The document discusses the convergence of International Financial Reporting Standards (IFRS) and U.S. Generally Accepted Accounting Principles (GAAP), emphasizing the importance of global accounting standards and their consistency in application. It highlights the SEC's stance on IFRS adoption, investor perspectives, the regulatory challenges involved, and the importance of adequate funding and due process in standard-setting. Recent updates to IFRS and ongoing FASB meetings concerning revenue recognition are also mentioned.

![Analysis of the Conclusion of the

SEC Staff Report

Governance

The SEC staff note that the overall design of the governance structure

of the IFRS Foundation strikes a reasonable balance between

providing oversight of the IASB and recognising and supporting its

independence. In addition, while the IASB’s objectivity could be

threatened by outside political influence, such tension is not unique to

the IASB.

[The IFRS Foundation] believes that the heterogeneous nature of the

IFRS community, the internationally and professionally diverse

composition of the IASB and the creation of the Monitoring Board all

help to dilute undue pressure from any one jurisdiction or special

interest group. Nevertheless, the IFRS Foundation and the IASB will

always have to be vigilant in protecting the independence of accounting

standard-setting.

10](https://image.slidesharecdn.com/ifrsandotherinternationaldevelopments2013-130620150848-phpapp01/85/IFRS-and-Other-International-Developments-2013-10-320.jpg)

![Analysis of the Conclusion of the SEC

Staff Report (continued)

Due Process

The SEC Staff:

(a) observes that the IASB’s due process is heavily based on consultation and

gathering of facts and views, open deliberations, analysis, and the explanation

of its decisions to the public;

(b) notes that IASB members’ deliberations involve extensive debate and

analysis; and

(c) believes that IASB members decide on the resolution of issues on projects

on the basis of their technical merits and overall usefulness for investors and

other users of financial statements.

[The IFRS Foundation] welcomes the SEC staff’s comments. Furthermore, during

2012 the IASB has been working with the Trustees to further enhance its

reporting, accountability and due process requirements. As a result of these

enhancements, the IASB is required to report throughout the life of each technical

project on the steps that it has taken to protect the integrity of its technical

decisions.

12](https://image.slidesharecdn.com/ifrsandotherinternationaldevelopments2013-130620150848-phpapp01/85/IFRS-and-Other-International-Developments-2013-12-320.jpg)

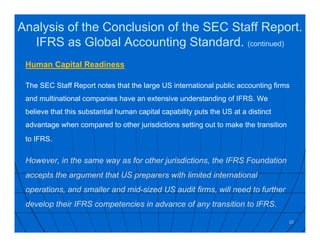

![Analysis of the Conclusion of the SEC Staff

Report. IFRS as Global Accounting Standard.

Comprehensiveness

Remaining differences between US GAAP and IFRS

[The IFRS Foundation] notes that, as a result of more than ten years of

joint work with the FASB to improve IFRS and US GAAP and bring about

their convergence, the differences that the US will have to bridge are

significantly smaller in scope than the differences faced by other major

countries that have already adopted IFRS.

14](https://image.slidesharecdn.com/ifrsandotherinternationaldevelopments2013-130620150848-phpapp01/85/IFRS-and-Other-International-Developments-2013-14-320.jpg)

![Analysis of the Conclusion of the SEC Staff Report.

IFRS as Global Accounting Standard. (continued)

Maintenance

The SEC Staff Report notes observations from outreach conducted by SEC staff

that the Interpretations Committee should do more to address issues on a timely

basis.

[The IFRS Foundation] agrees that the Interpretations Committee should be more

active in providing Interpretations.

In May 2012 the Trustees published the recommendations of a further review of

the efficiency and effectiveness of the Interpretations Committee. This review

recommended that the Interpretations Committee should:

(a) develop a broader range of ‘tools’ to be deployed by the Interpretations

Committee, enabling it to be more responsive to requests for assistance;

(b) revise the criteria used to determine which issues the Interpretations

Committee should take action on;

(c) improve the Interpretations Committee’s communications regarding issues

that it decides not to address; and

(d) expand the Interpretations Committee’s outreach and the transparency

surrounding its decisions.

