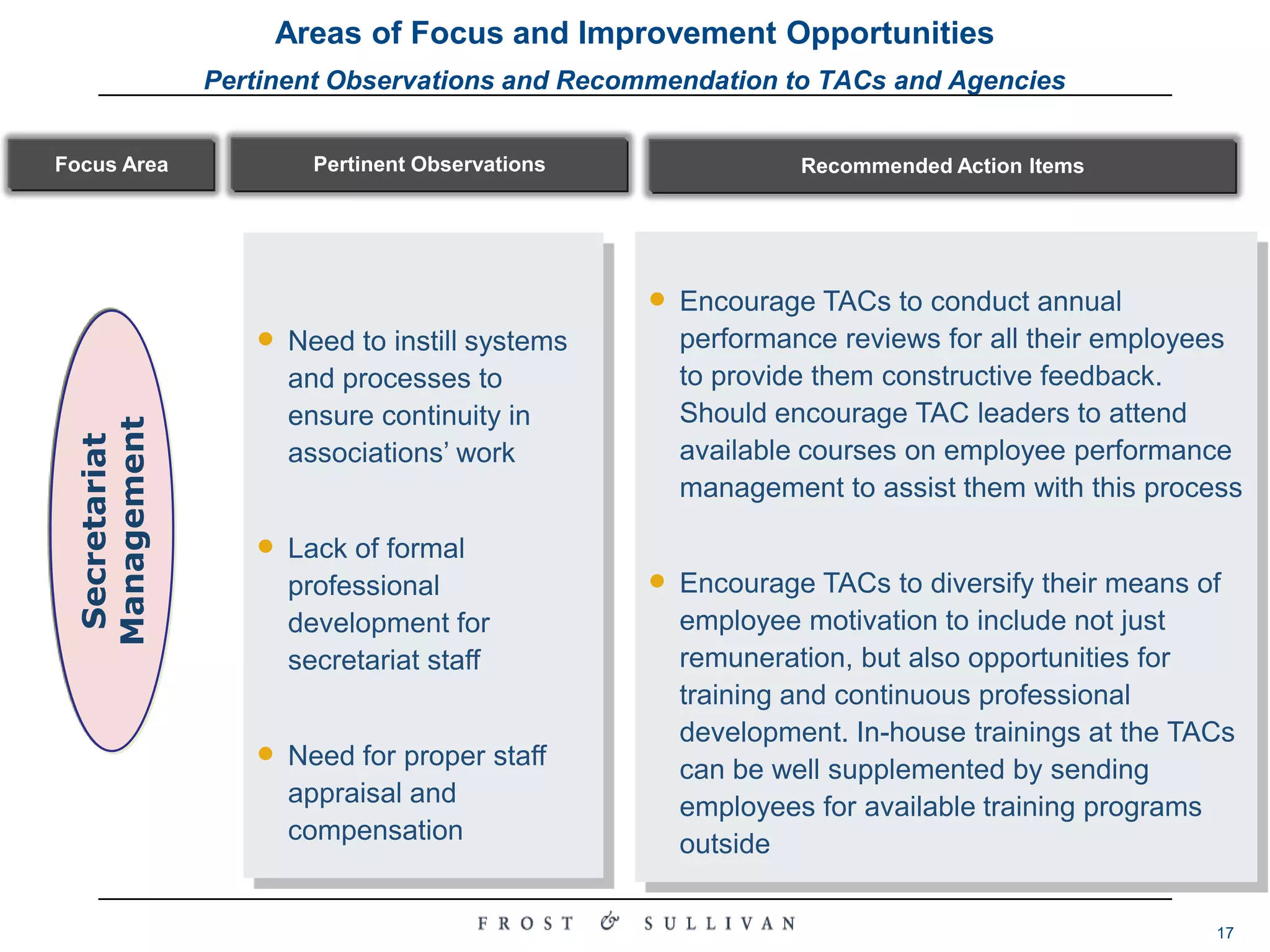

The document summarizes a study conducted on 25 Trade Associations and Chambers (TACs) under Singapore's LEAD Programme. The study aimed to develop an Association Capability Enhancement Framework (ACEF) to assess the TACs and identify areas for improvement. Key findings included that TAC leaders are committed but rely heavily on membership fees, secretariats are not often outsourced, and services could be expanded. Recommendations focused on improving strategic planning, financial sustainability through diversification, regular self-reviews, and better promotion of TACs to companies.