Karl miller feature article uk asset recovery vehicle

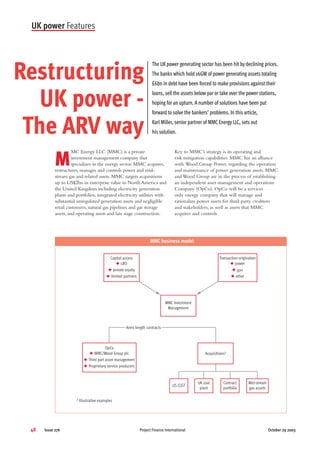

- 1. M MC Energy LLC (MMC) is a private investment management company that specializes in the energy sector. MMC acquires, restructures, manages and controls power and mid- stream gas and related assets. MMC targets acquisitions up to US$2bn in enterprise value in North America and the United Kingdom including electricity generation plants and portfolios, integrated electricity utilities with substantial unregulated generation assets and negligible retail customers, natural gas pipelines and gas storage assets, and operating assets and late stage construction. Key to MMC’s strategy is its operating and risk mitigation capabilities. MMC has an alliance with Wood Group Power, regarding the operation and maintenance of power generation assets. MMC and Wood Group are in the process of establishing an independent asset management and operations Company (OpCo). OpCo will be a services only energy company that will manage and rationalize power assets for third party creditors and stakeholders, as well as assets that MMC acquires and controls. UK power Features 48 Issue 276 Project Finance International October 29 2003 The UK power generating sector has been hit by declining prices. The banks which hold 16GW of power generating assets totaling £6bn in debt have been forced to make provisions against their loans, sell the assets below par or take over the power stations, hoping for an upturn. A number of solutions have been put forward to solve the bankers’ problems. In this article, Karl Miller, senior partner of MMCEnergy LLC, sets out his solution. Restructuring UK power - The ARV way MMC business model MMC Investment Management Capital access x LBO x private equity x limited partners Transaction origination x power x gas x other US CCGT UK coal plant Mid-stream gas assets Arms length contracts OpCo x MMC/Wood Group plc x Third part asset management x Proprietary service producers Acquisitions1 Contract portfolio 1 Illustrative examples

