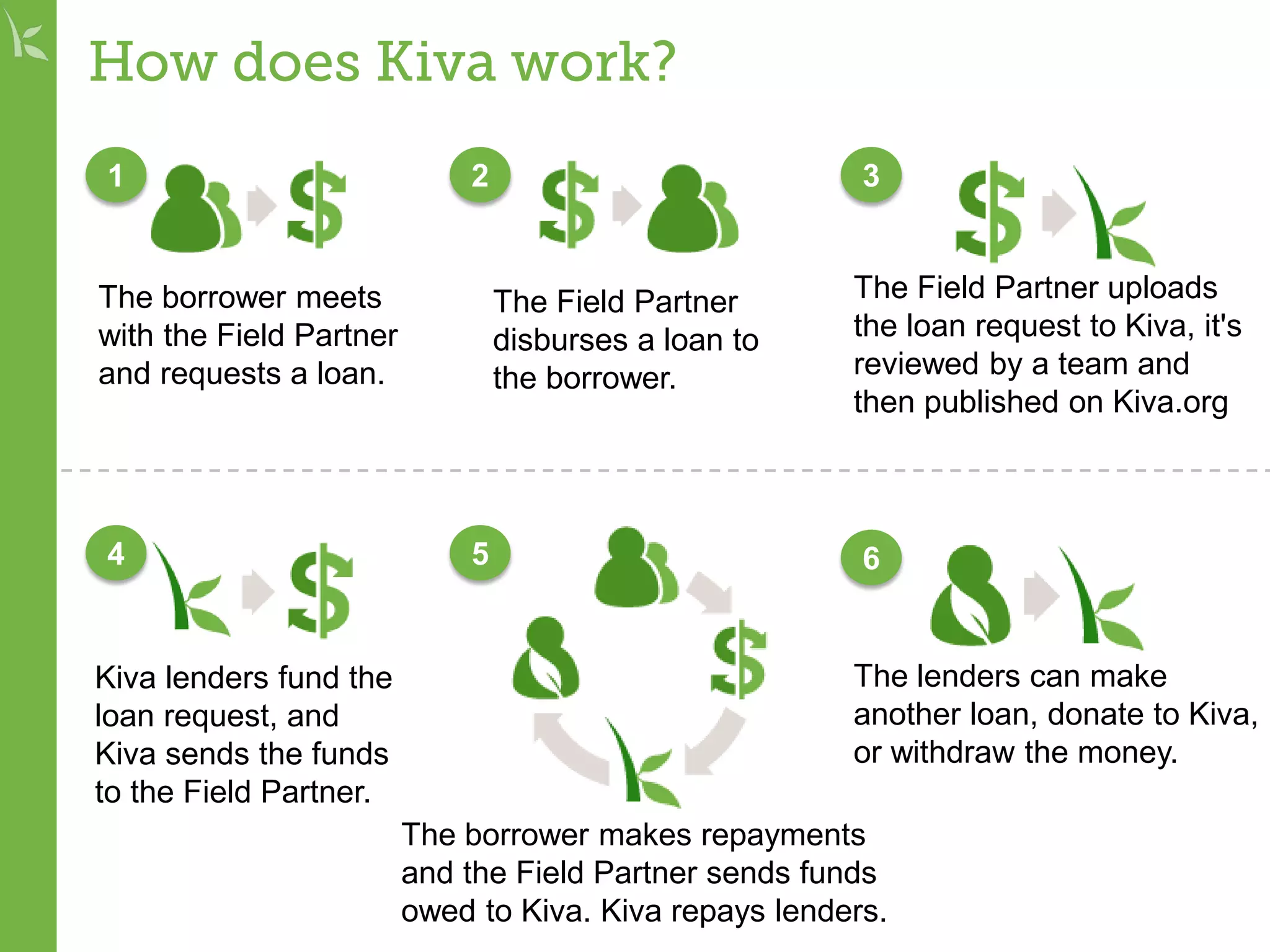

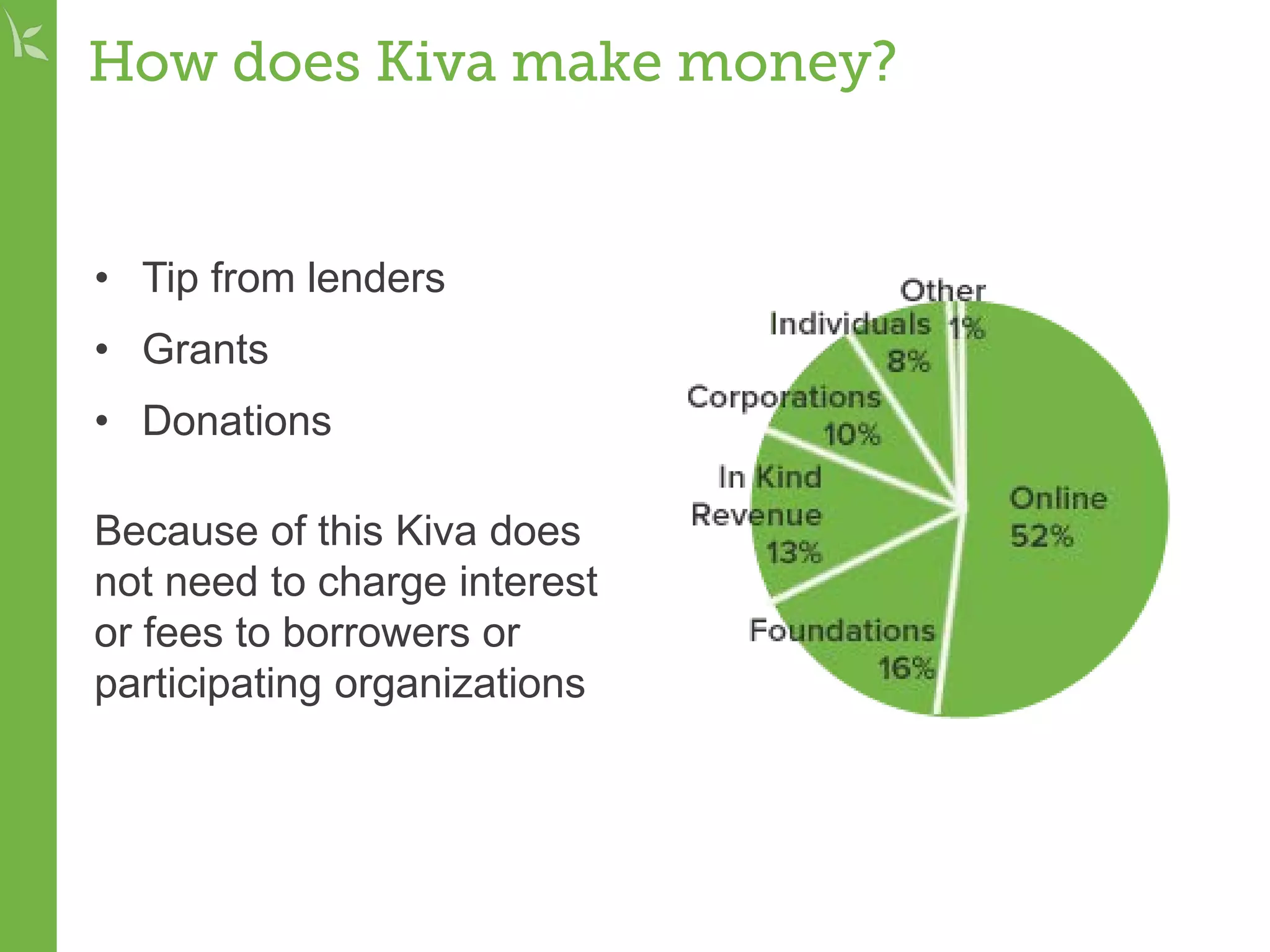

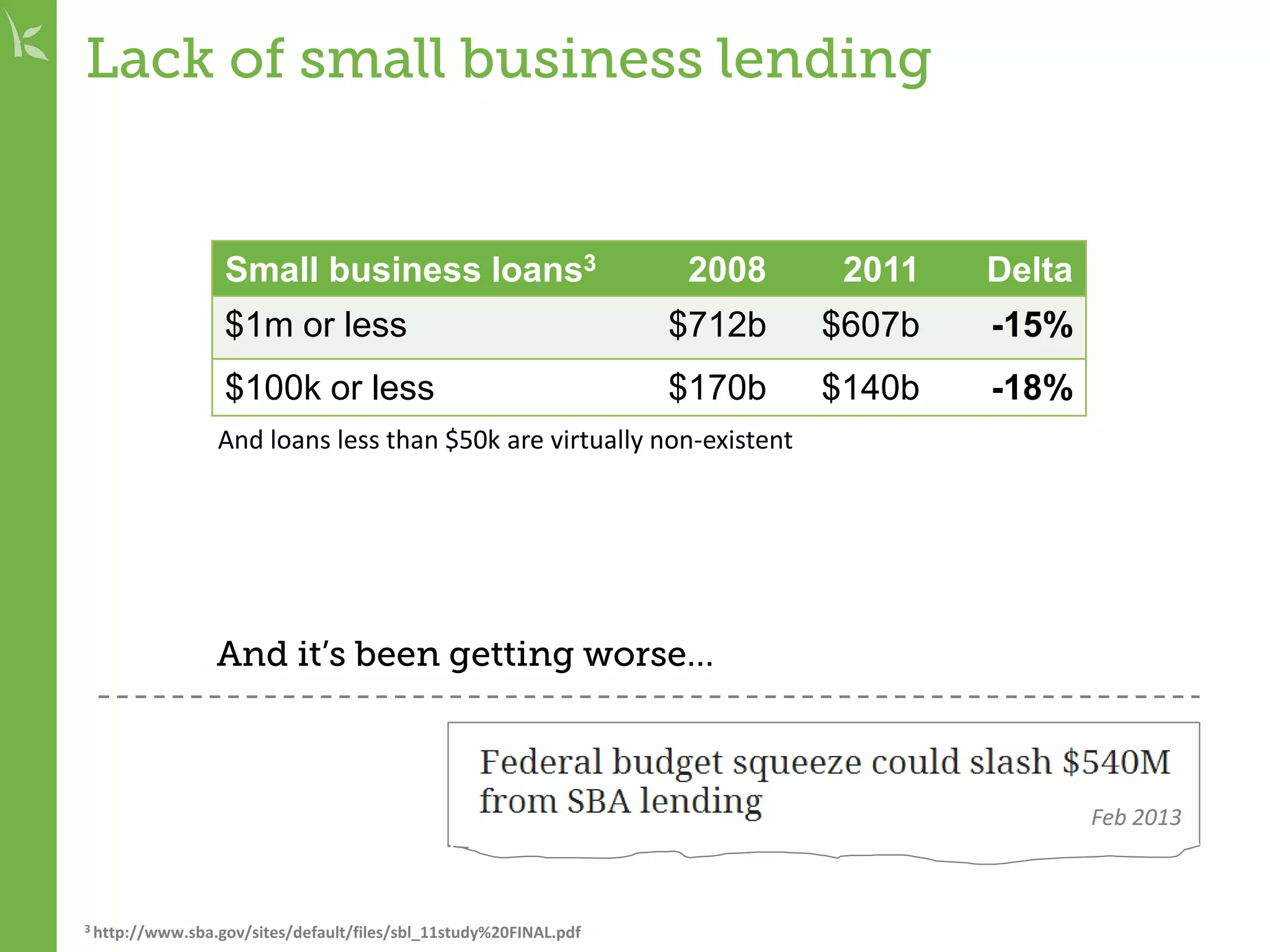

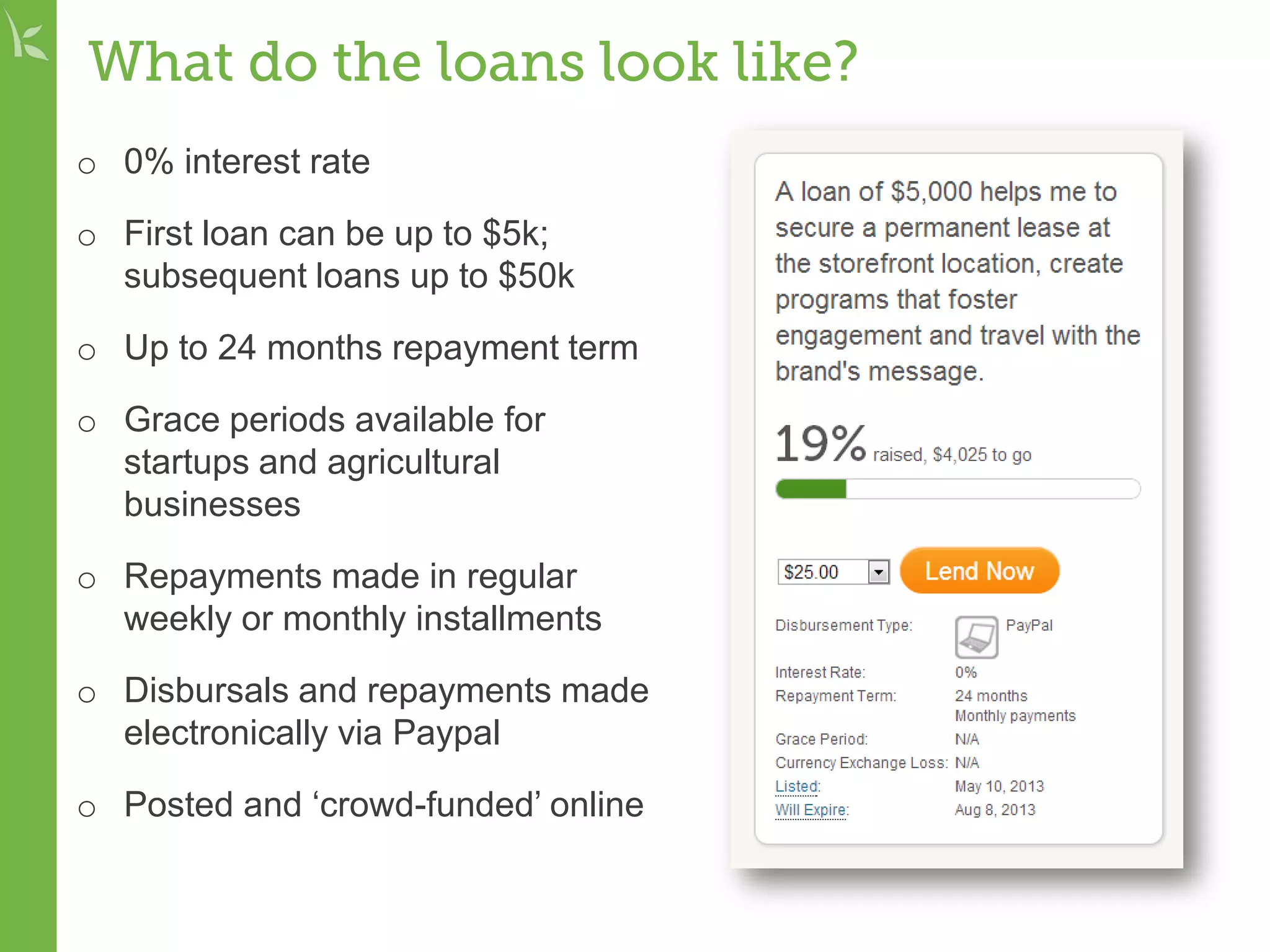

