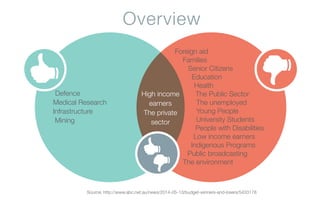

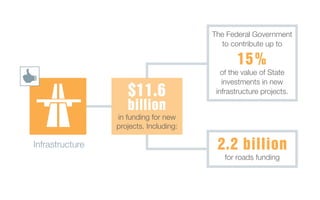

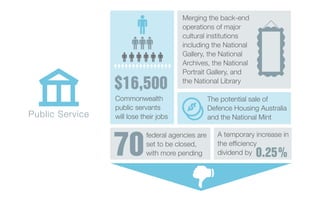

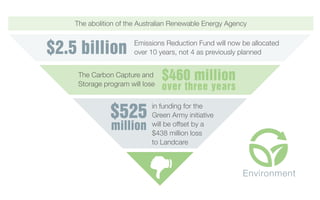

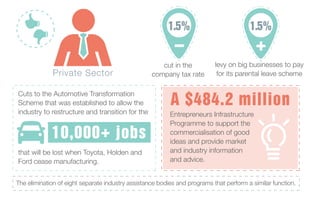

The 2014 federal budget aims for long-term economic recovery, affecting various sectors with approaches to cut spending on welfare, health, and education. It emphasizes infrastructure investment and support for medical research while reducing funding for certain programs, including cuts to industry assistance bodies. Businesses are encouraged to optimize operations and reduce costs in light of potential higher expenses from fuel and other resources.