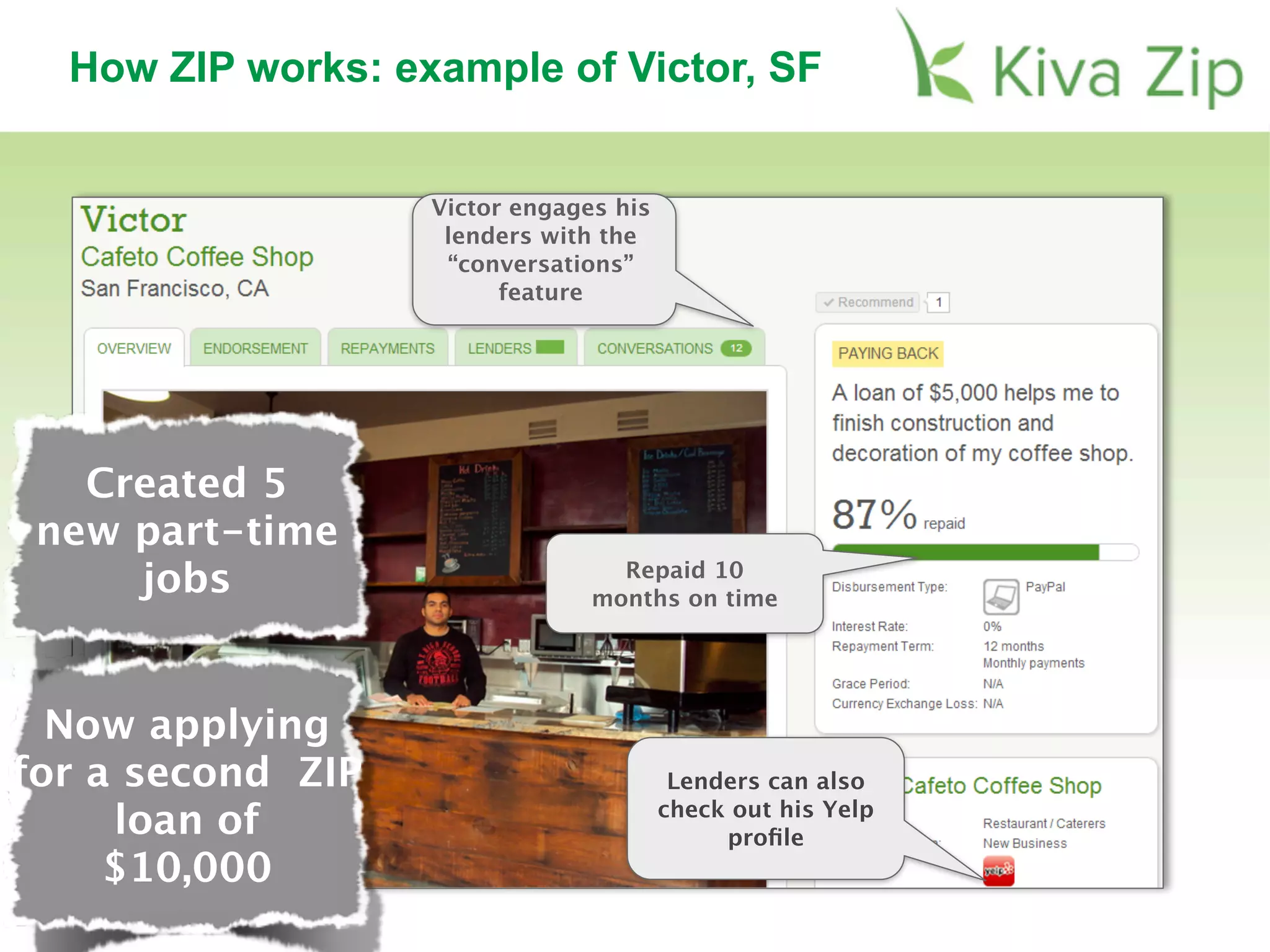

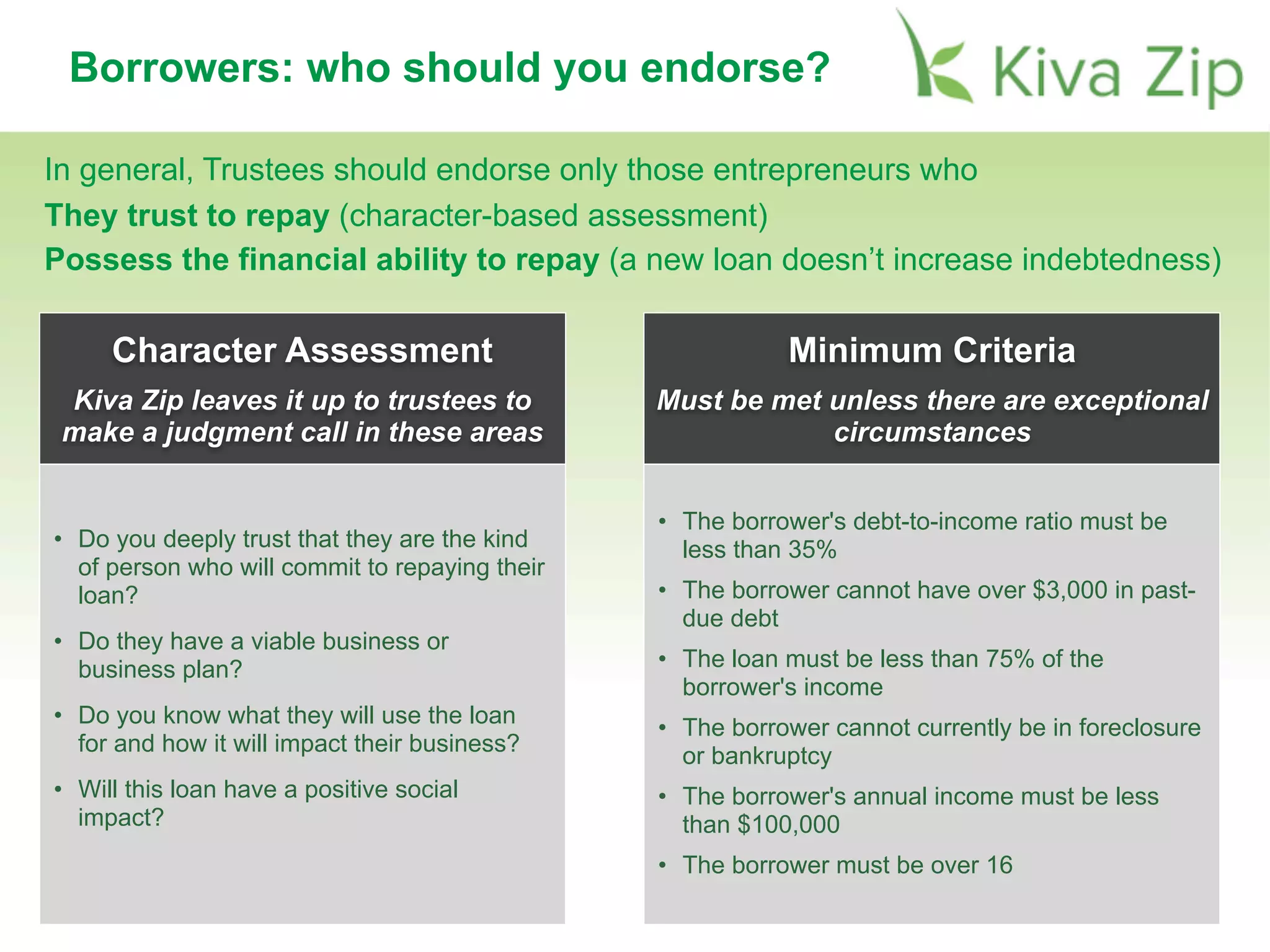

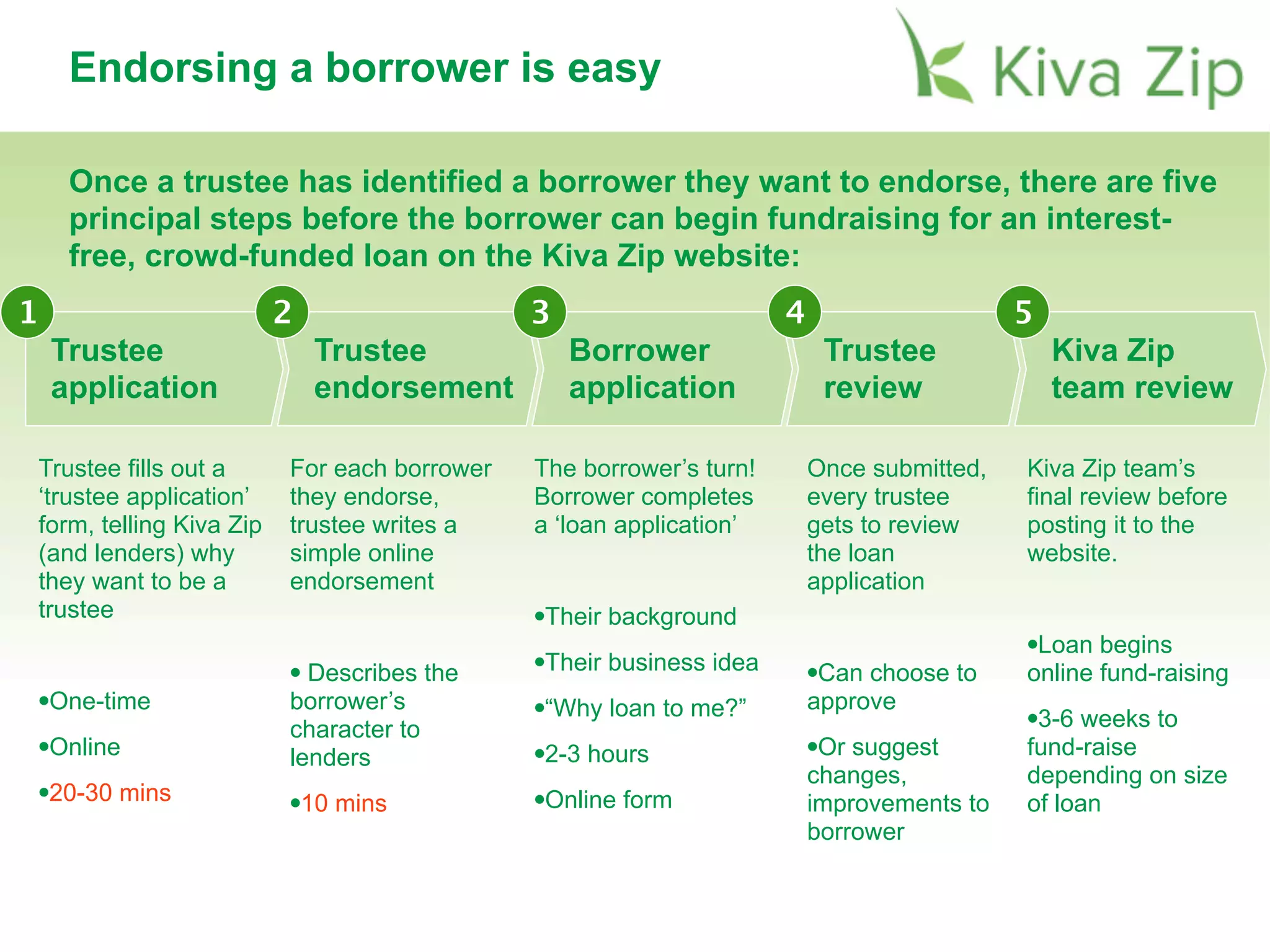

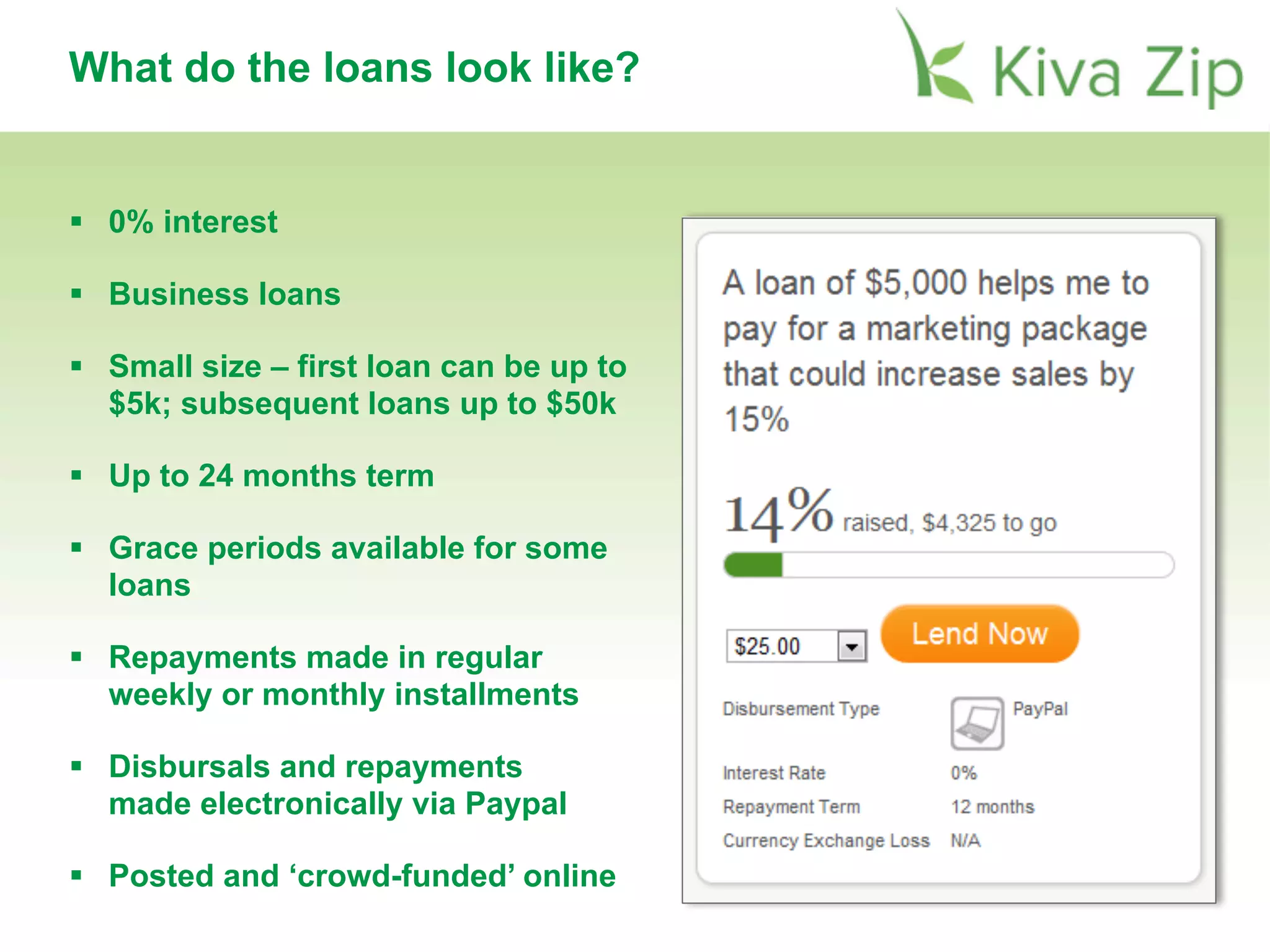

