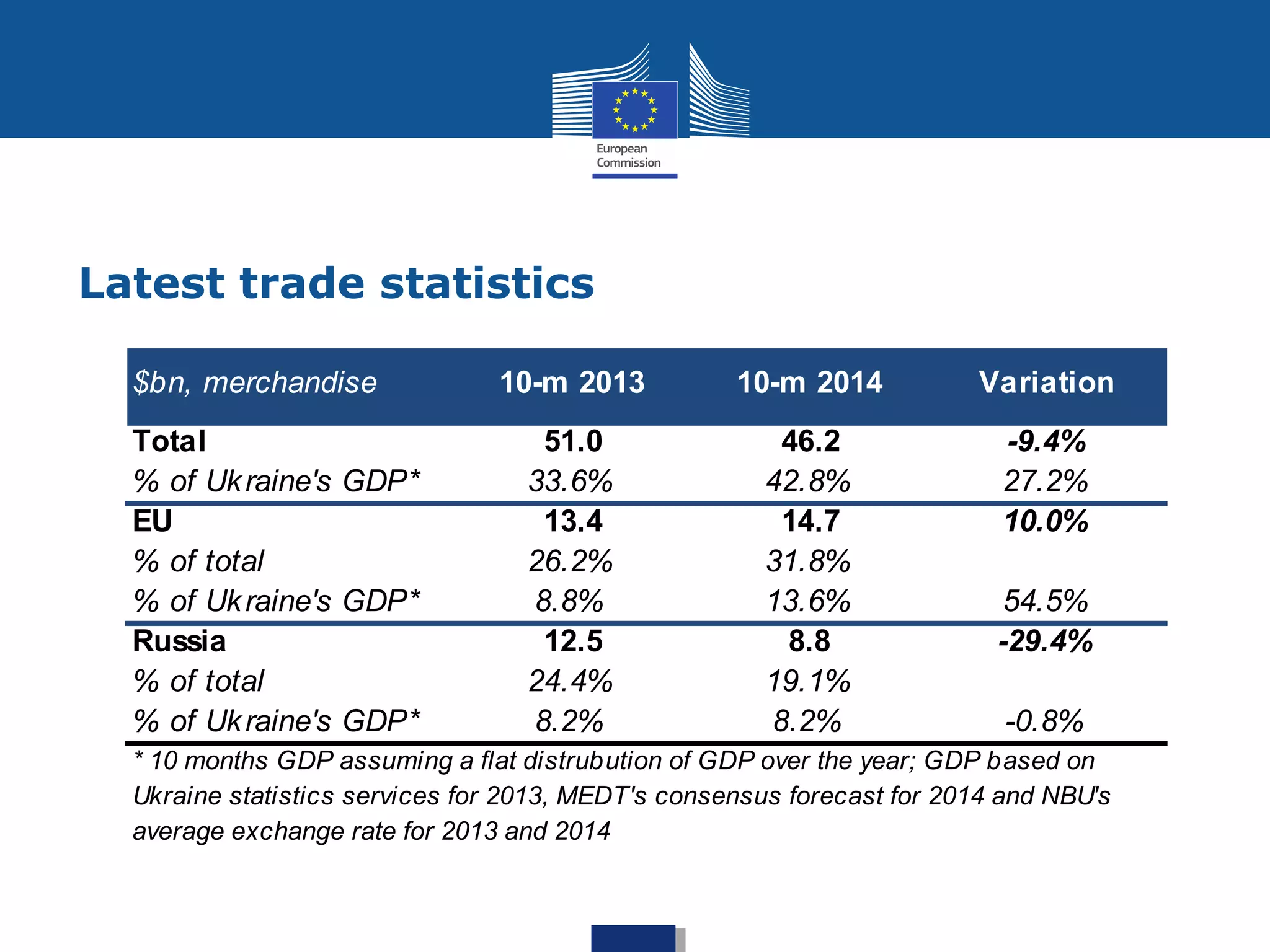

The document discusses Ukraine's trade relations with the EU and Russia. It provides statistics showing that in 2013, Ukraine's largest export partners were the EU (26.5% of exports) and Russia (23.8% of exports). However, in 2014 exports to the EU increased while exports to Russia decreased significantly due to sanctions and trade restrictions.

The EU and Ukraine have signed an Association Agreement that includes a Deep and Comprehensive Free Trade Area (DCFTA) aimed at facilitating trade and economic integration. The DCFTA will eliminate tariffs and reduce non-tariff barriers by aligning Ukrainian regulations and standards with those of the EU. Key areas of alignment include industrial goods, agricultural products, services, public