- 2. OpCo will have sophisticated asset and energy management capabilities.These capabilities will allow MMC to capture the value of a generation assets and manage partially contracted or merchant facilities on behalf of the various creditors/stakeholders. Unlike many financial investors, MMC will not outsource core operations. MMC is also a joint venture with Trans-Elect Inc to acquire selected assets from electricity and gas utilities in North America.Trans-Elect Inc is currently involved in assets totaling over US$1bn and representing 14,500 miles of transmission line. Ķ STATE OF THE UK GENERATION SECTOR The global utility market environment has been very badly affected by the Enron fallout, which has caused a deterioration of market confidence in a number of players, causing ratings downgrades and urgent short- term cash collateral requirements.These will be met mainly by asset disposals. Over the last five years, there has been a steady decline in UK wholesale power prices and, some commentators would argue that the introduction of the New Electricity Trading Arrangements (NETA) has accelerated this decline.The ‘true’ forward curve also reflects a weak price outlook over the next 5 years. This has caused a serious deterioration for merchant generators, and in many instances created financial distress, breach of debt covenants and default on debt repayments.The large players are balanced and largely immune to the fallout. Official generation capacity margins are forecast to remain high in the short to medium term, and unlikely to trigger a recovery in wholesale power prices. Unattractive economics have therefore halted new plant investment. Until there is a significant recovery in ‘true wholesale’ electricity prices, stakeholders are exposed to the considerable short-term liquidity crisis leading to breach of debt covenants and default on debt repayments. Stakeholders will need to have a well thought through plan to mitigate their exposure.The UK power sector is ready for significant restructuring. Ķ IMPACT ON MAJOR LENDERS Power price deterioration and associated revenue declines have given rise to numerous covenant breaches and in some cases default on senior or subordinated debt terms.These have caused lenders to review the asset restructuring alternatives available to them. In some cases, banks have taken ownership. Where asset sales for cash are being contemplated, proceeds are well short of current debt levels. Only for the best (and least geared) assets are senior lenders likely to avoid any conversion. In some cases more creative solutions may lead to better value preservation (tolling, contingent equity, O&M agreements). MMC analysis of value recovery for lenders on typical project financed assets indicates 60-70% for senior lenders and virtually no recovery for subordinated lenders. Single asset restructurings do not solve the problem, as lower capital costs allow generators to accept lower prices. Clearly a more comprehensive approach is required. Ķ INTRODUCTION TO THE MMC UK ARV MMC is targeting an 8-12GW portfolio of non-nuclear generation, representing a 12-18% market share. MMC has already bid for control of Drax and will offer Drax senior creditors participation in the ARV post restructuring. MMC sees multiple risks with the current Drax restructuring. MMC is in parallel discussions with various constituencies, including owners of other generators to contribute plants into the ARV, commodity service providers, to act as a preferred commodity and credit clearinghouse, fuel suppliers and off-takers under MMC supervision and control, and Wood Group regarding O&M and term maintenance provisions, to enhance asset utilization and reduce cost. A portfolio management approach will allow MMC to optimize the overall output to the benefit of the ARV cash flows and net revenues. Operating cost savings across the portfolio will be substantial. Enhanced cash flows from the ARV will be utilized to pay down restructured project debt. Ķ ARV ROLE IN THE UK POWER MARKET There is overcapacity in England and Wales and the generation market is competitive with no player having more than 20% market share. One third of the generating capacity is owned by small IPPs competing for market share.There is a price war caused by excess capacity and fragmented ownership.There is currently no economic mechanism to guarantee a recovery of the fixed costs of every plant (O&M costs, rates, debt and interest, etc) and this has led to plant falling into distress.This has resulted in lower electricity prices from when NETA went live. Prices have been consistently below £20/MWh on a weighted average basis. The ARV with 8-12GW and a ~12-18% market share will trade the output of all of its plant as one portfolio. The ARV will rationalize the portfolio in years of Features UK power October 29 2003 http://deals.thomsonib.com Issue 276 49

- 3. excess capacity and its remaining assets will enjoy the benefit of more sustainable prices.The magnitude of the value created by the ARV depends on the volume of generation (MW) it holds, the price change compared with the status quo and the number of years of price improvement compared with the status quo. Ķ ROLE FOR CAPITAL PARTNERS IN THE ARV The ARV Portfolio will require capital to centralize liquidity,trading and working capital lines.The ARV working capital may be funded by combination of secured debt facilities and private debt placement. Alternative exits for capital providers including re-levering the ARV balance sheet through asset securitization. There is also a rationale for sponsors to transfer non- distressed assets into the ARV.The value of individual assets can be enhanced in a portfolio environment. In order to fully profit from current opportunities, sponsors need to act swiftly.The ARV facilitates exit without fear of exiting ‘at the bottom’. Ķ ARV STRUCTURE Equity owners will exchange their equity stake in the power plants for an equity stake/economic interest in the ARV.This facilitates the operational/legal combination of the assets without disturbing the individual debt liabilities of the projects. ARV equity is allocated to the contributors in proportion to the individual equity value of the plants (or cash where MMC brings fresh equity) they contribute. Both ‘distressed and non-distressed’ power plants can be combined into one structure that can be managed and operated for the benefit of the ARV equity owners.All participants’ interests are aligned to benefit from any increase of free cash flow. UK power Features 50 Issue 276 Project Finance International October 29 2003 MMC operational structure Spares Structure to allow for inclusion of plants and/or existing project companies. Energy trading expertise will be provided by MMC – critical to create portfolio benefits. Arm’s length arrangements for O&M and other arrangements. Potential to consolidate O&M services. Use of commodity service provider as trading company should maximise netting against the market exposure with minimal costs. Banks MMC/capital providers O&M support services co. Trading company MarketARV Electricity/fuelElectricity/fuel Payments/receipts Payments/receipts Services Asset providers Newco 1 Newco 2 Newco 3 Newco 4 IPP co 1 IPP co 4IPP co 3IPP co 2 Asset/share transfers

