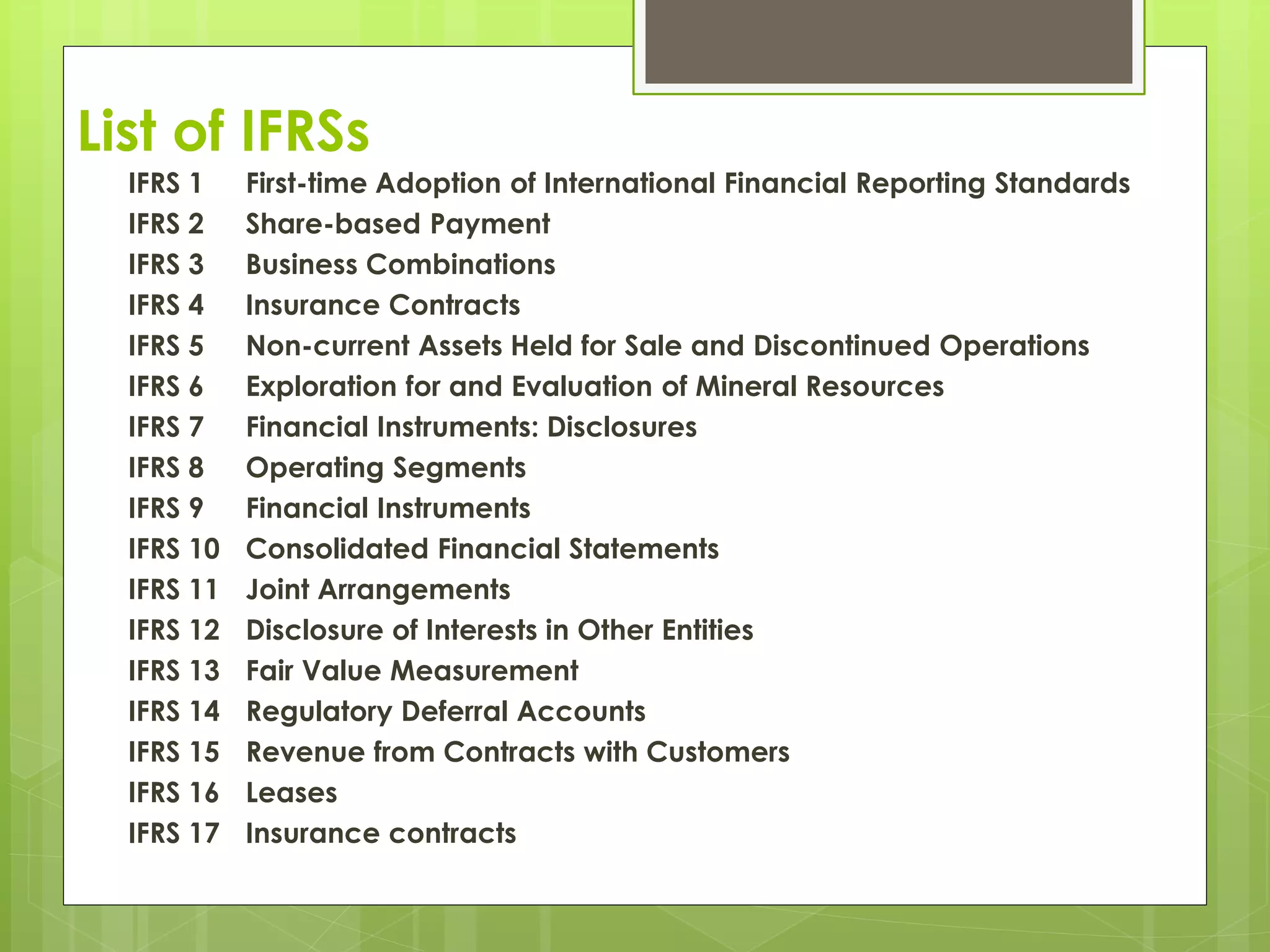

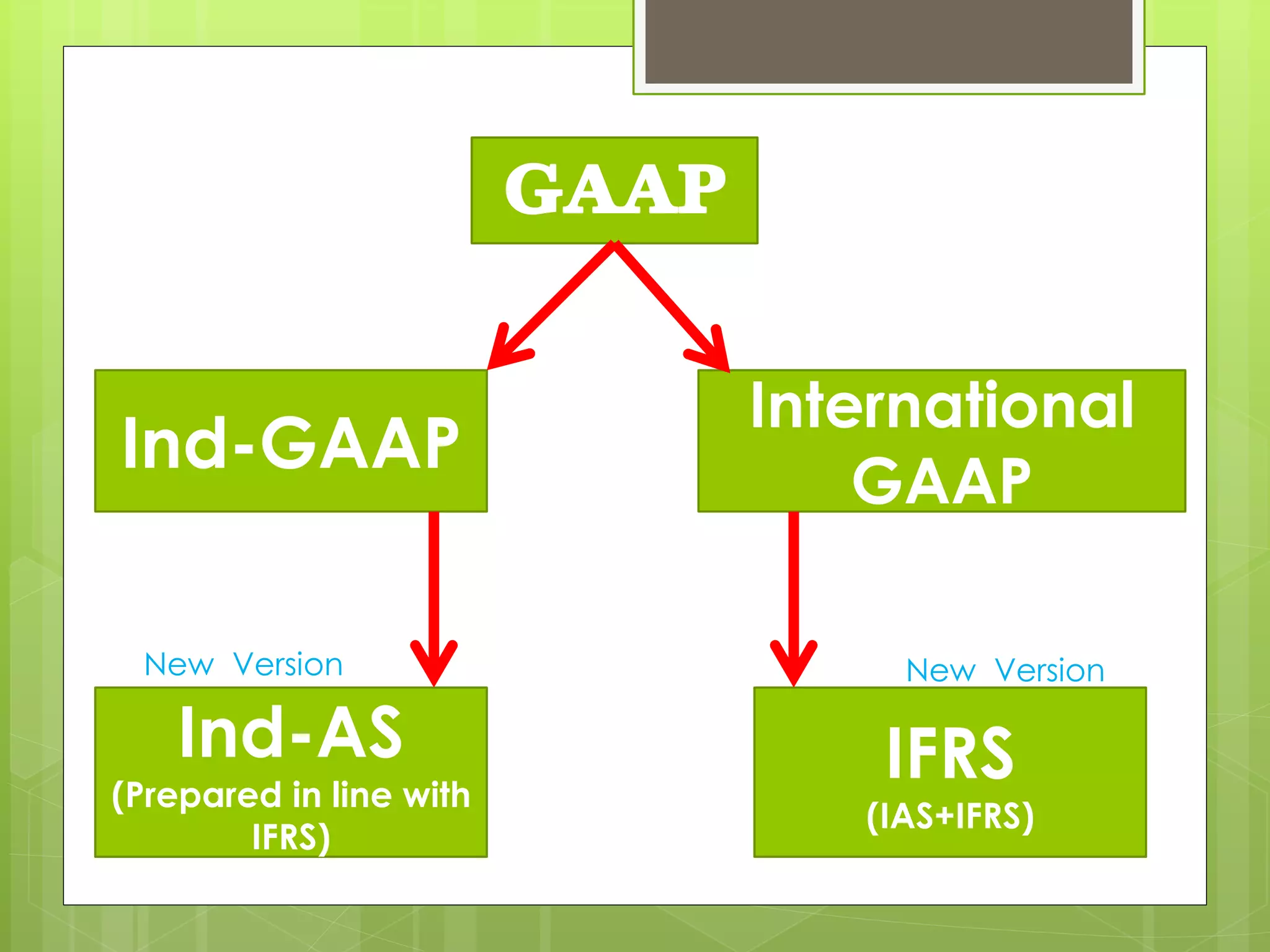

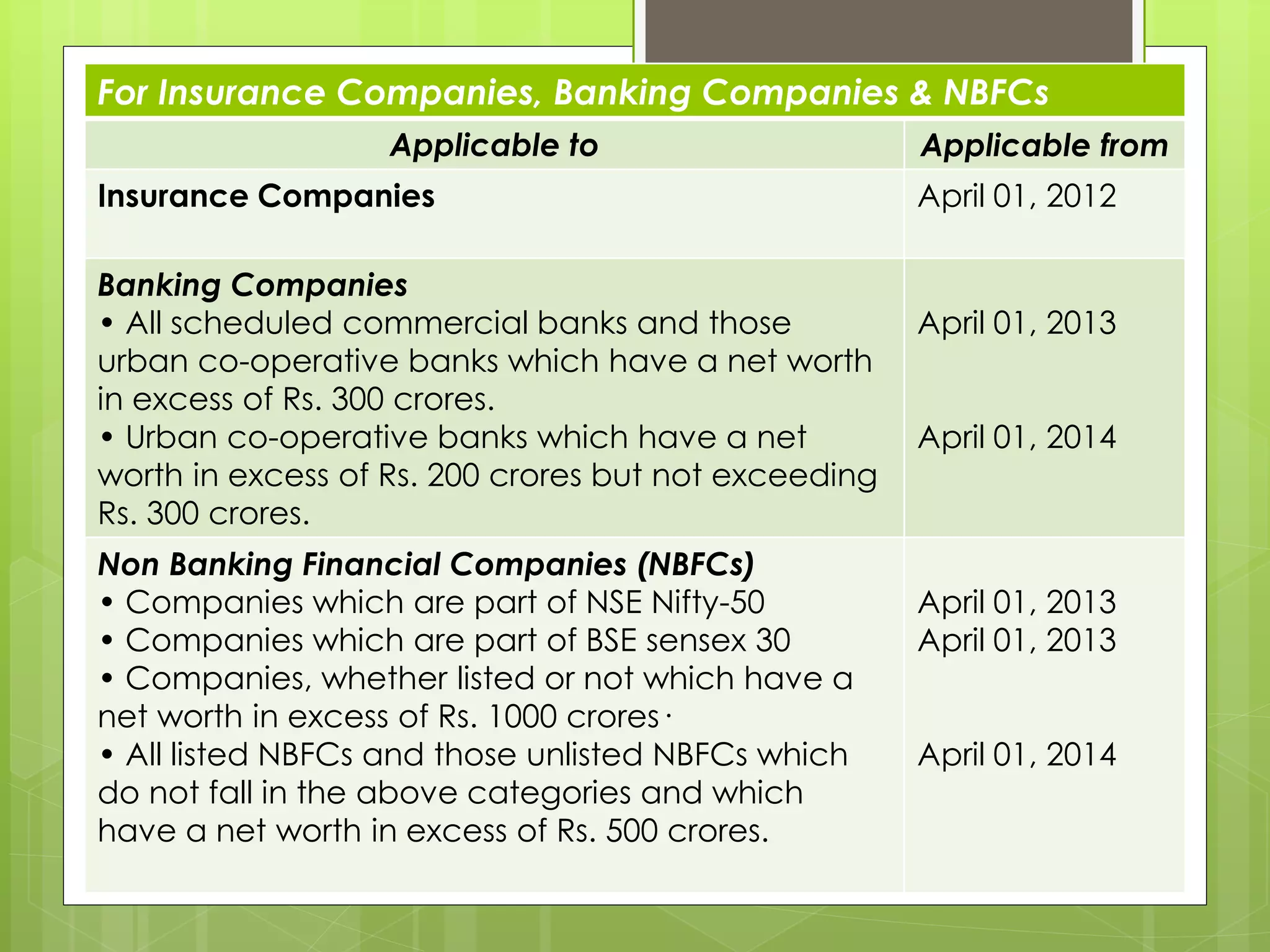

The document provides an overview of International Financial Reporting Standards (IFRS), detailing its origin, governance structure, and various standards. It discusses the benefits of convergence between national accounting standards and IFRS, including enhancing transparency and enabling access to global capital markets. Additionally, it highlights challenges in implementing IFRS within India and provides insights through a case study of Wipro Limited's financial statements under Indian GAAP and IFRS.