The recommendations of the review have been now been implemented in full. 15](https://image.slidesharecdn.com/ifrsandotherinternationaldevelopments2013-130620150848-phpapp01/85/IFRS-and-Other-International-Developments-2013-15-320.jpg)

![National Standard-Setters

The SEC Staff Report:

(a) recognises the procedures that the IASB has in place for working with

national standard-setters, as well as the high levels of interaction with

national standard-setters on a bilateral basis; and

(b) recommends that the IASB should extend its involvement with national

standard-setters in several processes, such as during the development of

a new Standard, outreach activities and Post-implementation Reviews.

16

The IASB already has strong and effective relationships with national and

regional accounting standard-setting bodies through a combination of

bilateral, multi-lateral and informal arrangements. However, [The IFRS

Foundation] agrees that these relationships could be strengthened further by

formalising such networks and organising them on a regional and global

basis. This was an important recommendation of the Trustees’ Strategy

Review.

Analysis of the Conclusion of the SEC Staff Report.

IFRS as Global Accounting Standard. (continued)](https://image.slidesharecdn.com/ifrsandotherinternationaldevelopments2013-130620150848-phpapp01/85/IFRS-and-Other-International-Developments-2013-16-320.jpg)

![Enforceability

The SEC Staff Report notes the importance of achieving greater

consistency in the enforcement of IFRS if the benefits of a single set of

global accounting standards are to be fully realised.

[The IFRS Foundation] agrees with this conclusion.

17

Analysis of the Conclusion of the SEC Staff Report.

IFRS as Global Accounting Standard. (continued)](https://image.slidesharecdn.com/ifrsandotherinternationaldevelopments2013-130620150848-phpapp01/85/IFRS-and-Other-International-Developments-2013-17-320.jpg)

![Issues Related to Adoption, Endorsement and Transition

The SEC Staff Report discusses various issues related to incorporating

IFRS into US GAAP. Many of these issues are specific to the US and can

only be addressed by US authorities in the environment in which they

operate.

The IFRS Foundation staff is not in a position to give definitive answers or

suggestions to the observations made by the SEC staff. Instead, in this

chapter we [IFRS Foundation] refer extensively to the way in which many

IFRS jurisdictions have dealt with different issues while adopting IFRS.

While it is true that every jurisdiction has its unique challenges, and this

will certainly be the case in the biggest national capital market in the world,

we believe this international experience provides a useful backdrop for

analysis.

18

Analysis of the Conclusion of the SEC Staff Report.

IFRS as Global Accounting Standard. (continued)](https://image.slidesharecdn.com/ifrsandotherinternationaldevelopments2013-130620150848-phpapp01/85/IFRS-and-Other-International-Developments-2013-18-320.jpg)

![Transition Arrangements

The SEC Staff Report notes that:

(a) some commentators were opposed to a ‘big bang’ method of

transition, favouring instead a more gradual transition to IFRS; and

(b) indirect methods of incorporation could lessen the total costs

required while extending any timeframe for incorporation.

20

[The IFRS Foundation] note that it is for individual jurisdictions to determine

the most appropriate method to adopt IFRS.

Analysis of the Conclusion of the SEC Staff Report.

IFRS as Global Accounting Standard. (continued)](https://image.slidesharecdn.com/ifrsandotherinternationaldevelopments2013-130620150848-phpapp01/85/IFRS-and-Other-International-Developments-2013-20-320.jpg)

![Regulatory Environment

The SEC Staff Report notes that adopting IFRS can present challenges to

the regulatory environment.

[The IFRS Foundation] agrees with the SEC that these challenges should

not be underestimated. Our analysis of other major jurisdictions that have

already adopted IFRS suggest that adaptations in the regulatory

environment can indeed be challenging, but they can be overcome.

22

Analysis of the Conclusion of the SEC Staff Report.

IFRS as Global Accounting Standard. (continued)](https://image.slidesharecdn.com/ifrsandotherinternationaldevelopments2013-130620150848-phpapp01/85/IFRS-and-Other-International-Developments-2013-22-320.jpg)