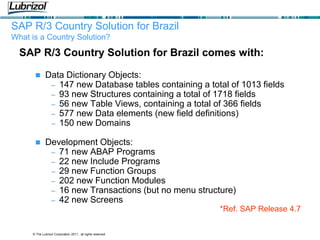

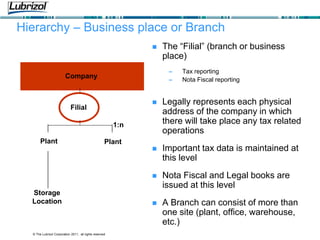

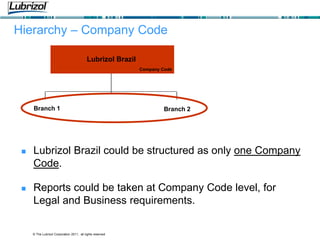

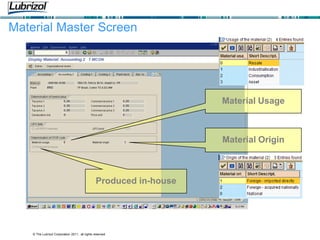

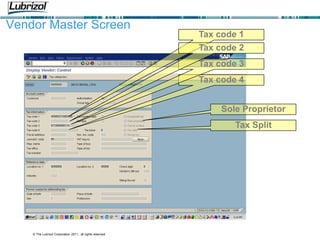

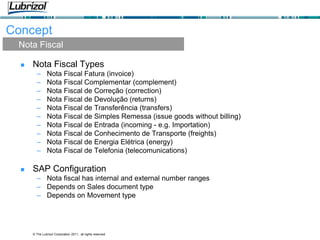

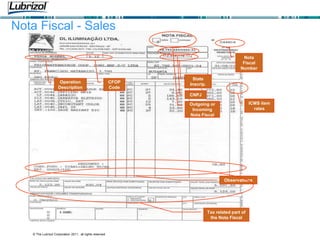

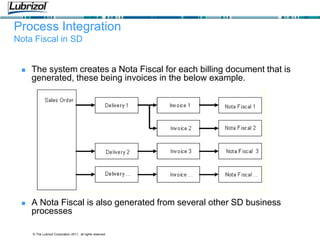

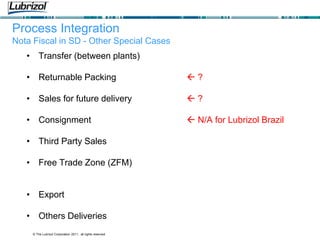

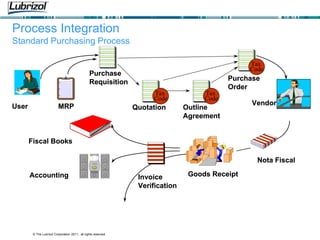

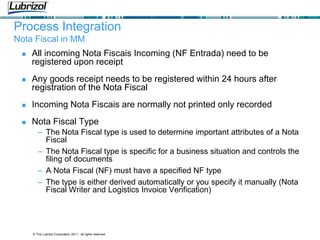

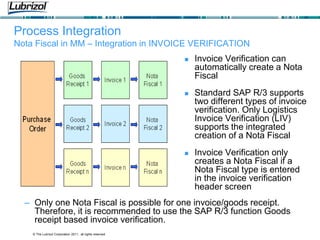

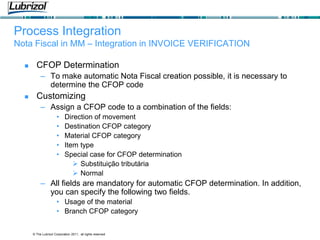

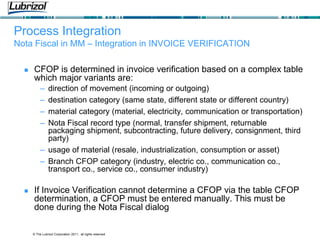

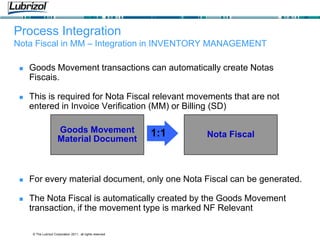

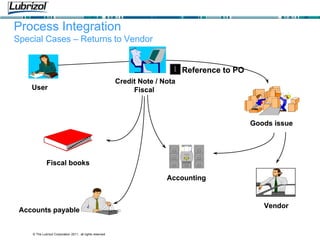

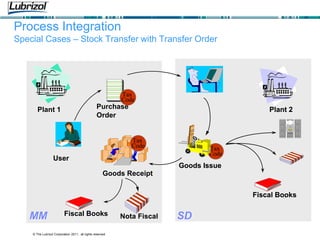

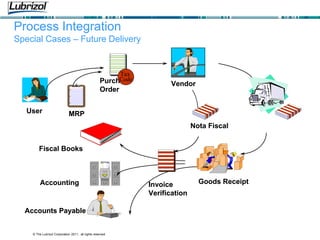

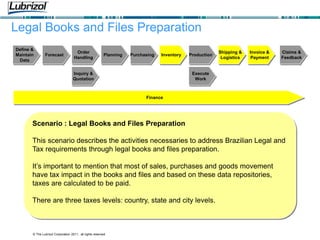

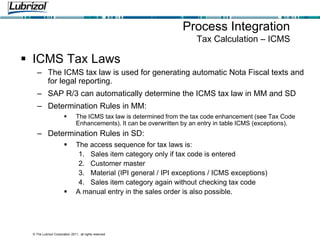

This document discusses the key elements required for an SAP R/3 implementation in Brazil. It covers the country solution provided by SAP for Brazil, including additional development objects, data, and customizing. It also describes Brazil-specific requirements in the areas of hierarchy, master data, taxes, Nota Fiscal documents, and tax reporting. The Nota Fiscal is the main fiscal/tax document in Brazil and impacts processes in sales, purchasing, inventory, and accounting. Taxes are levied on goods movements between branches rather than sales.