- 4. Each of the distressed and non-distressed plants is valued on the basis of the present value (PV) of future cash flows (FCF). Owners will transfer the equity interest in each of the Projects to the ARV and receive in exchange an equity (economic) interest in the ARV equal to the PV of FCF.The ARV will be the holding company for all the specific projects. Liabilities will remain at the SPV project level and will be satisfied by distributions from the ARV.The ARV structure ignores terms and conditions and the level of debt / leverage on each individual asset.The write off decision is left entirely with the creditors/stakeholders (within certain parameters). Ķ CAPTURING THE UPSIDE Preserving value for stakeholders is cumbersome and challenging on an asset by asset basis. Stakeholders should consider the case for key assets to be aggregated into an ARV as NETA’s emphasis on predictability and the wide bid/offer spreads in the balancing mechanism has constrained single assets but favours portfolio players. Economies of scale in plant operation, trading output and management of NETA imbalance risks. ARV creates a balanced fuel mix and provides multiple arbitrage opportunities. Efficiency spread in portfolio enables coverage of merit order.ARV enables economic decisions to be made about uneconomic plant within the portfolio and creates lower Opex due to transfer of best practices and synergies.ARV substantially eliminates the need for further debt provision particularly if new equity is injected. Ķ POTENTIAL PORTFOLIO UPSIDE MMC believes that the difference in price between a price war and a capacity shortage is £46/kW per year.The ARV pools generation and operates total capacity as single unit with great flexibility and optionality.The portfolio approach creates operational and trading economies of scale.The creation of the ARV should shorten the price war by a number of years and create a price benefit of some proportion of the figure above.These revenue benefits will to some extent be offset by the cost of acquiring plant that is subsequently mothballed due to inefficiency. Ķ ARV OPERATIONS, TRADING AND RISK MMC’s core capabilities are in the field of commodity risk management and operations. MMC will develop the appropriate risk management philosophy and execution strategy. Key internal considerations include cash flow/credit conditions, debt coverage needs, and value optimization. Key external considerations are market liquidity, duration of forward market pricing and credit/collateral needs. Examples of risk management activities include creating a portfolio of fuel purchases and power sales of different durations (near term is highly hedged, forward years less so). Hedge with options, which provide downside protection with possible upside benefits. Bilateral off-take agreements that secure longer term cash flows by selling the flexibility of the plant at a premium. Maximize spark spread (fuel conversion) value optimizing both the power being sold with the fuel being purchased. The ARV will extract O&M savings between the coal stations and between the gas stations that are contributed. Considering the coal and the gas stations together, there will be further cost savings from rationalizing finance, risk management and measurement, environmental, health and safety policy, etc. During the transition period MMC senior management will perform take responsibility for commodity risk management O&M using the existing station staff and MMC will put in place commercial agreements in the following areas: O&M, trading services and a trading guarantee facility. Features UK power October 29 2003 http://deals.thomsonib.com Issue 276 51 ARV legal structure In terms of cash distributions, all FCF (after payment of O&M, etc) is channeled through the equity participants in the ARV Topco. The entity/economic interest positions held in the ARV Topco are derived from the same PV of FCF calculation described in the general concepts paragraph below. ARV Topco Individual legal entities ARV equity held by distressed lenders as well as equity and debt holders of non-distressed assets. Free cash flow distributed according to equity proportions. 100% 100% 100% equity stake in individual legal entities