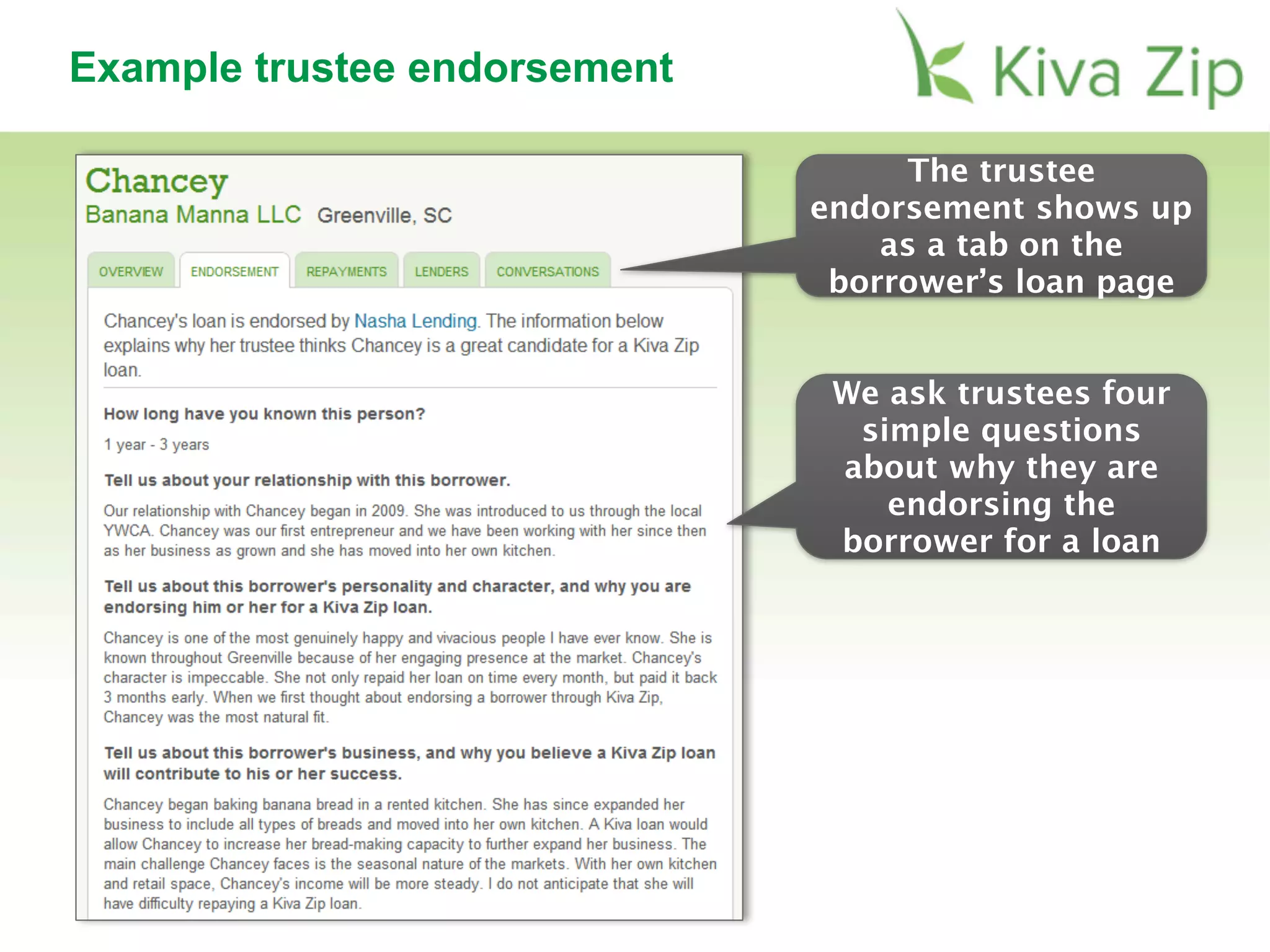

This document summarizes Kiva Zip, which provides 0% interest loans to small businesses through online crowdfunding. It discusses how Kiva Zip builds on the success of Kiva.org by focusing on US micro-entrepreneurs. Loans are funded through online lenders and facilitated by local "Trustees" who vet applicants and provide support. The process for Trustees to identify worthy borrowers and endorse them on the Kiva Zip platform is described in detail. Examples of successful borrowers and trustee partnerships are also provided.