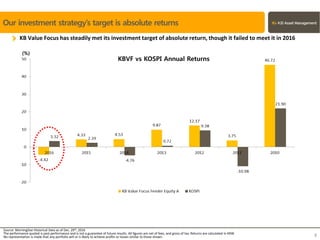

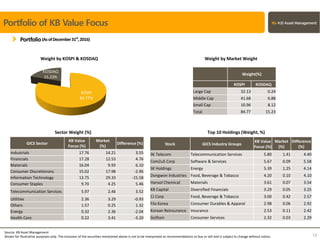

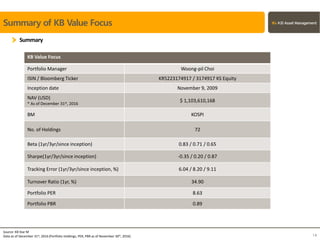

This document provides an overview and performance summary of the KB Value Focus Korea Equity Fund. Some key points:

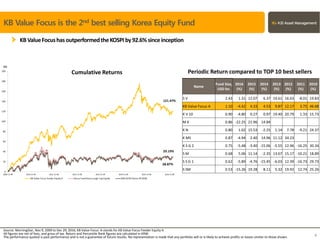

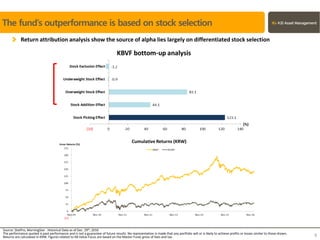

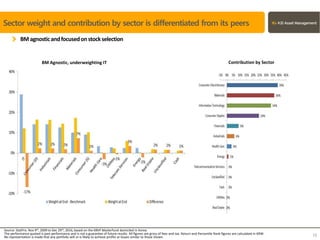

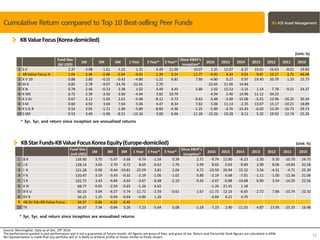

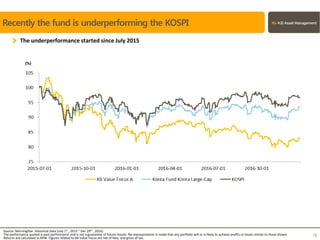

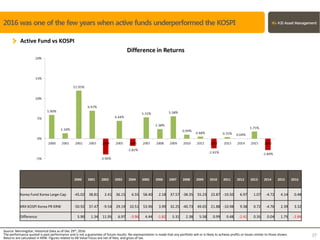

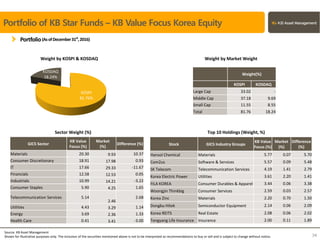

- The fund has outperformed the KOSPI index by 92.6% since inception due to differentiated stock selection, with the majority of its performance attributed to stock selection rather than sector allocation.

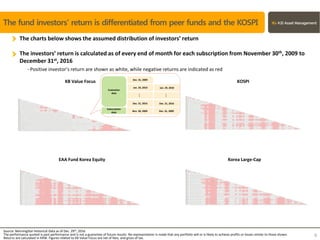

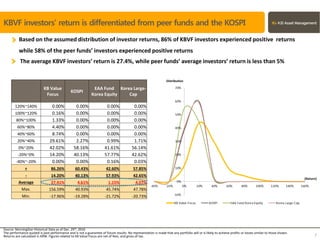

- 86% of KB Value Focus investors experienced positive returns compared to 58% for peer funds, with an average return of 27.4% for KB Value Focus investors versus less than 5% for peers.

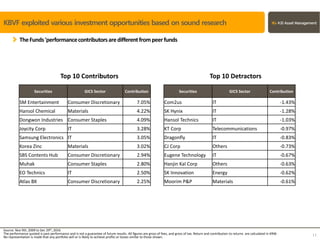

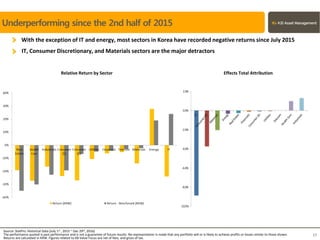

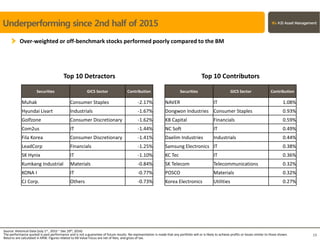

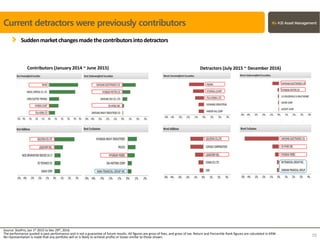

- Top contributors to performance included companies in consumer discretionary, materials, consumer staples, and IT, while detractors were primarily in IT, telecom, and other sectors.