- 5. UK power Features 52 Issue 276 Project Finance International October 29 2003 Pro-rata valuation approach Independent third party will value assets to minimise valuation disagreements. The FCF will be calculated using a combination of common inputs and plant-specific valuation parameters. We envisage using common inputs and a number of plant-specific parameters. Common Inputs Forward power price/fuel price curves, cost of debt, capex, tax rate, certain working capital items, inflation and environmental issues. Plant Specific Inputs Plant capacity, total load factor, generator efficiency, fuel type, plant life, maintenance capex, decommissioning costs and off-take/tolling/fuel contracts. Whenever projects are contributed into the ARV, the allocation of the pro rata equity stakes has to be recalculated for all the assets in the portfolio. Since not all assets will be contributed at the same time it could be that the opinion regarding certain common valuation assumptions has changed (ie price curves). One approach to deal with this issue is to revalue all the assets based on the revised common input(s). Stage 1 - Independent evaluation Project A Project DProject CProject B 50% 10%15%25% Evaluation of each asset based on PV of free cash avaliable for debt service How does the ARV create upside? There is overcapacity in England and wales and the generation market is competitive with no player having more then 20% market share. One third of generating capacity is owned by small IPPs competing for market share. Overcapacity creates market overhang – drag on earnings and cash. Fixed cost recovery not achievable. Natural gas cost problematic. There is a price war caused by excess capacity and fragmented ownership. There are currently no economic mechanisms to guarantee a recovery of the fixed costs of every plant (O&M costs, rates, debt and interest, etc.) and this had led to plant falling into distress. This has resulted in lower electricity prices when NETA went into effect. Prices have been consistently below £20.MWh. The ARV will rationalise the 8-12 GW portfolio in years of excess capacity and its remaining assets will enjoy the benefit of more sustainable prices, to the benefit of shareholders. Assuming ARV of 10,000 MW Generator Market share pre-ARV (%) IPP 33.3 BNFL/BE 17.9 Innogy 12.3 Power Gen 12.0 EDF 10.3 Cebtrica 6.1 Scots 5.0 Pumped 3.1 Total 100.0 Source: MMC analysis of NGC Severn Year Statement Generator Market share post-ARV (%) IPP 18.3 BNFL/BE 17.9 ARV 15.0 Innogy 12.3 Power Gen 12.0 EDF 10.3 Cebtrica 6.1 Scots 5.0 Pumped 3.1 Total 100.0 Source: MMC analysis of NGC Severn Year Statement

- 6. MMC believes that it can offer significant cost savings and revenue enhancement to the ARV by actively managing the volatility of fuel and power prices through a JointVenture with an investment grade Commodity Services Provider (CSP) that will offer pricing and execution of many alternatives, confirmation of all trades, 24-hour operation contract and risk management/risk mitigation services, accounting, settlements and invoicing services. Ķ SUMMARY The UK wholesale power prices have declined on average by 40% since NETA went live, resulting in a serious deterioration in the financial health of generators. MMC believes prices have not bottomed. The structural overcapacity in the industry will persist, constraining any longer term recovery in prices. Substantial price recovery will require a new approach. Lenders and stakeholders of power generators are consequently exposed to increasing burdens of ownership that include: earnings dilution and volatility, sub-par investment returns, short term liquidity constraints leading to breach of debt covenants, financial default and foreclosure, and increased political and market risk.Therefore the sector is ready for significant restructuring. A comprehensive and radical industry solution is called for through the creation of an Asset RecoveryVehicle (ARV), which will become a top ranking UK generation company. MMC believes the concept has broad support from key market participants.This includes creditor and corporate owned generators, investors, industry suppliers and off-takers and the regulators.An independent non-conflicted party such as MMC and its capital partners best accomplishes the pooling of generators into an ARV. Features UK power October 29 2003 http://deals.thomsonib.com Issue 276 53 “ ” A comprehensive and radical industry solution is called for through the creation of an Asset Recovery Vehicle (ARV), which will become a top ranking UK generation company. MMC believes the concept has board support from key market participants. The PFI Global Awards Dinner 22 January 2004 The Dorchester, London Book your table now for the project finance industry’s premier awards ceremony. Contact Della Sullivan on +44 (0)20 7369 7311, or email della.sullivan@thomson.com Sponsorship opportunities are available at the PFI Annual Awards Dinner. For further information please call Chris Brigden on +44 (0)20 7369 7629, or email chris.brigden@thomson.com