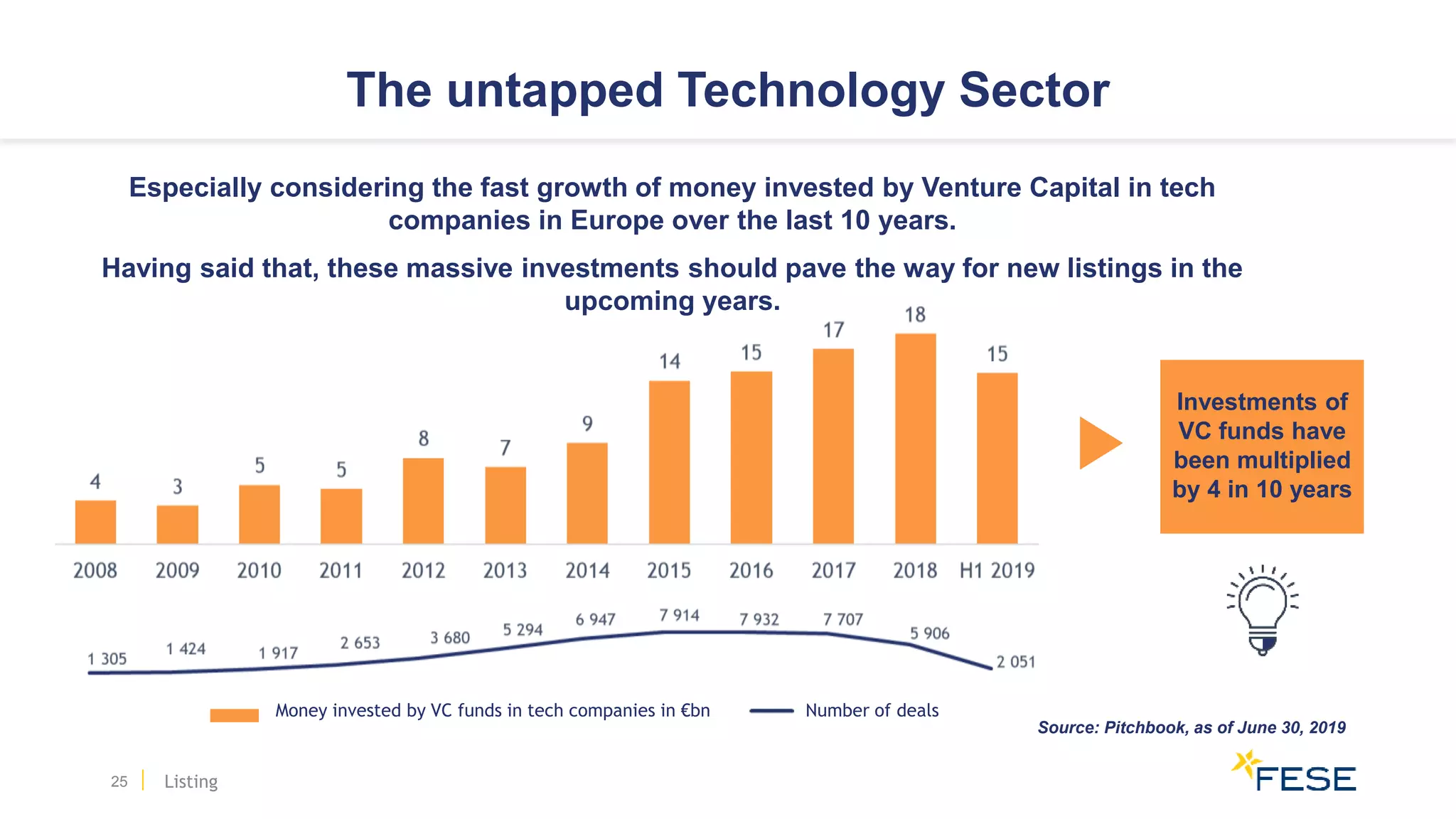

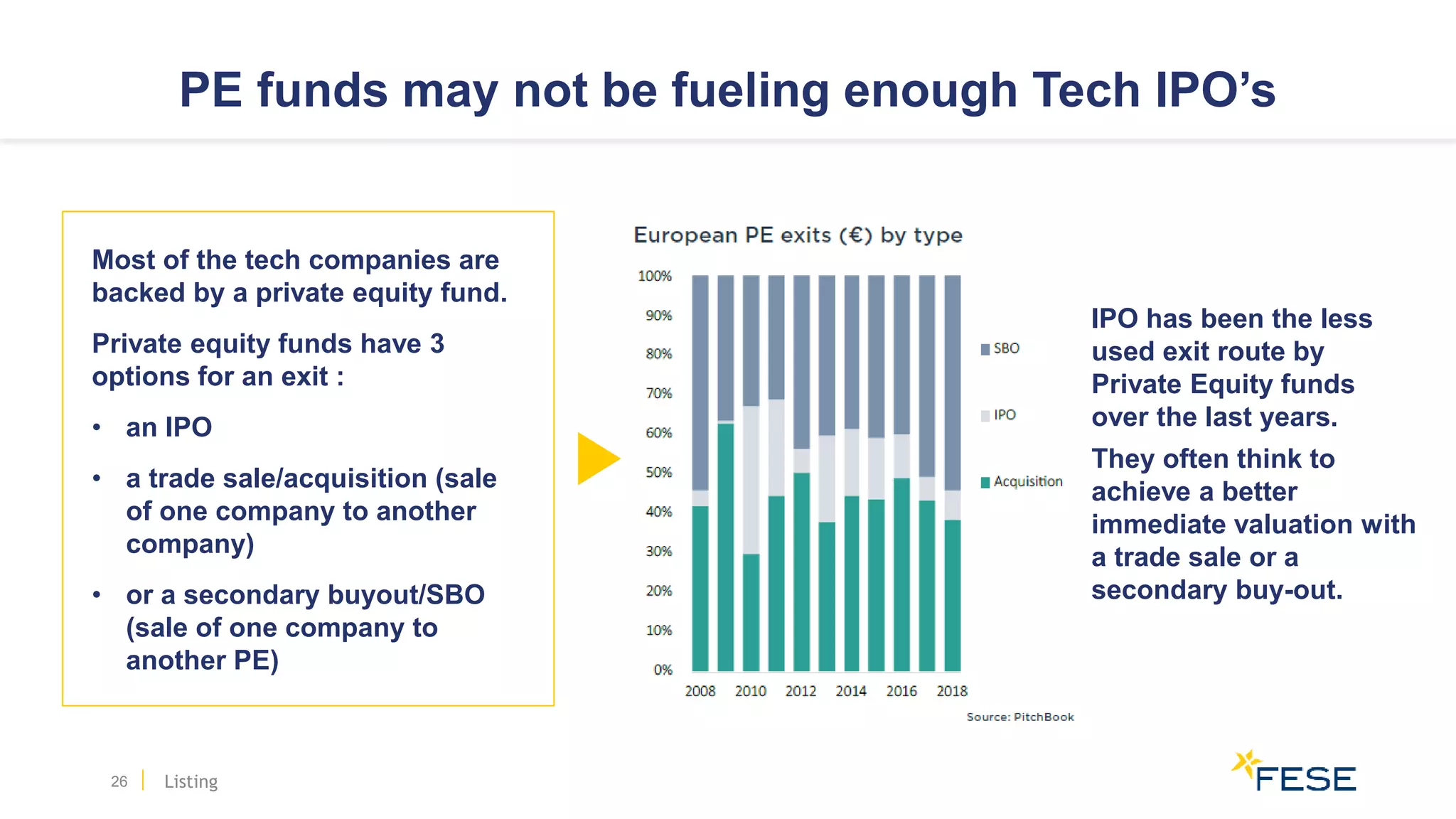

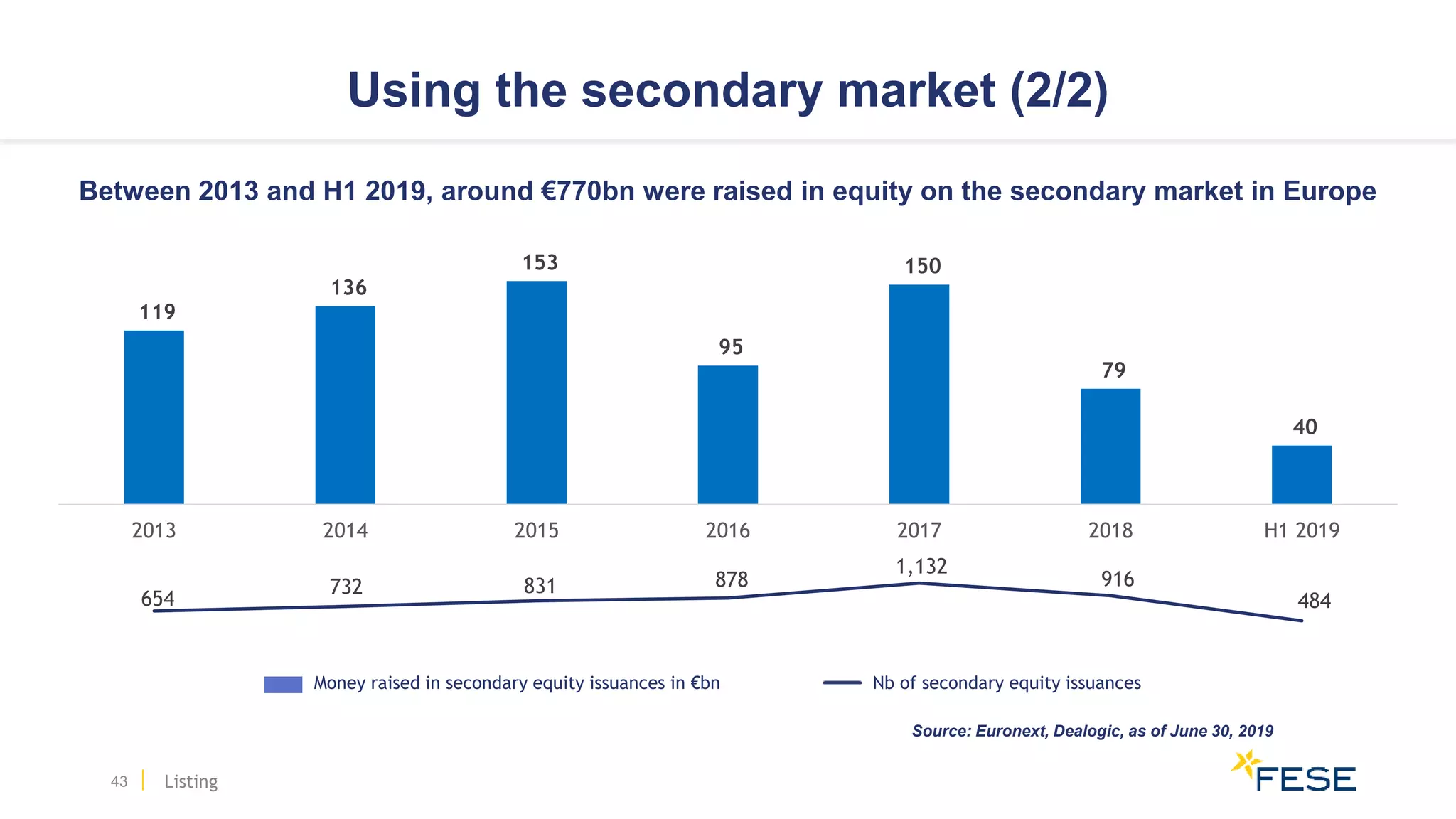

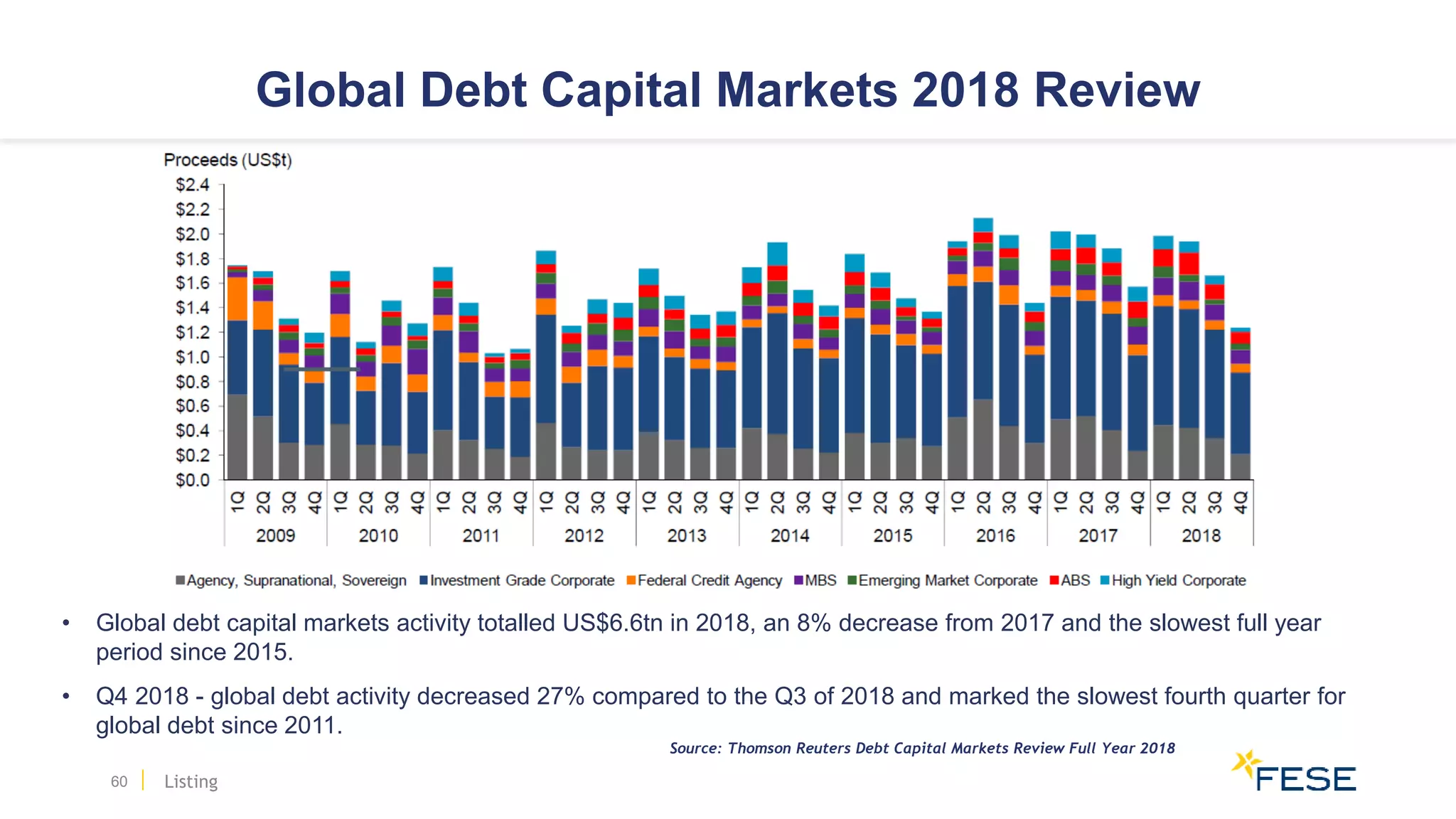

The document provides an overview of listing and initial public offerings (IPOs) in Europe. It discusses the benefits of going public for companies and shareholders. Some key points include:

