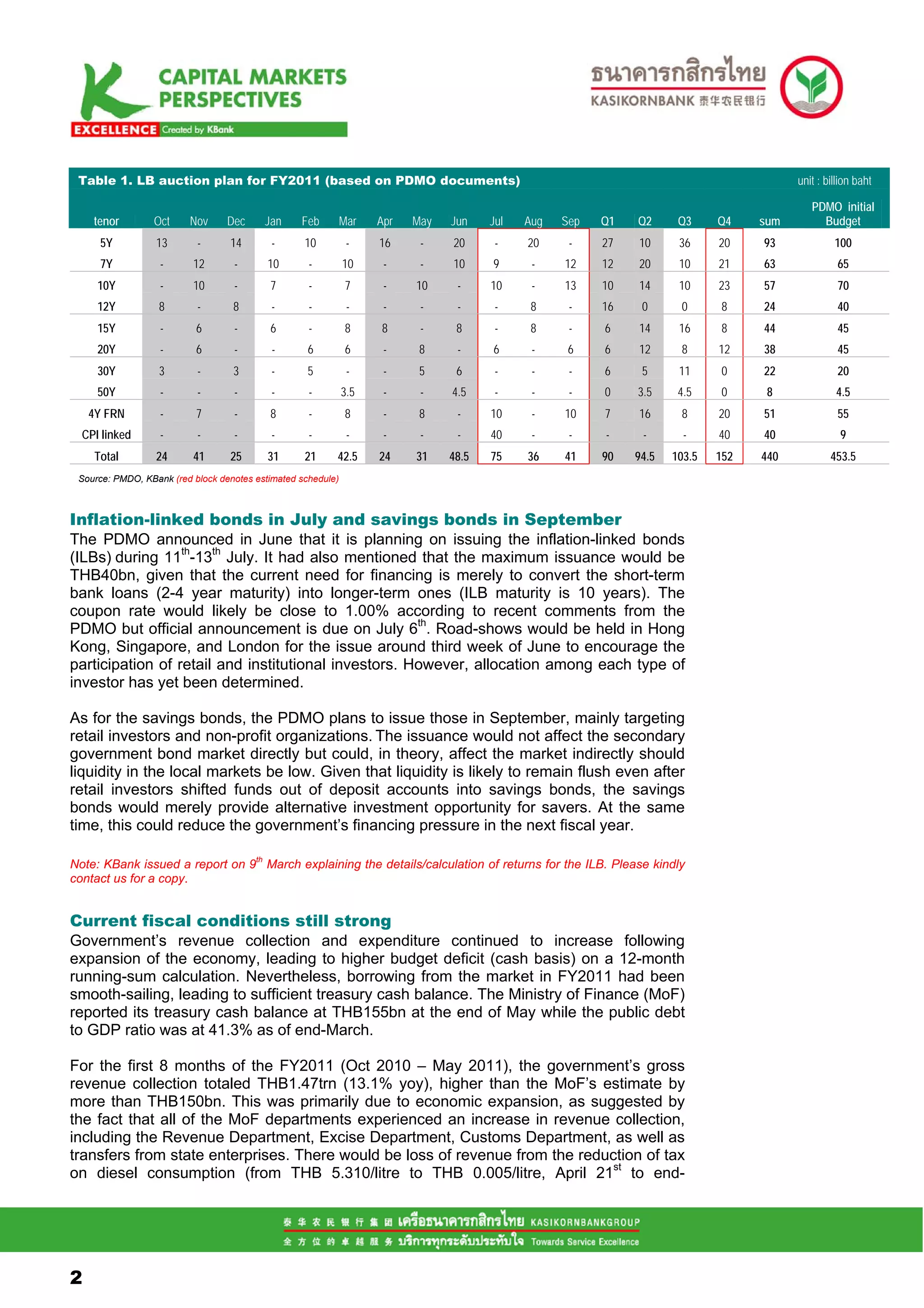

- The document summarizes views on Thailand's bond market in Q3, expecting about THB100 billion in government bond issuance, excluding THB40 billion in inflation-linked bonds. Fiscal conditions remain strong with revenue exceeding forecasts.

- It discusses details of the bond issuance schedule, and notes the introduction of Thailand's first inflation-linked bonds in July. Savings bonds will be issued in September.

- Monetary Policy Committee minutes reaffirmed inflation as a near-term concern over slowing global growth, though risks remain including energy prices and interest rate normalization. The policy rate forecast of 3.50% by year-end remains intact.