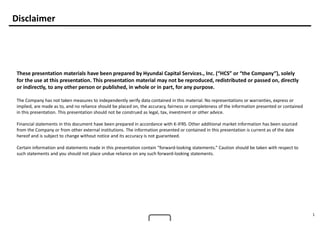

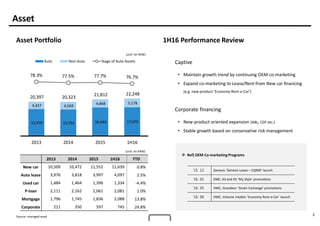

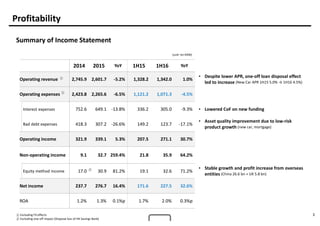

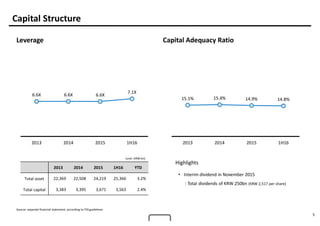

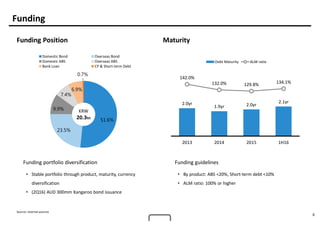

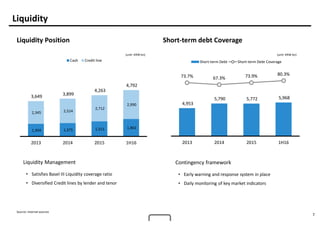

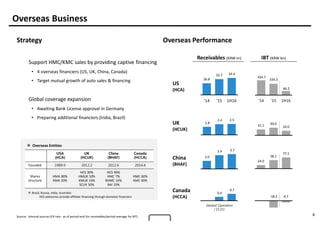

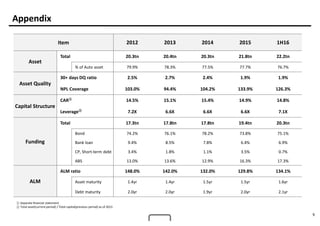

Hyundai Capital Services reported its 1H16 earnings. Total assets grew 3.2% to KRW 25.3 trillion driven by new car and mortgage financing. Net income increased 32.6% to KRW 227.5 billion due to operating income growth and stable profits from overseas subsidiaries. Asset quality improved with delinquency rates falling to 1.9% and coverage ratios rising to 126.3% as the portfolio shifted toward lower risk auto loans. Liquidity and funding remained strong with a 134.1% ALM ratio and 75.1% of funding from bonds.