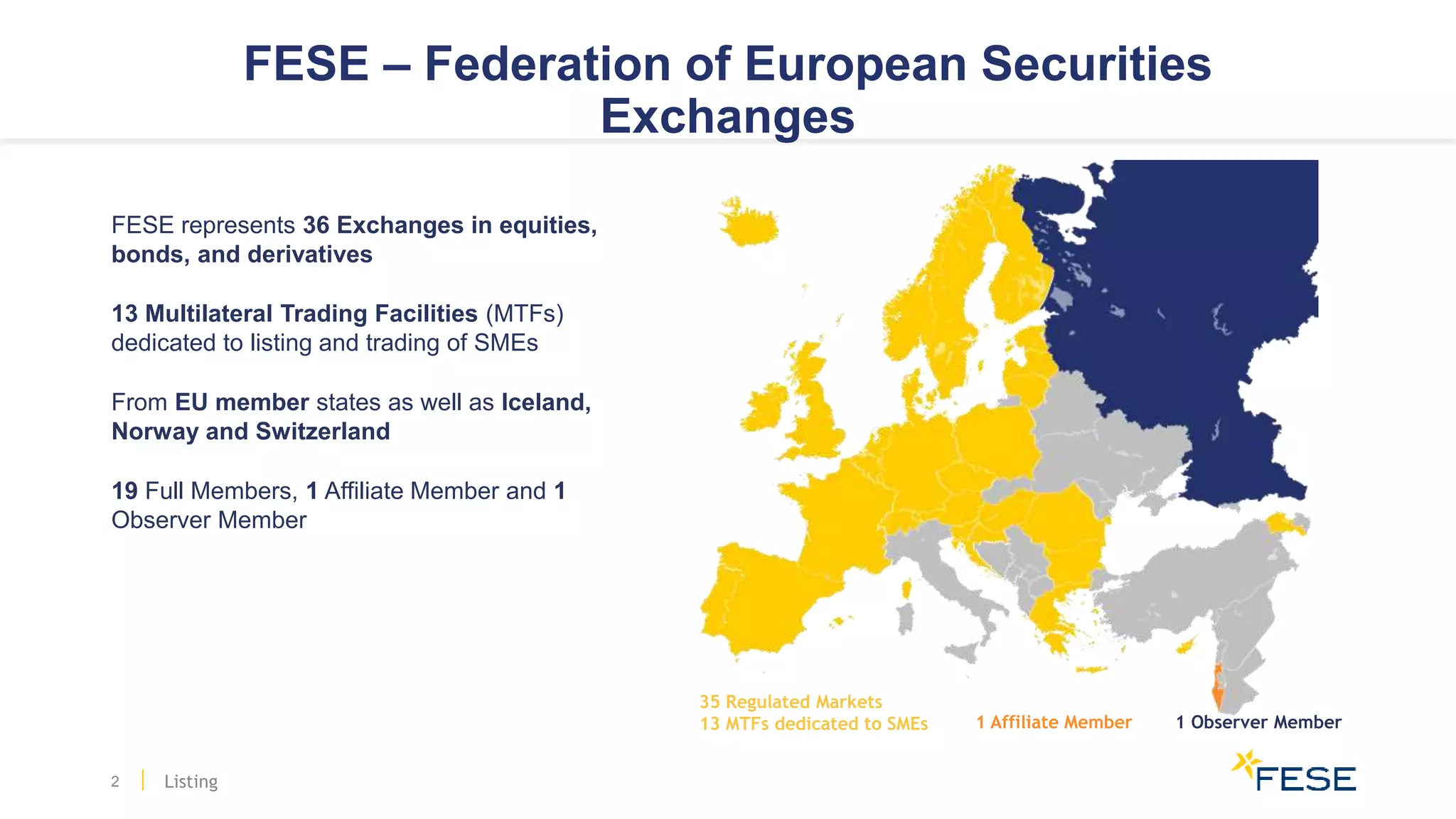

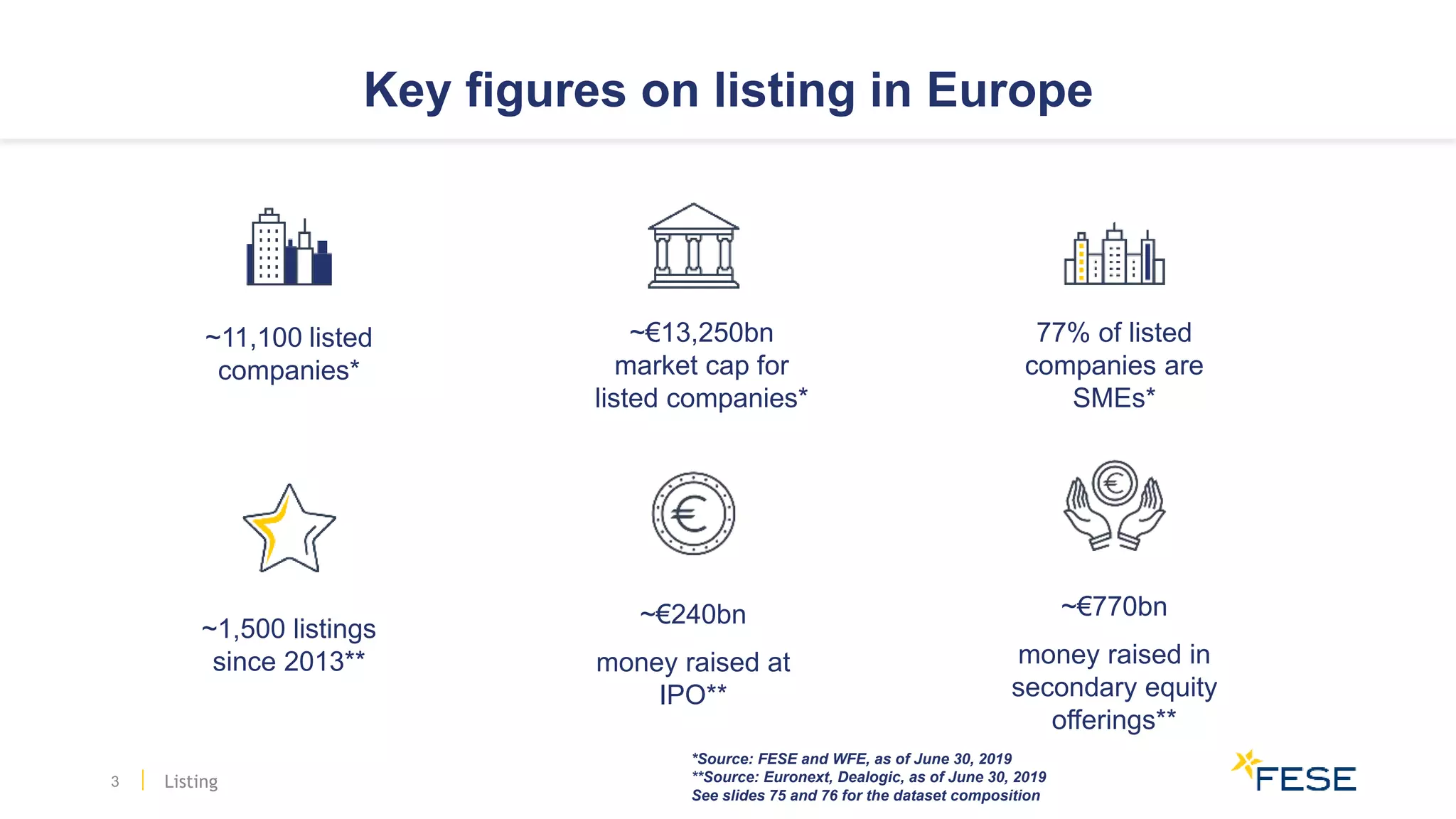

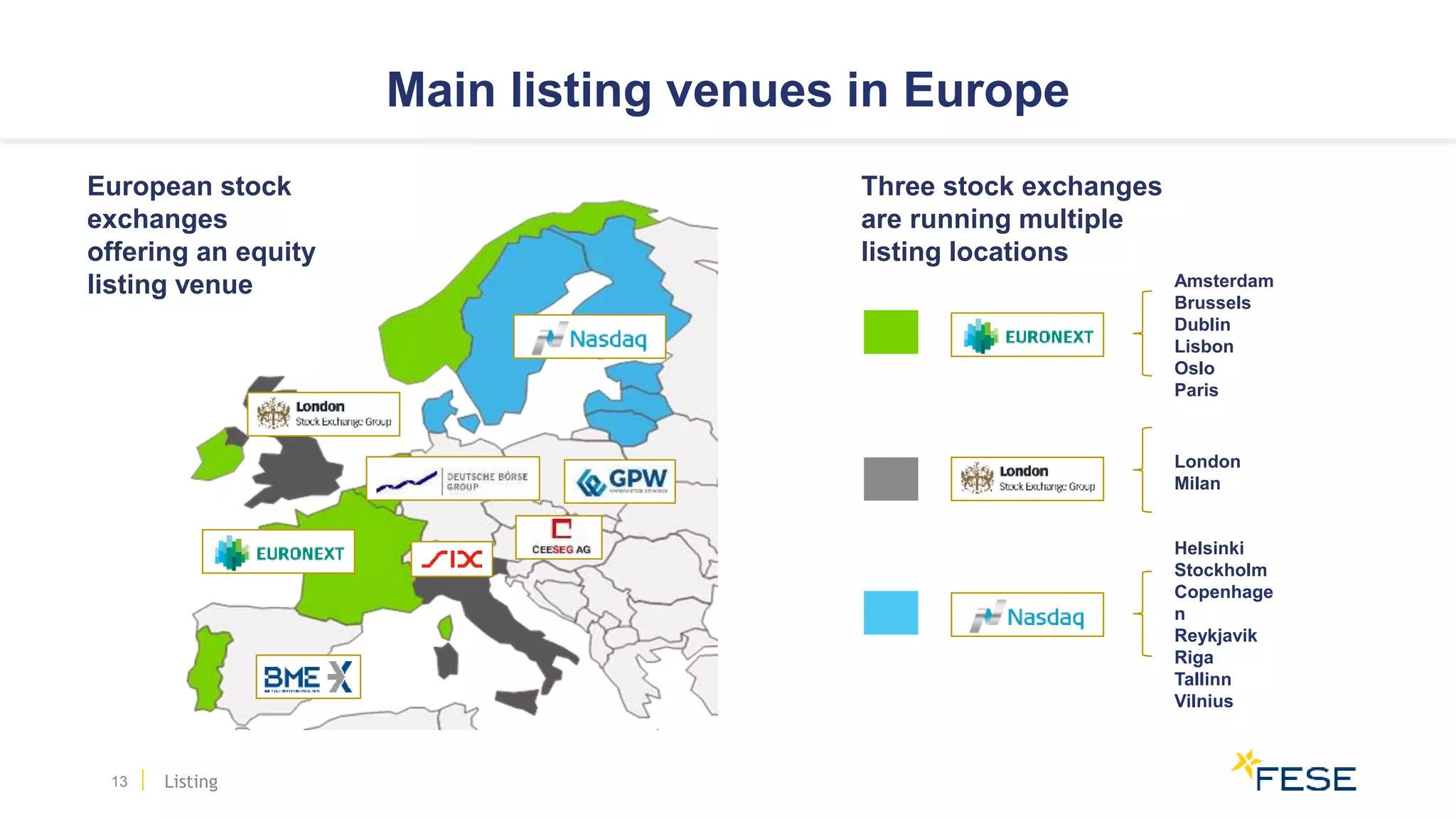

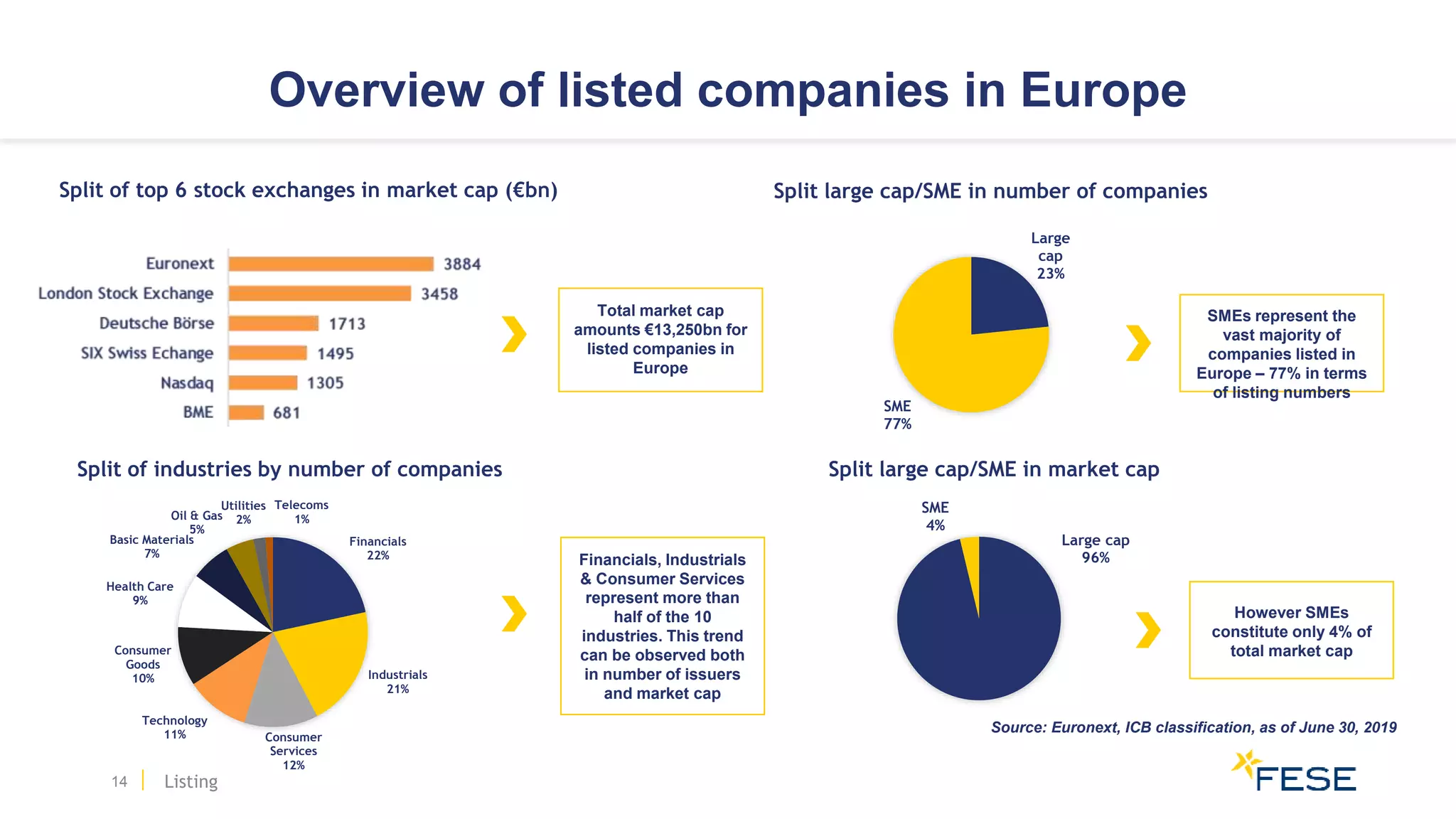

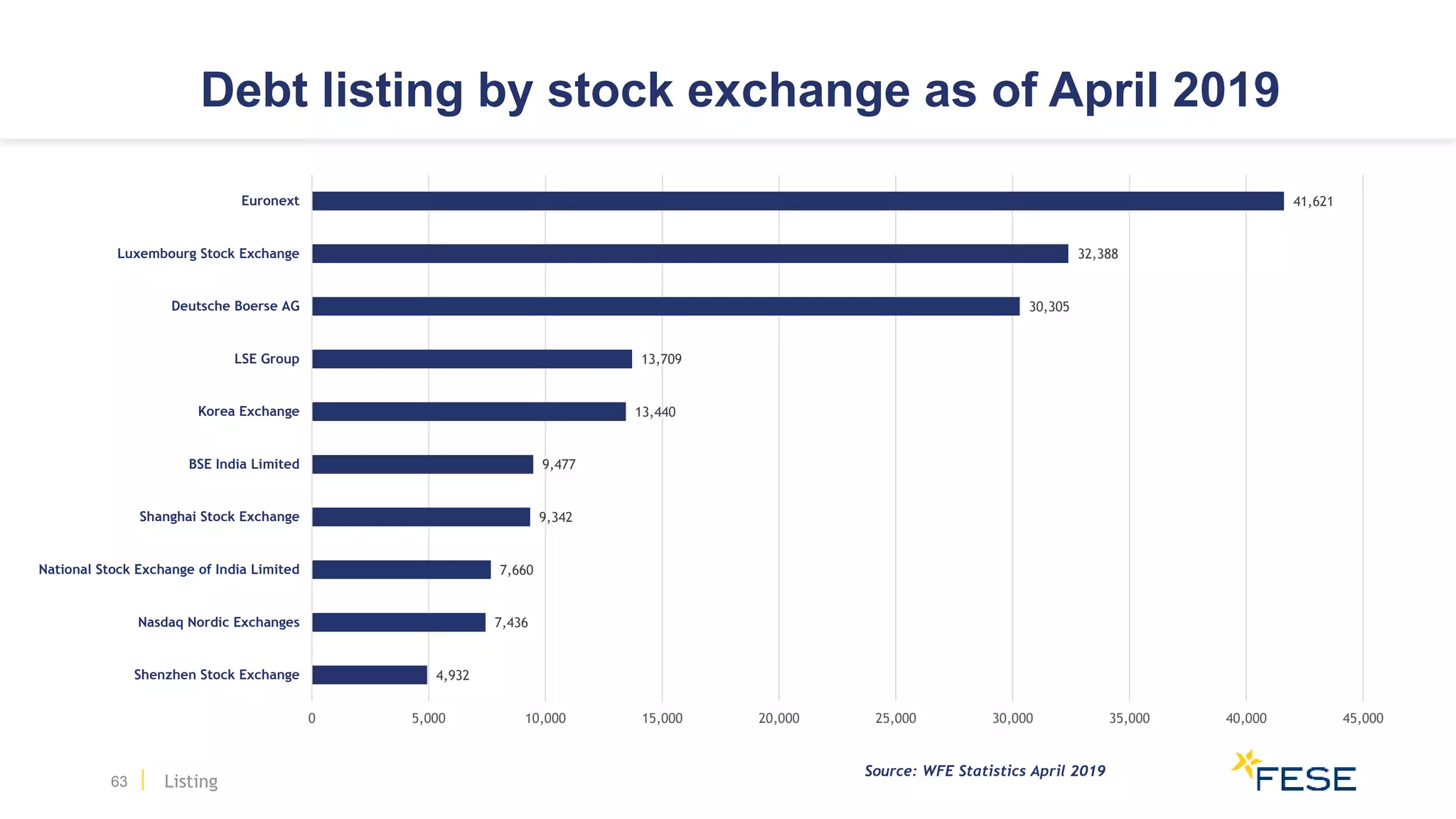

- FESE represents 36 stock exchanges in Europe that list equities, bonds, and derivatives. About 11,100 companies are listed in Europe, with a total market capitalization of around €13 trillion.

