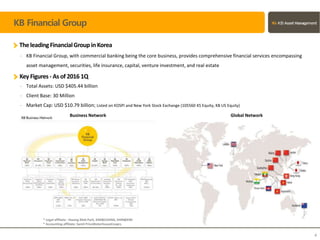

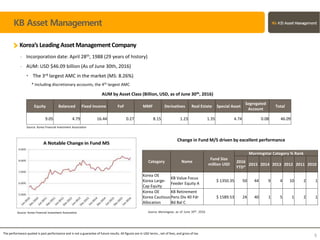

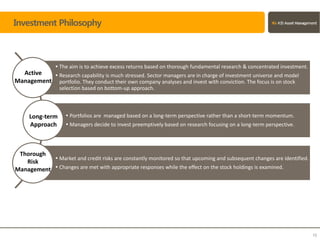

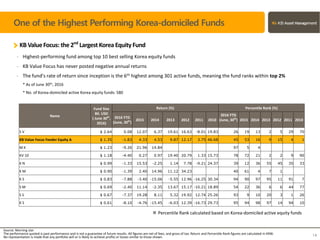

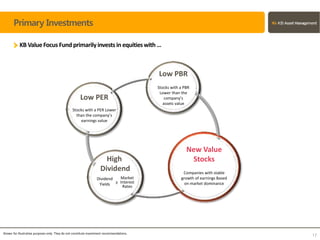

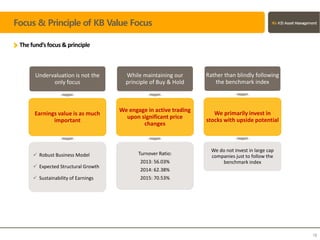

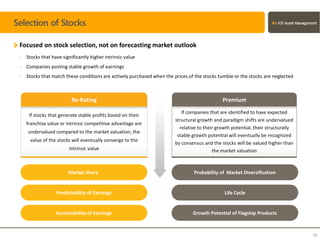

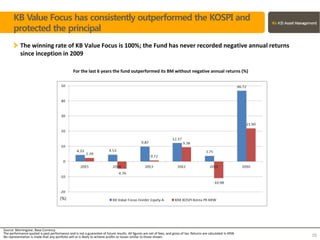

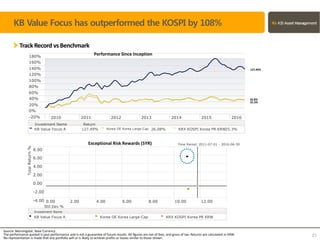

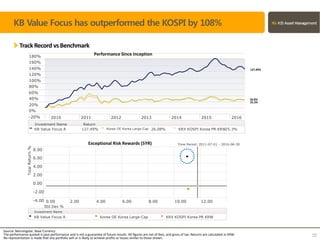

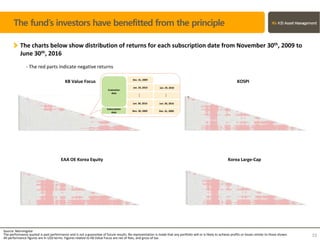

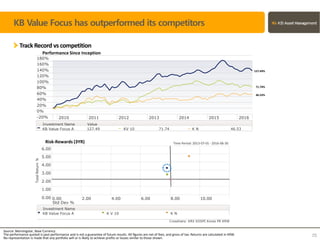

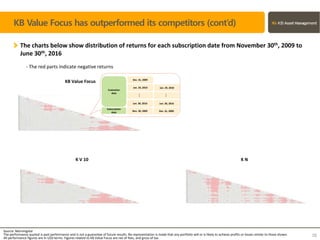

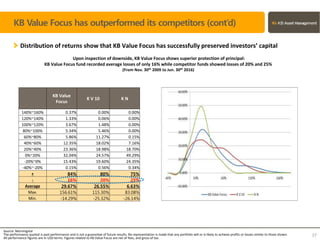

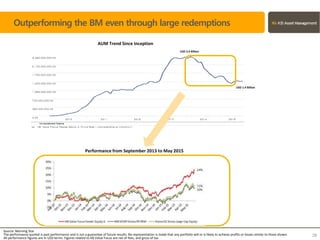

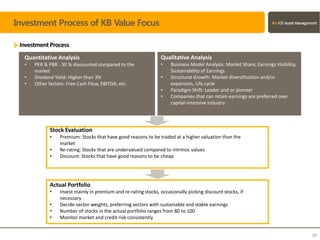

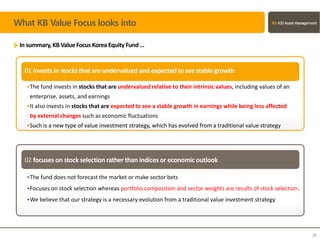

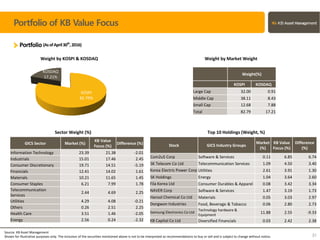

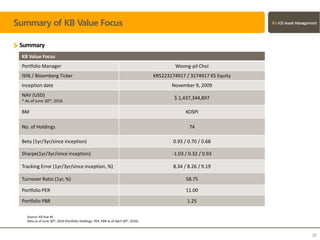

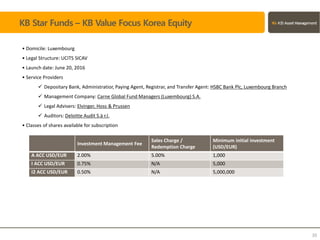

The KB Value Focus Korea Equity Fund, as of June 2016, is a prominent investment vehicle with significant assets under management and a strong track record, characterized by consistent performance with no negative annual returns since inception. However, the document emphasizes that past performance is not indicative of future results and highlights various investment risks, including potential capital loss. It is crucial for investors to read the fund's prospectus in full before making investment decisions.