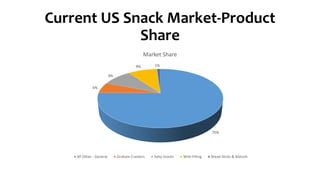

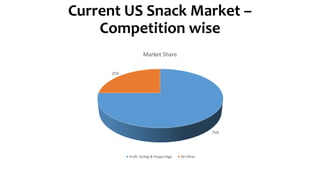

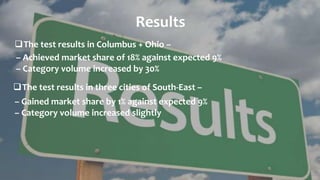

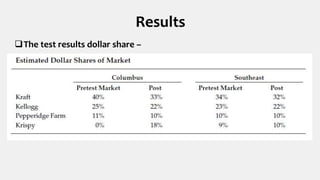

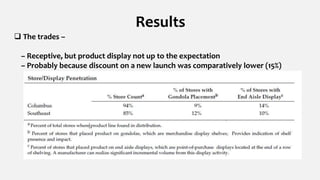

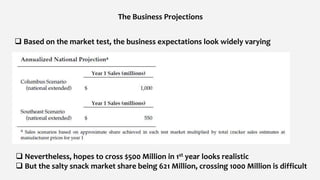

Pemberton Products, a $18 billion snack food company, plans to enter the salty snack market. It acquired Krispy, a regional salty snack brand, but Krispy failed to meet sales goals. Pemberton will re-launch Krispy as Krispy Natural with improved taste, packaging, and flavors. A 16-week market test in Ohio and Southeast cities showed Krispy Natural gained 18% market share in Ohio but only 1% in Southeast cities. Based on the successful Ohio test, Pemberton believes it can achieve $500 million in first year sales for Krispy Natural with a national rollout, but capturing over half of the $621 million salty snack market may be difficult.