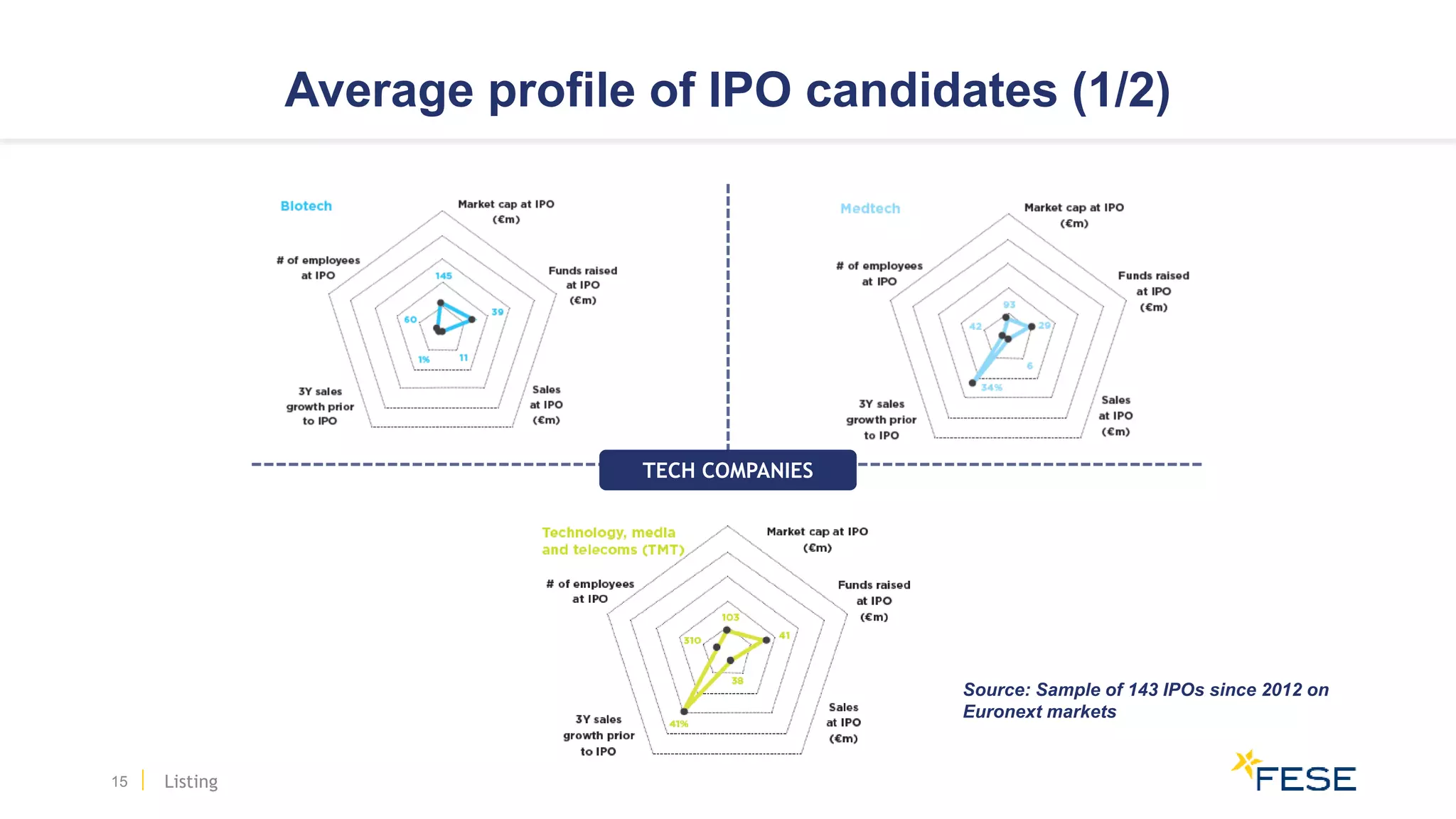

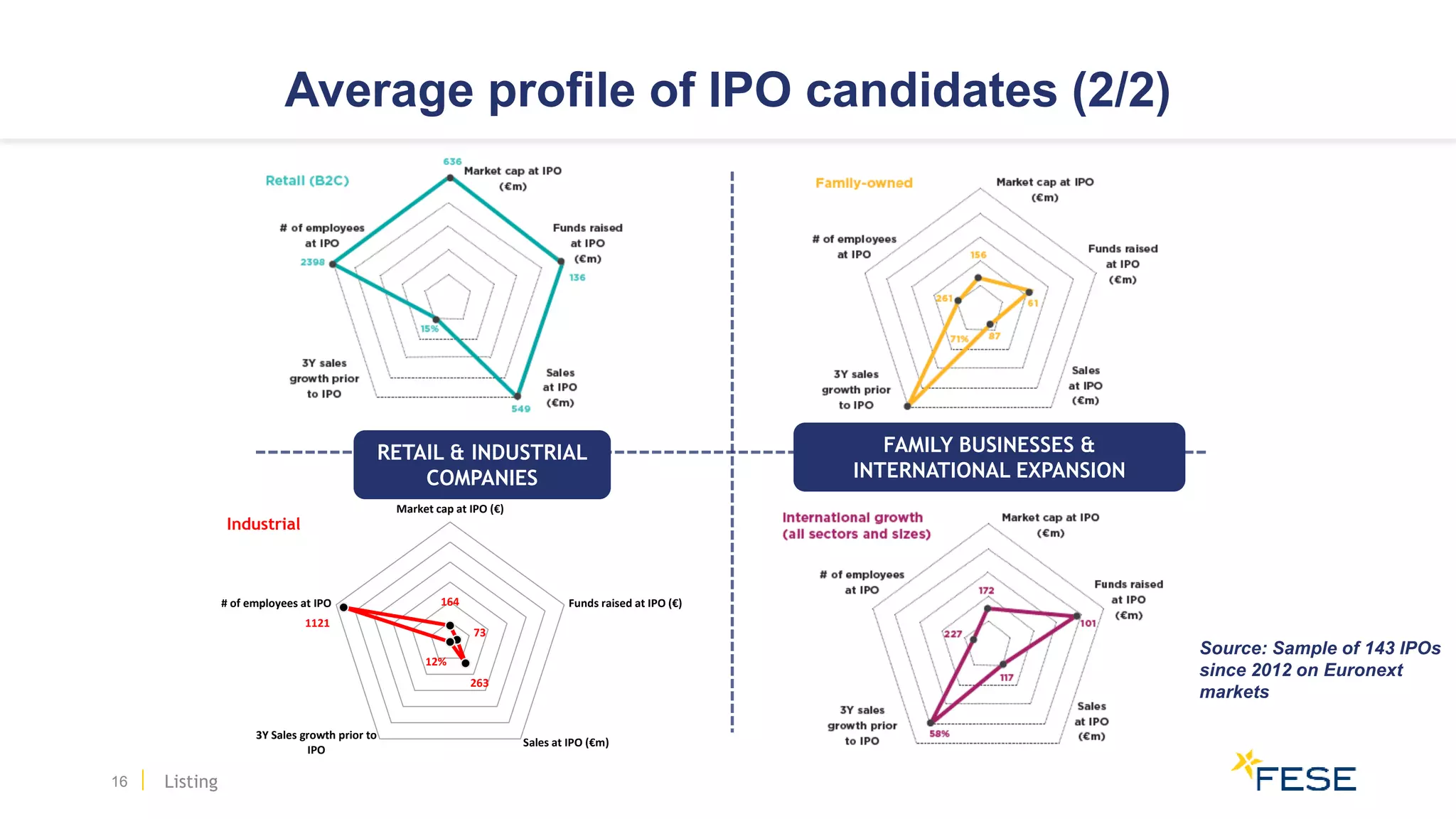

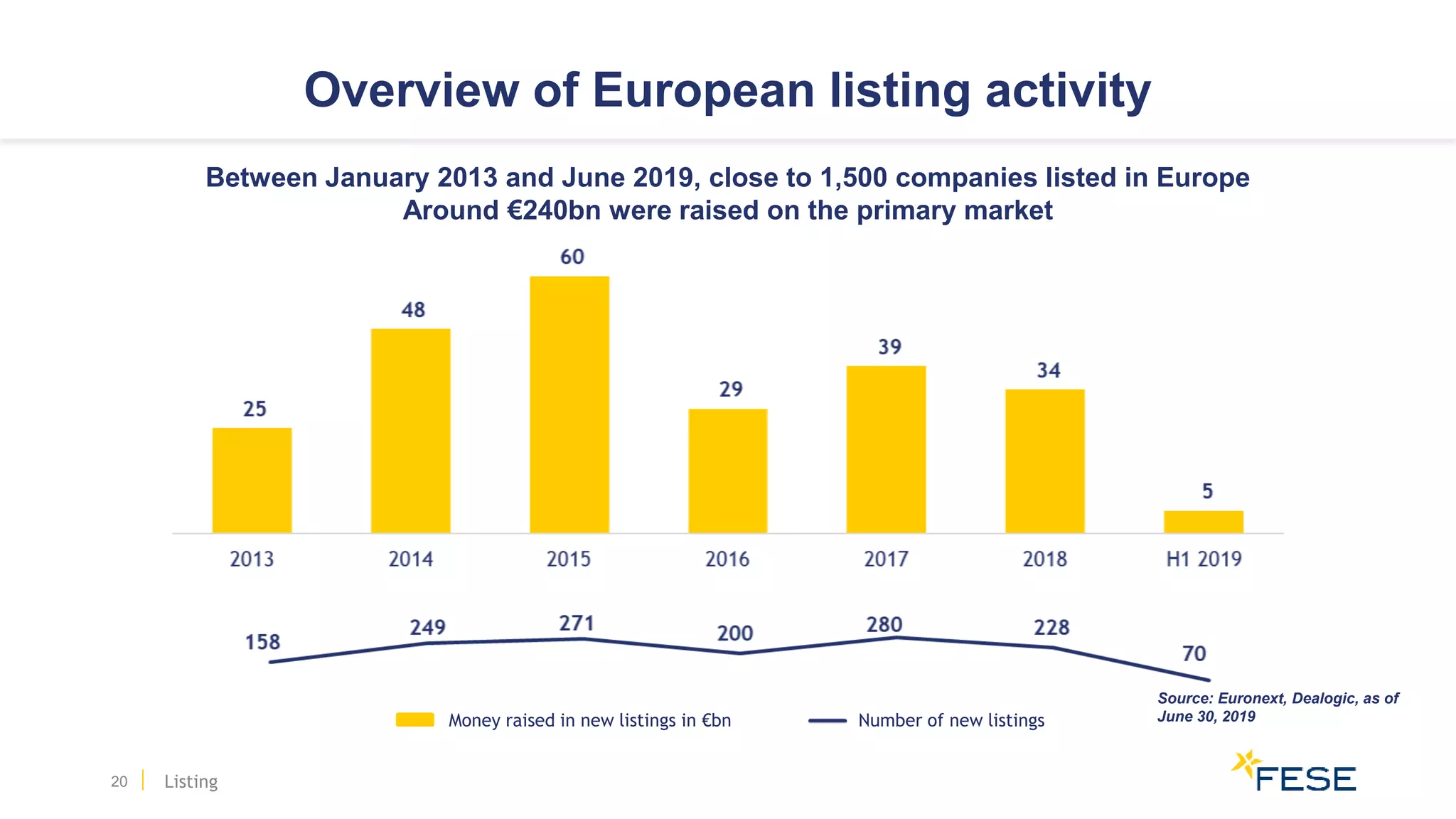

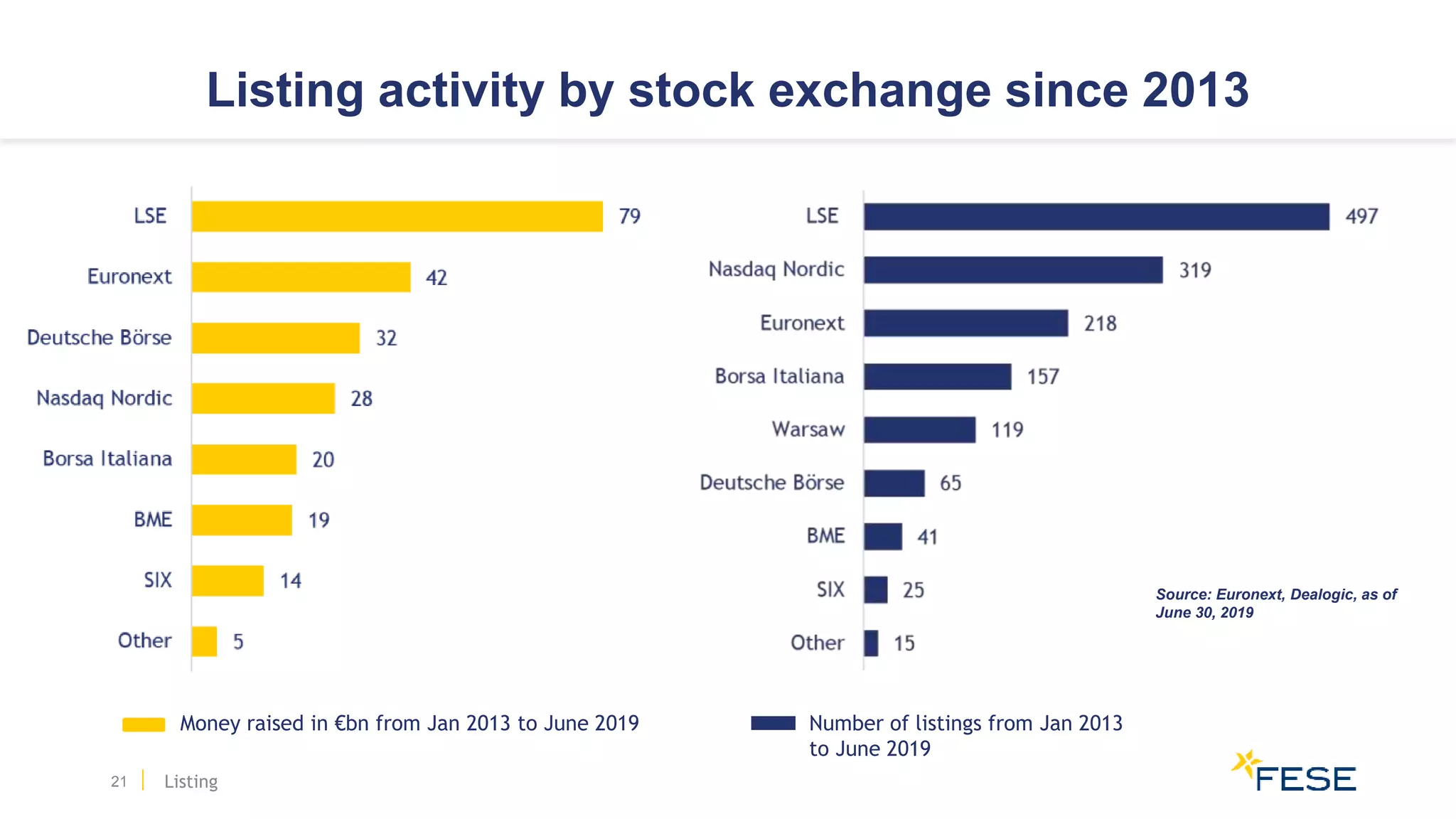