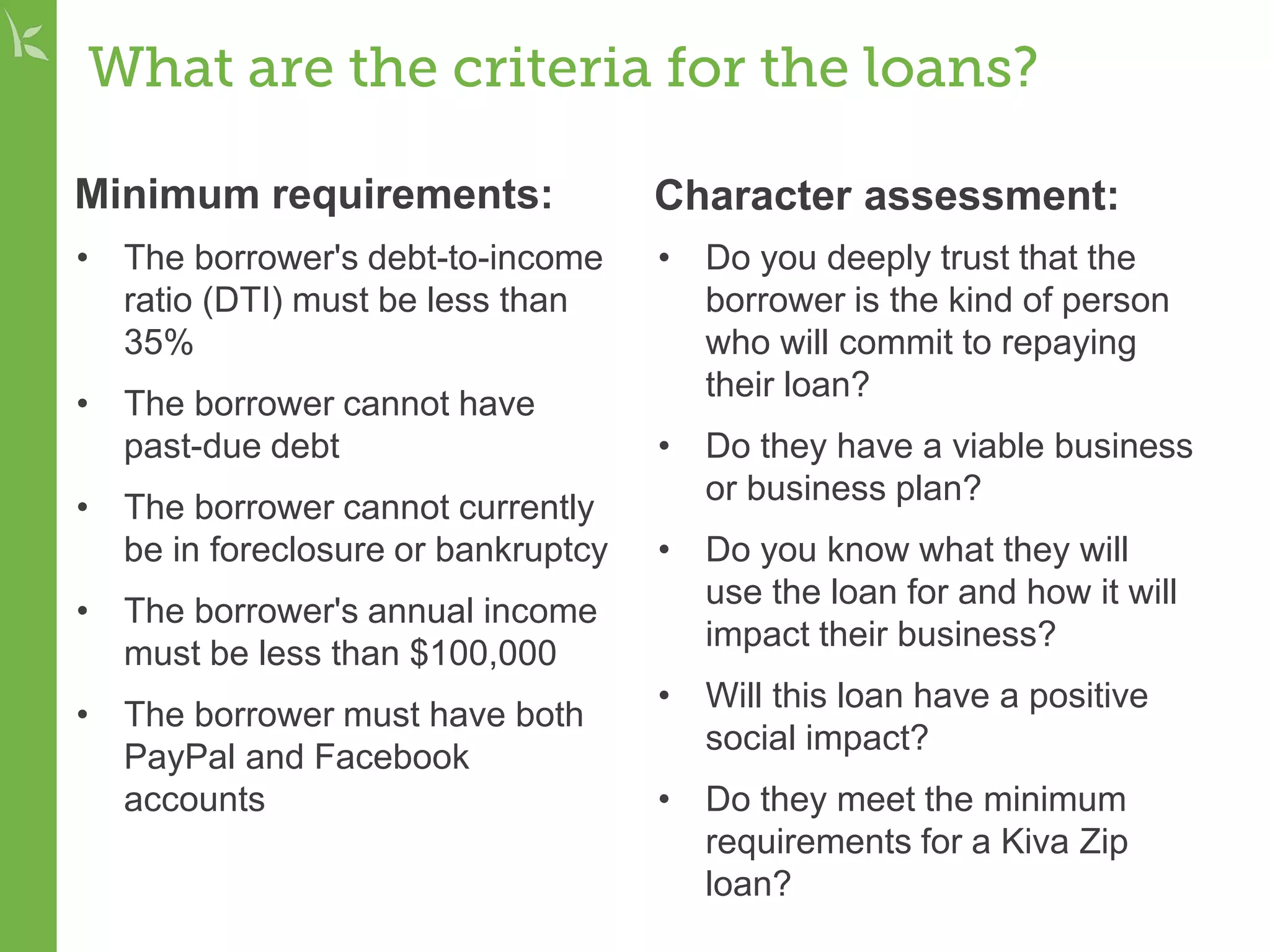

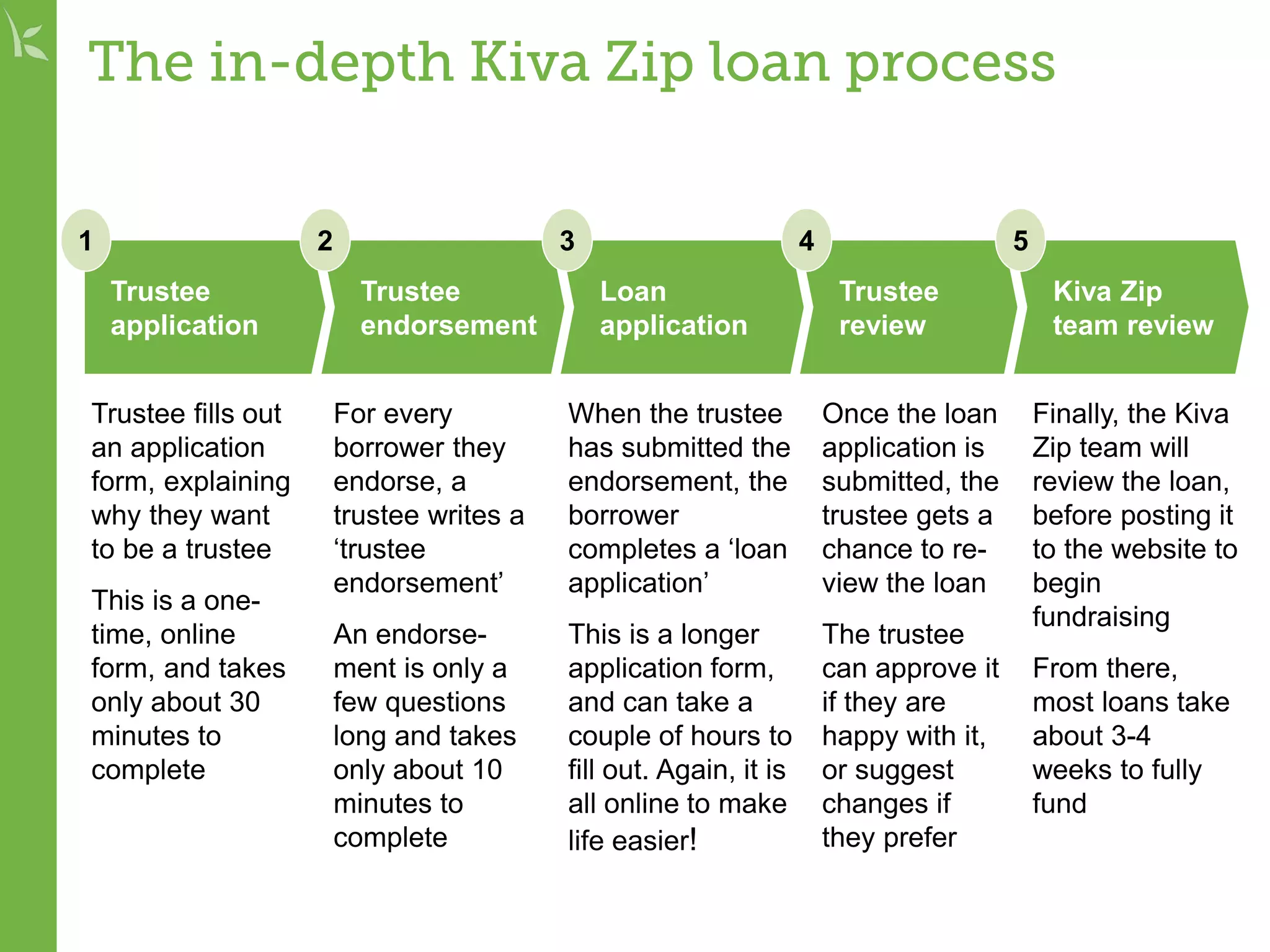

Kiva is a nonprofit organization that connects lenders to borrowers around the world to alleviate poverty through microloans. Kiva Zip allows individuals in the US to access small business loans of up to $5,000 through a network of trustees who review applications and endorse borrowers. Trustees can be individuals who know a borrower for 6+ months or organizations providing business support. Borrowers and lenders interact through an online platform, with loans as small as $25 funding within 3-4 weeks. Early results show over 200 loans posted, 120 trustees in 35 states, and an 86% repayment rate building local communities of support.