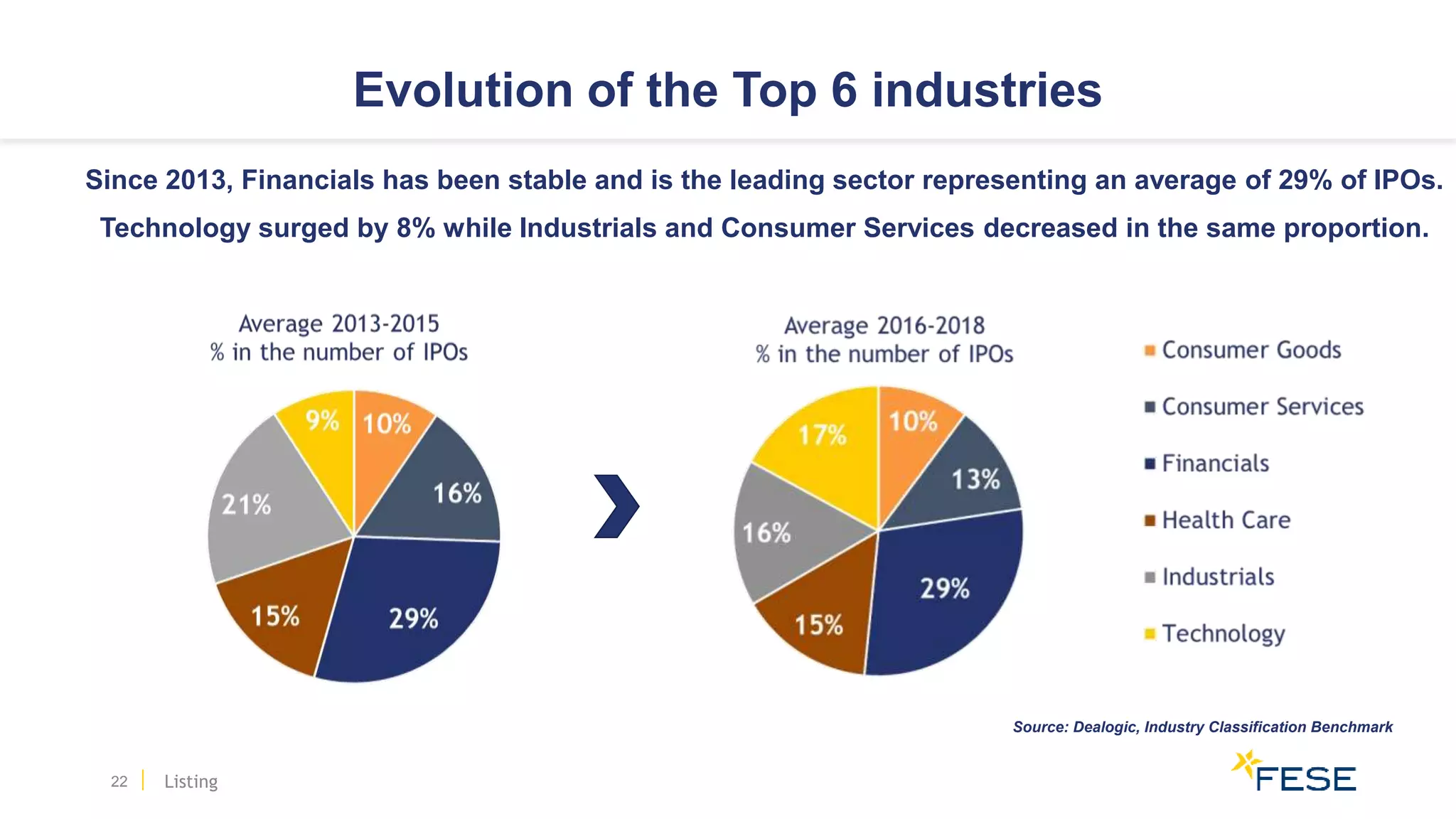

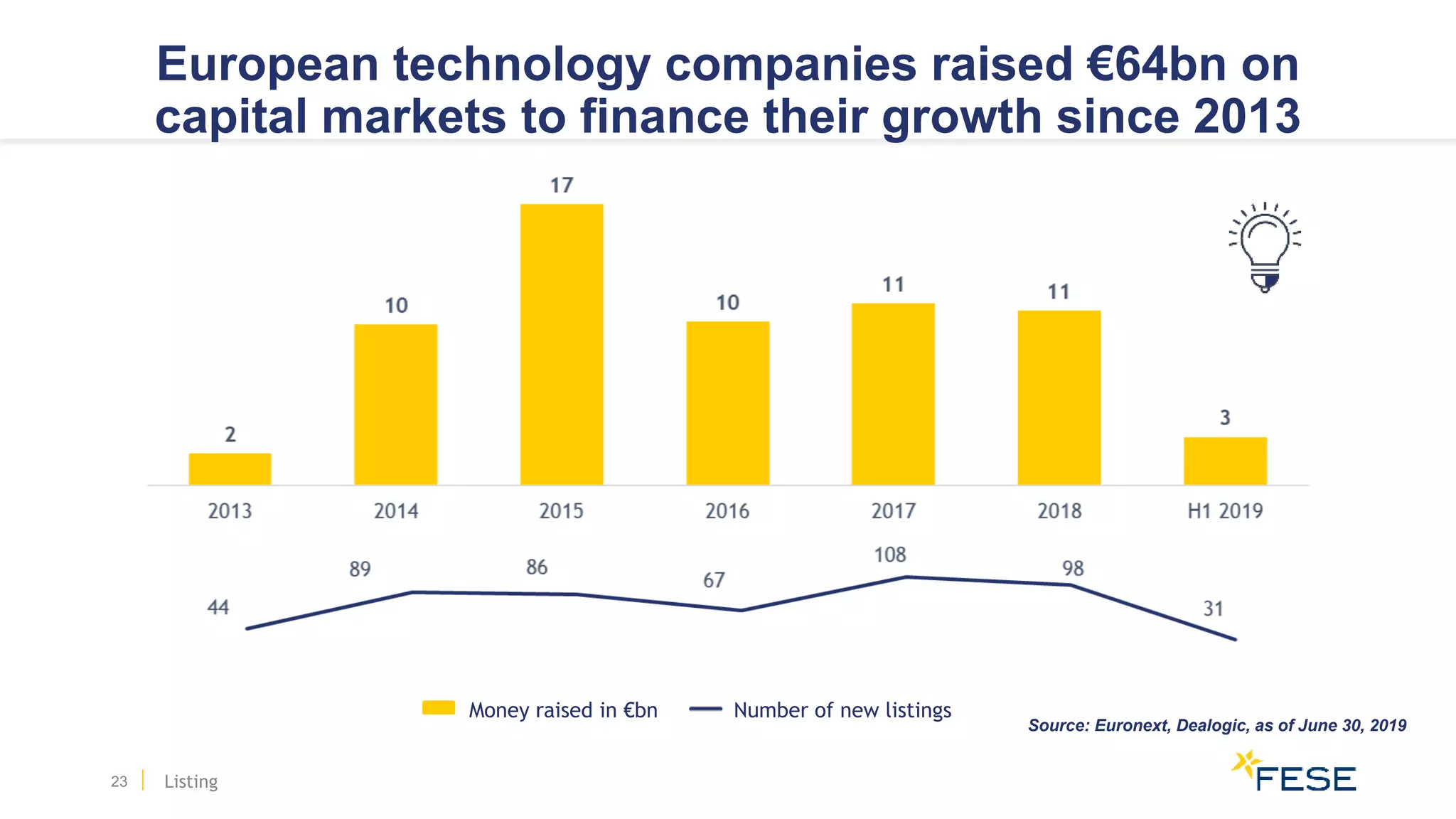

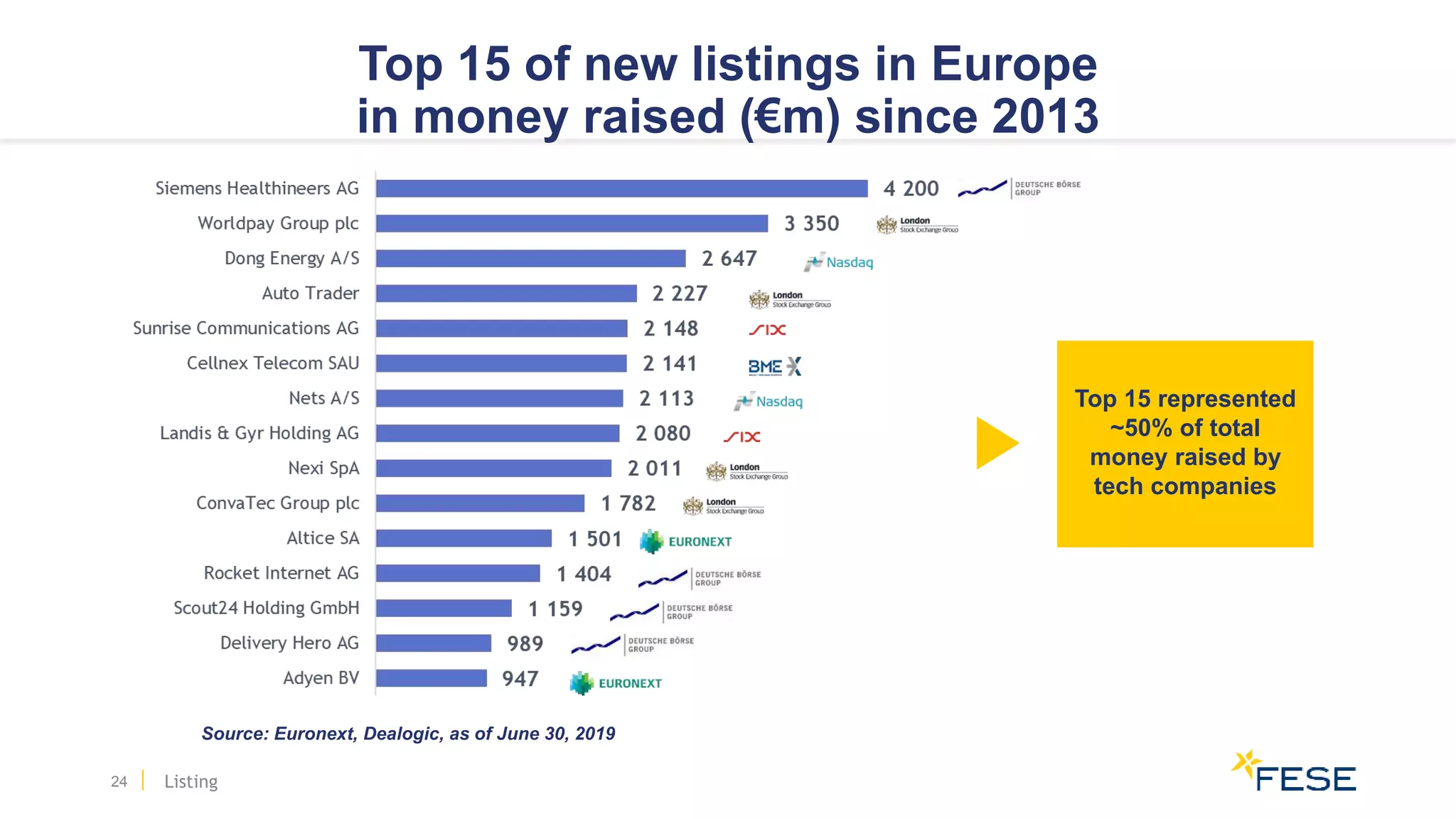

- Between 2013-2019, around 1,500 companies listed in Europe raising a total of €240 billion. Leading sectors for listings include financials, industrials, and consumer services.

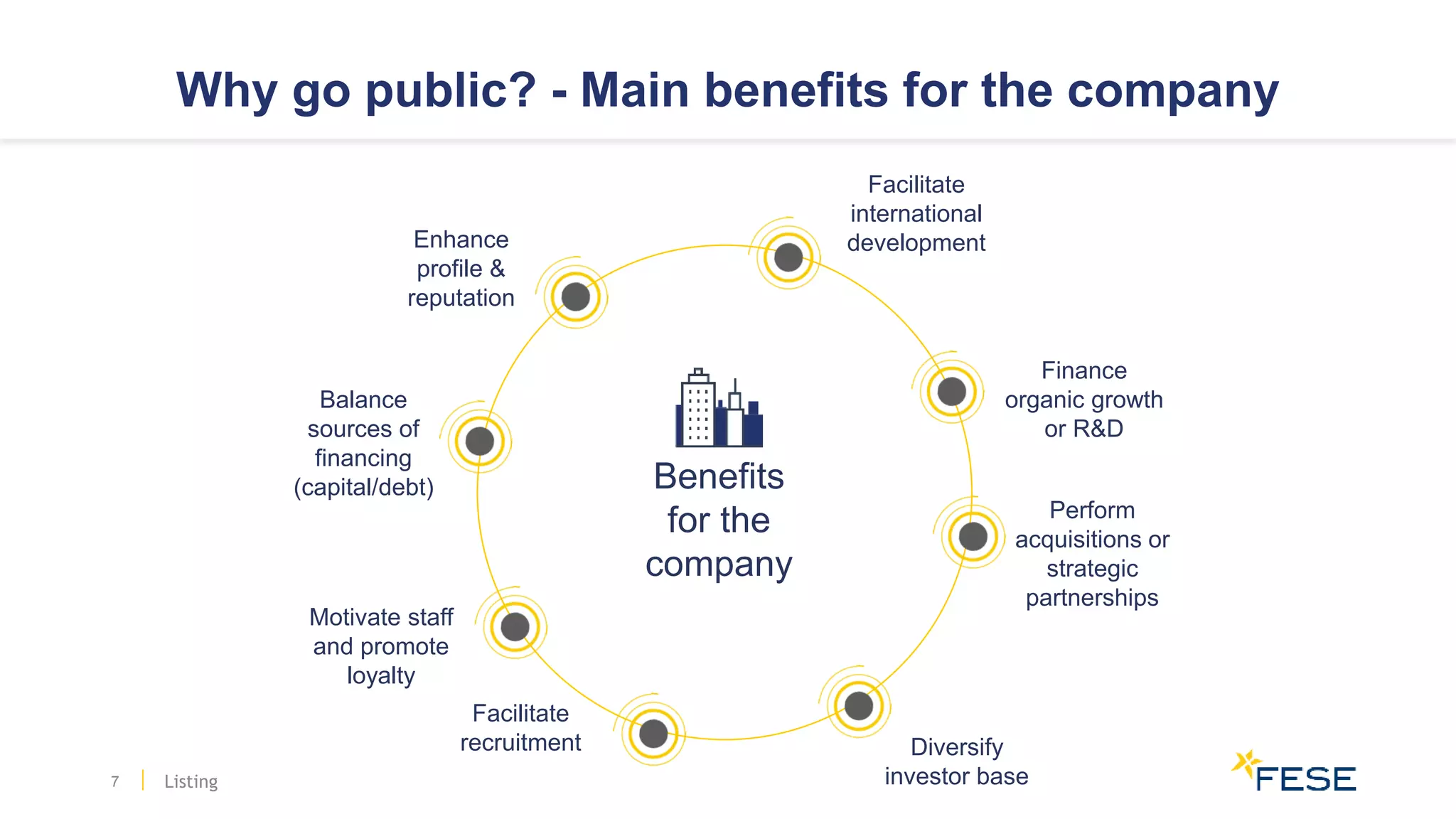

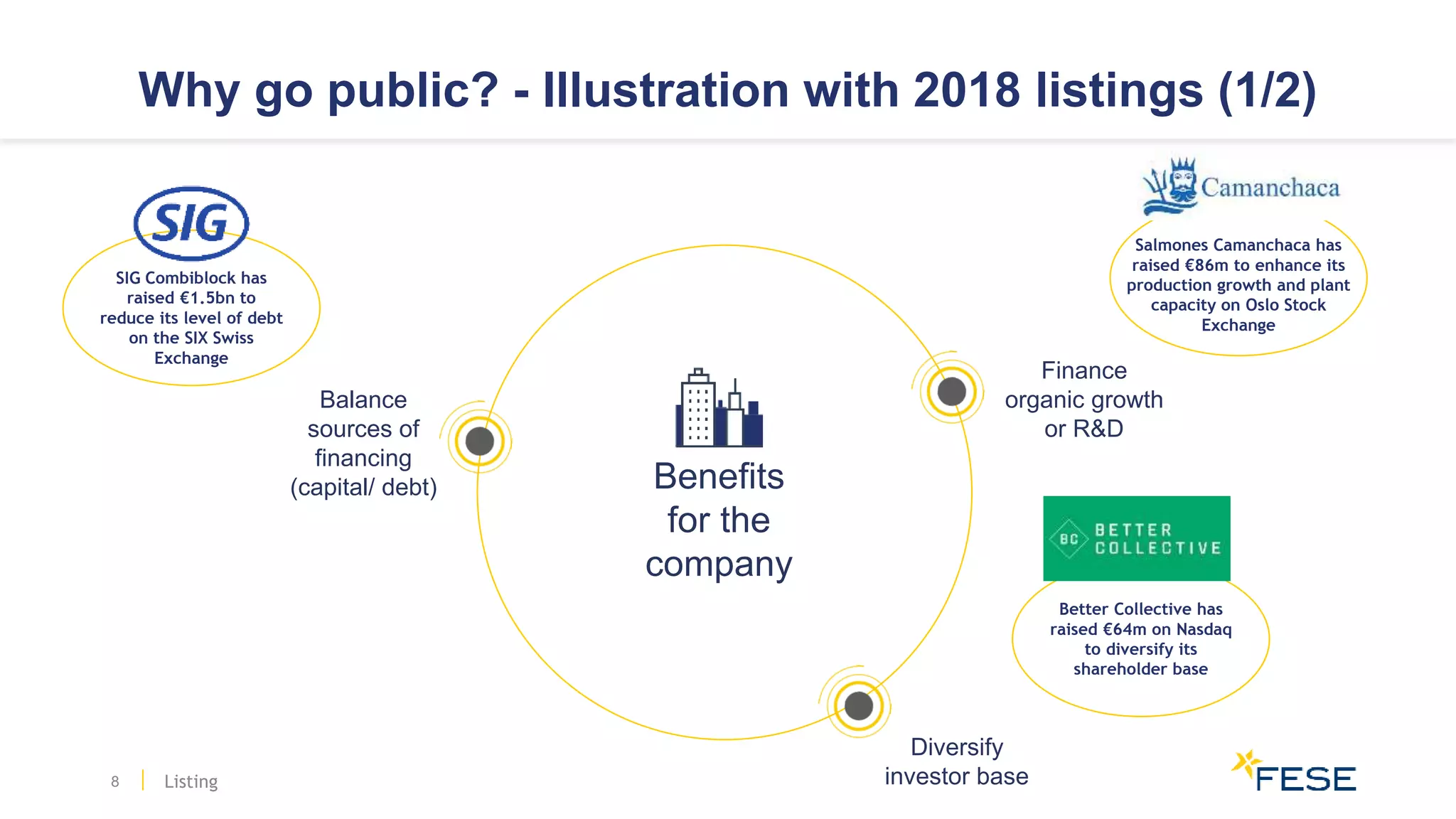

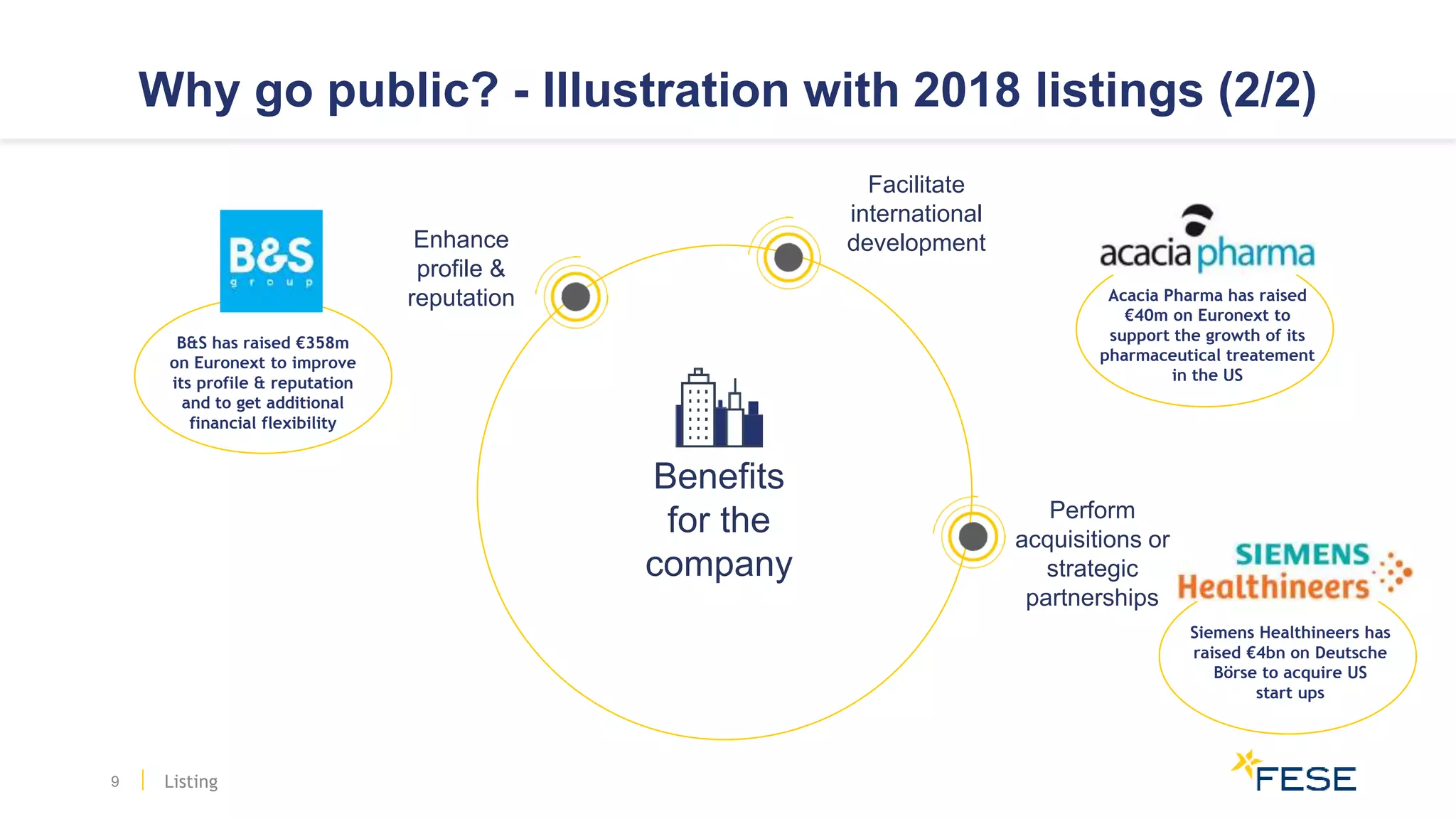

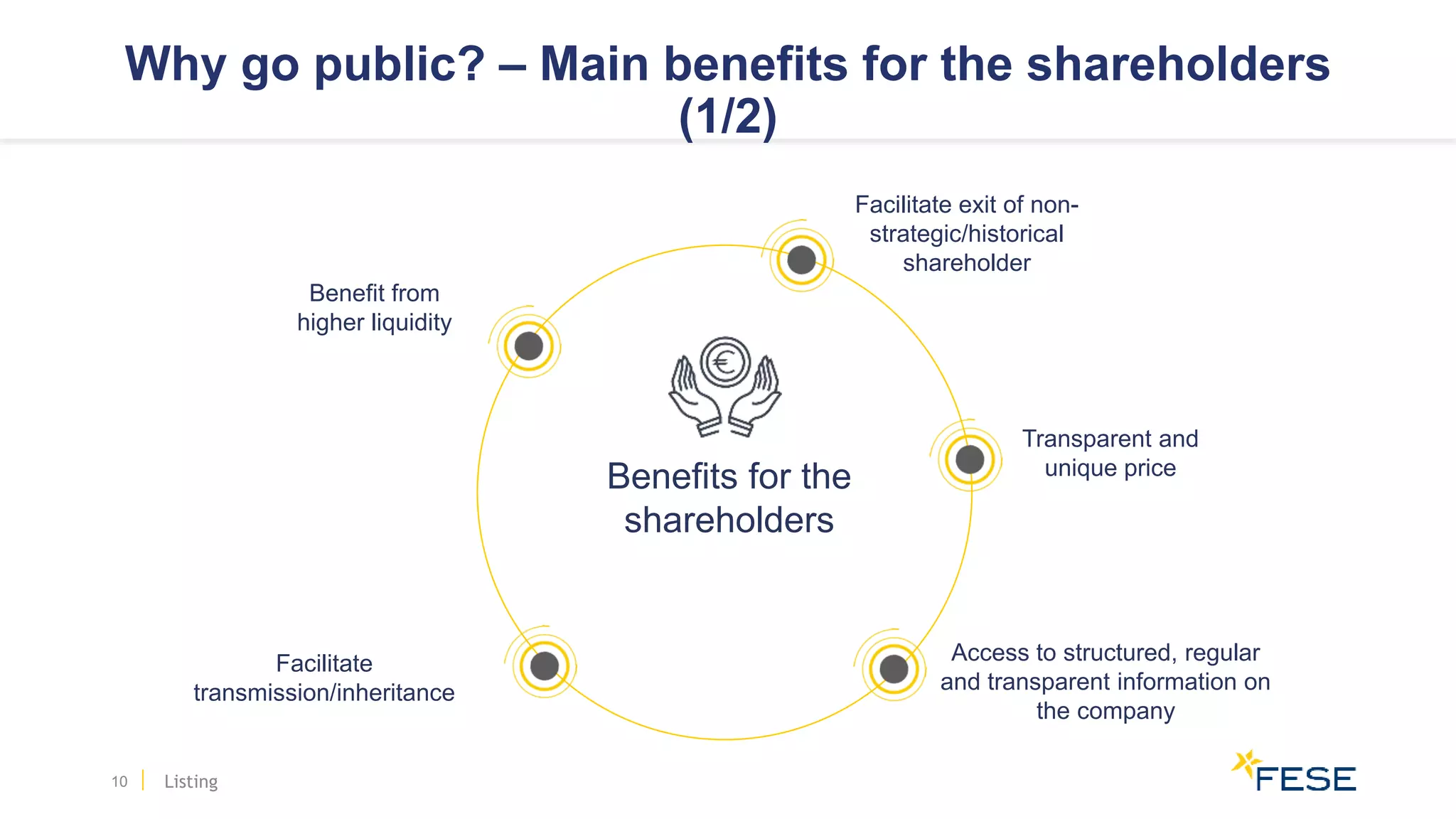

- Companies go public to raise funds for growth, finance acquisitions, enhance their reputation, and diversify their investor